80000 Divided By 12 Months In January 2016 IFRS 16 Leases made various amendments to IAS 40 including expanding its scope to include both owned investment property and investment property held by a lessee as

However IAS 40 does require companies that adopt the cost model to measure investment property to disclose the property s fair value as well Hence a fair value of the property will Interrelationship between IFRS 3 and IAS 40 Judgement is required to determine whether the acquisition of investment property is the acquisition of an asset a group of assets or a

80000 Divided By 12 Months

80000 Divided By 12 Months

https://us-static.z-dn.net/files/d33/b3d32566b39b639ebee22c6fbca01130.jpg

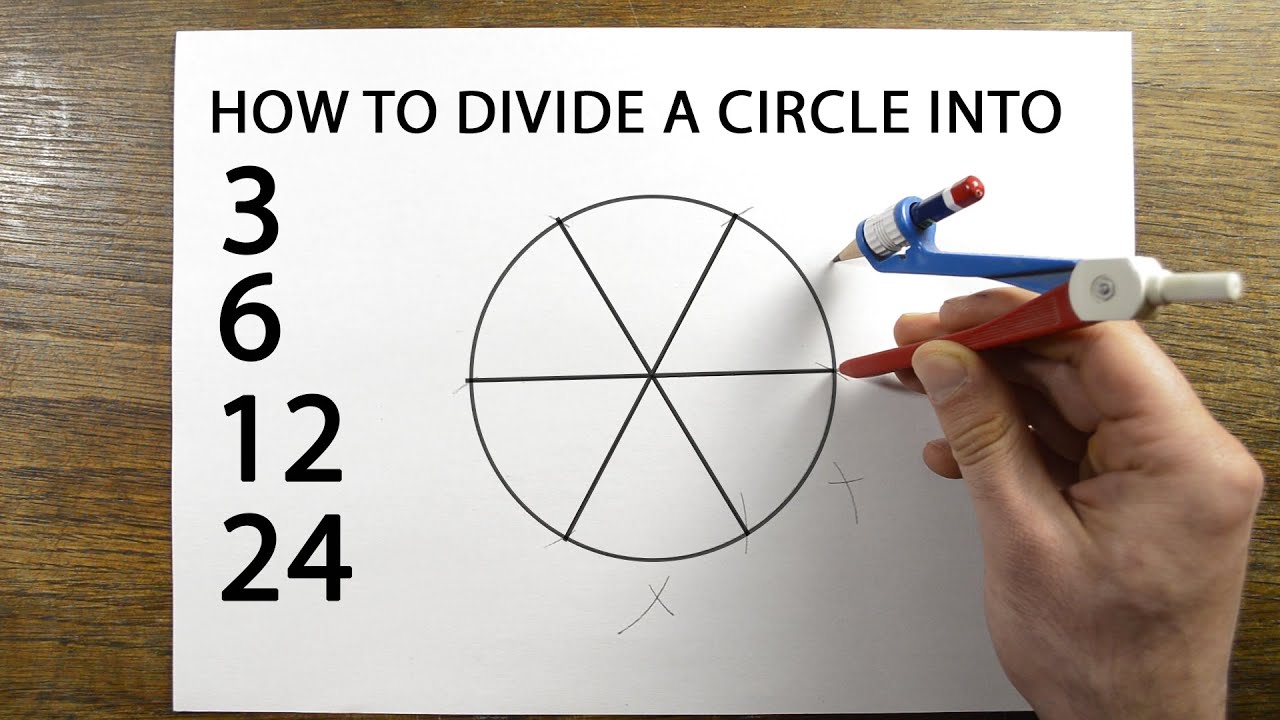

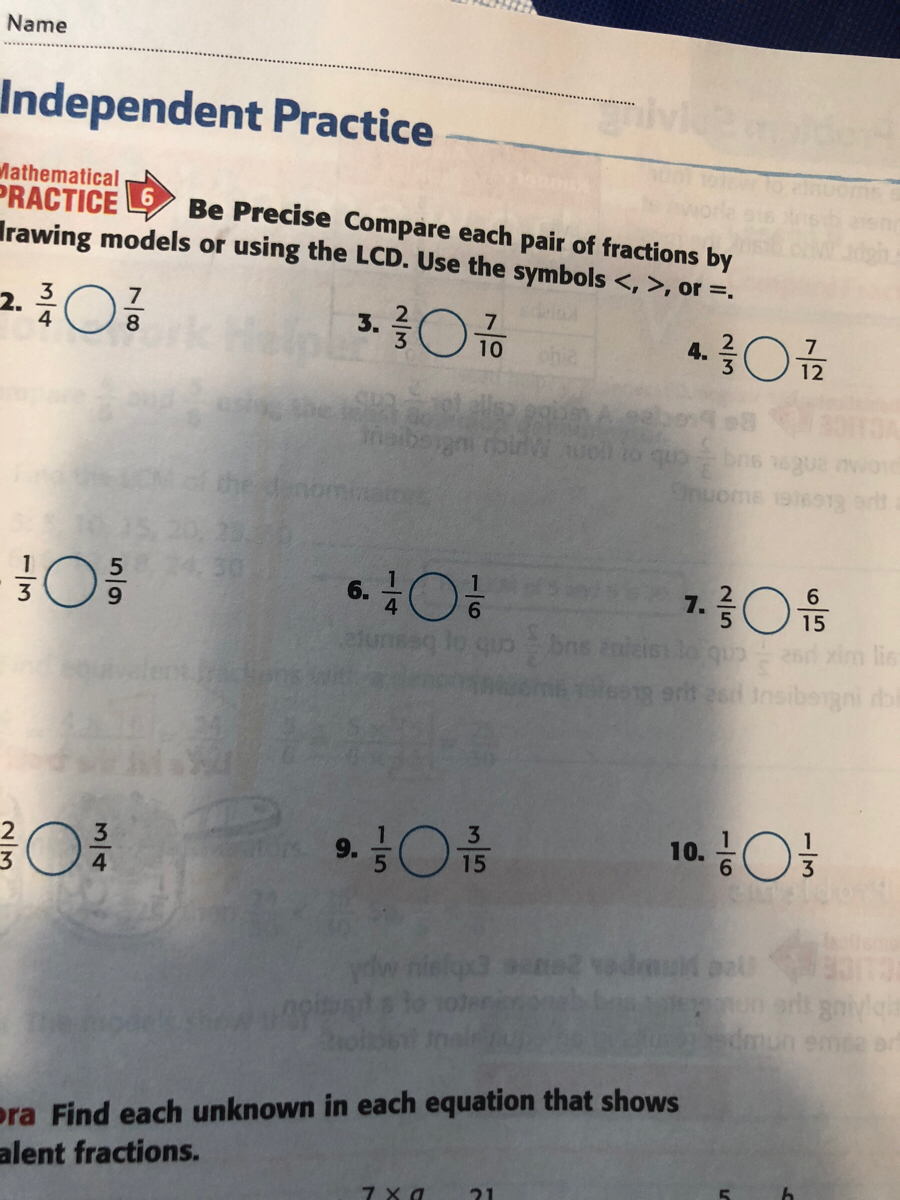

12 Divided By 1 8 Twelve Divided By One Eight YouTube

https://i.ytimg.com/vi/FaJ7mUqz0ek/maxresdefault.jpg

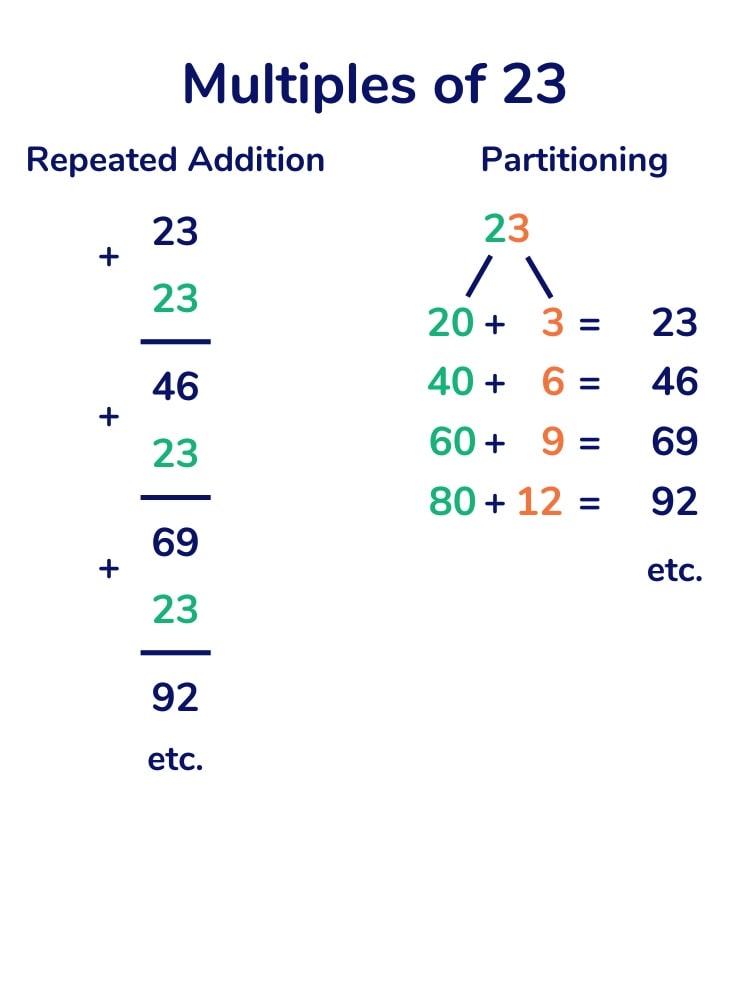

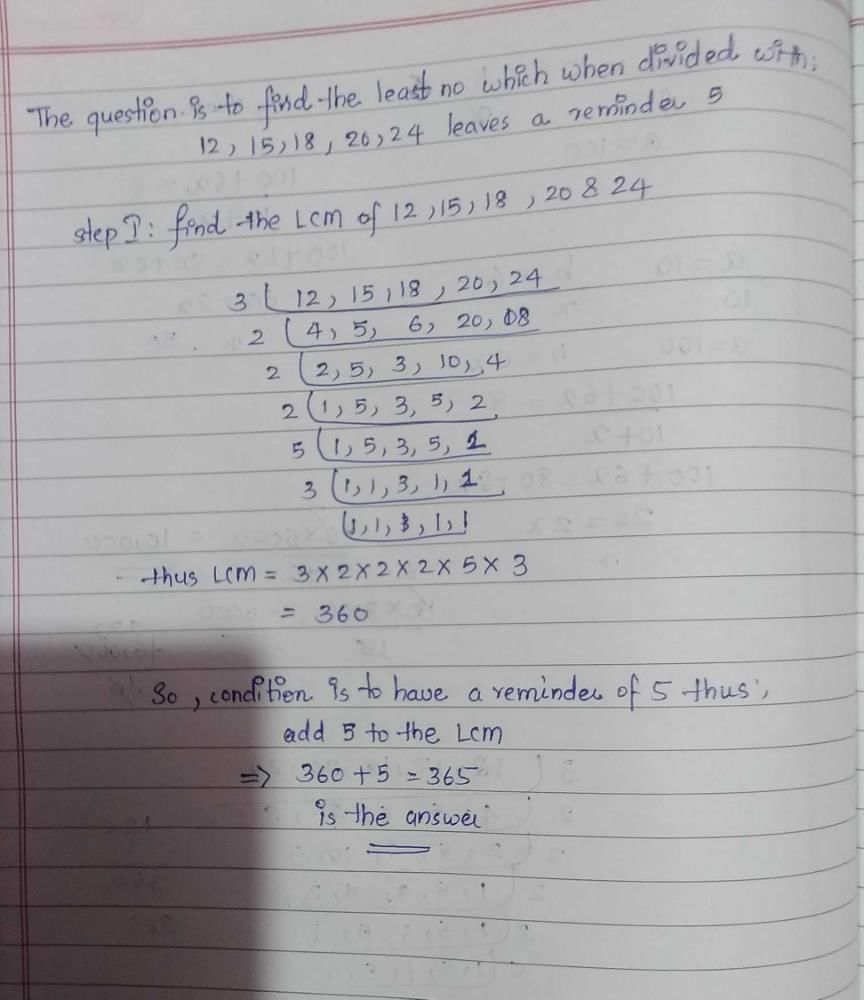

Therefore The Least Number Which When Divided By 12 15 18 And 24

https://hi-static.z-dn.net/files/d96/f7697f5bbfd696ef076dc0e92c3fecbe.jpg

If a property moves from inventory to investment property carried at fair value any difference between the fair value on the transfer date and its previous carrying amount is This updated factsheet outlines the key requirements of IFRS 9 Financial Instruments including classification and measurement and impairment of financial assets

