Deferred Meaning In Accounting What is a Deferral in Accounting Deferral in general means a company s prepaid expenses or revenues A deferral can also be defined as an account where the expenses or revenue is not recognized until the order ends on the balance sheet

In accounting a deferral refers to the delay in recognition of an accounting transaction This can arise with either a revenue or expense transaction A deferral is used in order to only recognize revenues when earned and expenses when consumed A deferral in accounting is used to recognize prepaid expenses or unearned revenue A company will record a deferred expense when it has already paid for the goods or services or a deferred revenue entry when it has received payment for the goods or

Deferred Meaning In Accounting

Deferred Meaning In Accounting

https://i.pinimg.com/736x/76/bb/87/76bb879d3ad7ae4559cce4d0143ac0d1.jpg

Deferred Revenue Examples Journal Entry In Accounting YouTube

https://i.ytimg.com/vi/_X1NLeptcM4/maxresdefault.jpg

Deferred Revenue Expenditure EXPLAINED By Saheb Academy YouTube

https://i.ytimg.com/vi/U70b6USByeA/maxresdefault.jpg

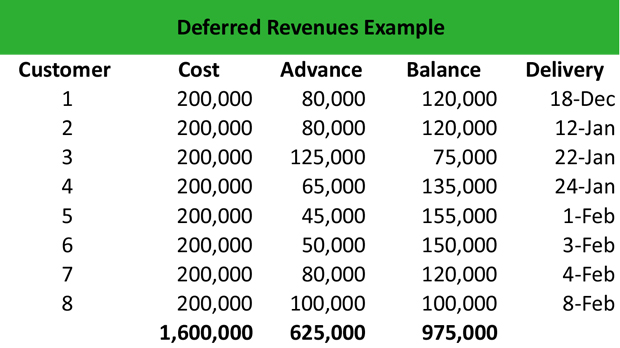

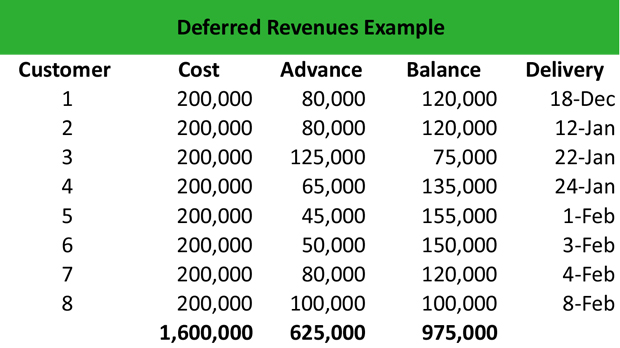

Deferred revenue also known as unearned revenue refers to advance payments a company receives for products or services that are to be delivered or performed in the future The company that A deferral of an expense or an expense deferral involves a payment that was paid in advance of the accounting period s in which it will become an expense An example is a payment made in December for property insurance covering the next six months of January through June

