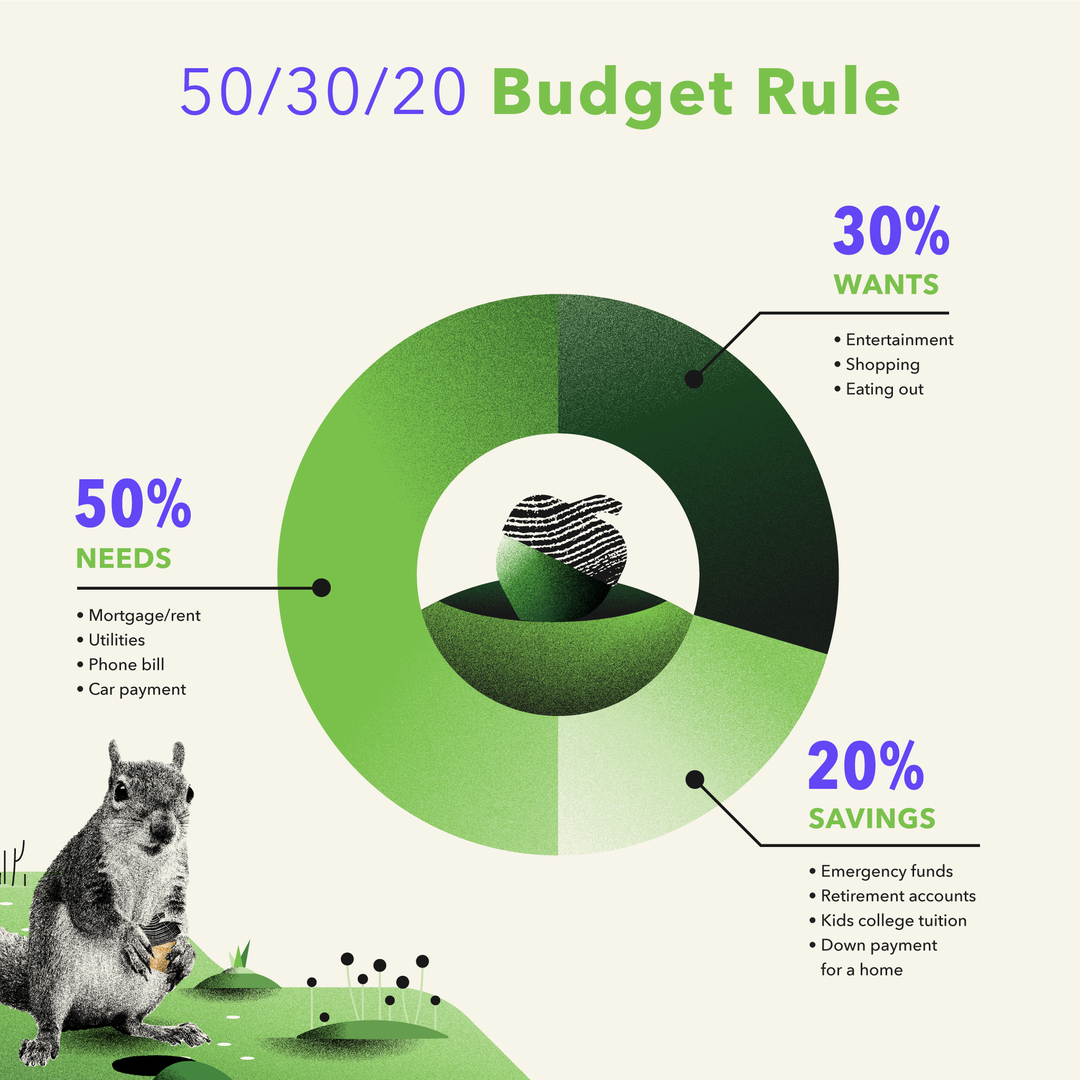

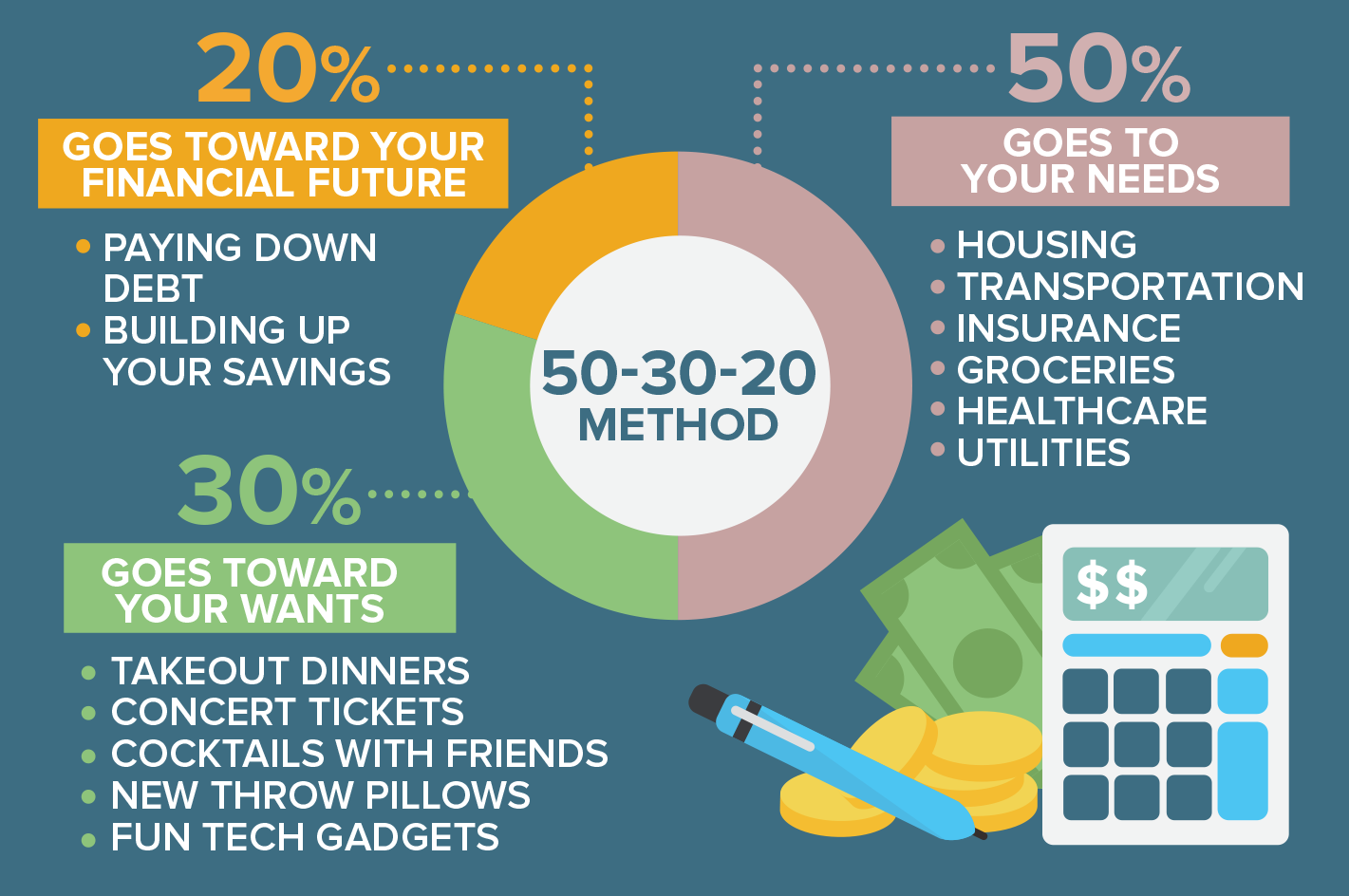

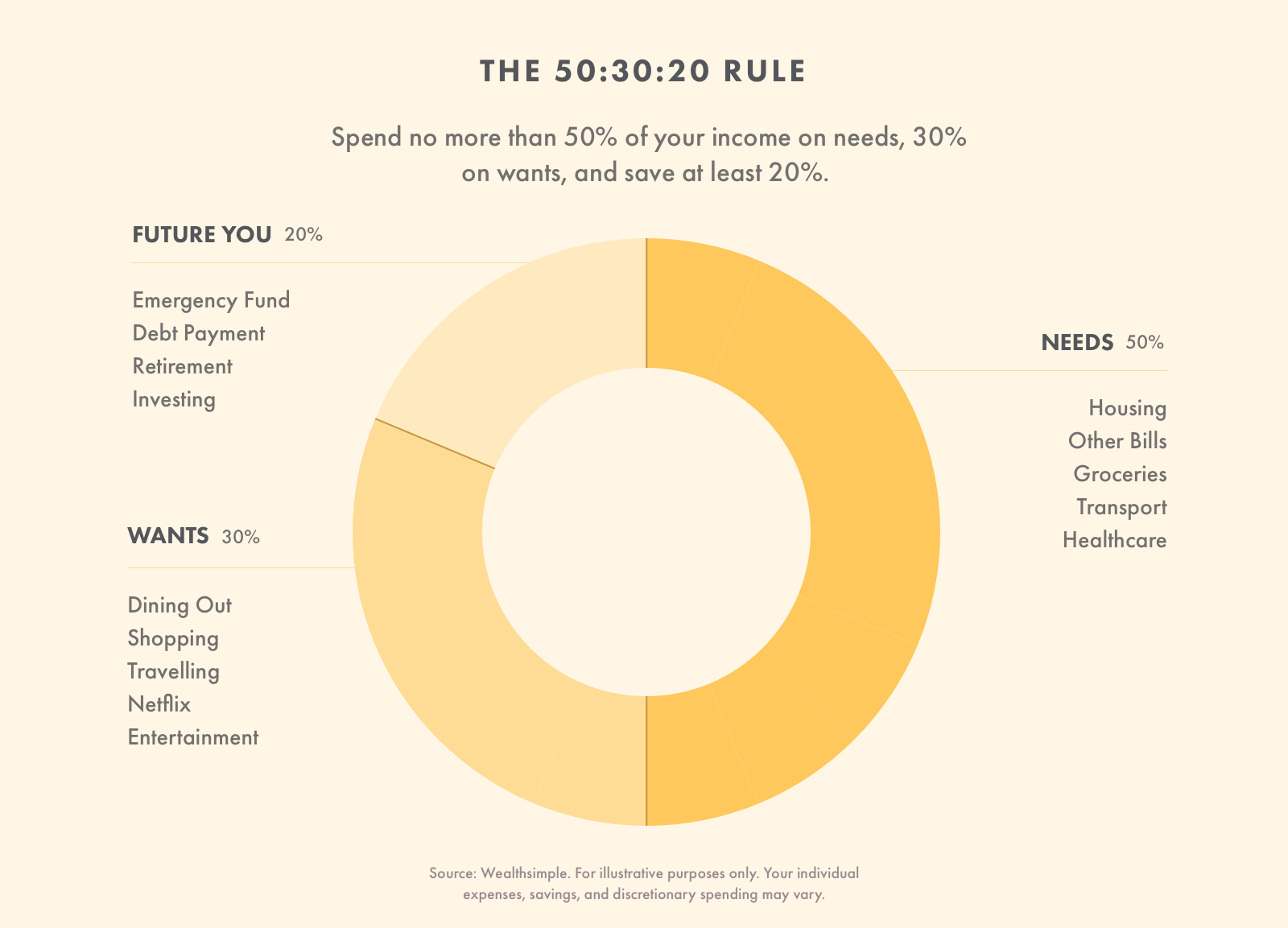

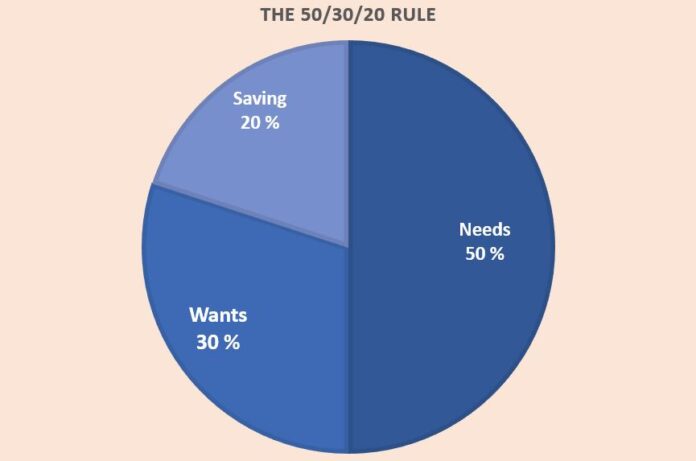

50 30 20 Investing Rule What Is the 50 30 20 Rule The 50 30 20 rule involves splitting your after tax income into three categories of spending 50 goes to needs 30 goes to wants and 20 goes to

