Instructions For Box 12 Dd The UPPER CASE capital letters in box 12 report different things to the IRS Here s a list of what each one means Box 12 codes A Uncollected social security or RRTA tax on tips reported to

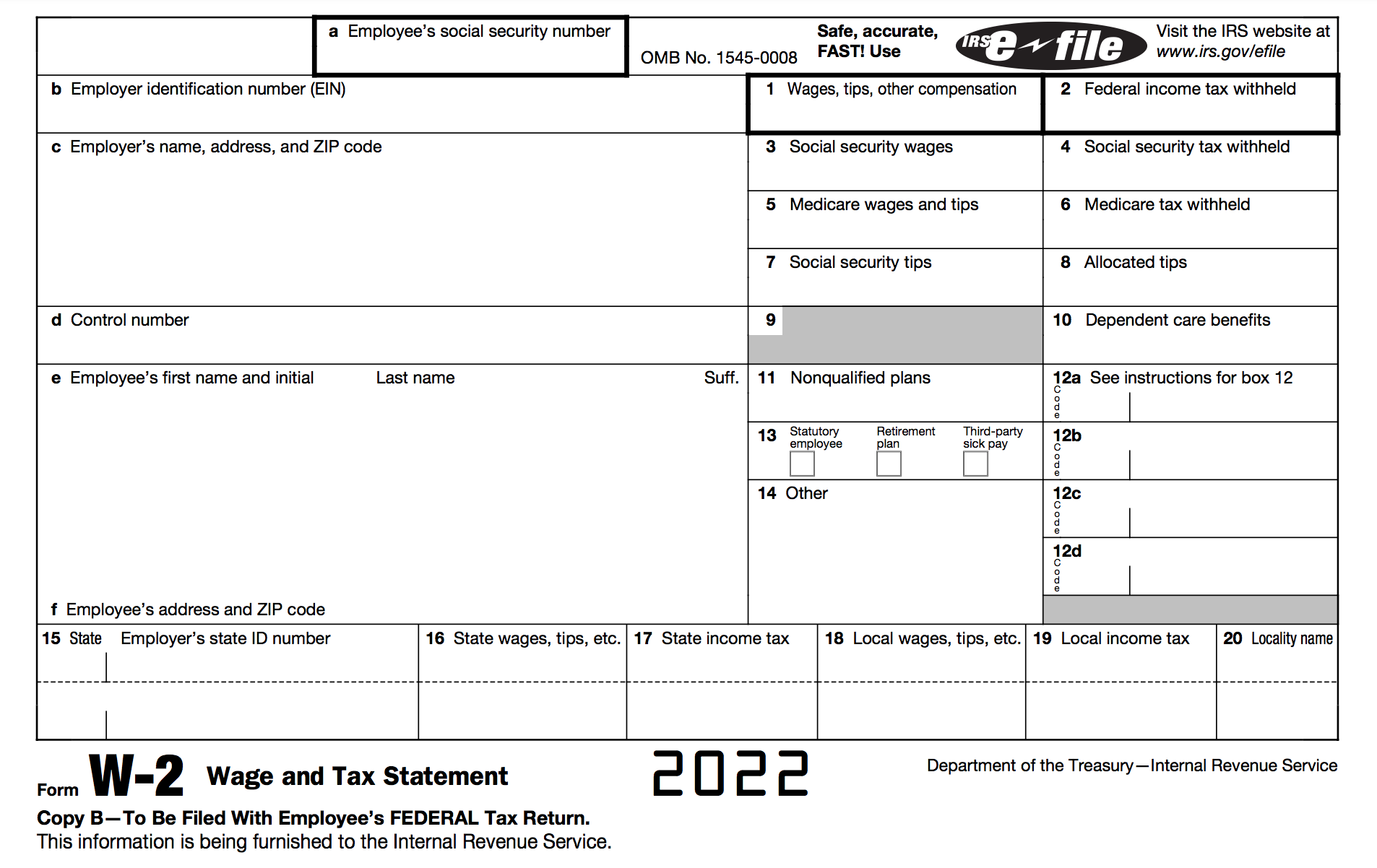

Individuals employees do not have to report the cost of coverage under an employer sponsored group health plan that may be shown on their Form W 2 Wage and Tax Statement in Box 12 30 rowsForm W 2 Box 12 codes instructions The code and

