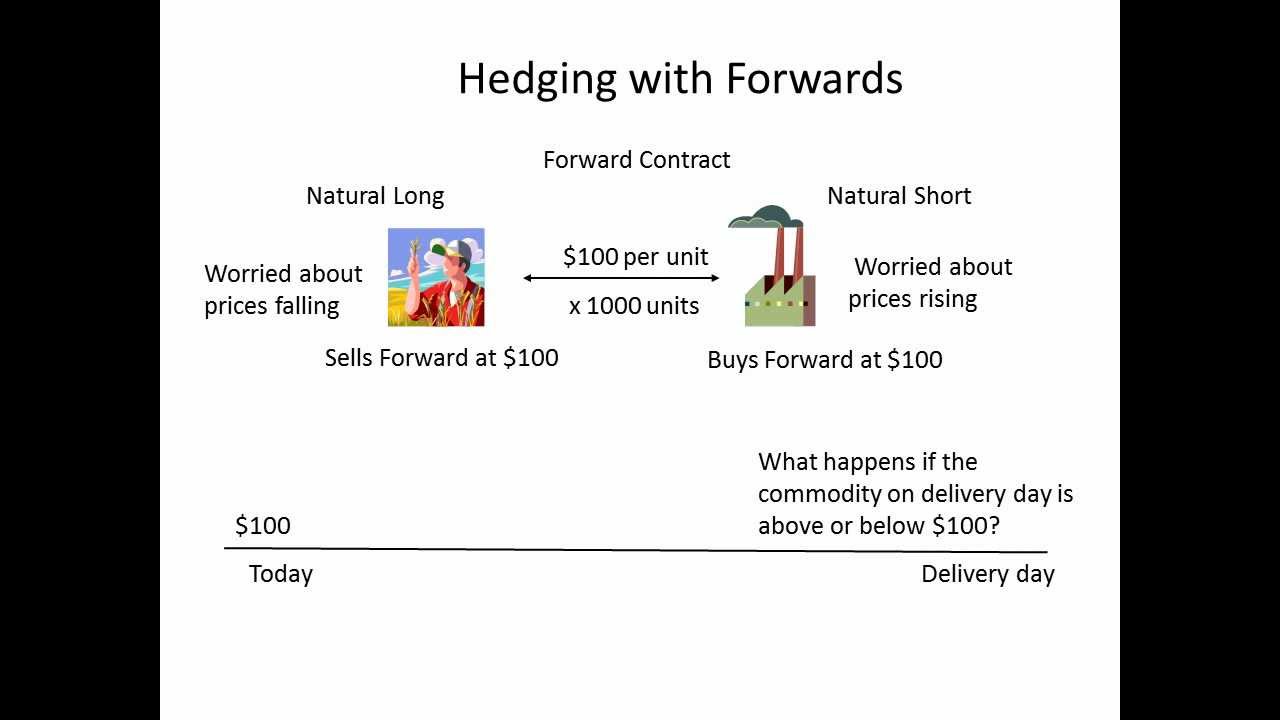

Fx Forward Example A currency forward is a customized written contract between two parties that sets a fixed foreign currency exchange rate for a transaction set for a specified future date Currency forward contracts are used to hedge foreign currency exchange risk They are most commonly made between importers and exporters headquartered in different countries

What Is a Forward Exchange Contract FEC A forward exchange contract FEC is an over the counter OTC transaction that is used to exchange currencies that are infrequently or never Forex currency forwards are derivatives that give you the obligation to buy or sell FX at a specific price on a specific date in the future FX forwards are traded over the counter and they are not standardised for everyone