Define and calculate the recoverable amount of an asset and any associated impairment losses Identify circumstances which indicate that the impairment of an asset may have occurred How IAS 40 works and our Top 5 differences from real estate accounting under US GAAP IFRS Standards have different accounting and disclosure requirements for real

More picture related to 80000 Divided By 12 Months

Solved When A Number Is Divided By 12 The Quotient Is 15 A algebra

https://p16-ehi-va.gauthmath.com/tos-maliva-i-ejcjvp0zxf-us/c5b9caefe95841a48d1a985b6b96942a~tplv-ejcjvp0zxf-10.image

IPhone 15 Repair Ginni Rich

https://www.ginnirich.com/wp-content/uploads/2024/03/Ginni-Rich-General-Trading-LLC.png

8 Long Division Examples And How To Solve Them

https://thirdspacelearning.com/wp-content/uploads/2022/08/Long-Division-Examples-Multiples-of-23-1.jpg

Under the cost model investment property is measured at cost less accumulated depreciation and any accumulated impairment losses Fair value is disclosed Gains and losses on disposal Measure investment property at cost less accumulated depreciation and accumulated impairment losses in accordance with IAS 16 principles or IFRS 16 for right of use assets

[desc-10] [desc-11]

Find The Least Number Which When Divided By 12 15 18 20 And 24

https://edurev.gumlet.io/ApplicationImages/Temp/7112660_c12f60d9-82b9-45a8-9724-44a8d32207cd_lg.png

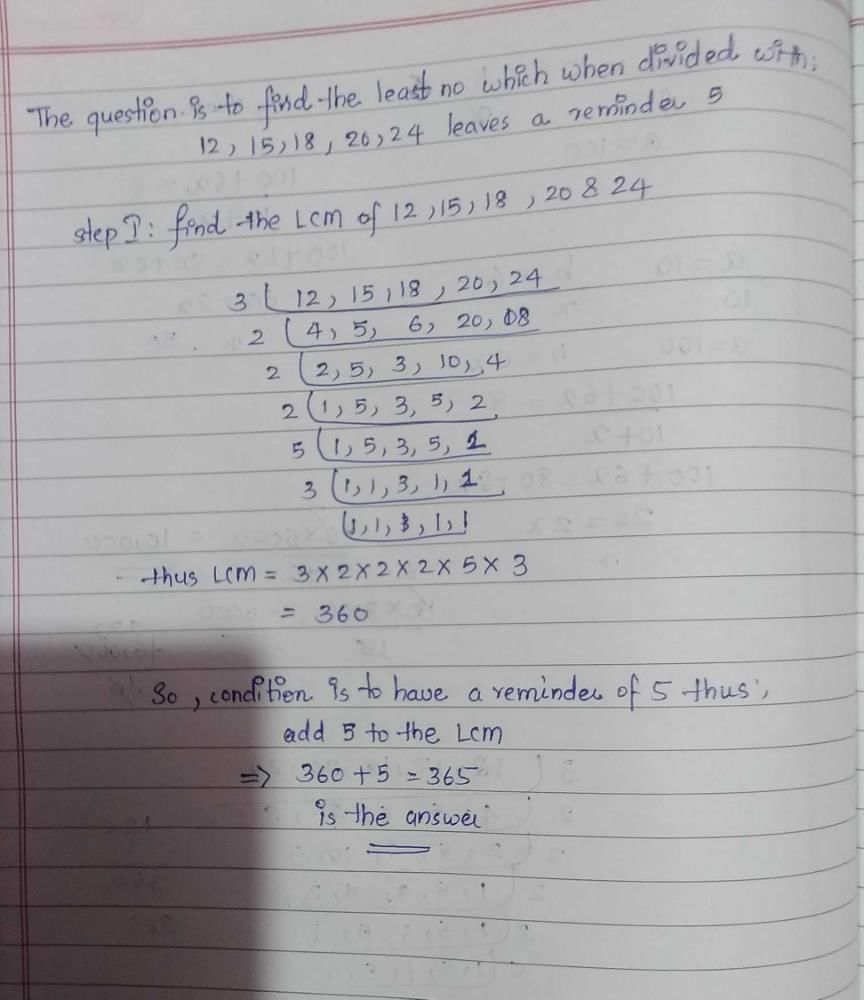

Circles Divided In Segments With Numbers From 1 To 12 Outline Round

https://static.vecteezy.com/system/resources/previews/013/834/187/original/circles-divided-in-segments-with-numbers-from-1-to-12-outline-round-shapes-cut-in-equal-parts-simple-graphic-pie-or-donut-chart-examples-vector.jpg

