Hear Pronunciation In American English Discover how the Gordon Growth Model calculates terminal value using growth and discount rates to project future cash flows effectively Understanding the Gordon Growth

The Gordon Growth Model GGM values a company s share price by assuming constant growth in dividend payments The formula requires three variables as mentioned The value is calculated by dividing the last cash flow by the discount rate minus the growth rate The Terminal Value Formula under the Gordon Growth Model is FCF 1 g r

Hear Pronunciation In American English

Hear Pronunciation In American English

https://i.ytimg.com/vi/ZTS8M602-Ec/maxresdefault.jpg

How To Pronounce Squirt British English And American English

https://i.ytimg.com/vi/JFGHOxmUAVI/maxresdefault.jpg

Facebook

https://lookaside.fbsbx.com/lookaside/crawler/media/?media_id=241237558880246

We review the intuition behind the Gordon Growth Formula used to calculate Terminal Value in a Discounted Cash Flow DCF analysis The Gordon Growth Model is a formula used to calculate the intrinsic value of a company s stock based on the expected dividend yield the growth rate of the company s earnings and the

How to Estimate Terminal Value Using Gordon Growth Model 1 Forecast the Free Cash Flows 2 Use the Discount Rate from the DCF Valuation Model The Simplest yet There are two main ways to calculate it Gordon Growth Model Perpetuity Method Exit Multiple Method This article focuses on the more common Gordon Growth Model used in

