Expenses Record Example However as a rule you can deduct any reasonable current expense you incur to earn income The deductible expenses include any GST HST you incur on these expenses minus the amount of any input tax credit claimed Also since you cannot deduct personal expenses enter only the business part of expenses on Form T2125 T2042 or T2121

For more information on deductible expenses go to Rental expenses you can deduct Non compliant amount For tax years after 2023 if a short term rental is non compliant for any portion of the tax year the non compliant amount for that year is determined by multiplying A by B and then dividing that total by C A x B C Ineligible expenses The following expenses are not eligible for the HATC amounts paid to acquire a property that can be used independently of the qualifying renovation the cost of annual recurring or routine repairs or maintenance amount paid to buy household appliances amount paid to buy electronic home entertainment devices

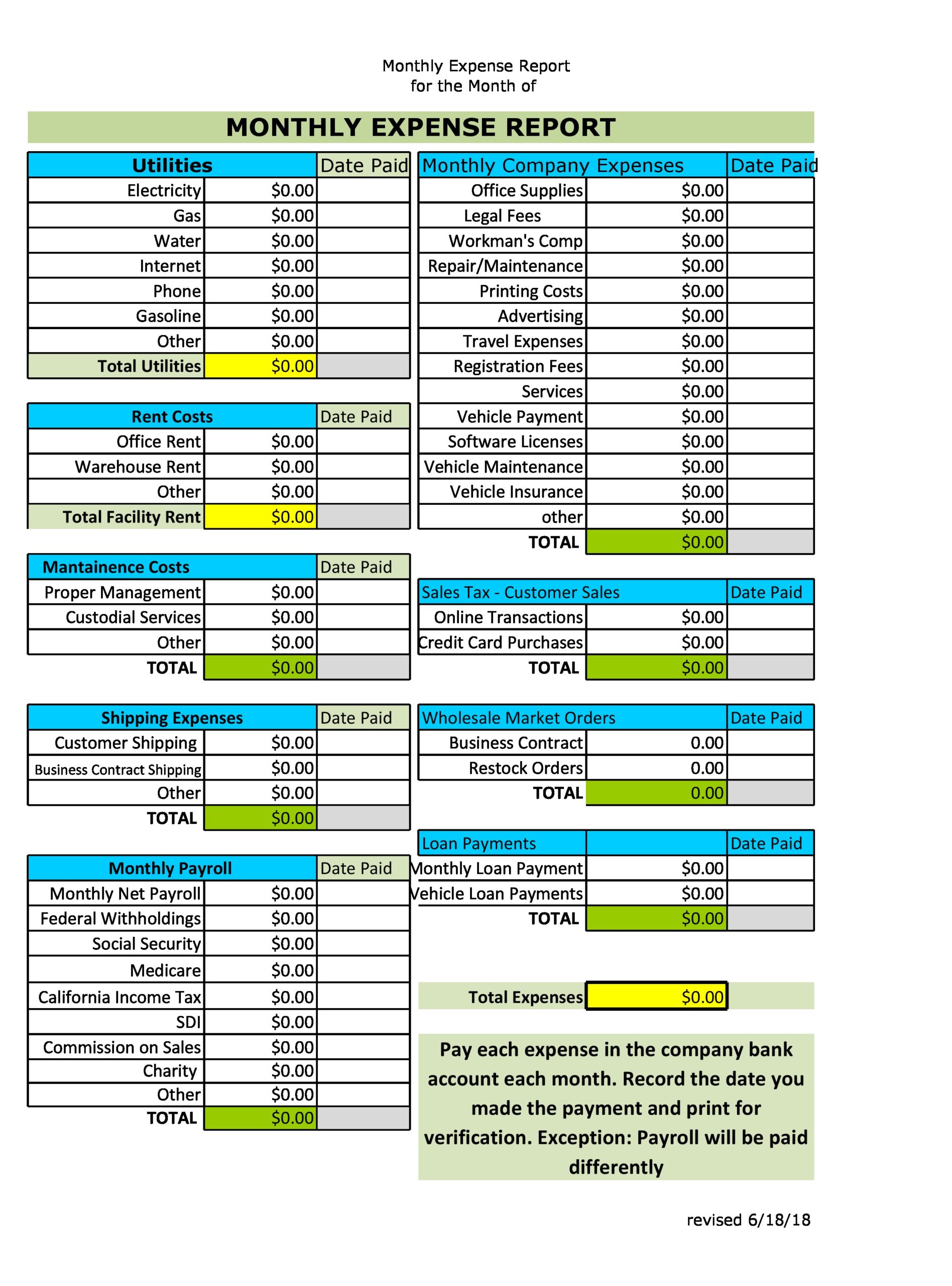

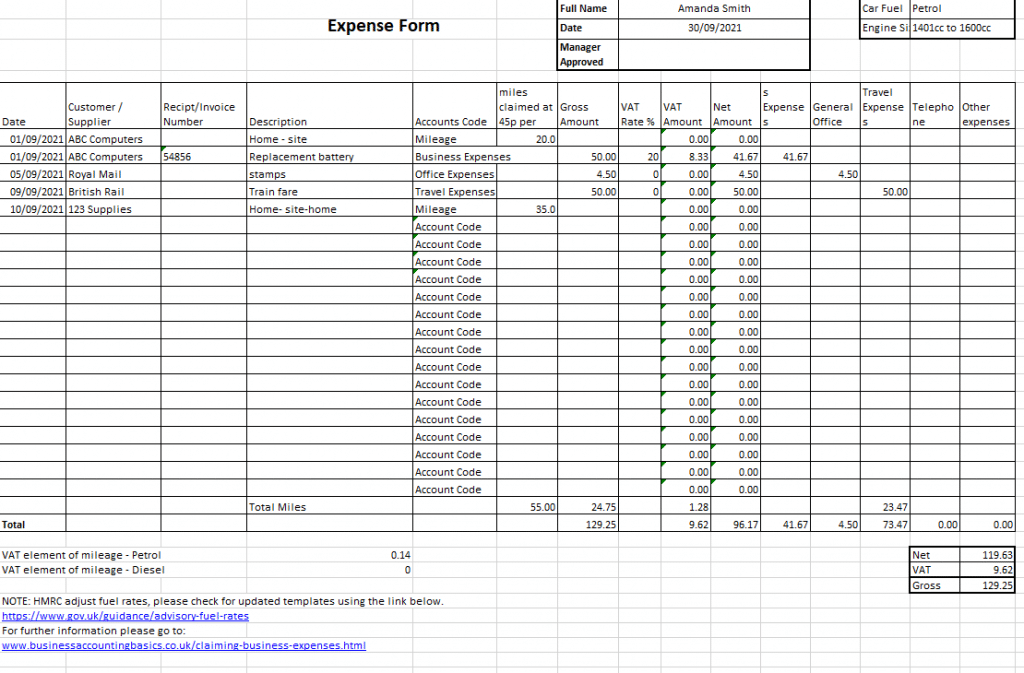

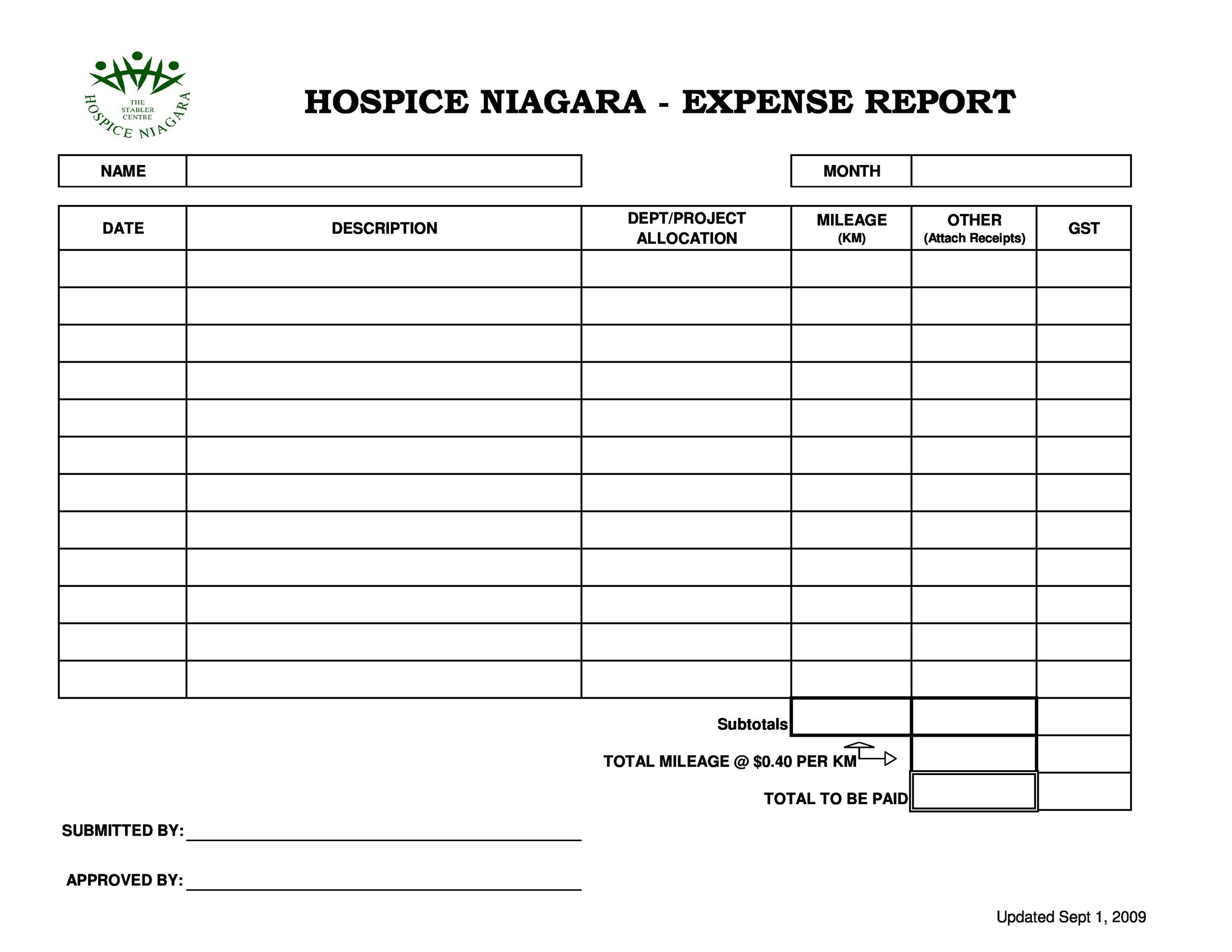

Expenses Record Example

Expenses Record Example

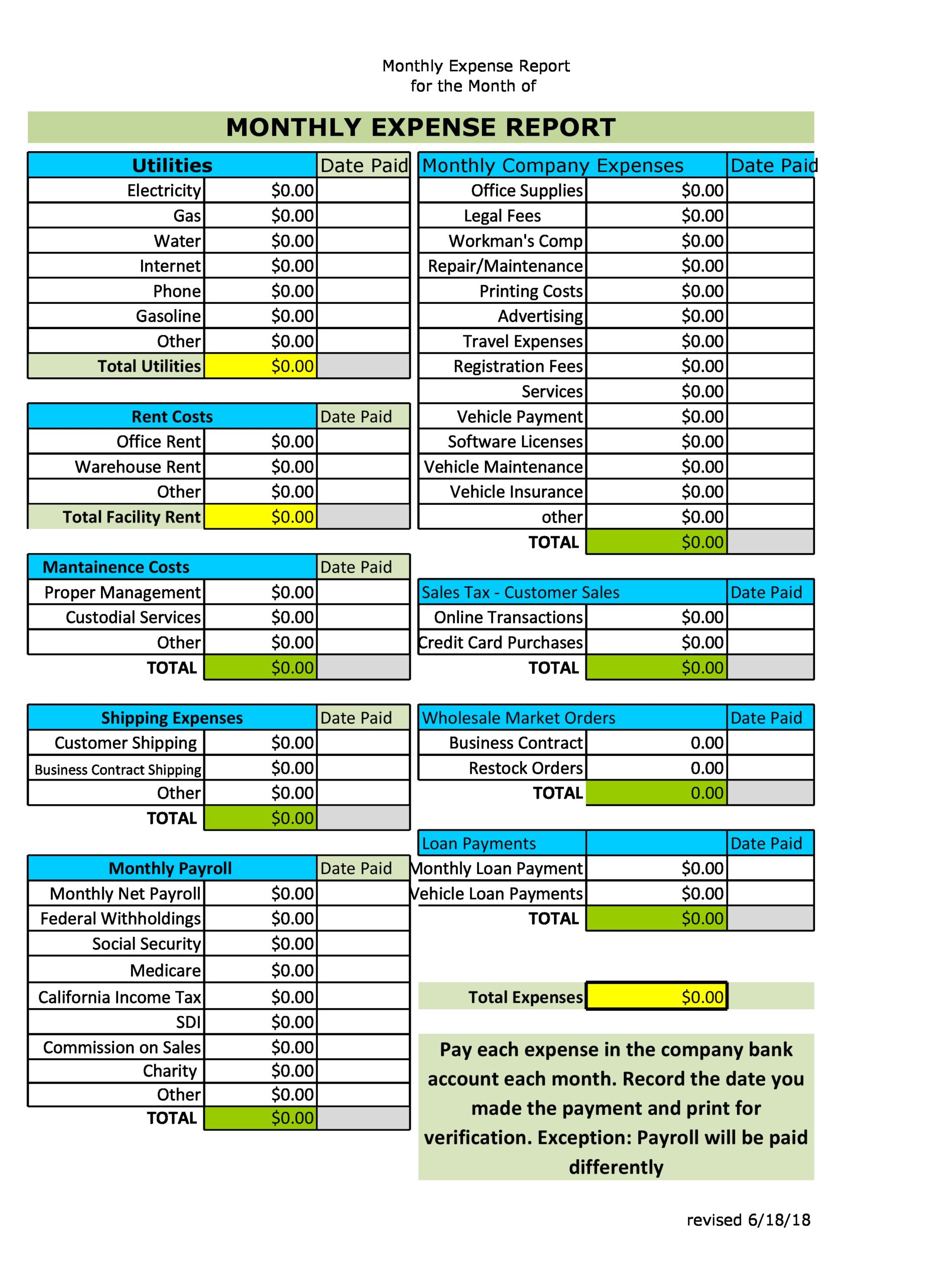

https://templatearchive.com/wp-content/uploads/2020/12/monthly-expenses-template-05-scaled.jpg

