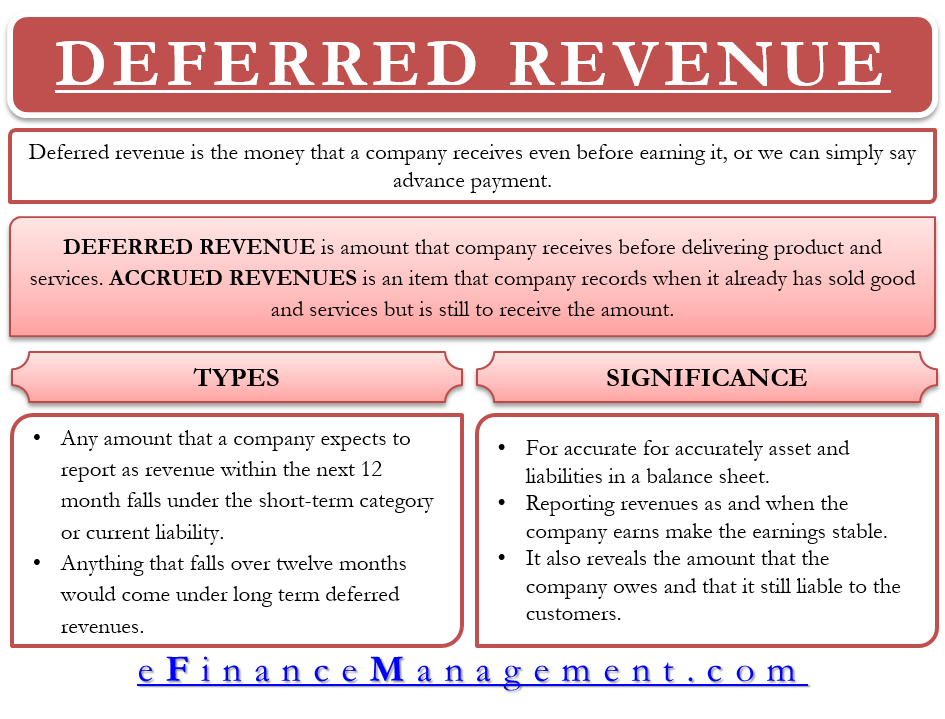

Deferred Income Meaning Deferred revenue also known as unearned revenue refers to advance payments a company receives for products or services that are to be delivered or performed in the future The company that

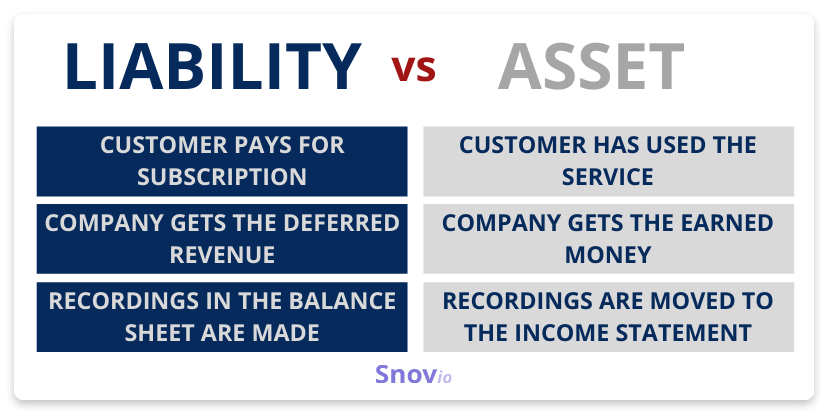

Deferred revenue is money collected from customers before earning it such as prepayments or retainers Learn why it s a liability how to record it and how it differs from accrued expenses Deferred income is money received for goods or services not yet delivered or earned Learn how to account for deferred income its benefits and challenges and see examples of software

Deferred Income Meaning

Deferred Income Meaning

https://i.ytimg.com/vi/1OYD88LvfCk/maxresdefault.jpg

:max_bytes(150000):strip_icc()/Terms-d-deferred-revenue-Final-a8fb680c51014901a4b8f88ac7fb7f77.jpg)

Revenue Definition Formula Calculation And Examples 49 OFF

https://www.investopedia.com/thmb/9R0Qsq4PgzyrHOAfjdMr6jMnGi8=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/Terms-d-deferred-revenue-Final-a8fb680c51014901a4b8f88ac7fb7f77.jpg

:max_bytes(150000):strip_icc()/TermDefinitions_DeferredTax_V2-d5ae6ed922204f7eaa8bfb6b7b4b7f44.jpg)