More picture related to Hear Pronunciation In American English

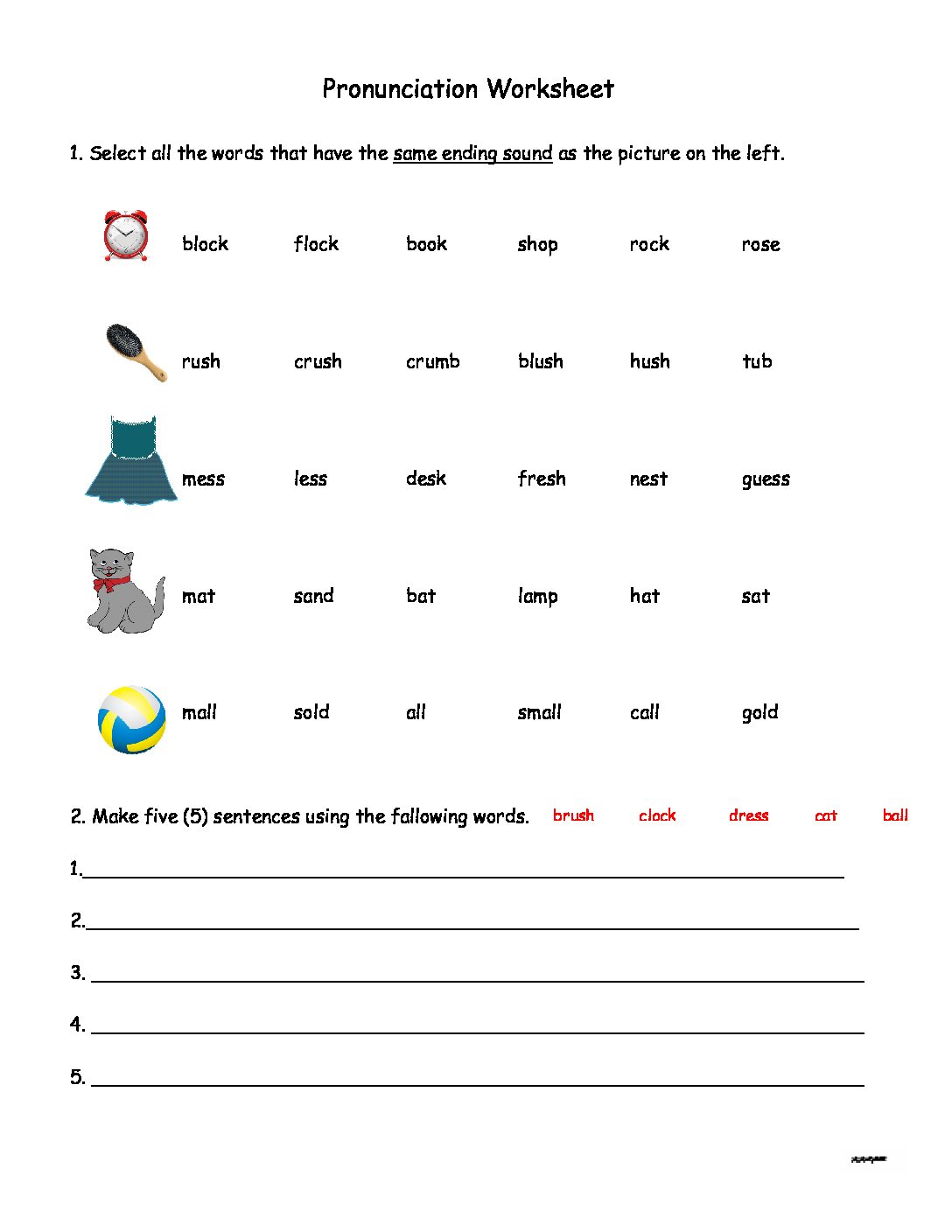

Pronunciation Worksheet ACCURATE APPROACH

https://www.accurateapproach.net/wp-content/uploads/2022/11/Pronunciation-Worksheet2-pdf.jpg