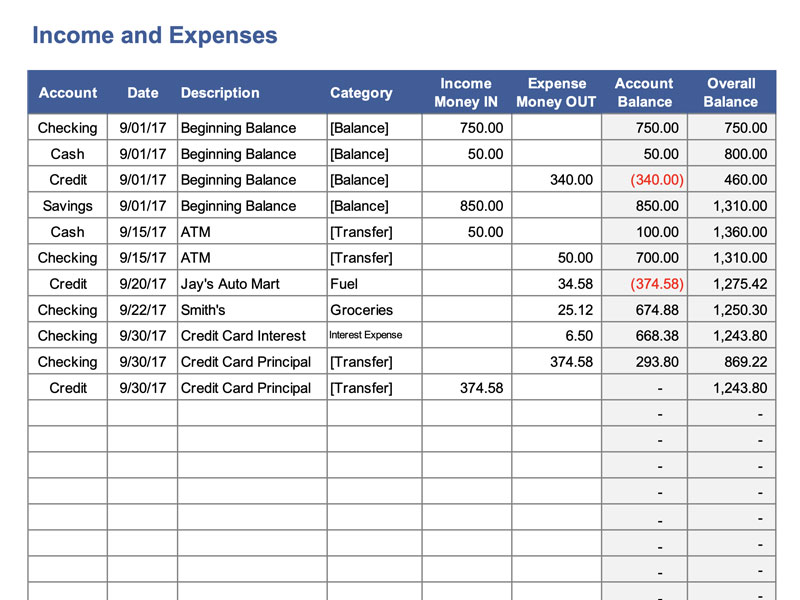

EXCEL Of Income And Expense xlsx WPS Free Templates

https://newdocer.cache.wpscdn.com/photo/20190826/42c4673e960f4a78ae730ac669615eab.jpg

EXCEL Of Daily Expenses Report xls WPS Free Templates

https://newdocer.cache.wpscdn.com/photo/20190830/cfb8a944d48f426c8ee793f48130f526.jpg

Relevant affiliate interest and financing expenses of a controlled foreign affiliate of a taxpayer determined as though the definition taxpayer in this subsection did not include the words or a partnership for an affiliate taxation year means subject to subsection 19 the total of all amounts other than an amount that is deductible in computing any income or loss of the Download and save the PDF to your computer Open the downloaded PDF in Acrobat Reader 10 or later Use this form if you are an employee and your employer requires you to pay expenses to earn your employment income

Comparison of the 2024 Fall Economic Statement and Main Estimates 2025 26 The following reconciliation is for the purpose of providing greater clarity on the relationship between the figures presented in the 2024 Fall Economic Statement and the 2025 26 Estimates and to allow for a more effective comparison and study of how the Estimates cash requirements are derived Vehicle expenses you can deduct You can deduct expenses you incur to run a motor vehicle that you use to earn business income However several factors can affect your deduction The types of expenses you can claim on Line 9281 Motor vehicle expenses not including CCA of Form T2125 or Form T2121 or line 9819 of Form T2042 include