To budget your money using the 50 30 20 rule first calculate your after tax income Plan to spend 50 of your income on needs 30 on wants and 20 on savings and paying down debt Look at how much money you have coming in regularly This will primarily be your salary if you re working If your income changes from month to month work out the average over the last 3 months Then looking at your bank statements for the last 3

50 30 20 Investing Rule

50 30 20 Investing Rule

https://i.pinimg.com/originals/ba/ec/49/baec4963c8cc70b86f50107efba931a1.jpg

50 30 20 Rule Works Amazingly When It s 20 30 50 Know How

https://jarofknowledge.com/wp-content/uploads/2023/03/Is_50_30_20_Rule_Good_for_you_Explained_by_Finance_Influencers_featured_Image-1.jpg

What Is The 50 30 20 Rule Of Budgeting For Saving Investing Spending

https://assets.freedominabudget.com/wp-content/uploads/2023/04/11211011/what-is-the-50-30-20-rule-of-budgeting-for-saving-investing-and-spending-kelly-anne-smith.png

Discover how the 50 30 20 budgeting rule can streamline your finances Learn to balance needs wants and savings for a more secure financial future 50 20 30 Rule A slight variation of the original rule this version recommends allocating 50 to needs 20 to wants and 30 to savings and debt repayment This could work well for those willing to invest more heavily in savings

It asks you to break your in hand income into three parts 50 of the income goes to needs 30 for wants and 20 to savings and investing In this way you will have set buckets for everything and operate within the permissible amount for each bucket This 50 30 20 rule allocates budgeting 20 of your monthly income towards savings such as investments emergency fund or extra debt repayments For example using your 2000 income and this rule you can budget for 400 for saving investing

More picture related to 50 30 20 Investing Rule

What Is The 50 30 20 Rule Acorns

https://sqy7rm.media.zestyio.com/50-30-20.png?width=1080&height=1080&fit=crop

How 50 20 30 Rule Will Change Your Life Finance Expert

https://bankonus.com/finance-expert/wp-content/uploads/2018/11/d4b56bad34702ffb869c6e9628f996f6-1.png

How To Use The 50 30 20 Rule For Budgeting Your Money

https://www.kindafrugal.com/wp-content/uploads/50-30-20-rule-021.png

Discover the 50 30 20 rule for investors a simple yet effective budgeting framework that ensures balanced spending saving and investing Learn how to apply this rule with step by step solutions best practices and examples to achieve long term financial security The 50 30 20 rule suggests that you divide your after tax income into three main categories 50 for essential needs 30 for personal wants and 20 for savings This system ensures that you set aside a fixed portion for each category reducing the temptation to transfer funds between them Don t Miss Why SIP Is The Best Investment Option

[desc-10] [desc-11]

50 30 20 Budget Rule A Better Way To Budget Your Money Boss Personal

https://cdn.shopify.com/s/files/1/0258/4566/1782/articles/50_30_20_rule.jpg?v=1663168783

50 30 20 Rule Of Budgeting How To Apply It

https://cdn-scripbox-wordpress.scripbox.com/wp-content/uploads/2022/12/50-30-20-rule-image.jpg

https://www.investopedia.com › ask › answers

What Is the 50 30 20 Rule The 50 30 20 rule involves splitting your after tax income into three categories of spending 50 goes to needs 30 goes to wants and 20 goes to

https://www.wealthsimple.com › en-ca › learn

To budget your money using the 50 30 20 rule first calculate your after tax income Plan to spend 50 of your income on needs 30 on wants and 20 on savings and paying down debt

50 30 20 Rule Of Financial Planning How It Works FinCalC Blog

50 30 20 Budget Rule A Better Way To Budget Your Money Boss Personal

The 50 30 20 Rule Explained Will It Work For You Live It Awesome

The 50 30 20 Budgeting Formula The Idea Of Saving More Inventiva

50 30 20 Rule Calculator Documoli

50 30 20 Budget Rule For Saving Investing Dhan Blog

50 30 20 Budget Rule For Saving Investing Dhan Blog

How To Budget Using The 50 30 20 Rule K Unity

50 30 20 Rule What It Is And How To Use It Investing Aid

Monthly 50 30 20 Budget Rule Of Guideline For Saving And Spending The

50 30 20 Investing Rule - This 50 30 20 rule allocates budgeting 20 of your monthly income towards savings such as investments emergency fund or extra debt repayments For example using your 2000 income and this rule you can budget for 400 for saving investing