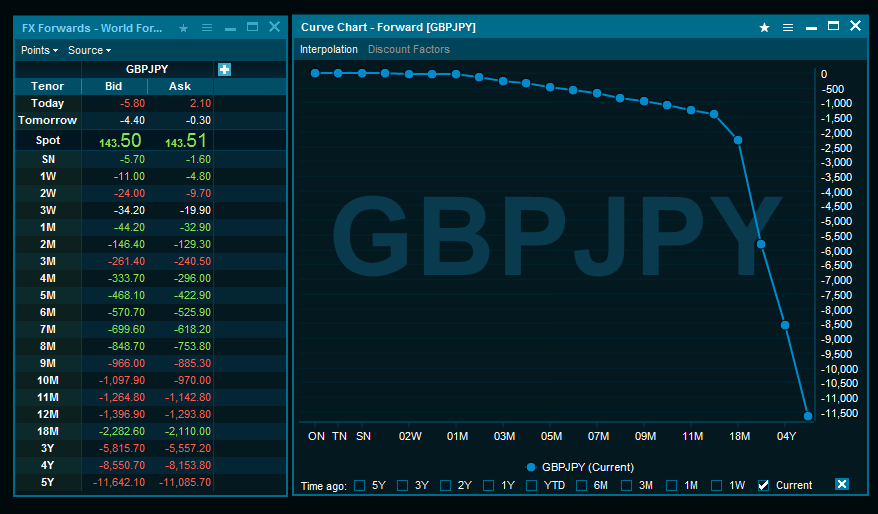

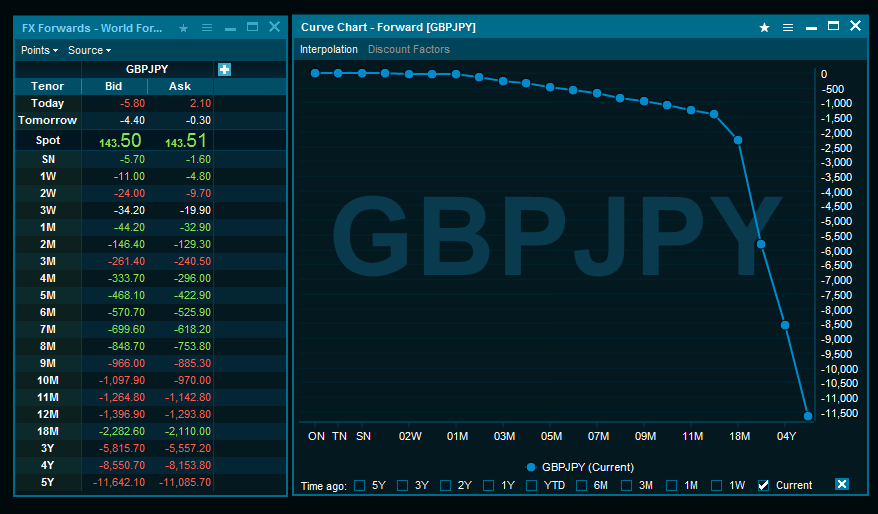

Fx Forward Points Explained FX points are mathematically derived by the prevailing interest rate markets Using our example of the GBP EUR 1 year forward points 131 is a result of the 1 year GBP and EUR interest rate outlook

Forward points are adjustments made to the spot exchange rate to derive the forward exchange rate They reflect interest rate differentials and manage foreign exchange Currency forwards are over the counter OTC instruments known as outright forwards It is a binding contract in the foreign exchange FX market that locks in the exchange rate for the