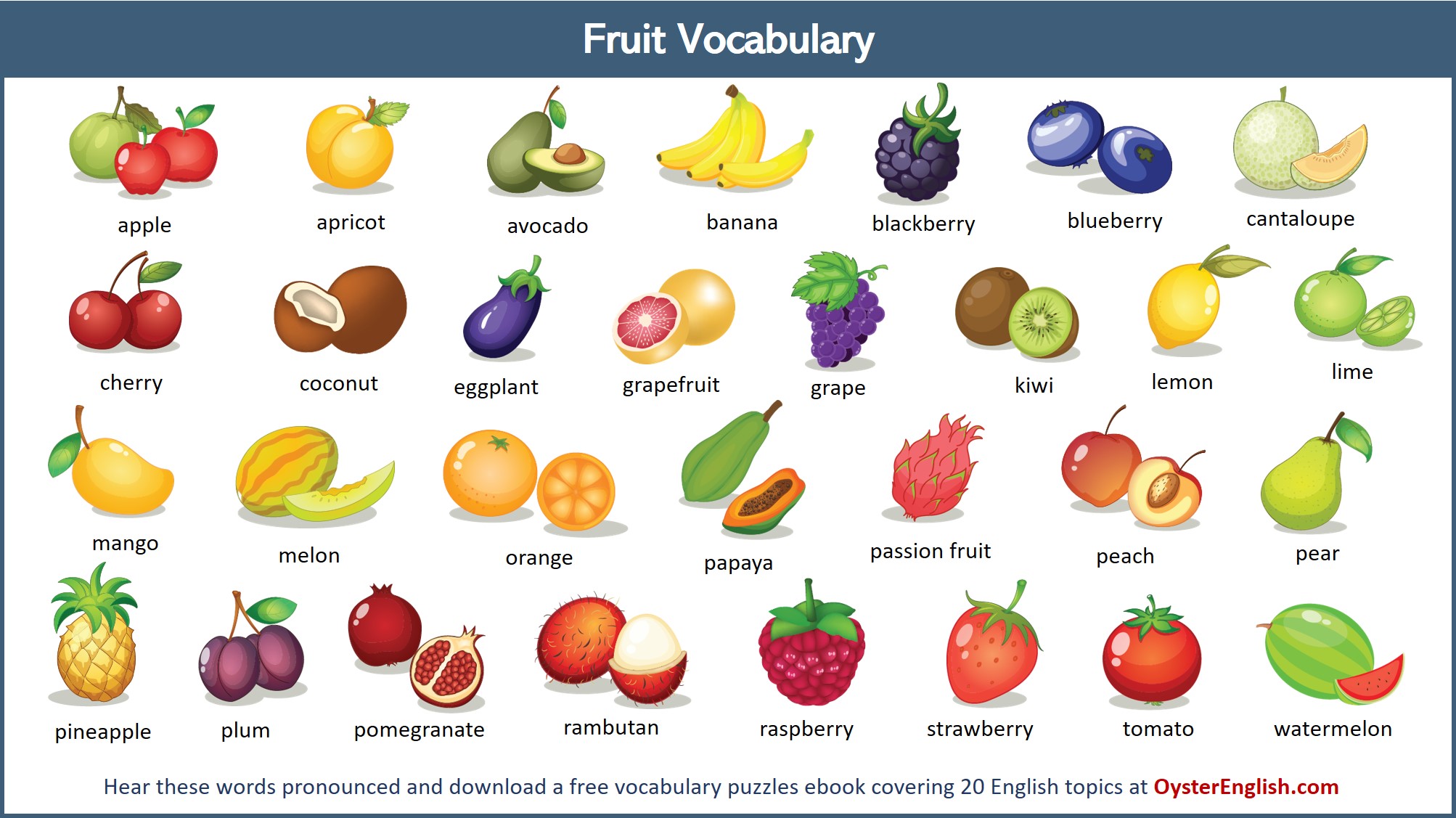

Learn English Fruit Vocabulary

https://www.oysterenglish.com/images/fruit-vocabulary-words.jpg

Bear In Mind These Words Sound The Same In American English Save To

https://lookaside.fbsbx.com/lookaside/crawler/media/?media_id=100078416252669

Step 4 Find the present value of the Gordon Growth Model Terminal Value Present value of Terminal value 219 5 Step 5 Find the Fair Value the PV of Projected Terminal value is a discounting method used to estimate a firm s future worth and apply it to the current pricing Financial tools that depend on terminal value include the Gordon

[desc-10] [desc-11]

American English Vowels English Notes

http://english.philograph.com/wp-content/uploads/GeneralAmericanEnglishVowels.jpg

Inja Zalta European Actors Management

https://european-actors.com/wp-content/uploads/2022/09/Inja-Zalta.jpg

https://accountinginsights.org › what-is-the-gordon...

Discover how the Gordon Growth Model calculates terminal value using growth and discount rates to project future cash flows effectively Understanding the Gordon Growth

https://www.wallstreetprep.com › knowledge › gordon-growth-model

The Gordon Growth Model GGM values a company s share price by assuming constant growth in dividend payments The formula requires three variables as mentioned

