How Much Is A Ton Gold Worth Licences and rights over software website development costs and domain names will often be accounted for as intangible assets and will therefore fall within the intangible

Tax treatment Under FRS 102 if software classifies as a tangible fixed asset it would normally obtain tax relief through the capital allowances regime unless there is an argument to treat the First it is worth recapping what constitutes a digital expense Most businesses develop and maintain a website Expenditure on software licences is also common How these

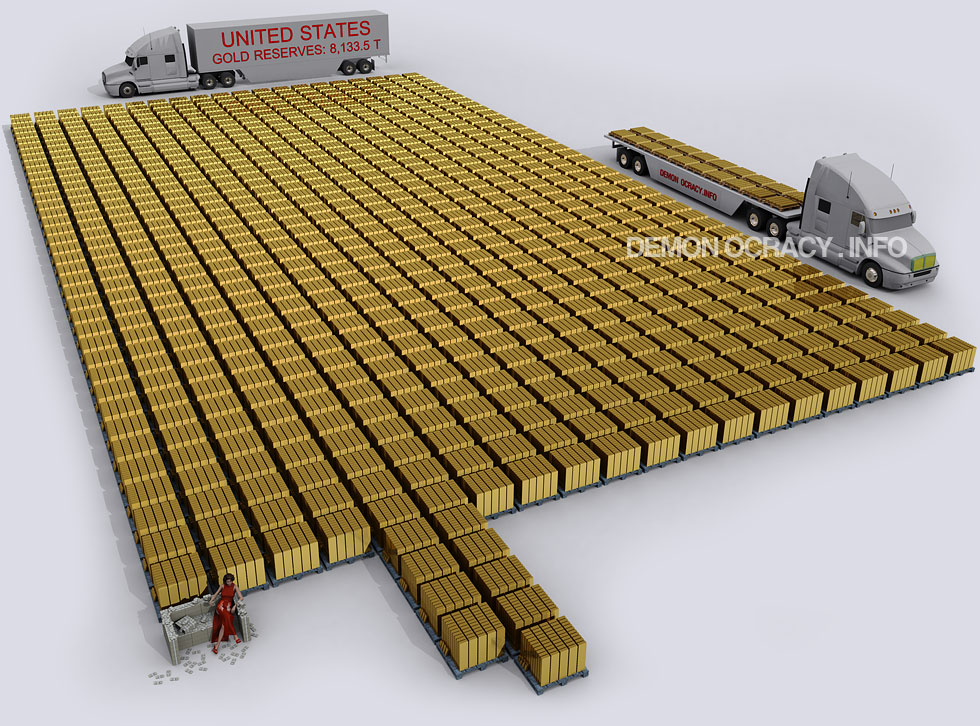

How Much Is A Ton Gold Worth

How Much Is A Ton Gold Worth

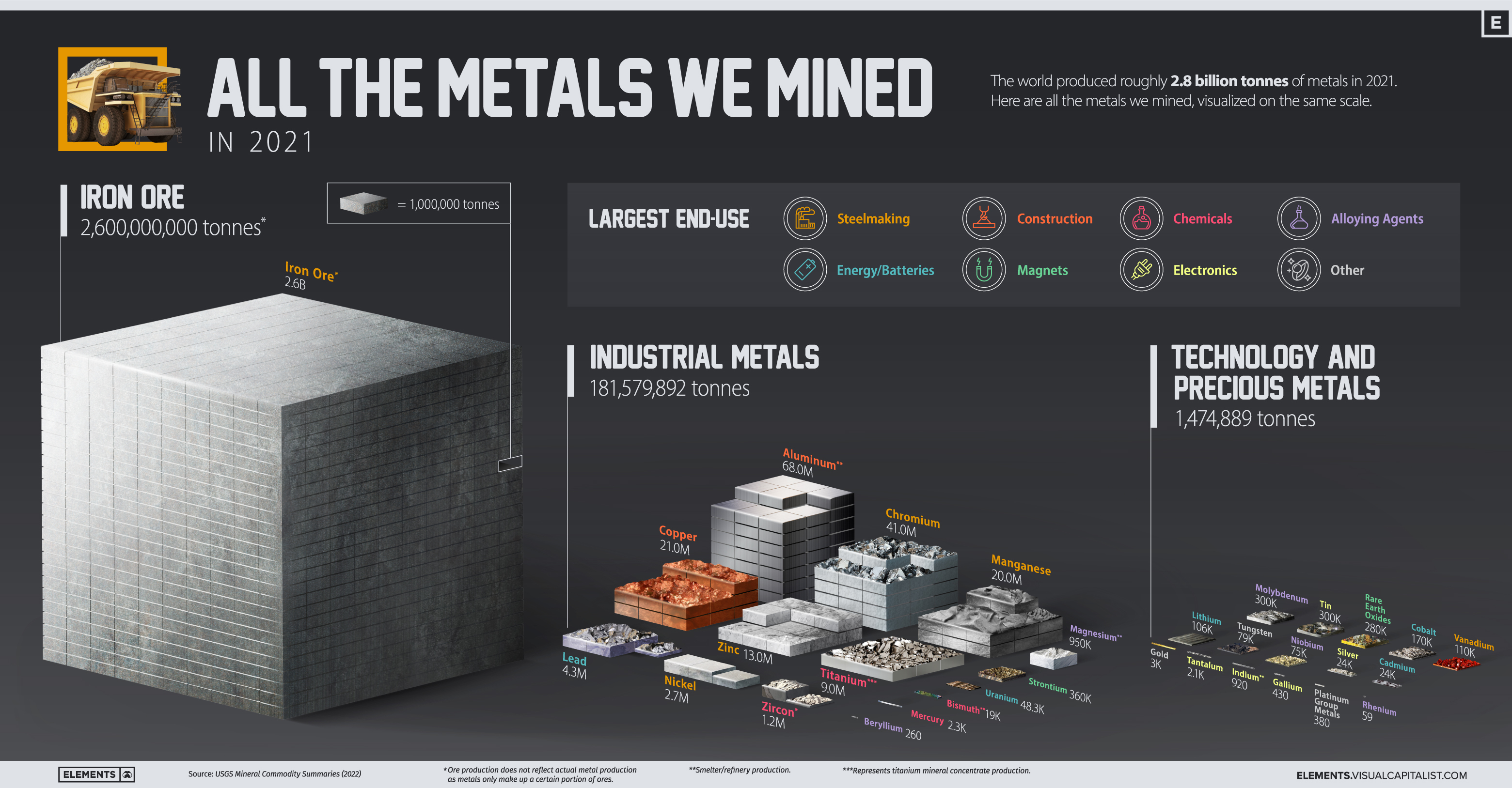

https://elements.visualcapitalist.com/wp-content/uploads/2022/10/all-the-metals-we-mined-infographic-2021-updated.jpg

What Is Metric Ton Energy Theory

https://energytheory.com/wp-content/uploads/2023/06/JAN23-What-is-Metric-Ton.jpg

How Much Is A Ton In Pounds Brainly

https://us-static.z-dn.net/files/d45/e99429ca298f6595a728f20fa95f4f25.png

THE SUPER DEDUCTION AND COMPUTER SOFTWARE The Finance Bill 2021 introduced a new super deduction 130 first year allowance for corporation tax on most new plant and HMRC could claim that the equipment has a duality of purpose and you could be taxed on the value of the purchase as a benefit in kind Computer equipment such as a PC

Licences and rights over software that was created or acquired from an unrelated party by a company on or after 1 April 2002 usually fall within the Corporation Tax intangible fixed Expenditure on licensed computer software falls within the intangible fixed assets IFAs regime see 60 280ff This means that it will usually be treated as a trading expense the deduction

More picture related to How Much Is A Ton Gold Worth

Pin On The Allure Of Gold

https://i.pinimg.com/originals/d4/e0/78/d4e078d2cc8110d70e168d9cd2456e8b.jpg

How Much Is A Horse How To Own A Horse

https://howtoownahorse.com/wp-content/uploads/Featured-Processed/how-much-is-a-horse-how-to-own-a-horse.jpg

How Much Is A Ton Of Gold Worth Vanessa Benedict

https://www.vanessabenedict.com/wp-content/uploads/2022/06/how-much-is-a-ton-of-gold-worth5.jpg

