3pm Gmt To Central Time KRA Headquaters Times Tower Haile Selassie Avenue Nairobi Kenya Contact Centre 254 20 4 999 999 254 711 099 999 callcentre kra go ke Get Directions eTIMS File Returns FAQs

Enables KRA to identify those who do not pay taxes Enhances transparency in taxation as well as improved compliance in respect to return filing and full disclosure Who should file a return Simplified Tax services for Kenyan Tax Payers

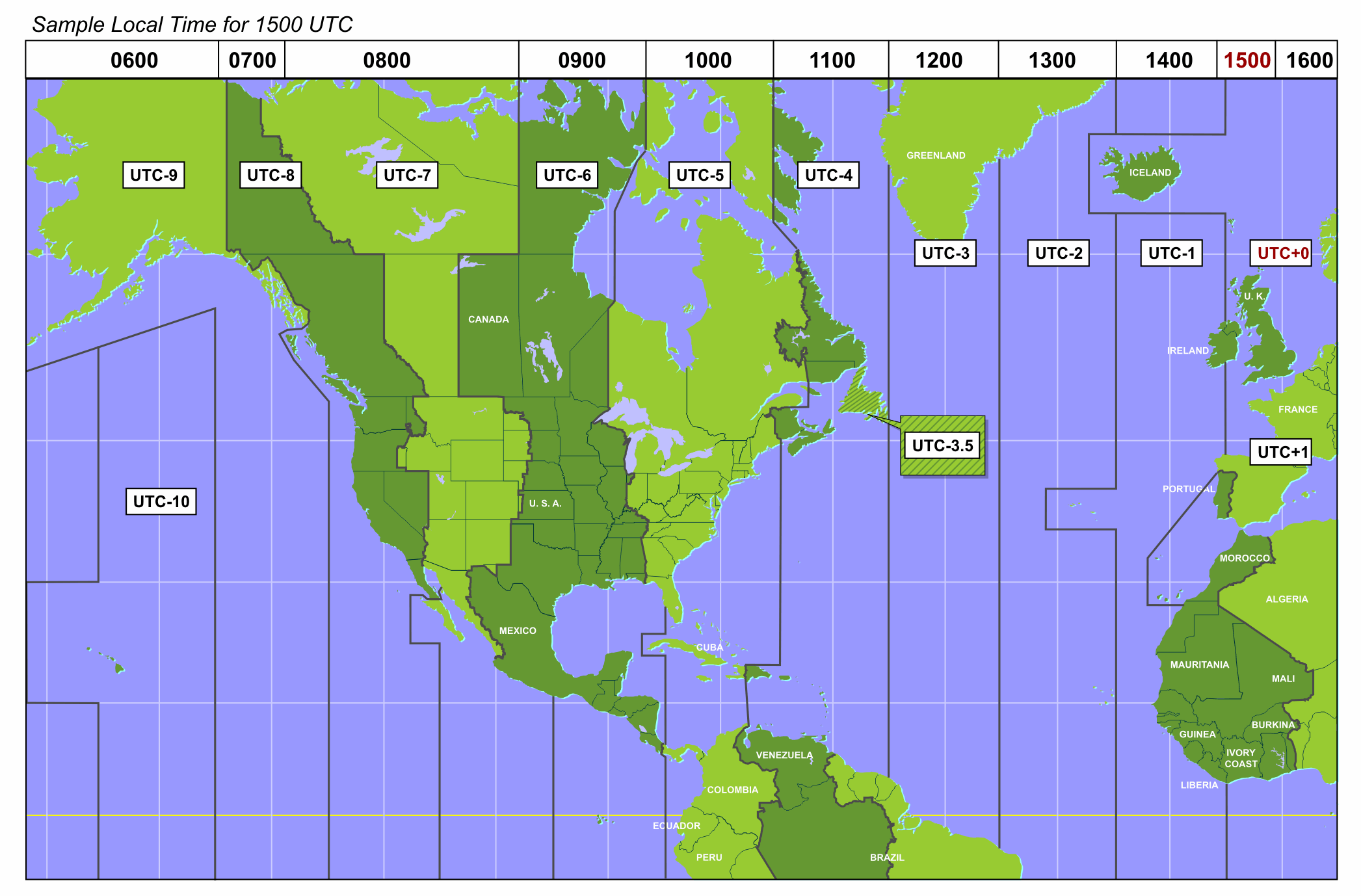

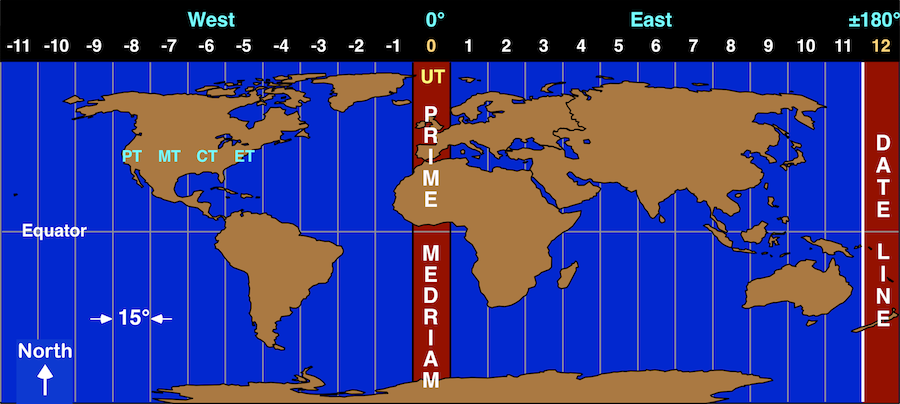

3pm Gmt To Central Time

3pm Gmt To Central Time

https://www.e-education.psu.edu/meteo3/sites/www.e-education.psu.edu.meteo3/files/images/lesson1/timezones0103.png

Coordinated Universal Time UTC

https://copradar.com/utctime/gmtzones.png

Greenwichi K z pid GMT

http://hu.thetimenow.com/img/coordinated_universal_time.jpg

Forgot your password Are you new on this system eTIMS How to Guide Enables KRA to identify those who do not pay taxes Enhances transparency in taxation as well as improved compliance in respect to return filing and full disclosure Who should file a return

The PIN Checker allows you to confirm whether or not a particular PIN is genuine A genuine PIN is generated by the KRA Domestic Taxes Department System and is in Active status The KRA PIN Tax Obligations Guidelines for Returning Residents Importation Diplomatic First Arrival Privileges