More picture related to Expenses Record Example

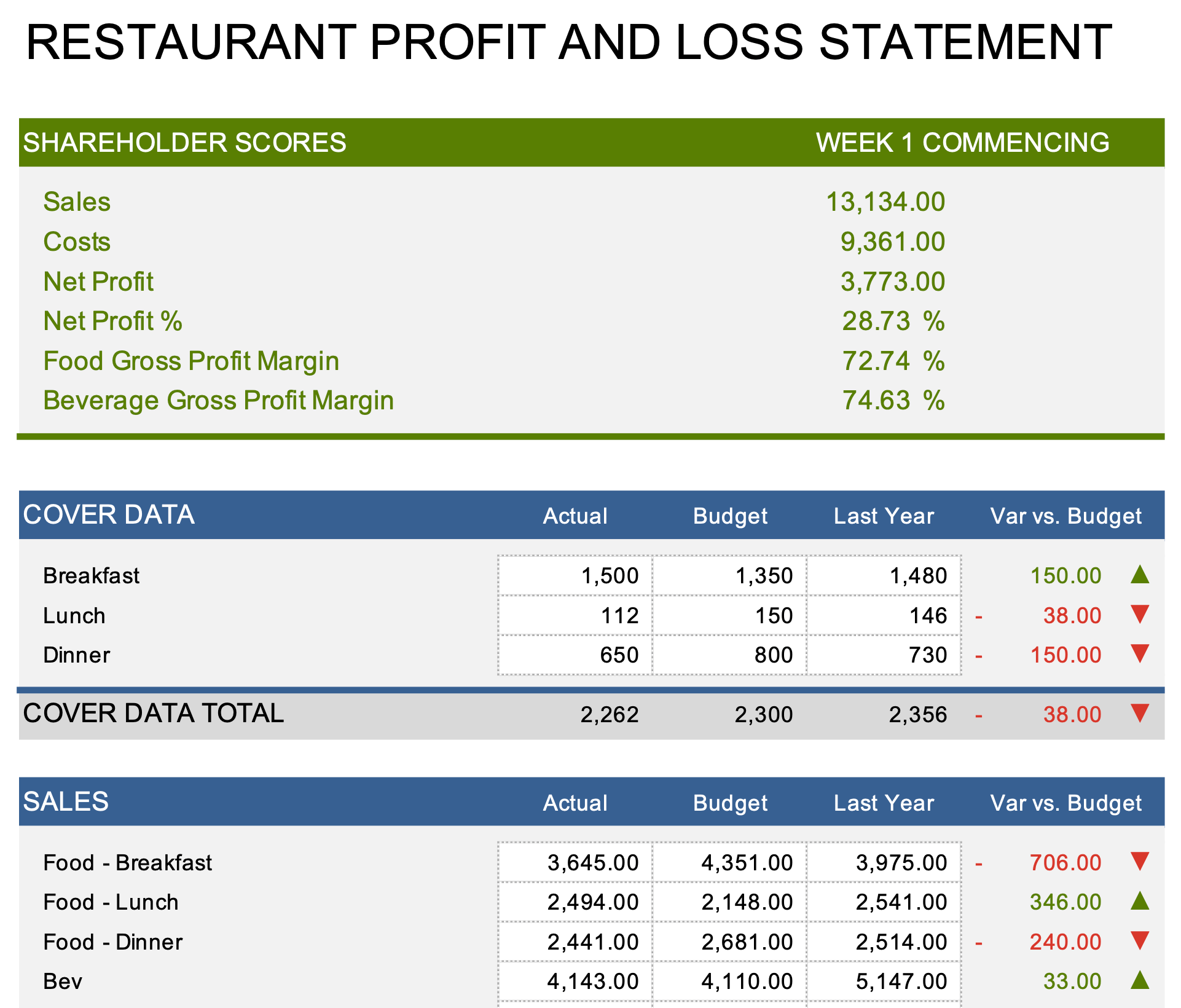

Restaurant Excel Templates Galaxyspa

https://www.exceltemplates.com/wp-content/uploads/2020/04/Restaurant-Expense-Report-Template.png