Motto

American English Vowels English Notes

11 Regular Verbs Pronunciation Figure Out English Podcast

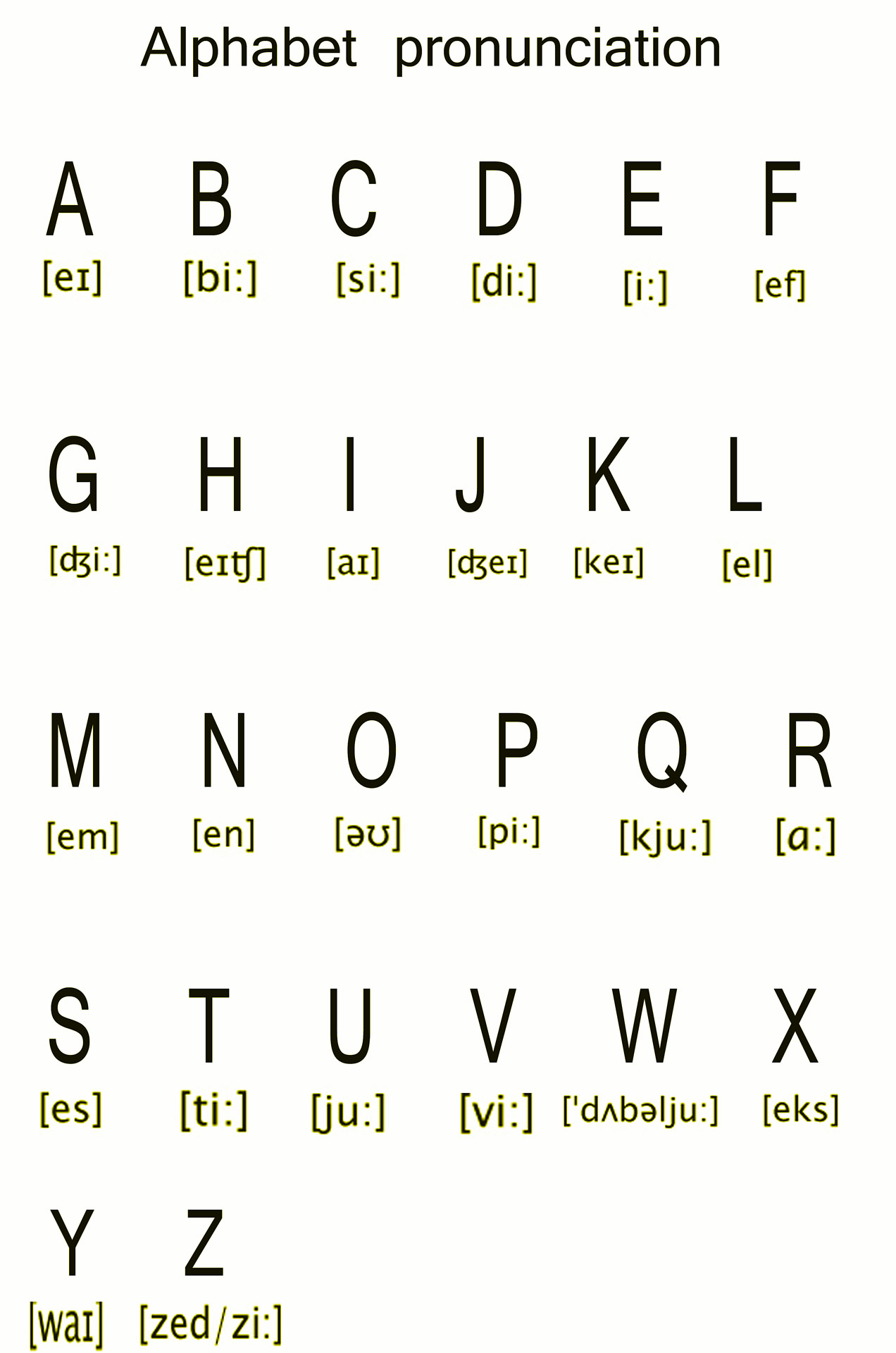

Alphabet Aussprache Kostenloses Stock Bild Public Domain Pictures

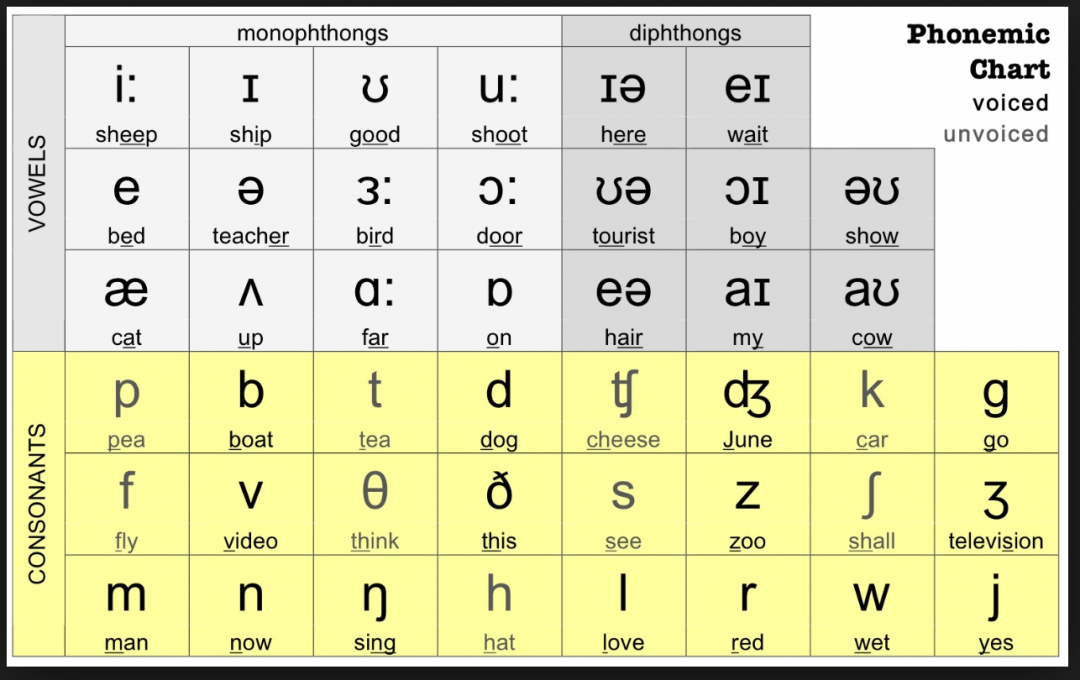

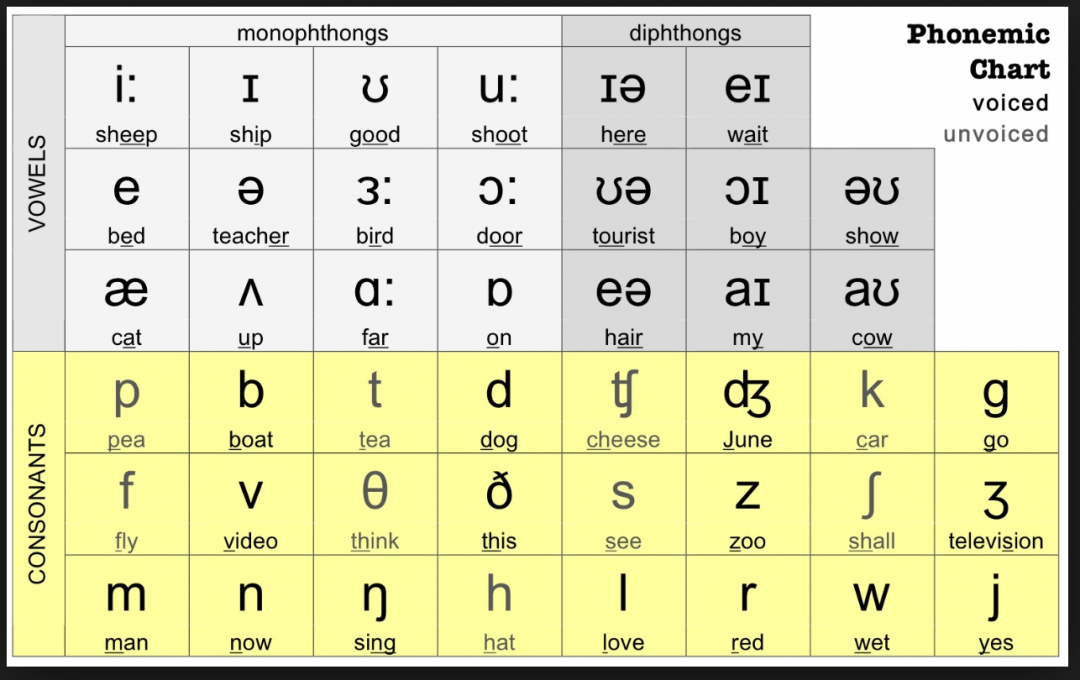

Pronunciation The Basics Academic English UK

Pronunciation The Basics Academic English UK