Fx Forward Example

Fx Forward Example

https://i.ytimg.com/vi/--kAurY5u60/maxresdefault.jpg

Hedging With Forwards YouTube

https://i.ytimg.com/vi/4SczeWA_CgE/maxresdefault.jpg

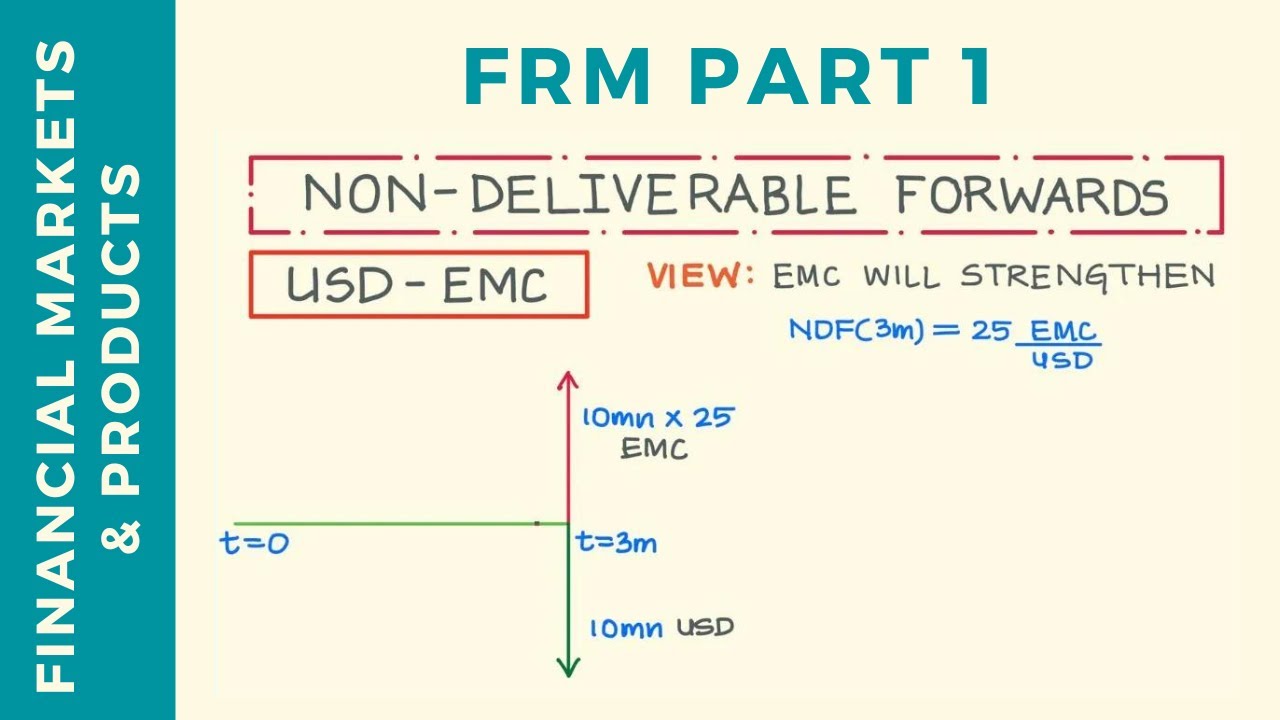

FX Forward Contracts Derivatives Video 2 YouTube

https://i.ytimg.com/vi/7yr77X_atN4/maxresdefault.jpg

An illustrated tutorial on FX forward contracts including how to calculate forward exchange rates and interest rate parity and how forward arbitrage covered interest arbitrage works A currency forward also known as an outright forward is a tailored foreign exchange contract that is traded over the counter OTC and allows parties to set a specific exchange rate for a future date