Businesses that treat software expenditure as an intangible fixed asset will normally receive tax relief in line with accounts i e as it amortised or when it is more advantageous to If software classifies as a tangible fixed asset it would normally obtain tax relief through the capital allowances regime unless there is an argument to treat the expenditure as revenue for

[desc-10] [desc-11]

A One Ton Time Bomb Carbon Visuals

https://images.squarespace-cdn.com/content/v1/54c8c11ee4b0b53cb9733f51/1429967397072-VGCZ5UZSHMSTLKJK3TRO/image-asset.jpeg

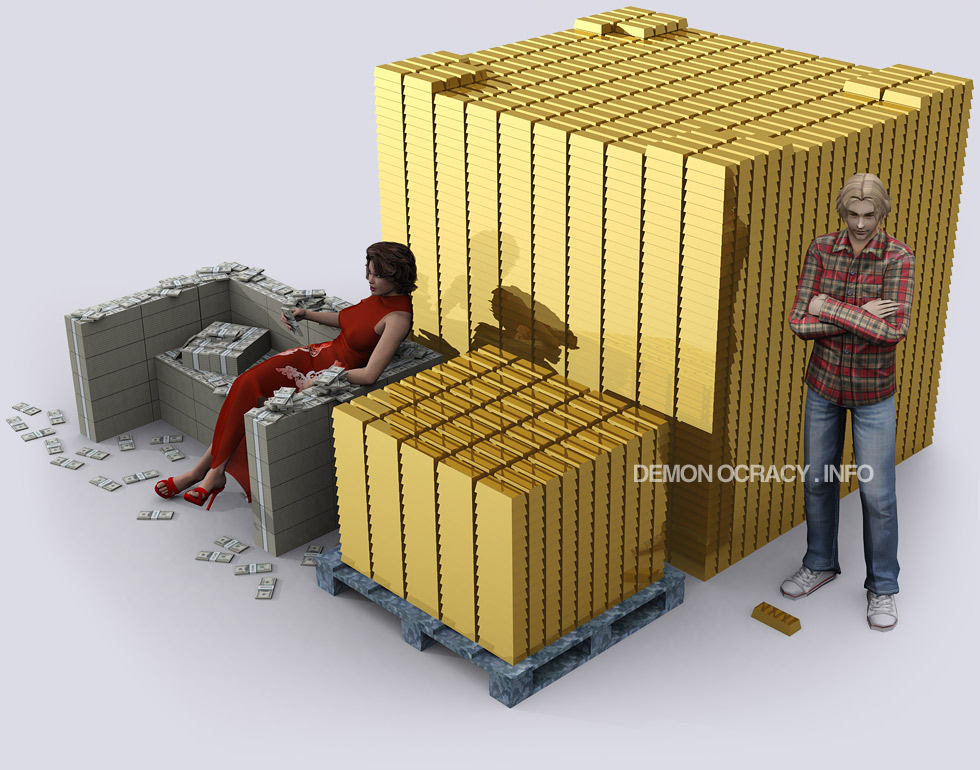

J2a M92

http://demonocracy.info/infographics/world/gold/images/demonocracy-gold-10_tons-100_tons.jpg

https://www.att.org.uk › technical › news › tax-treatment-software-and...

Licences and rights over software website development costs and domain names will often be accounted for as intangible assets and will therefore fall within the intangible

https://www.accaglobal.com › uk › en › technical-activities › uk-tech › in...

Tax treatment Under FRS 102 if software classifies as a tangible fixed asset it would normally obtain tax relief through the capital allowances regime unless there is an argument to treat the

