History Of Bonus Depreciation The 2017 tax law Tax Cuts and Jobs Act or TCJA permitted a 100 percent bonus depreciation deduction for assets with useful lives of 20 years or less Bonus

History of Bonus Depreciation Before the Tax Cuts and Jobs Act TCJA was enacted effective for tax years beginning in 2018 you were only allowed to take 50 bonus depreciation for qualified property acquired and Bonus depreciation also referred to as bonus first year depreciation or accelerated first year depreciation has generally been available since September 11 2001 the provision expired

History Of Bonus Depreciation

![]()

History Of Bonus Depreciation

https://www.beaconfunding.com/Portals/0/Images/blog/thumbnails/2302-bonus-depreciation-for-2023-thumbnail3.jpg

PPT Chapter 7 Accounting Periods Methods Depreciation PowerPoint

https://image1.slideserve.com/1631195/50-bonus-depreciation-l.jpg

Pennsylvania s Complicated History With Bonus Depreciation Bloomberg

https://data.bloomberglp.com/bna/sites/9/2020/03/Pennsylvania-Bonus-Depreciation.png

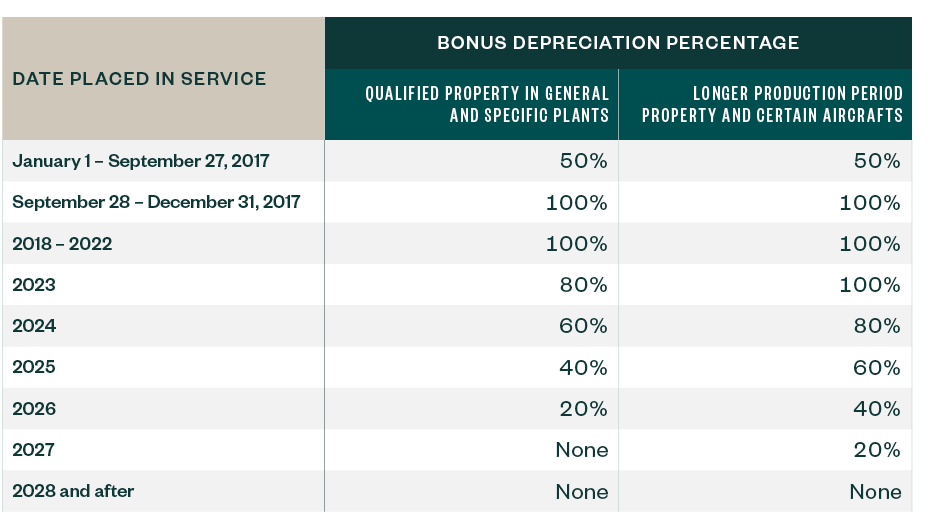

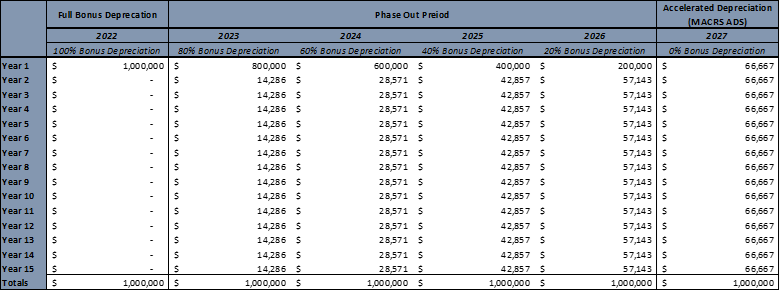

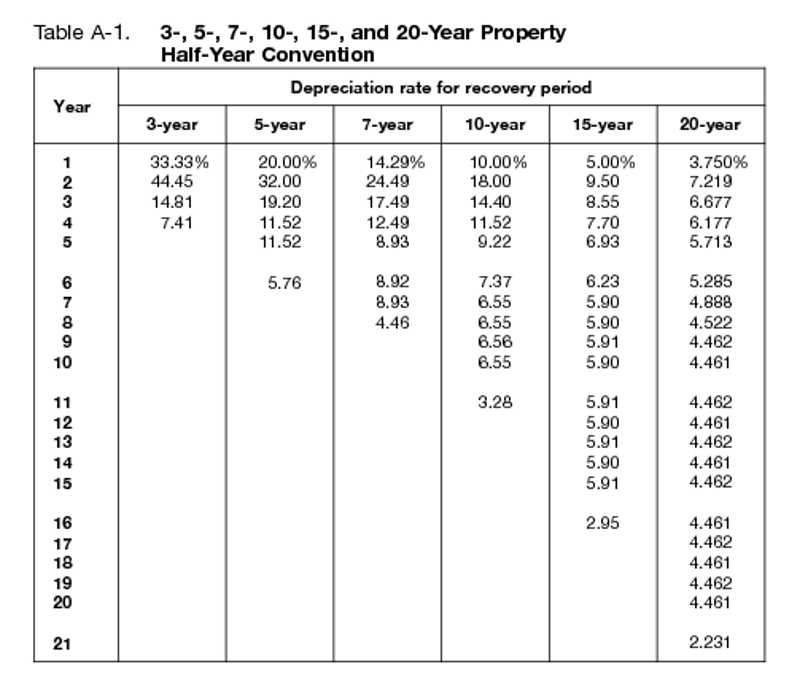

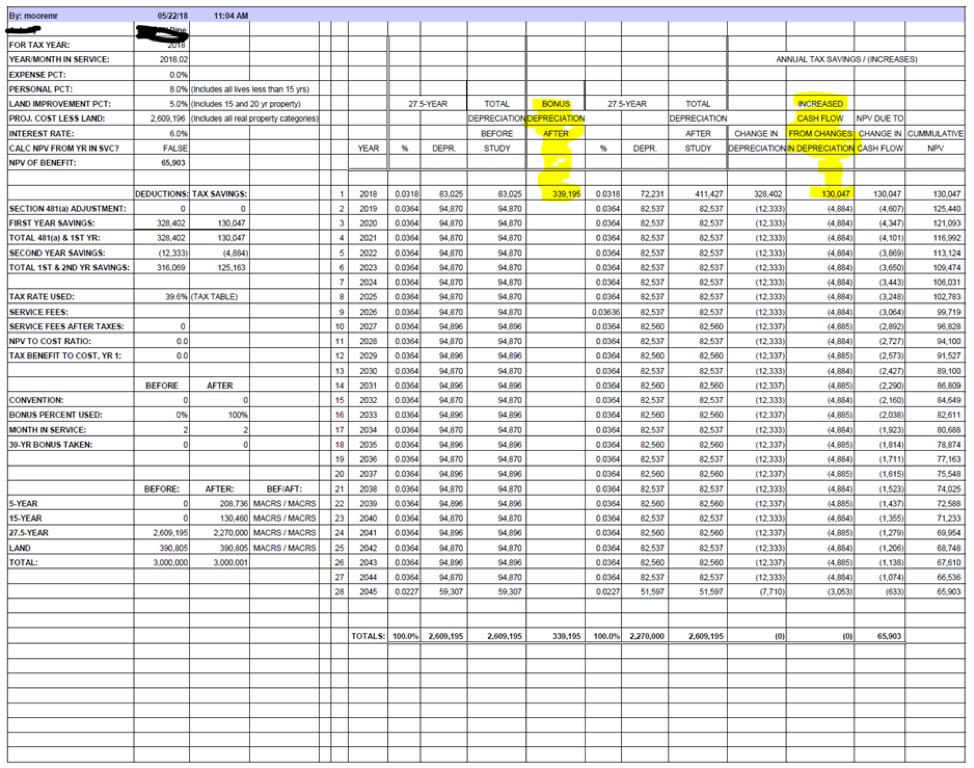

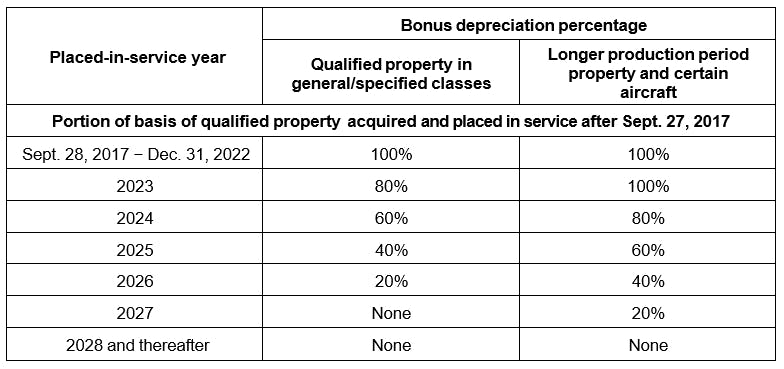

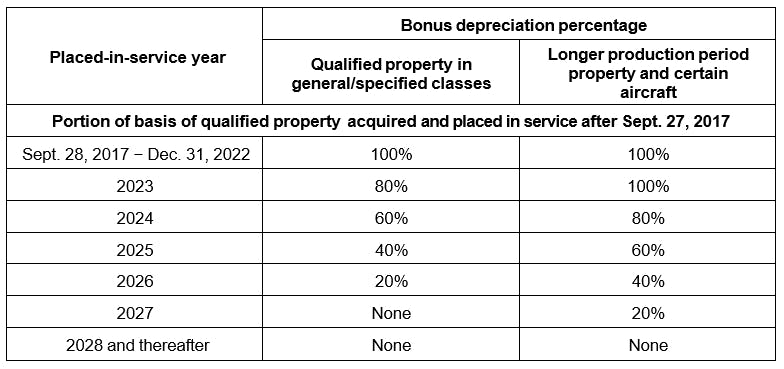

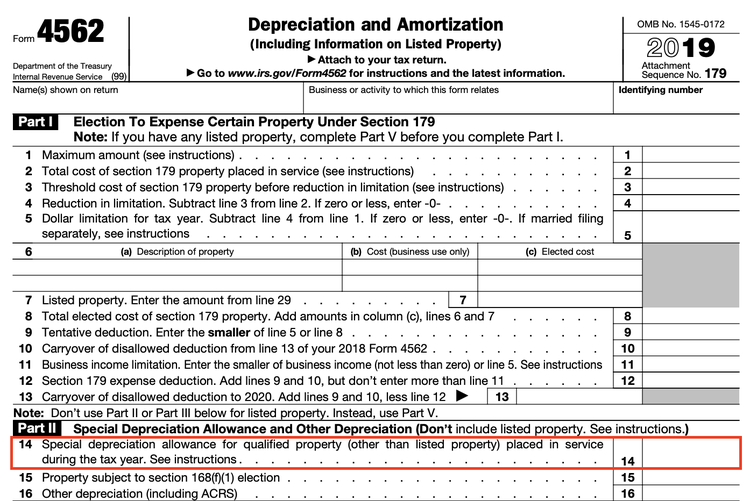

Bonus depreciation also known as the additional first year depreciation deduction or the 168 k allowance accelerates by allowing businesses to write off a large percentage of an eligible asset s cost in the first year it was purchased Full bonus depreciation is phased down by 20 each year for property placed in service after Dec 31 2022 and before Jan 1 2027 Under the new law the bonus depreciation rates are as follows A transition rule

