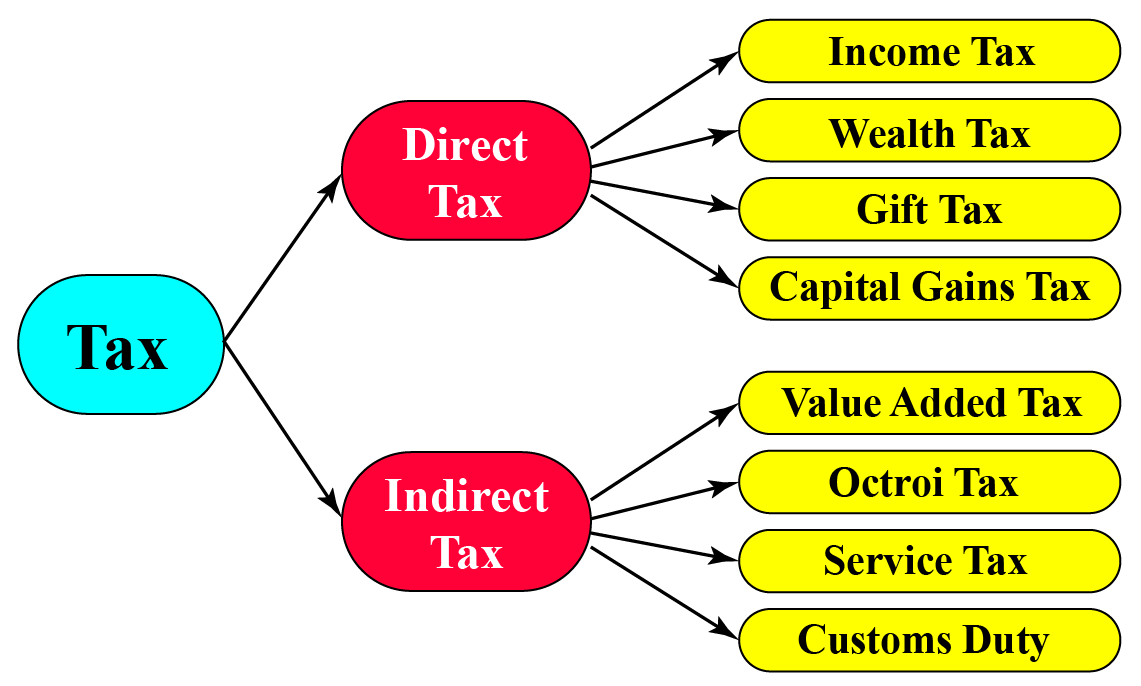

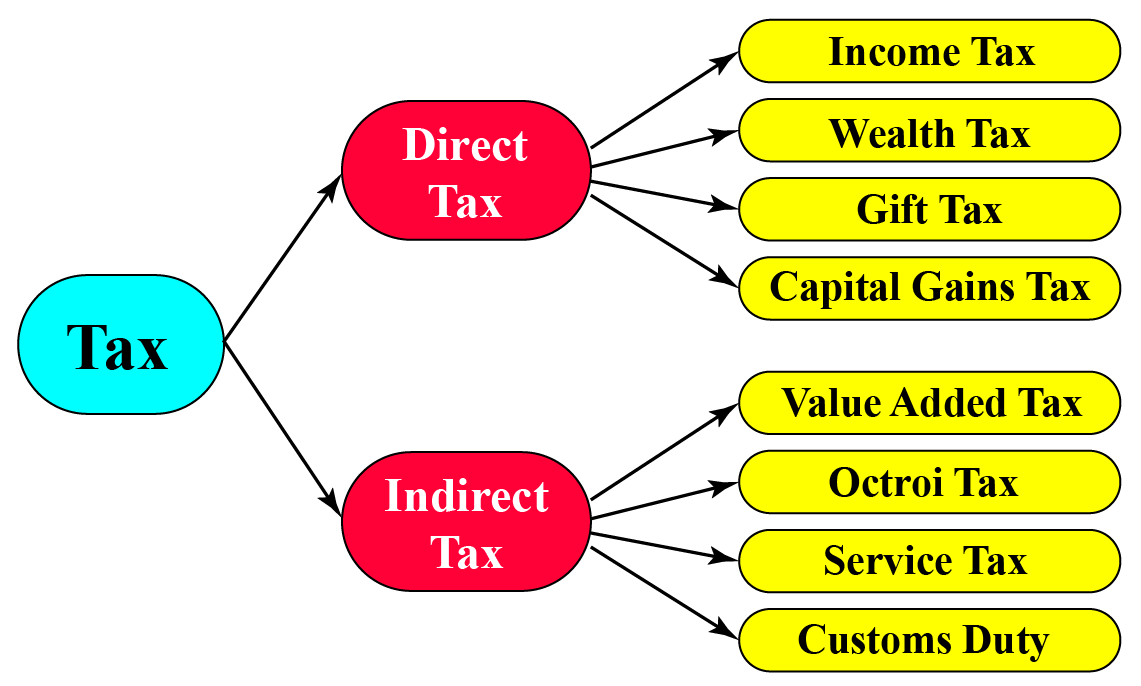

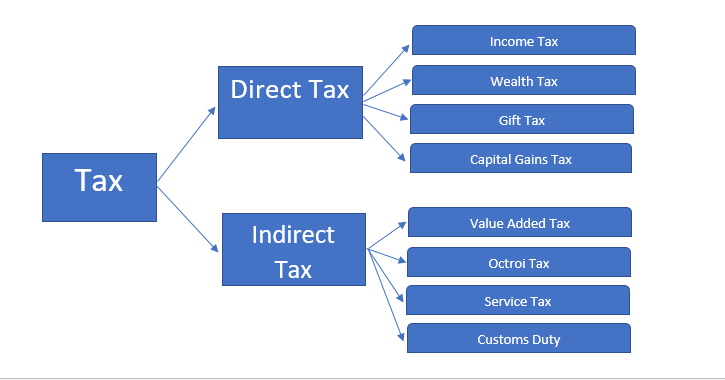

Different Types Of Taxes In India Pdf Types of Taxes in India The Indian tax system primarily consists of two types of taxes Direct Taxes and Indirect Taxes i Direct Taxes Taxation at the Source Direct taxes are levied

1 review the literature relating to different aspects of the tax system in India 2 examine the historical evolution of the Indian tax system 3 discuss the structure of taxation in India 4 Indian government must administer levy reclaim and collect income tax in India