Fx Forward Points Explained

Fx Forward Points Explained

https://i.ytimg.com/vi/Pkl0kjny90M/maxresdefault.jpg

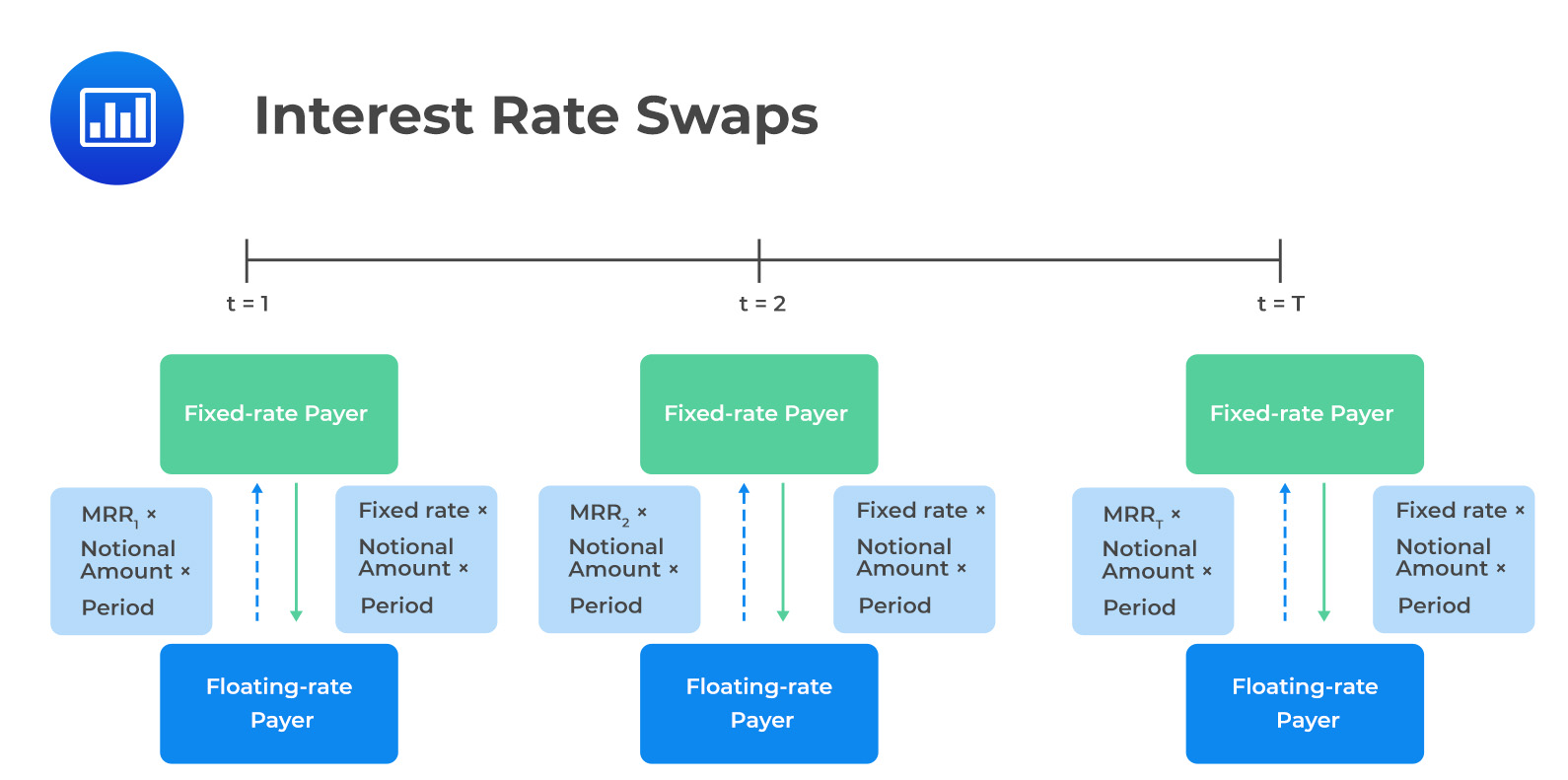

FX Swaps Explained FRM Part 1 FRM Part 2 CFA Level 1 CFA Level 3

https://i.ytimg.com/vi/Dx10l7XyeK0/maxresdefault.jpg

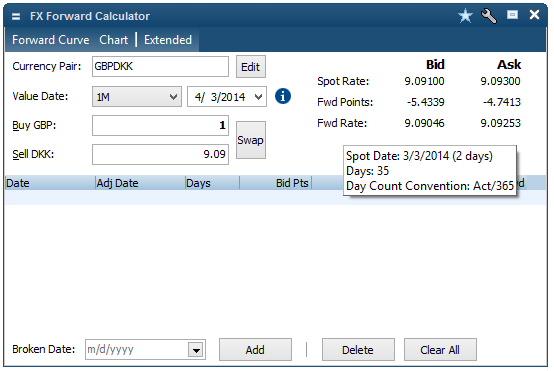

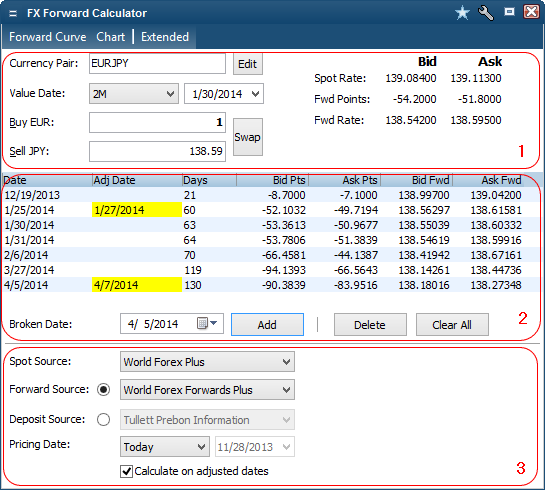

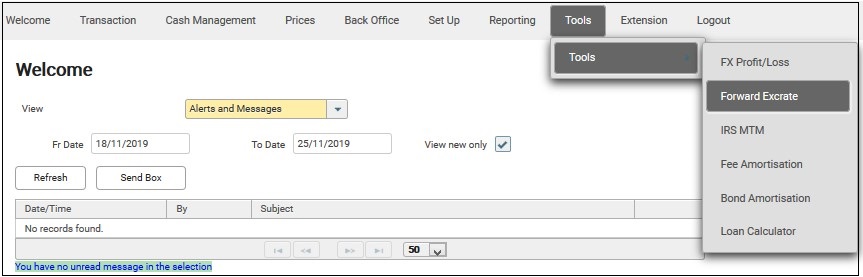

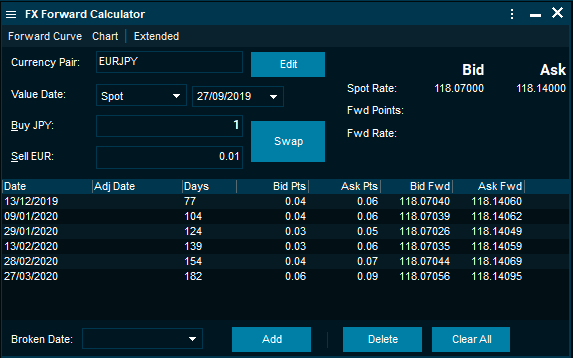

FX Forward Calculator

http://software.infrontservices.com/helpfiles/infront/ver57/en/fxforwardcalculator.png

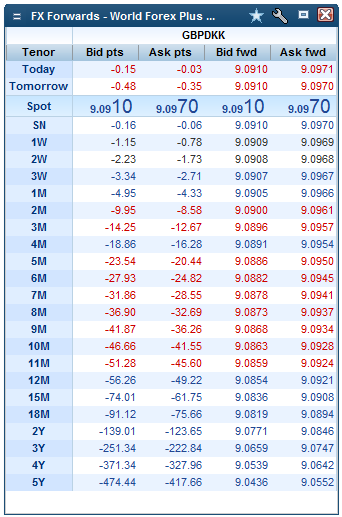

Forward points correspond to the interest rate differential in a currency pair Forward points reflect the time value TV adjustment made to the spot rate of a currency In forward trading the term forward points denotes the basis points or pips added to or subtracted from a spot rate when calculating the future value of a currency or securities Forward points

Forward points determine the currency forward rate in a binding contract commonly used in the forex The contract is set on a predetermined exchange rate for a particular currency pair The difference between the forward rate and the spot rate for a particular currency pair when expressed in pips is typically known as the swap points These points are computed using an

More picture related to Fx Forward Points Explained

FX Forward Calculator

http://software.infrontservices.com/helpfiles/infront/ver57/en/fx_fwd_calculator_full.png