This history was also determined by a shift from a policy in which the depreciation allowances were intended to reflect the accrued loss in asset values to one in which the depreciation Regarding the use of bonus depreciation during years when 50 percent bonus was in place the total use across legal forms ranged from about 210 billion average for 2004 2008 2009 to

More picture related to History Of Bonus Depreciation

Explore Tax Laws That Could Impact Business Cash Flow

https://www.mossadams.com/getmedia/3278ac67-5134-4594-9d5f-458ee981ee6d/22-MCP-0990_bonus_depreciation_rates.png?width=945&height=530&ext=.png

Bonus Depreciation What Is It And Where Is It Going MLG Capital

https://mlgcapital.com/wp-content/uploads/2023/06/Bonus-Depreciation-Example.png

Bonus Depreciation Updates Tax Cuts Jobs Act Central PA CPA Firm

https://macpas.com/wp-content/uploads/2019/04/Bonus-Depreciation-Example-3-1024x515.jpg

Bonus depreciation allows businesses to deduct a large percentage of the cost of eligible purchases the year they acquire them rather than depreciating them over a period of years It was created as a way to Bonus depreciation is a valuable tax incentive that allows businesses to deduct a significant portion of the cost of eligible assets upfront rather than writing them off incrementally over

By Eric Bennett CPA Director and Linda Miller Senior AccountantHear from Senior Accountant Linda Miller about Bonus Depreciation and read the article below History of History of Bonus Depreciation Bonus depreciation was created by the Job Creation and Worker Assistance Act of 2002 by the addition of Section 168 k 1 The original bonus depreciation