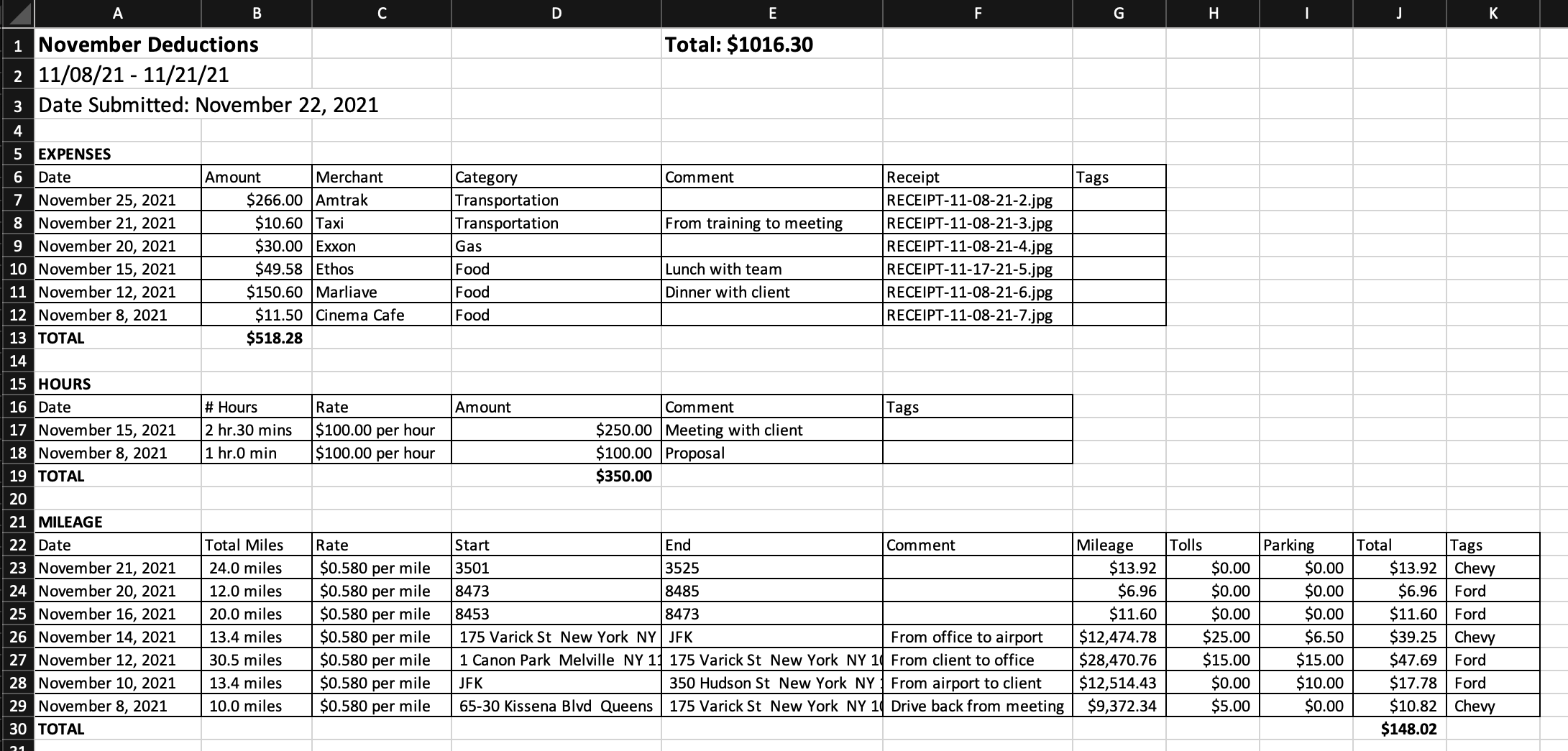

Excel Templates For Expenses

https://falconexpenses.com/blog/wp-content/uploads/2021/11/expense-report-template-in-excel.png