Coverage Ratio Definition Types Formulas Examples 46 OFF

https://www.investopedia.com/thmb/t6uPsyWkraC2sbbet4YidajtTU0=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/TermDefinitions_DeferredTax_V2-d5ae6ed922204f7eaa8bfb6b7b4b7f44.jpg

Deferred revenue is a liability for goods or services paid for but not yet received Learn how to compute it record it and recognize it in accounting with examples and FAQs Deferred revenue is the income earned by a company for goods or services not yet delivered Learn how to account for deferred revenue when to recognize it as revenue and see examples of deferred revenue in different scenarios

Deferred income is a term used in accounting to describe revenue that has been earned but not yet received or recorded Learn how deferred income differs from accrued expense and see Deferred income vs accounts receivable Clearing the confusion It s easy to confuse deferred income and accounts receivable but they represent opposite sides of a transaction

More picture related to Deferred Income Meaning

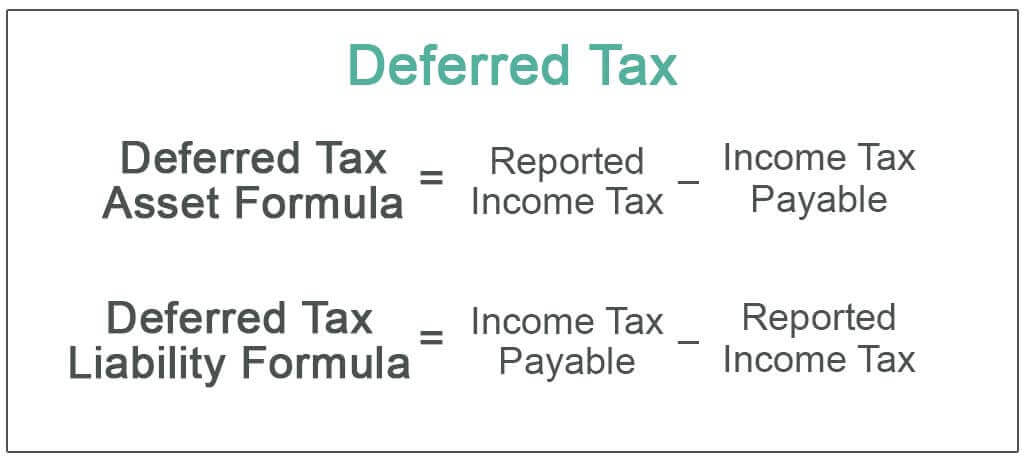

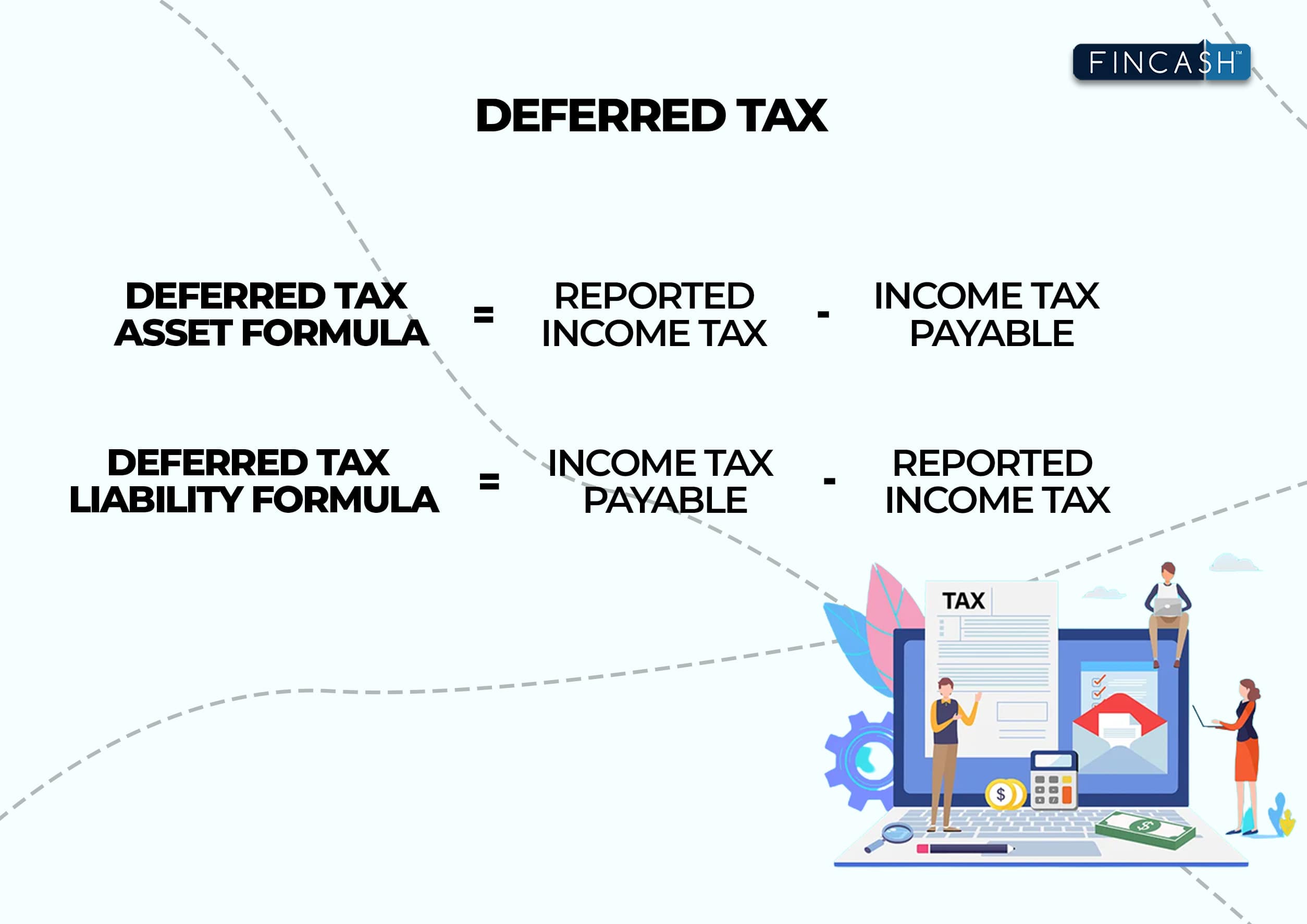

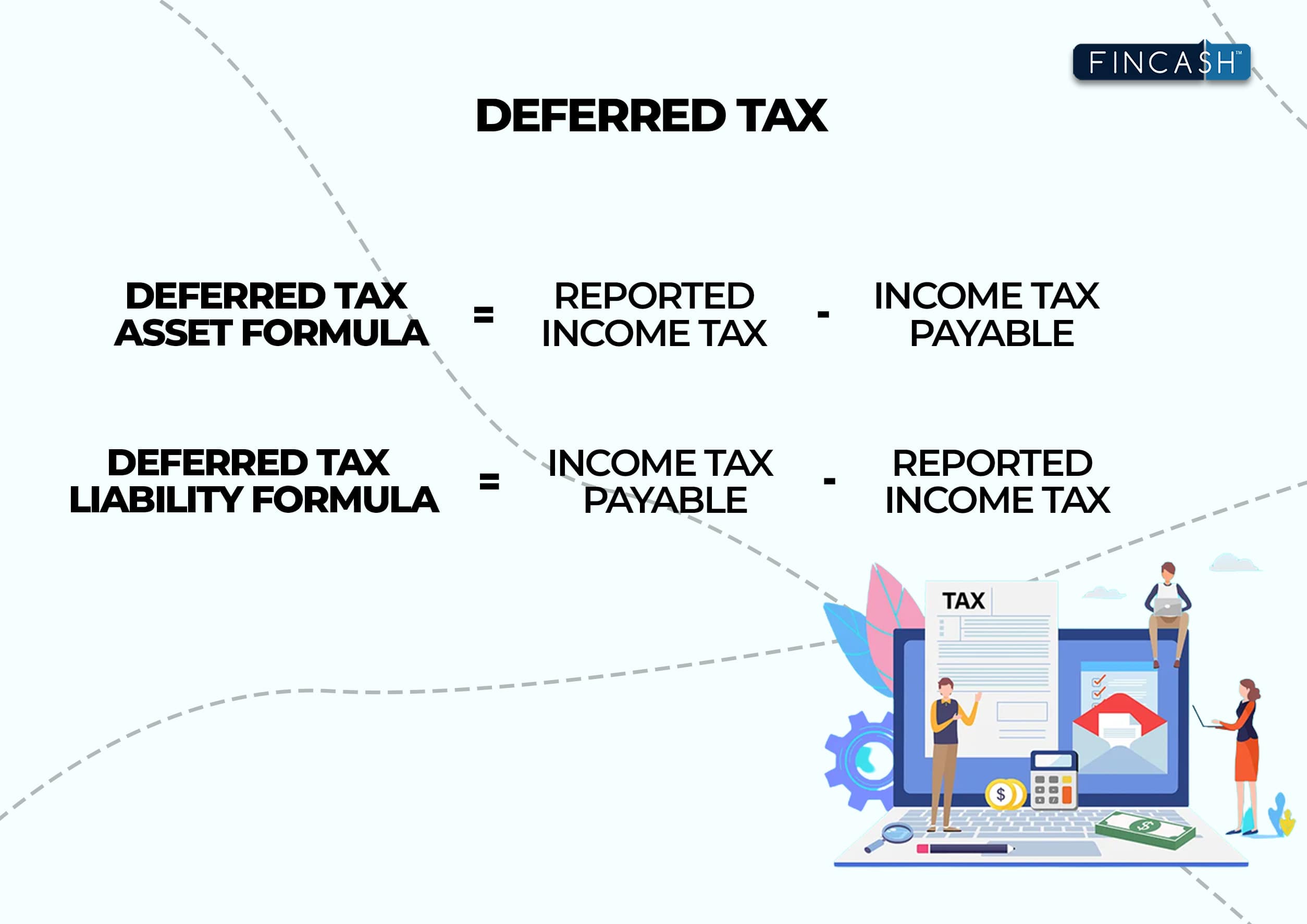

Deferred Tax Deferred Tax In Accounting Standards

https://cdn.educba.com/academy/wp-content/uploads/2020/09/Deferred-Tax.jpg

:max_bytes(150000):strip_icc()/deferred-credit_final-309c8fbbe2584a3a97d44a9e81c5b62c.png)