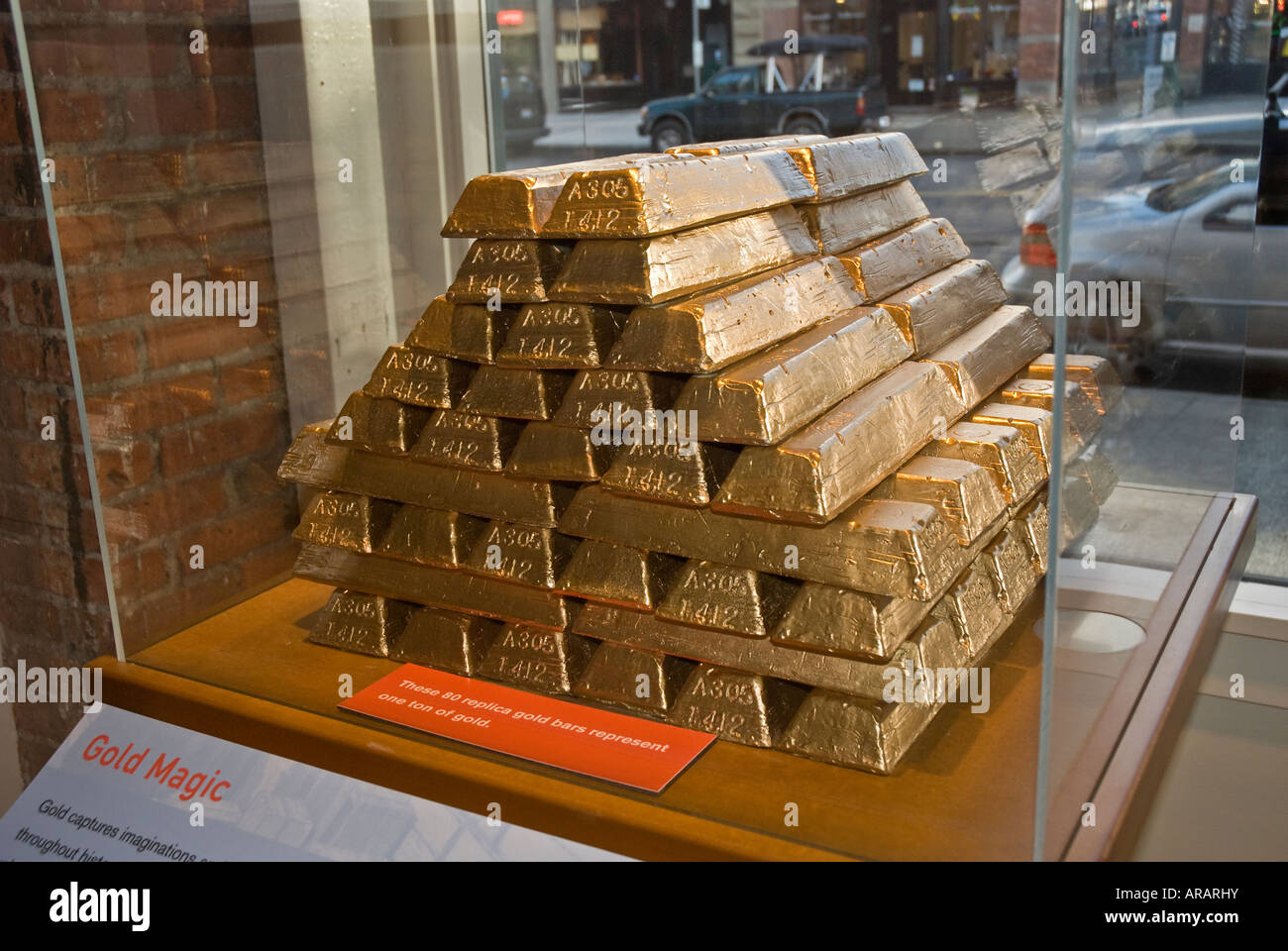

80 Replica Gold Bars Representing One Ton Of Gold On Display At Stock

A One Ton Time Bomb Carbon Visuals

How Much Is A Pound Of Gold Worth Gold Cost Per Lb

12 Stunning Visualizations Of Gold Shows Its Rarity

12 Stunning Visualizations Of Gold Shows Its Rarity

12 Stunning Visualizations Of Gold Shows Its Rarity

12 Stunning Visualizations Of Gold Shows Its Rarity

How Much Is A Ton Of Gold Worth Vanessa Benedict

How Much Is A Horse In Mexico How To Own A Horse

How Much Is A Metric Ton Of Gold Worth Vanessa Benedict

How Much Is A Ton Gold Worth - Expenditure on licensed computer software falls within the intangible fixed assets IFAs regime see 60 280ff This means that it will usually be treated as a trading expense the deduction