More picture related to 3pm Gmt To Central Time

8 Utc Time Nextjord

https://i.pinimg.com/originals/96/e3/f8/96e3f8286ce94e667b645cac2275f19d.jpg

[img_title-5]

[img-5]

[img_title-6]

[img-6]

How to File KRA Returns Using P9 Form Filing your annual tax returns is a crucial civic duty This guide provides a detailed step by step walkthrough of how to file your 2024 KRA s tax service offices and contact centres will be open from 9 00am to 6 00pm on both Saturday and Sunday On Monday June 30 the final day to qualify for the amnesty

[desc-10] [desc-11]

[img_title-7]

[img-7]

[img_title-8]

[img-8]

https://www.kra.go.ke

KRA Headquaters Times Tower Haile Selassie Avenue Nairobi Kenya Contact Centre 254 20 4 999 999 254 711 099 999 callcentre kra go ke Get Directions eTIMS File Returns FAQs

https://www.kra.go.ke › file-my-returns

Enables KRA to identify those who do not pay taxes Enhances transparency in taxation as well as improved compliance in respect to return filing and full disclosure Who should file a return

[img_title-9]

[img_title-7]

[img_title-10]

[img_title-11]

[img_title-12]

[img_title-13]

[img_title-13]

[img_title-14]

[img_title-15]

[img_title-16]

3pm Gmt To Central Time - KRA PIN Tax Obligations Guidelines for Returning Residents Importation Diplomatic First Arrival Privileges