What Does Defer Mean Store Cityofclovis

https://www.investopedia.com/thmb/WQb_o6OWFyYDVyWfcCeTHabQIaI=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/deferred-credit_final-309c8fbbe2584a3a97d44a9e81c5b62c.png

Deferred Tax Meaning Expense Examples Calculation

https://wallstreetmojocms.recurpro.in/uploads/Deferred_Tax_2894cd29dc.jpg

Deferred revenue is revenue that has not yet been earned but represents goods or services owed to the customer Learn how to record and recognize deferred revenue in accrual accounting with an example and a template Deferred income is revenue received in advance for future products or services Learn how to account for it manage it and use it for financial planning and reporting

Deferred revenue is money that a company receives in advance for products and services that will be delivered or performed later Learn how deferred revenue works when it Deferred income is a term used in accounting to describe money a business has received for goods or services that haven t been delivered yet It s essentially a liability not

Deferred Income Tax In India Fincash

https://d28wu8o6itv89t.cloudfront.net/images/DeferredTaxminjpg-1684824721547.jpeg

Exemplary Ias 12 Illustrative Examples Schedule 6 Of Companies Act

https://i.ytimg.com/vi/m0WPbOLnKjU/maxresdefault.jpg

https://www.investopedia.com › terms › d…

Deferred revenue also known as unearned revenue refers to advance payments a company receives for products or services that are to be delivered or performed in the future The company that

:max_bytes(150000):strip_icc()/Terms-d-deferred-revenue-Final-a8fb680c51014901a4b8f88ac7fb7f77.jpg?w=186)

https://www.bench.co › blog › accountin…

Deferred revenue is money collected from customers before earning it such as prepayments or retainers Learn why it s a liability how to record it and how it differs from accrued expenses

What Is Deferred Revenue Definition Examples Importance And Tips

Deferred Income Tax In India Fincash

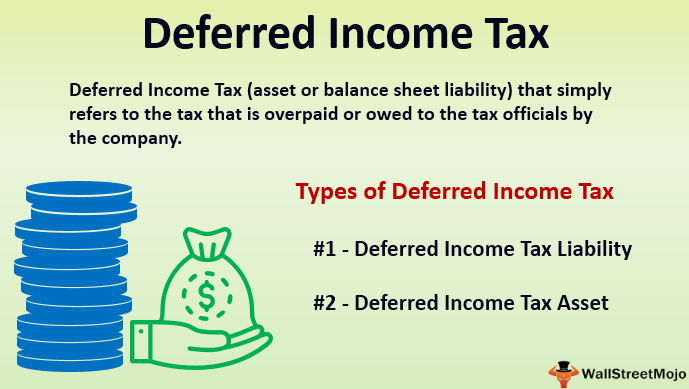

Deferred Income Tax Definition Example How To Calculate

Worked Example Accounting For Deferred Tax Assets The Footnotes Analyst

What Is Deferred Revenue Complete Guide Pareto Labs

Deferred Income Tax Definition Example How To Calculate

Deferred Income Tax Definition Example How To Calculate

Deferred Revenue Definition Accounting For Deferred Income

Deferred Income Tax DIT Definition Types And Examples Marketing91

Deferred Revenue Meaning Importance And More

Deferred Income Meaning - Deferred revenue is the income earned by a company for goods or services not yet delivered Learn how to account for deferred revenue when to recognize it as revenue and see examples of deferred revenue in different scenarios