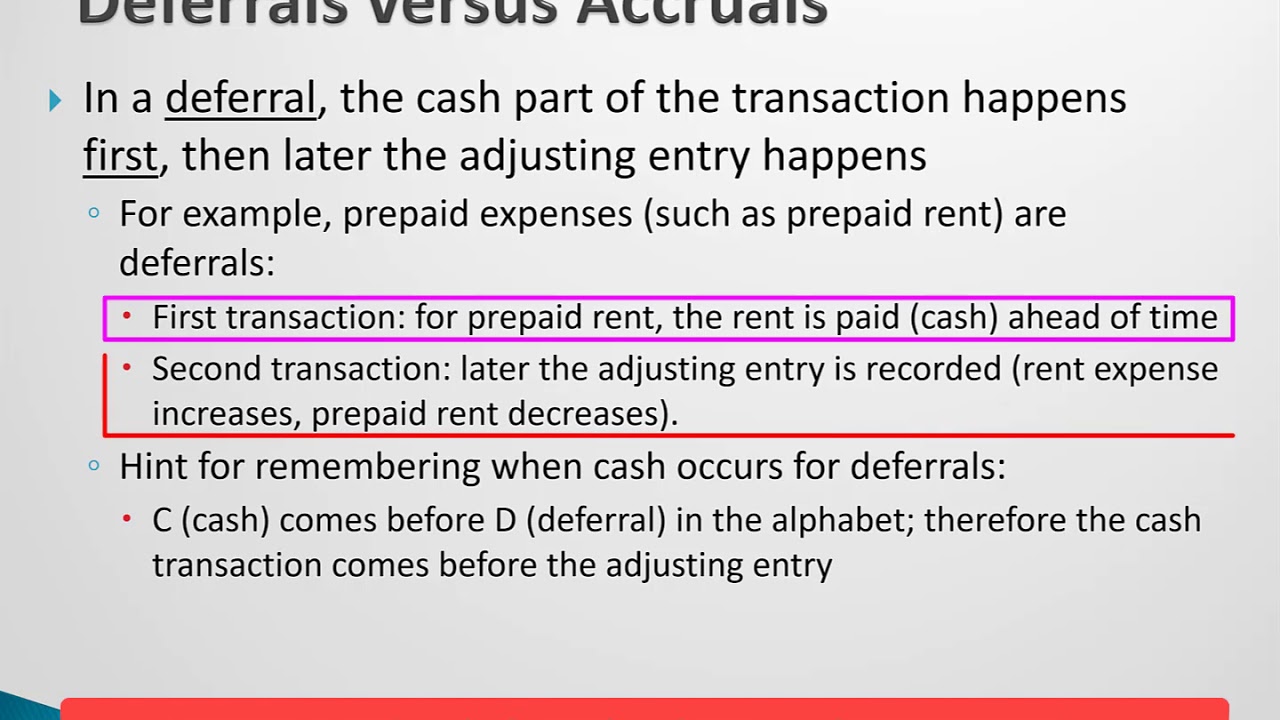

Deferrals are the opposite of accruals The deferrals are incomes that a business already receives cash for but has not yet earned or expenses that the company has already paid for but hasn t yet consumed We commonly call deferred expenses prepaid expenses Deferral accounting is a fundamental concept that allows businesses to manage the timing of revenue and expense recognition This practice is rooted in the matching principle which aims to align revenues with the expenses incurred to generate them within the same accounting period