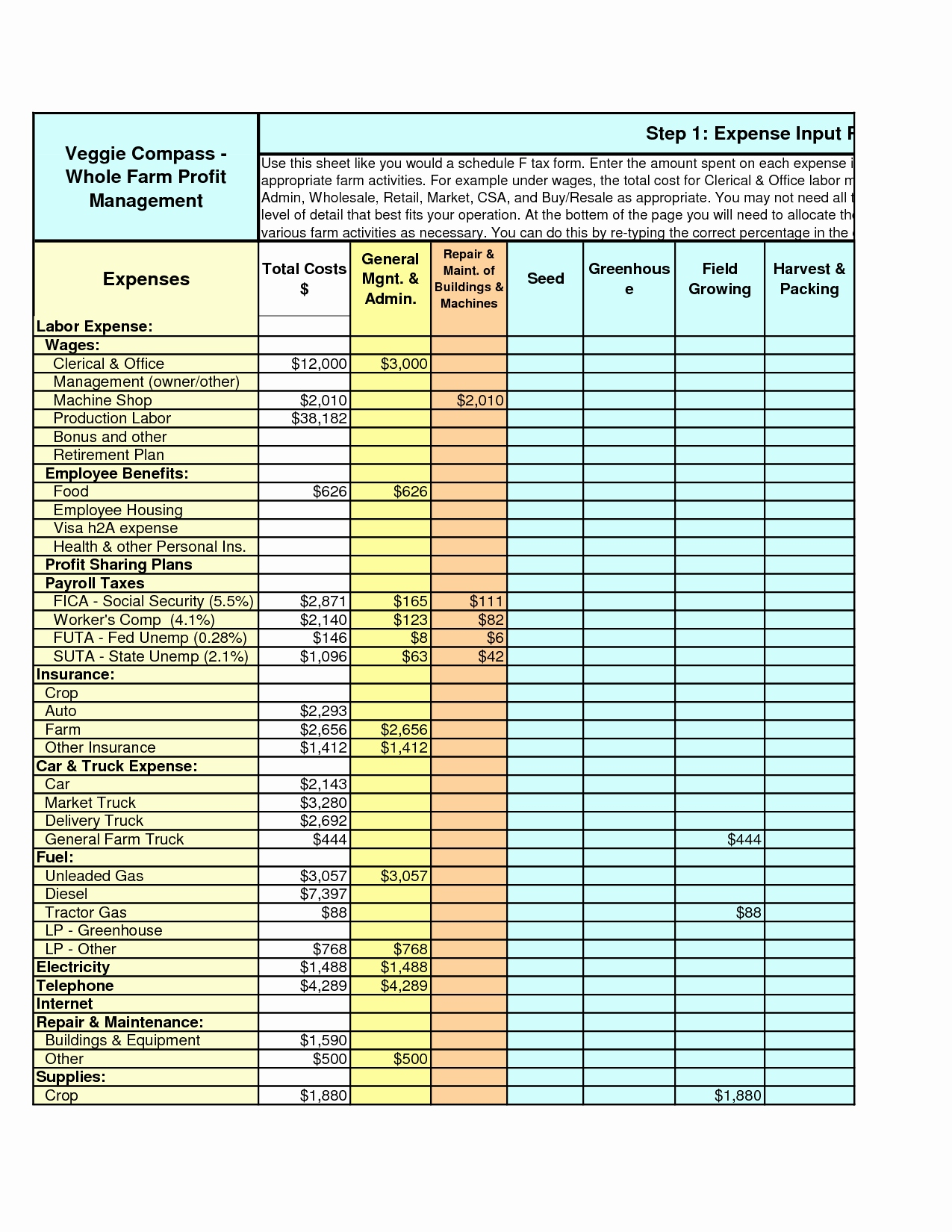

Farm Budget Spreadsheet Excel Db excel

https://db-excel.com/wp-content/uploads/2019/01/farm-budget-spreadsheet-excel-regarding-farm-expenses-spreadsheet-elegant-accounting-templates-example-of.jpg

T2SCH130 Excessive Interest and Financing Expenses Limitation 2023 and later tax years Download instructions for fillable PDFs The expenses are related to the performance of their employment duties step 2 The amount of the allowance or reimbursement is reasonable step 3 Taxable situation If the allowance or reimbursement you provide to your employee for travel expenses does not meet all of the conditions above the allowance or reimbursement is generally taxable

[desc-10] [desc-11]