Bonus Depreciation Explained For Non real Estate Professionals Cash

https://blog.cashflowportal.com/wp-content/uploads/2021/08/bonus-depreciation-rates-by-year-768x432.png

Bonus Depreciation Updates Tax Cuts Jobs Act Central PA CPA Firm

https://macpas.com/wp-content/uploads/2019/04/Bonus-Depreciation-Example-2.jpg

https://taxfoundation.org › ... › all › federal

The 2017 tax law Tax Cuts and Jobs Act or TCJA permitted a 100 percent bonus depreciation deduction for assets with useful lives of 20 years or less Bonus

https://www.blueandco.com › bonus-depre…

History of Bonus Depreciation Before the Tax Cuts and Jobs Act TCJA was enacted effective for tax years beginning in 2018 you were only allowed to take 50 bonus depreciation for qualified property acquired and

Primer On Bonus Depreciation ScottMadden

Bonus Depreciation Explained For Non real Estate Professionals Cash

Make The Most Of Bonus Depreciation

Cost Segregation Bonus Depreciation Simple Passive Cashfow

How Much Is Bonus Depreciation In 2025 Neet Oliver Mustafa

New Depreciation Rules For 2024 Dion Myrtie

New Depreciation Rules For 2024 Dion Myrtie

Business Vehicle Bonus Depreciation 2024 Brana Brigitte

IRS Announces Depreciation And Lease Inclusion Amounts On Vehicles For

100 Bonus Depreciation 2024 Suv Etta Olympe

History Of Bonus Depreciation - Bonus depreciation stands as an accelerated tax deduction contrasting with traditional asset depreciation Instead of gradual allocation over an asset s life businesses can