Estate Planning Best Practices VII Estate Duty The Estate Duty has been abolished with effect from 11 February 2006 The estate duty chargeable in respect of estates of persons dying on or after 15 July

3 If the value of the deceased s estate does not exceed 50 000 will the application procedure be different 4 What happen if the value of the estate exceeds 50 000 but does not exceed Estate n 1 C He is a real estate agent 2 U C When his father died he left an estate of one million dollars

Estate Planning Best Practices

Estate Planning Best Practices

https://www.edisonwm.com/wp-content/uploads/2020/02/200214-Estate-Planning-and-IHT-scaled.jpg

What Is Estate Planning Here s What You Should Know

https://www.biggerpockets.com/blog/wp-content/uploads/2021/07/Estate-planning-for-real-estate-investors.jpg

The Basics Of Estate Planning YouTube

https://i.ytimg.com/vi/YIiuM7WOw48/maxresdefault.jpg

Property real estate 1 property He forfeited his property by crime 2 real estate She had three children A B and C C passed away one year ago C had two children D and E 1 If my grandmother died with a will directing her estate be distributed

If the deceased leaves a spouse but leaves no issue parent brother or sister of the whole blood the same parents or issue of a brother or sister of the whole blood then the surviving The Estate Agency Agreement for Purchase of Residential Properties in Hong Kong Form 4 is designed for Purchasers This agreement is provided by the Estate Agents Authority in

More picture related to Estate Planning Best Practices

End Form

https://tbalaw.com.au/wp-content/uploads/2022/09/Estate-Planning-Checklist-Lead-Magnet-copy.jpg

Home Professional Wealth Advisors LLC

https://static.fmgsuite.com/media/sourceImages/d0a75788-244f-4a14-8346-b0f82c5de81b.png?v=1

Estate Planning Online Seminar Worksho

https://cesacademy.com/wp-content/uploads/2022/10/ESTATE-PLANNING-training_gfx-1.gif

B Estate provision According to the Intestate Estate Ordinance IEO Cap 73 if a person has not married his her cohabiting partner and his her cohabiting partner dies intestate without a fourth estate

[desc-10] [desc-11]

Estate Planning Online Seminar Worksho

https://cesacademy.com/wp-content/uploads/2022/10/FB-Cover-ESTATE-PLANNING-Nov-17-2022.gif

Personal Estate Planning Kit WHYY

https://whyy.planmylegacy.org/documents/w/whyy/r0/images/pepk-covers.png

https://www.clic.org.hk › en › topics › taxation › estate_duty

VII Estate Duty The Estate Duty has been abolished with effect from 11 February 2006 The estate duty chargeable in respect of estates of persons dying on or after 15 July

https://www.clic.org.hk › en › topics › probate › administering_the_estate

3 If the value of the deceased s estate does not exceed 50 000 will the application procedure be different 4 What happen if the value of the estate exceeds 50 000 but does not exceed