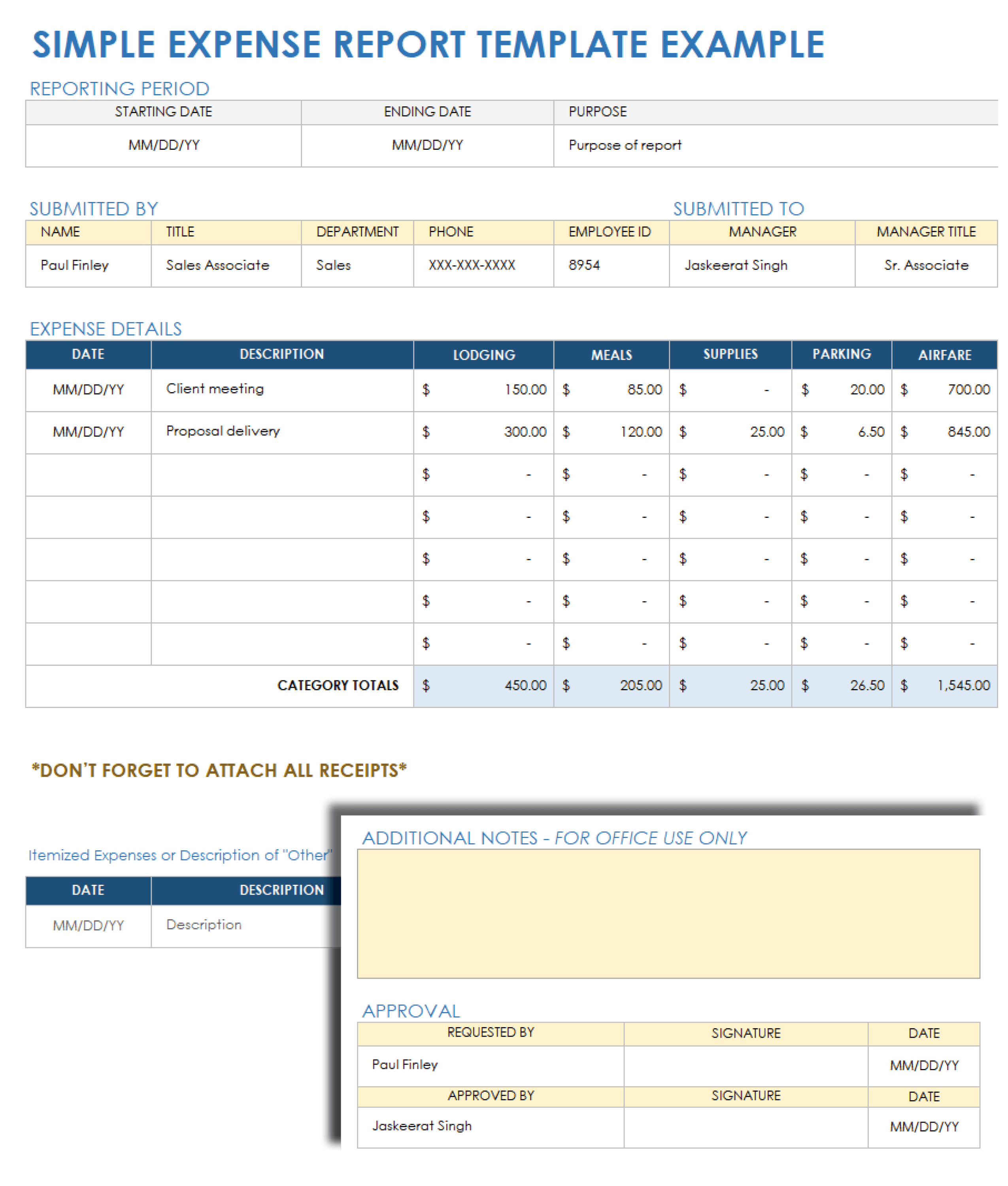

Download 13 BEST Expense Report Templates For FREE EXCEL WORD

https://www.wordstemplatespro.com/wp-content/uploads/2022/03/expense-report-template-1719505.png

Expenses Excel Template

https://www.businessaccountingbasics.co.uk/wp-content/uploads/expense-form-example-1024x673.png

https://www.canada.ca › en › revenue-agency › services › tax › business…

However as a rule you can deduct any reasonable current expense you incur to earn income The deductible expenses include any GST HST you incur on these expenses minus the amount of any input tax credit claimed Also since you cannot deduct personal expenses enter only the business part of expenses on Form T2125 T2042 or T2121

https://www.canada.ca › en › revenue-agency › news › newsroom › tax-ti…

For more information on deductible expenses go to Rental expenses you can deduct Non compliant amount For tax years after 2023 if a short term rental is non compliant for any portion of the tax year the non compliant amount for that year is determined by multiplying A by B and then dividing that total by C A x B C

Daily Expenses Excel Template Database Www vrogue co

Download 13 BEST Expense Report Templates For FREE EXCEL WORD

Simple Expense Tracker Excel Template

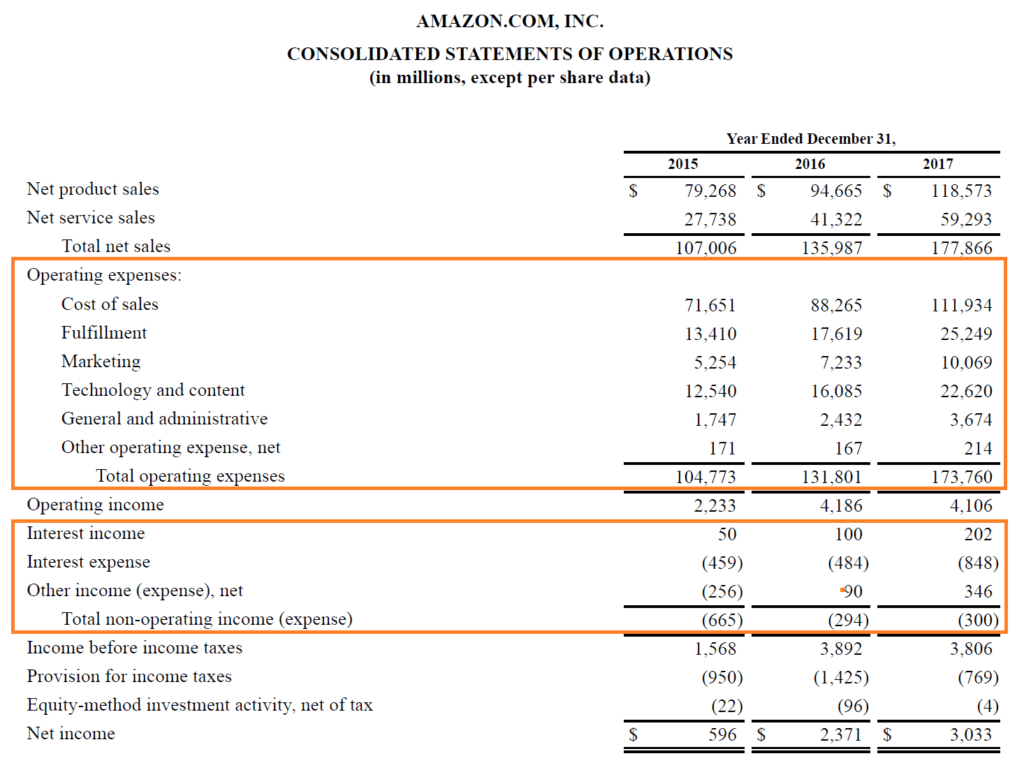

Expenses Definition Types And Practical Examples

Expense Form Template

Income Expense Tracker Template

Income Expense Tracker Template

Daily Expenses Sheet Excel Templates In 2024 Excel Templates Excel

Google Sheets Monthly Expense Report Template Lordfit Vrogue co

Daily Expense Sheet ExcelTemplate

Expenses Record Example - [desc-13]