FX Forward Calculator

http://software.infrontservices.com/helpfiles/infront/ver57/en/fwdcurve.png

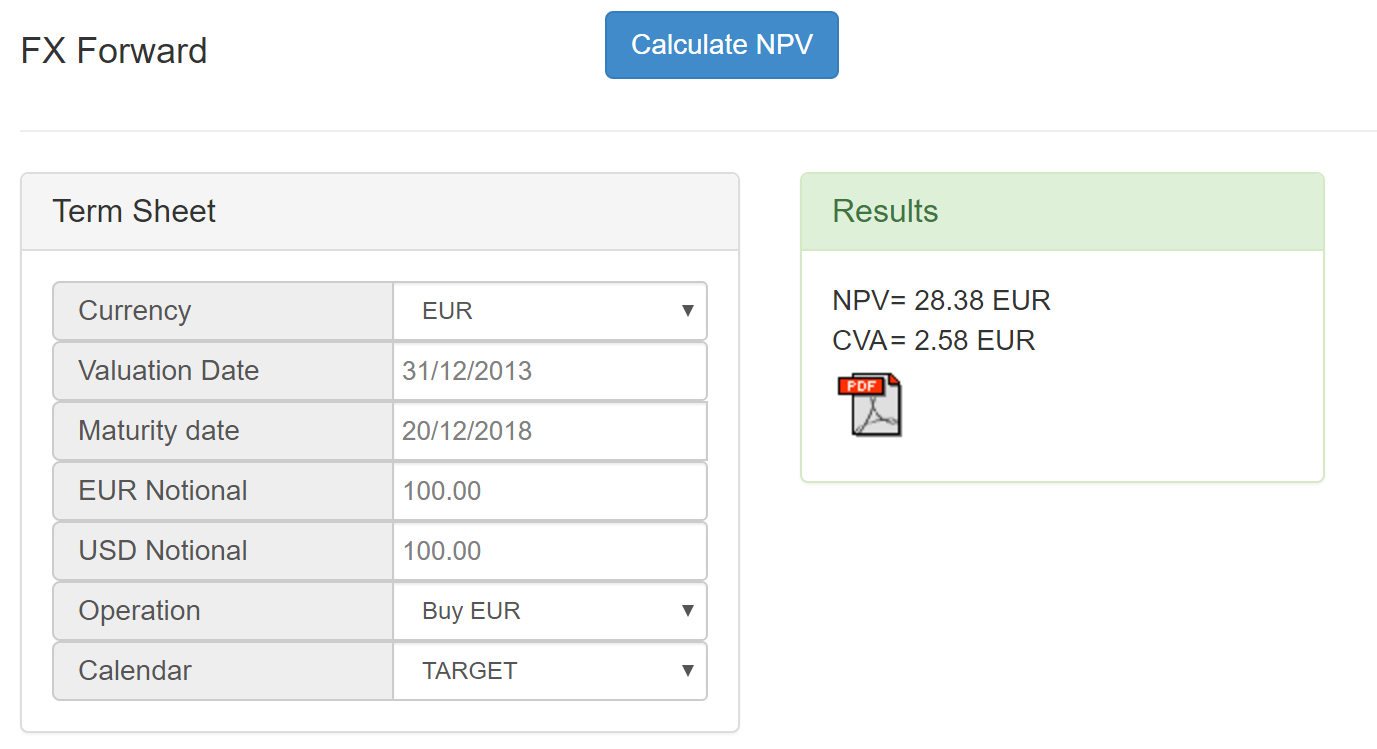

FX Forward Valuation Excel

https://www.pricederivatives.com/en/wp-content/uploads/2013/10/Capture-1024x492.png

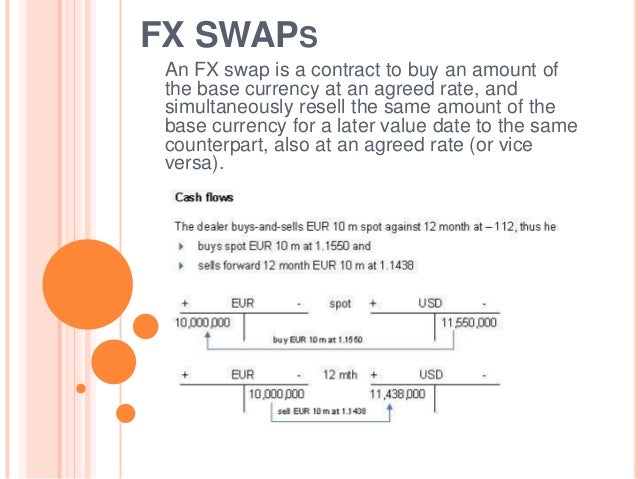

So what are fx swap points and forward points FX swap points refer to the interest rate differentials between two currencies involved in a currency swap while forward points are adjustments made to the spot An FX forward curve is a curve that shows FX forward pricing for all the different dates in the future FX forward pricing is determined by the current exchange rate the interest rate differentials between the two currencies and the length of the

The standard forward has one leg left hand side is FRD right hand side OVML FWD The asterisk next to the side ask for the 3m forward example refers to the side of The forward exchange rate formula helps parties lock in a fair exchange rate between currencies at a future date accounting for inflation and time value You can get

Unveiling The Swap Charges Maze A Comprehensive Guide For Forex

http://www.phillipcfd.com/wp-content/uploads/2020/08/EUR-USD-infographic-Short.jpg

Foreign Exchange Risk

https://image.slidesharecdn.com/d25a85e0-1216-47b1-b3d8-c56311dc28bb-160322023125/95/foreign-exchange-risk-8-638.jpg?cb=1458613900

https://hedgebook.com

FX points are mathematically derived by the prevailing interest rate markets Using our example of the GBP EUR 1 year forward points 131 is a result of the 1 year GBP and EUR interest rate outlook

https://www.financestrategists.com › ... › forward-points

Forward points are adjustments made to the spot exchange rate to derive the forward exchange rate They reflect interest rate differentials and manage foreign exchange