More picture related to Deferred Meaning In Accounting

Deferred Revenue Meaning Examples With Accounting Entry Liability Or

https://i.ytimg.com/vi/1OYD88LvfCk/maxresdefault.jpg

What Is The Difference Between Deferrals And Accruals YouTube

https://i.ytimg.com/vi/pgbRPVVF5Mg/maxresdefault.jpg

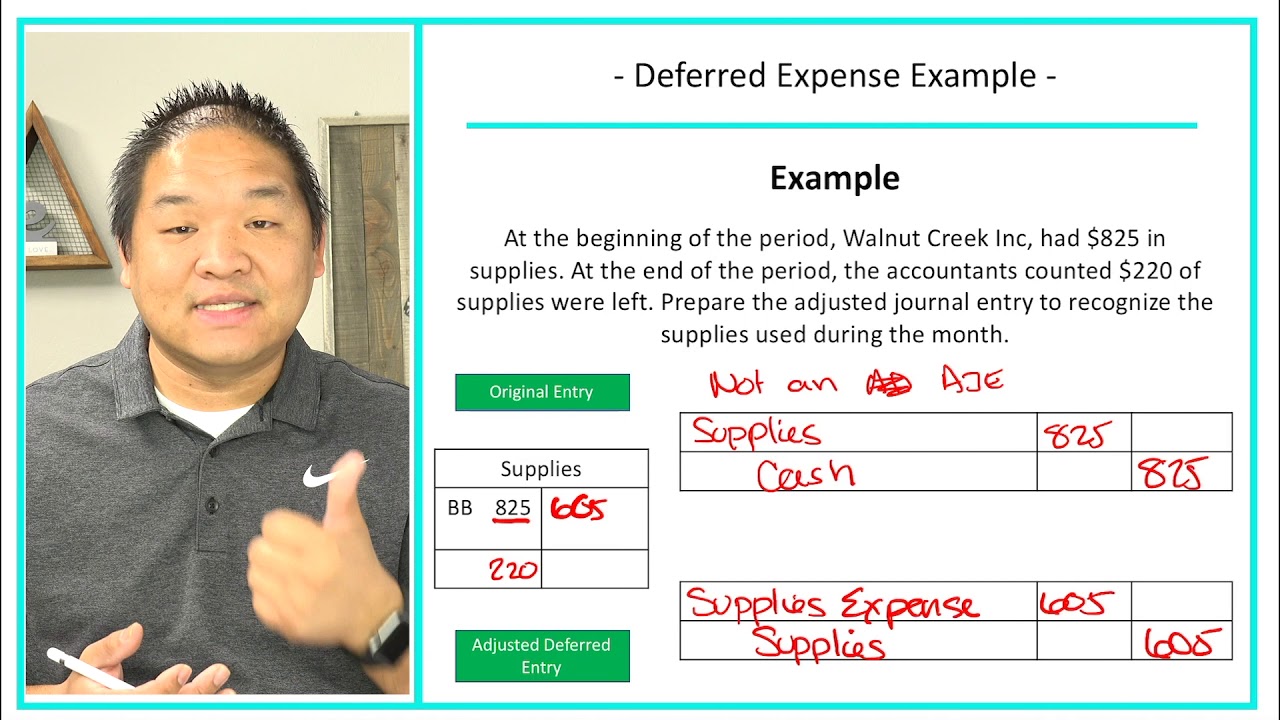

Financial Accounting Lesson 4 3 Deferred Expense Example YouTube

https://i.ytimg.com/vi/PckFtLEjMu8/maxresdefault.jpg

What is deferral in accounting In simple terms deferral refers to delaying the recognition of certain transactions It s like saying Hold on we ve received this money or paid this expense but let s not record it as revenue or expense yet Deferred expenses are expenses a company has prepaid They are recorded as Assets on a balance sheet Deferred revenue is income a company has received for its products or services but has not yet invoiced for They are considered Liabilities on a balance sheet

[desc-10] [desc-11]

:max_bytes(150000):strip_icc()/Terms-d-deferred-revenue-Final-a8fb680c51014901a4b8f88ac7fb7f77.jpg)

Revenue Definition Formula Calculation And Examples 49 OFF

https://www.investopedia.com/thmb/9R0Qsq4PgzyrHOAfjdMr6jMnGi8=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/Terms-d-deferred-revenue-Final-a8fb680c51014901a4b8f88ac7fb7f77.jpg

Deferred Tax Deferred Tax In Accounting Standards

https://cdn.educba.com/academy/wp-content/uploads/2020/09/Deferred-Tax.jpg

https://www.deskera.com › blog › deferral

What is a Deferral in Accounting Deferral in general means a company s prepaid expenses or revenues A deferral can also be defined as an account where the expenses or revenue is not recognized until the order ends on the balance sheet

https://www.accountingtools.com › articles › deferral

In accounting a deferral refers to the delay in recognition of an accounting transaction This can arise with either a revenue or expense transaction A deferral is used in order to only recognize revenues when earned and expenses when consumed

:max_bytes(150000):strip_icc()/deferred-credit_final-309c8fbbe2584a3a97d44a9e81c5b62c.png)

What Does Defer Mean Store Cityofclovis

:max_bytes(150000):strip_icc()/Terms-d-deferred-revenue-Final-a8fb680c51014901a4b8f88ac7fb7f77.jpg)

Revenue Definition Formula Calculation And Examples 49 OFF

Deferred Expenses Definition Examples How To Account

Deferred Expenses Definition Examples How To Account

Deferred Shares What Are They Examples Types Advantages

What Is A Deferral Definition Meaning Example

What Is A Deferral Definition Meaning Example

Deferred Compensation Meaning Plan Types Examples

Deferred Revenue Journal Entry Double Entry Bookkeeping

What Is A Deferred Tax Liability DTL Definition Meaning Example

Deferred Meaning In Accounting - Deferrals are the opposite of accruals The deferrals are incomes that a business already receives cash for but has not yet earned or expenses that the company has already paid for but hasn t yet consumed We commonly call deferred expenses prepaid expenses