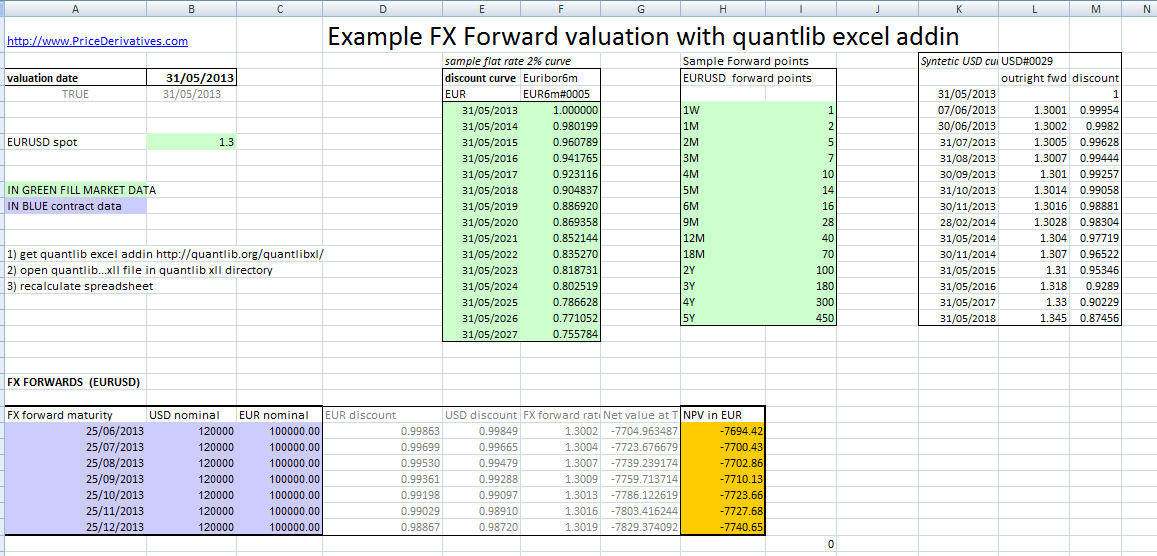

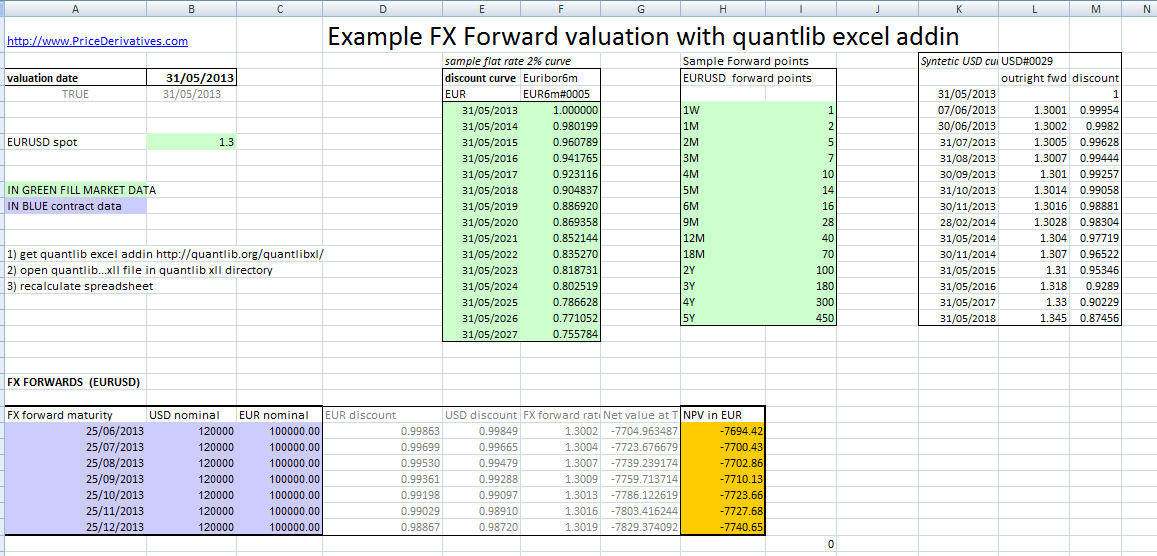

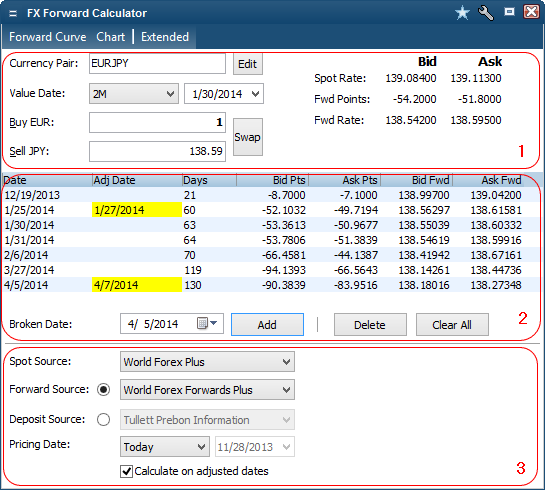

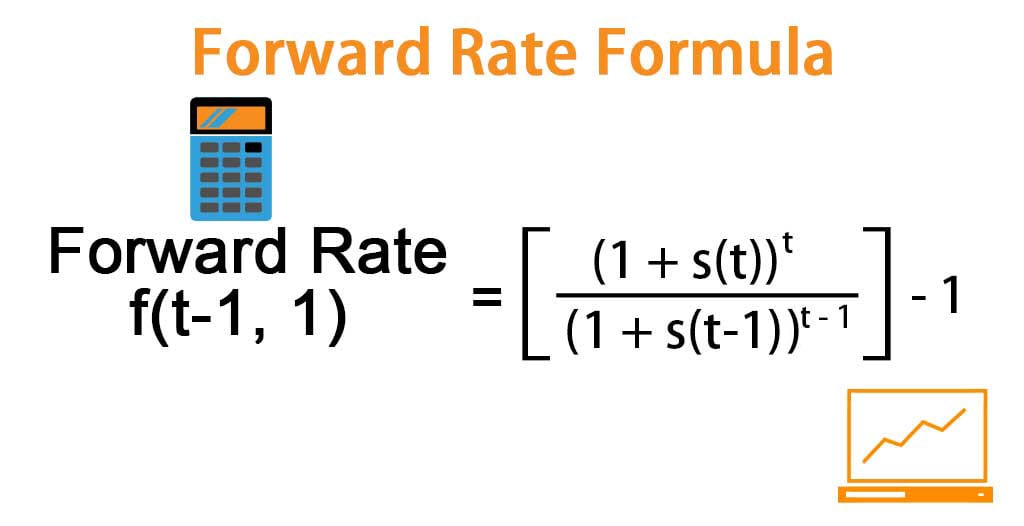

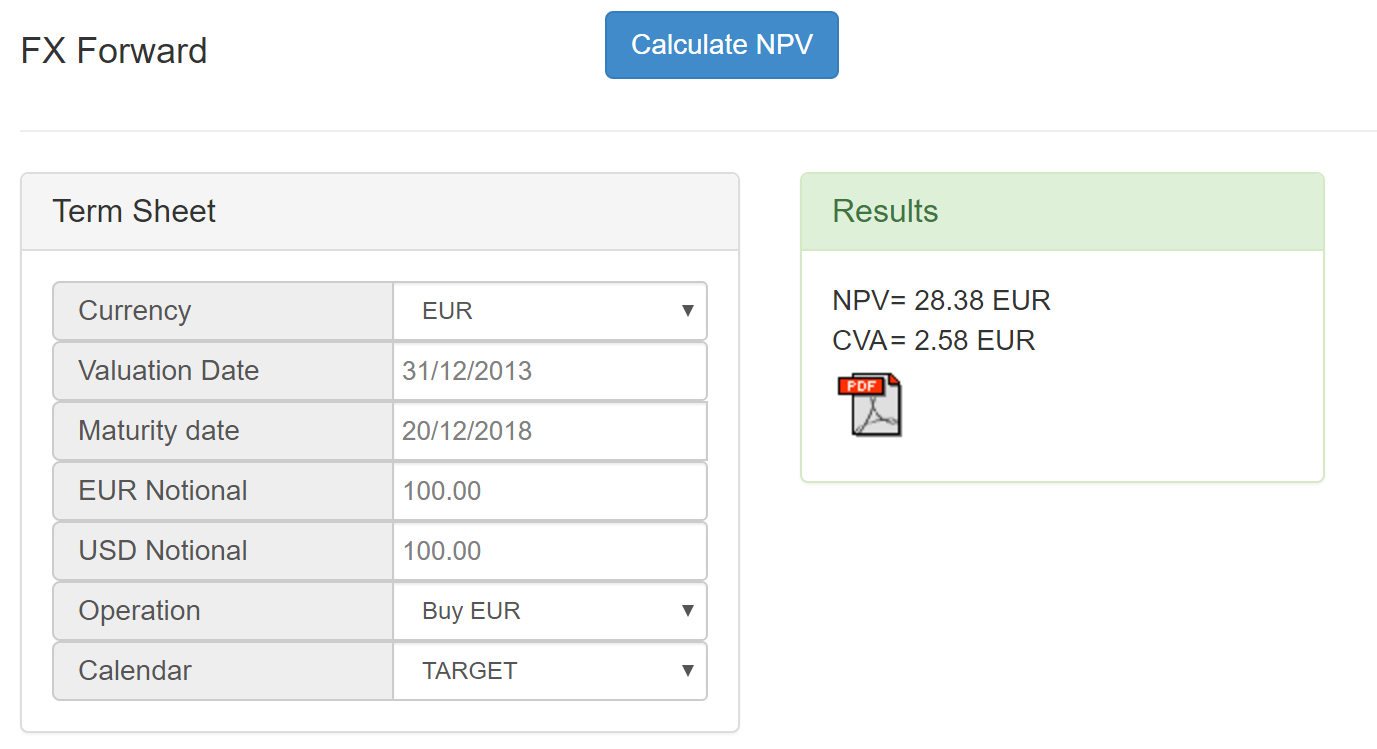

The forward exchange rate is calculated using the current spot rate the interest rates of the currencies involved and the time of the contract The formula is Forward rate is S x 1 r d x t 360 1 r f x t 360 Forward rate for one year 86 5008 x 1 0 06 1 0 05 x 1 Here t 360 1 86 5008 x1 0095 87 3225 FX forward Definition An FX Forward contract is an agreement to buy or sell a fixed amount of foreign currency at previously agreed exchange rate called strike at defined date called maturity FX Forward Valuation Calculator