Dragon Age The Veilguard Has Gone Gold

Unveiling The Swap Charges Maze A Comprehensive Guide For Forex

Forward FX Rate Calculation CS Lucas

Forward FX Rate Calculation CS Lucas

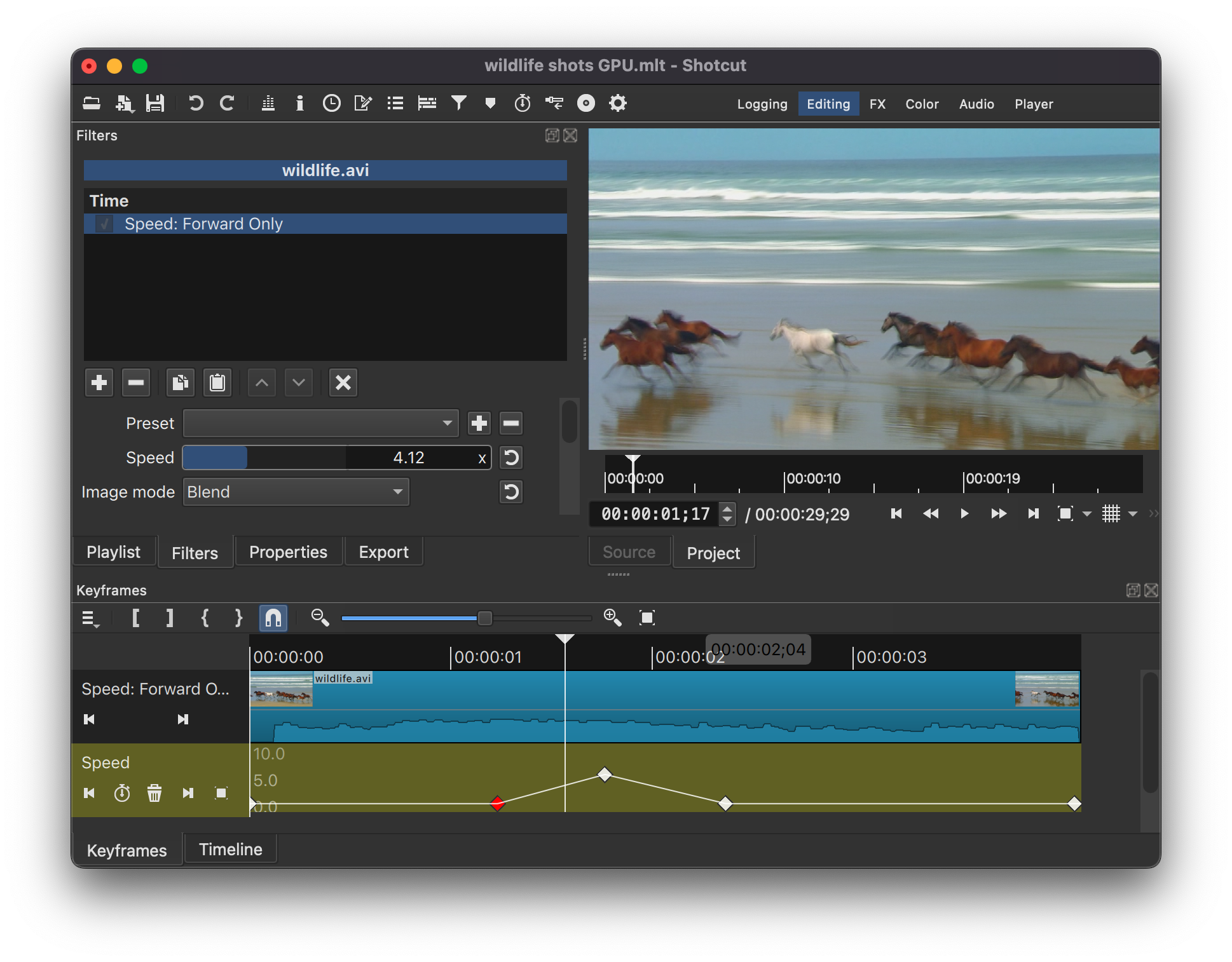

Shotcut New Version 23 05

FX Forward Calculator

FX Forward Calculator

FX Forward Calculator

Interest Rate Swap Telegraph

Fx Forward Points Explained - Types of FX Transactions Explained Spot Forwards Futures Options and Swaps A forward contract is a private agreement to exchange a set amount of currency at a