Estate Planning

Estate Planning Online Seminar Worksho

Estate Planning Seminar Idaho Humane Society

Exclusive Estate Planning Resources EState Planner

The Basics Of Estate Planning Estate Planning Personal Finance Blogs

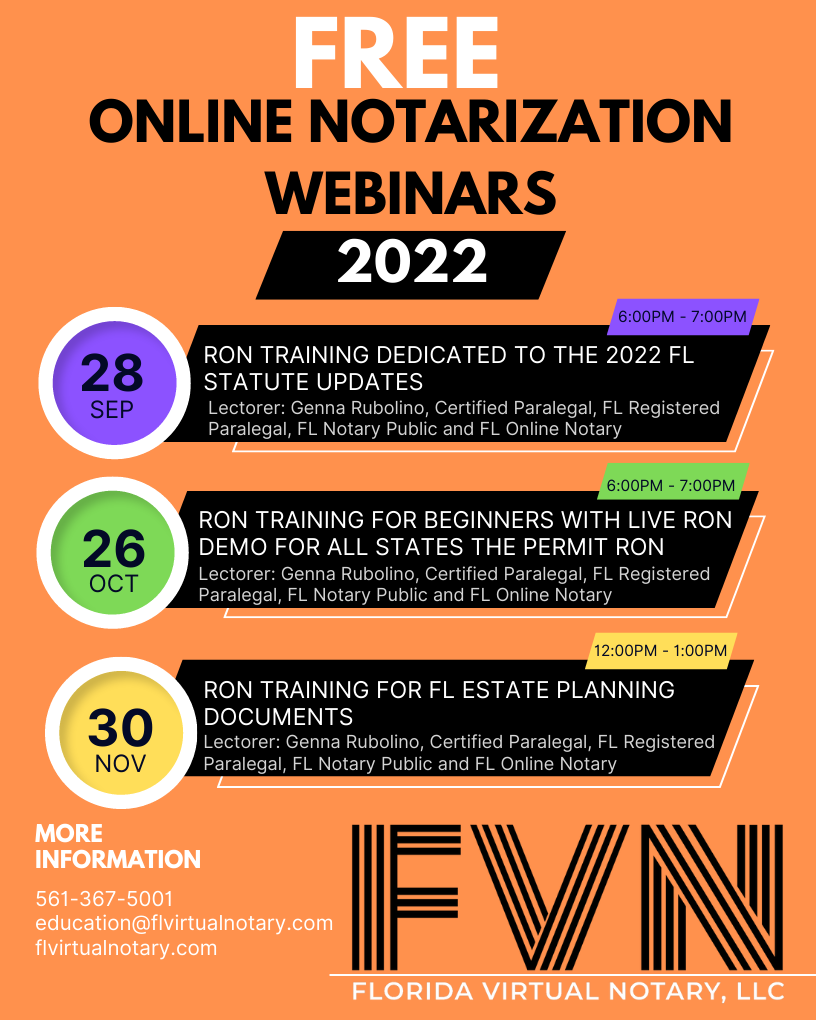

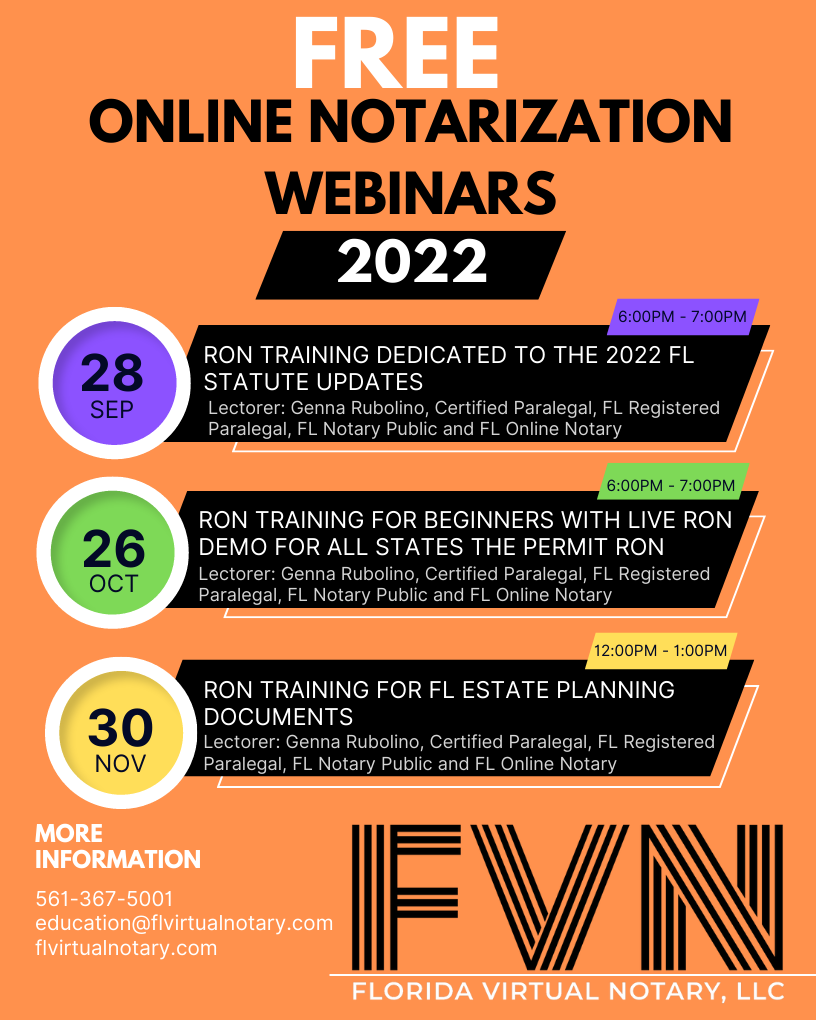

Upcoming Trainings And Webinars Florida Virtual Notary

Upcoming Trainings And Webinars Florida Virtual Notary

Exclusive Estate Planning Resources EState Planner

Free Estate Planning Guide Estate Planning Law Center

Ultimate Estate Planning Checklist Gordon Fischer Law Firm

Estate Planning Best Practices - [desc-14]