More picture related to Fx Forward Example

Non Deliverable Forwards NDFs Explained CFA Level 3 YouTube

https://i.ytimg.com/vi/4_xXWaw9gLk/maxresdefault.jpg

FX Swaps Outright Forward Transaction Foreign Exchange Markets FRM

https://i.ytimg.com/vi/WIrsEBACCQ4/maxresdefault.jpg

What Does Forward Purchase Agreement Mean Marie Thoma s Template

https://blog.ipleaders.in/wp-content/uploads/2017/02/Flow-Of-Forward-Contract.png

In the world of international finance currency forwards are key for financial risk management They are also known as FX forwards These tools help businesses fix exchange rates for future deals This guide explains why currency forwards are important and how they help keep costs stable in changing currency markets What Are Currency Forwards An FX forward is a contractual agreement between the client and the bank or a non bank provider to exchange a pair of currencies at a set rate on a future date The pricing of the contract is determined by the exchange spot price interest rate differentials between the two currencies and the length of the contract which the buyer and the

[desc-10] [desc-11]

FX Forward Valuation Excel

https://www.pricederivatives.com/en/wp-content/uploads/2013/10/Capture.png

Treasury Essentials Yield Curves The Association Of Corporate Treasurers

https://www.treasurers.org/ACTmedia/images/forwardyieldcurve_bi.jpg

https://corporatefinanceinstitute.com › resources › ...