Pronunciation The Basics Academic English UK

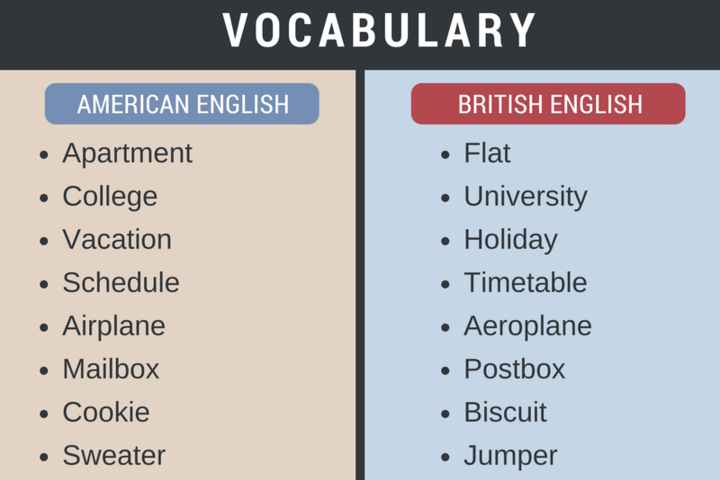

British Vs American English Top 21 Differences

English Pronunciation 101 Poem Pronunciation Writing Words Poems

Hear Pronunciation In American English - How to Estimate Terminal Value Using Gordon Growth Model 1 Forecast the Free Cash Flows 2 Use the Discount Rate from the DCF Valuation Model The Simplest yet