https://www.ifrs.org › ... › english › issued › part-a

In January 2016 IFRS 16 Leases made various amendments to IAS 40 including expanding its scope to include both owned investment property and investment property held by a lessee as

https://www.accaglobal.com › content › dam › ACCA_Glob…

However IAS 40 does require companies that adopt the cost model to measure investment property to disclose the property s fair value as well Hence a fair value of the property will

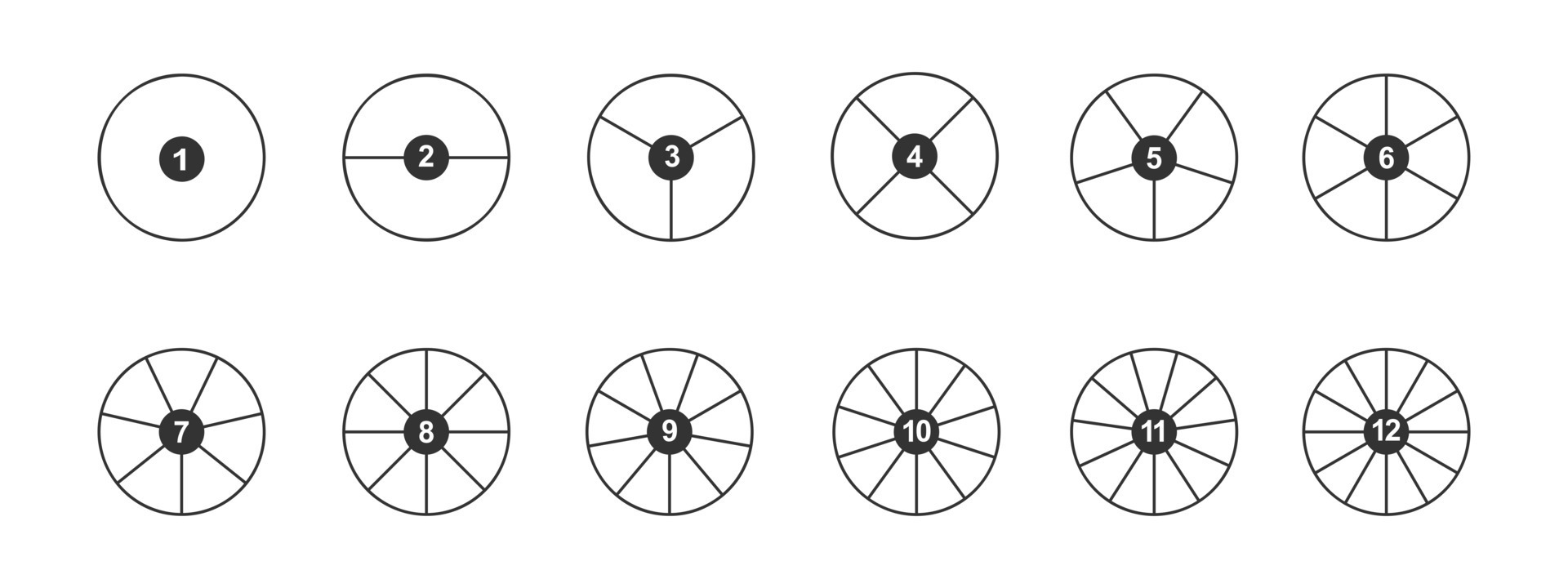

How Do U Divide A Circle Into 3 Equal Parts BEST GAMES WALKTHROUGH