A currency forward is a customized written contract between two parties that sets a fixed foreign currency exchange rate for a transaction set for a specified future date Currency forward contracts are used to hedge foreign currency exchange risk They are most commonly made between importers and exporters headquartered in different countries

https://www.investopedia.com › terms › forward...

What Is a Forward Exchange Contract FEC A forward exchange contract FEC is an over the counter OTC transaction that is used to exchange currencies that are infrequently or never

Forward Price Definition Formula How To Calculate

FX Forward Valuation Excel

Images Of JapaneseClass jp

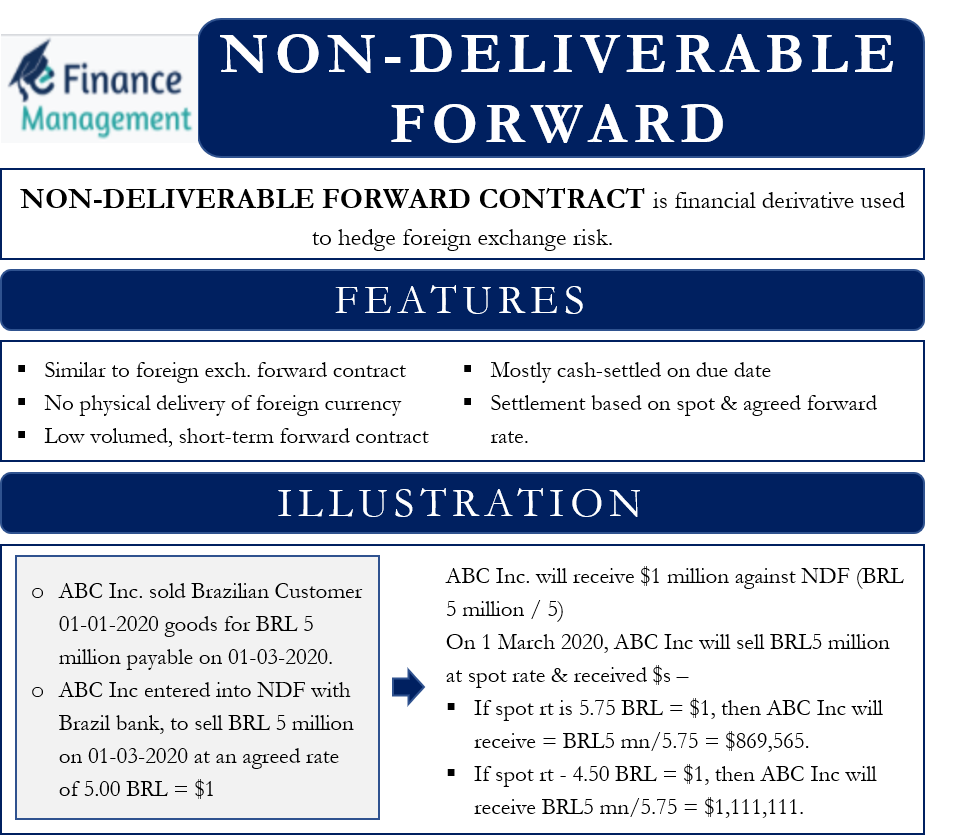

Non deliverable Forward NDF Definition How It Works

FX Forward Calculator

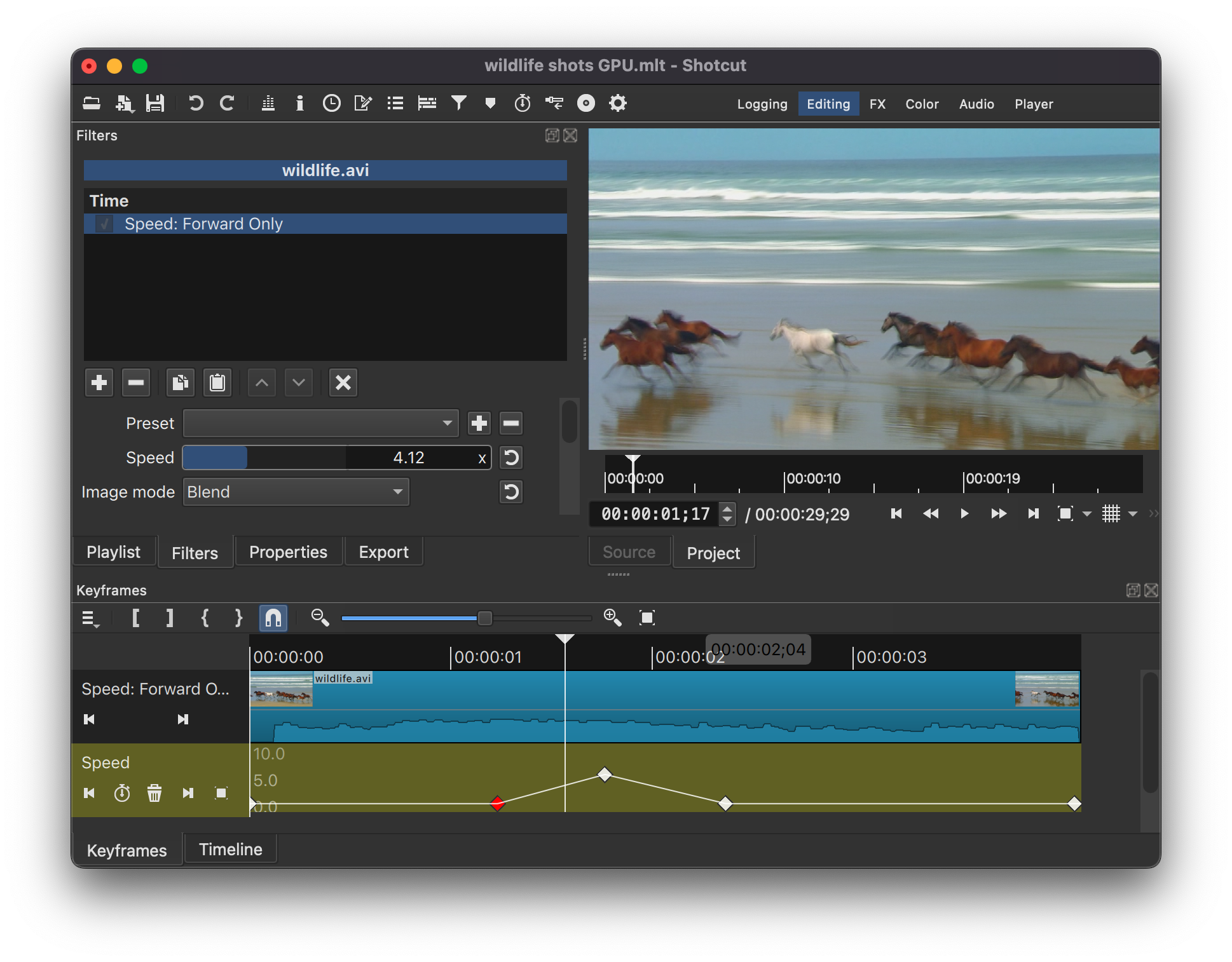

Shotcut New Version 23 05

Shotcut New Version 23 05

The Basic Mechanics Of FX Swaps And Cross currency Basis Swaps

Forward Rate Formula Formula Examples With Excel Template

Fx Forward Example - FX forward Definition An FX Forward contract is an agreement to buy or sell a fixed amount of foreign currency at previously agreed exchange rate called strike at defined date called maturity FX Forward Valuation Calculator