Different Types Of Taxes In India Pdf

Different Types Of Taxes In India Pdf

https://i.ytimg.com/vi/GlwuLOStujw/maxresdefault.jpg

Direct Tax Types Of Direct Taxes In India Income Tax Wealth Tax

https://i.ytimg.com/vi/gqK14FNVpZ8/maxresdefault.jpg

Different Types Of Taxes We Pay In The US If You Want To Know What

https://i.pinimg.com/736x/b3/f8/0e/b3f80e5fd621a84c87c68e9e3f2ed053.jpg

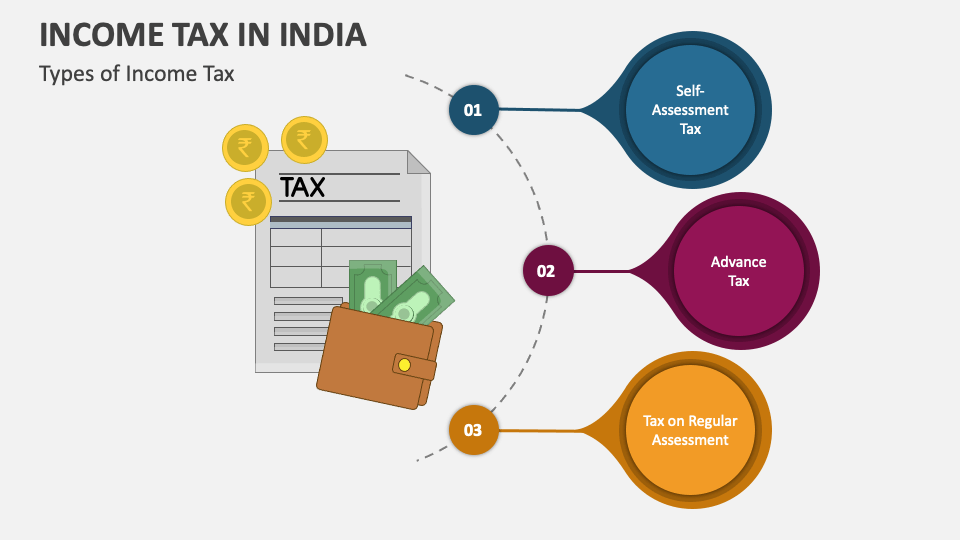

Let us discuss in detail the various direct taxes These form source of revenue for the Union Government a Income Tax This is the tax which is levied on the total income of the tax This Unit orients the learners with important aspects of tax administration the various types of taxes role of Goods and Services Tax Council and the role of Central Board of Direct Taxes

These three tiers are i the Union government ii the State government and iii the Local government In this unit we first review the state of finances of each of these tiers of Major types of direct tax Income Tax Levied on and paid by the same person Corporate Tax Paid by companies and corporations on their profits Wealth Tax Levied on the value of

More picture related to Different Types Of Taxes In India Pdf

April 2019 Capitalante

https://capitalante.com/wp-content/uploads/2019/04/Types-of-Taxes-In-India-768x614.png

Llaves Secundarias DBA Dixit

http://dbadixit.com/wp-content/uploads/Llaves-secundarias.gif

Taxes types

https://i0.wp.com/thereviewstories.com/wp-content/uploads/2017/06/taxes-types.jpg?fit=1200%2C1000&ssl=1

The tax is divided into two types depending on its incidence and impact One is direct tax and another is indirect tax Direct tax is a form of income tax wherein its impact and incidence is on In addition to reviewing the available literature on the subject the present paper attempts to trace the historical evolution of the Indian tax system during three different periods taxes in ancient India taxes during British rule and taxes in

India has a well developed tax structure with a three tier federal structure comprising the Union Government the State Governments and the Urban Rural Local Bodies The power to levy taxes Types of Taxes in India The tax structure in India is broadly classified as Direct tax and Indirect tax Direct Tax is imposed on the income or wealth of a person Eg Income tax

Indirect Tax

https://d138zd1ktt9iqe.cloudfront.net/media/seo_landing_files/priya-gupta-a-taxes-04-1609861613.png

Individual Income Tax Rates 2023 In Singapore Image To U

https://i0.wp.com/justonelap.com/wp-content/uploads/2023/06/Tax-rates-2024-1.jpg?w=1526&ssl=1

https://www.eoiparis.gov.in › content › A-Key-Pillar...

Types of Taxes in India The Indian tax system primarily consists of two types of taxes Direct Taxes and Indirect Taxes i Direct Taxes Taxation at the Source Direct taxes are levied

https://ijmr.net.in › current

1 review the literature relating to different aspects of the tax system in India 2 examine the historical evolution of the Indian tax system 3 discuss the structure of taxation in India 4

2025 To 2025 Tax Brackets Wesley Abbot

Indirect Tax

Types Of Taxes In India AASAN TAX BLOG

Different Types Of Taxes In India SAG Infotech

Tax Bachao

Direct Tax Definition Explained Types Features Examples

Direct Tax Definition Explained Types Features Examples

Direct Tax Definition Explained Types Features Examples

Income Tax In India PowerPoint And Google Slides Template PPT Slides

Income Tax Guide With Examples Tax Calculator

Different Types Of Taxes In India Pdf - Major types of direct tax Income Tax Levied on and paid by the same person Corporate Tax Paid by companies and corporations on their profits Wealth Tax Levied on the value of