Find The Least Number Which When Divided By 12 15 18 20 And 24

Mission Ginni Rich

DARZALEX daratumumab based Maintenance Regimens Show Clinically

24 Basis Of Matrix Calculator EdwinAnastasija

Sony BRAVIA XR 55 A95L 4K QD OLED TV 2023 Buy Online Heathcotes co nz

Sony BRAVIA XR 55 A95L 4K QD OLED TV 2023 Buy Online Heathcotes co nz

10K 0 13ct Diamond Pendant Unclaimed Diamonds

Making Sense Of The Markets This Week July 7 2024 Workresearchlive

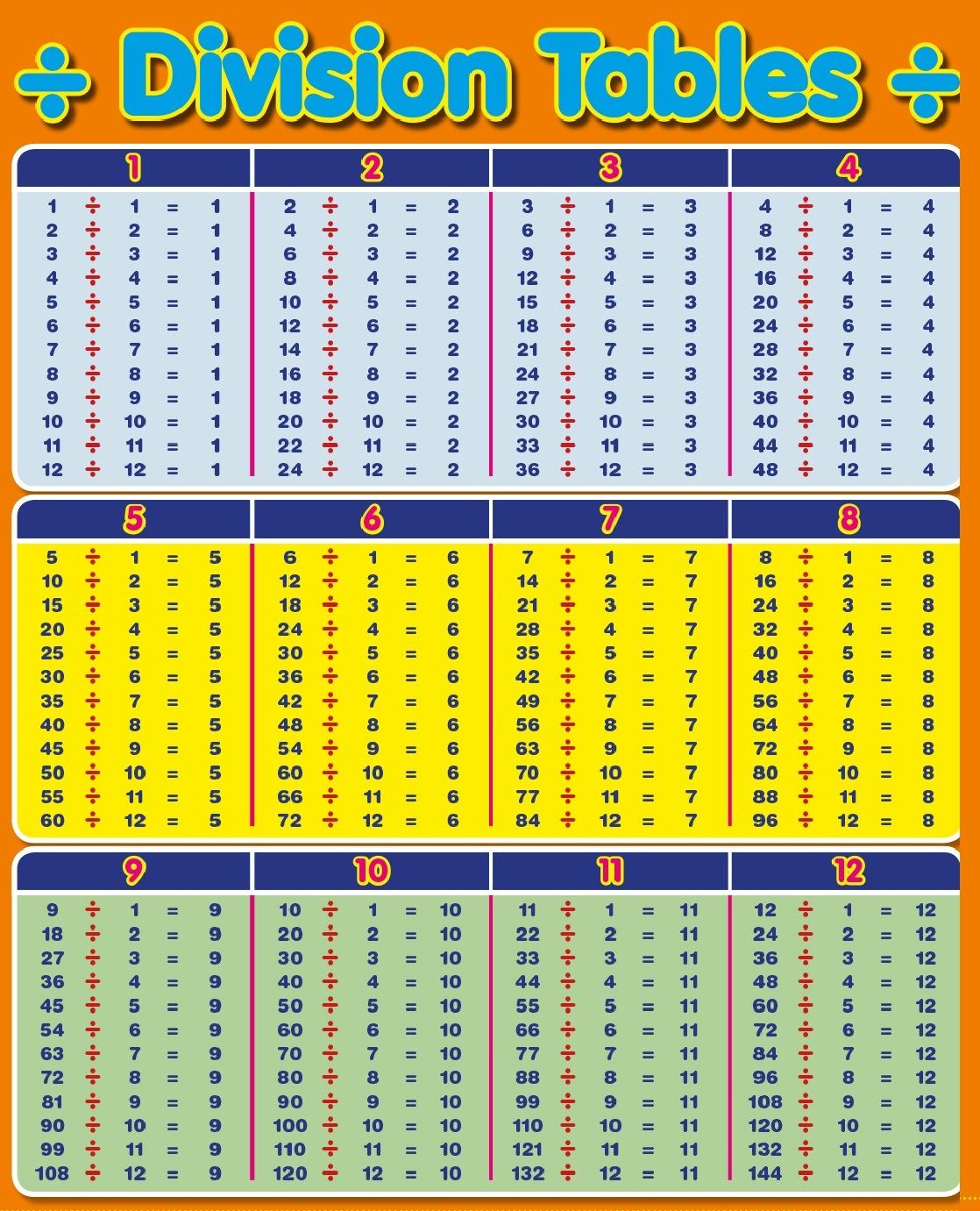

Divide Table Chart

80000 Divided By 12 Months - [desc-12]