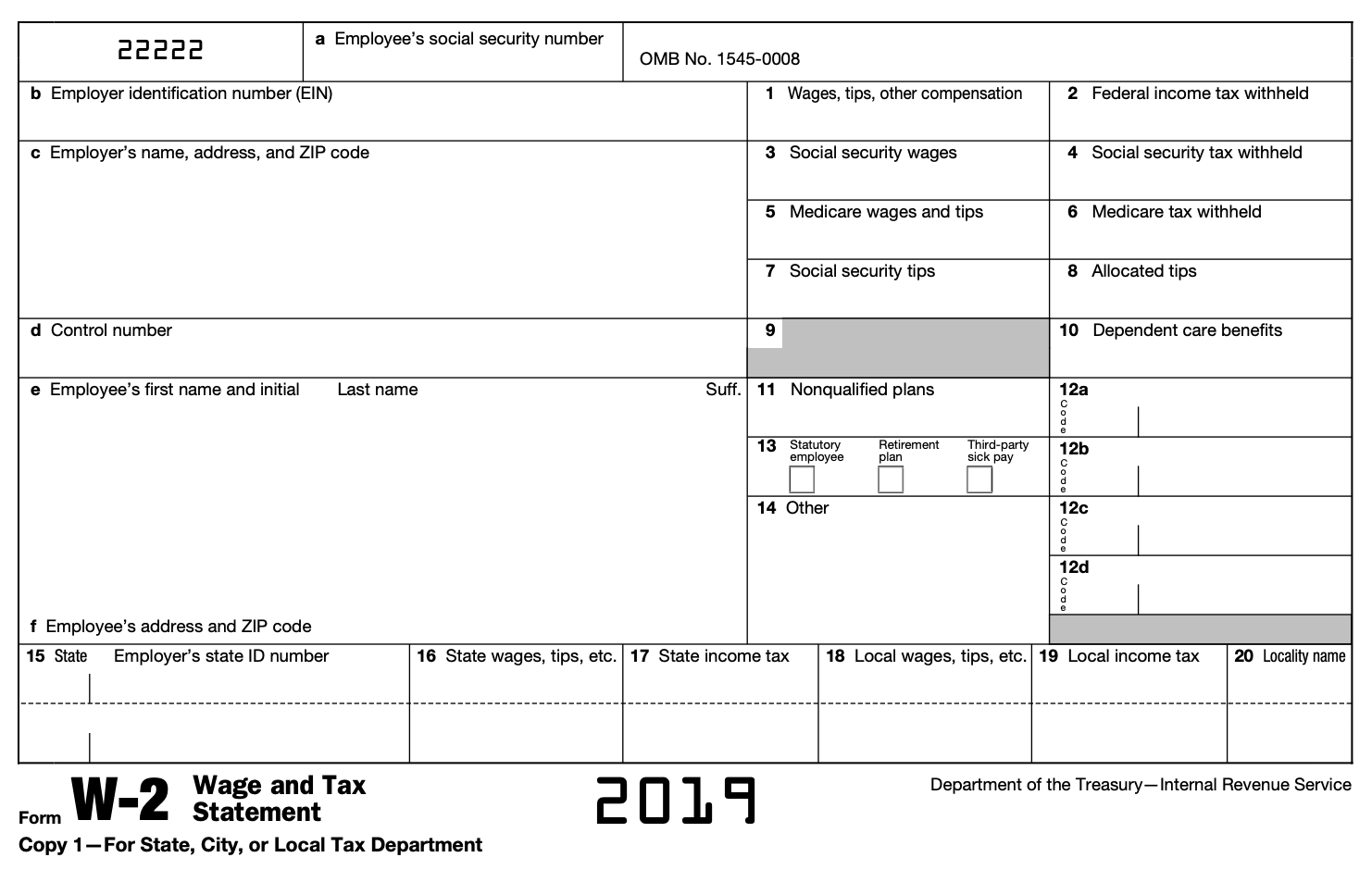

Instructions For Box 12 Dd

Instructions For Box 12 Dd

https://i.ytimg.com/vi/4Wn5z3ctCz8/maxresdefault.jpg

What Does Box 12 DD On My W 2 Mean YouTube

https://i.ytimg.com/vi/I4Ye2wJ6axQ/maxresdefault.jpg

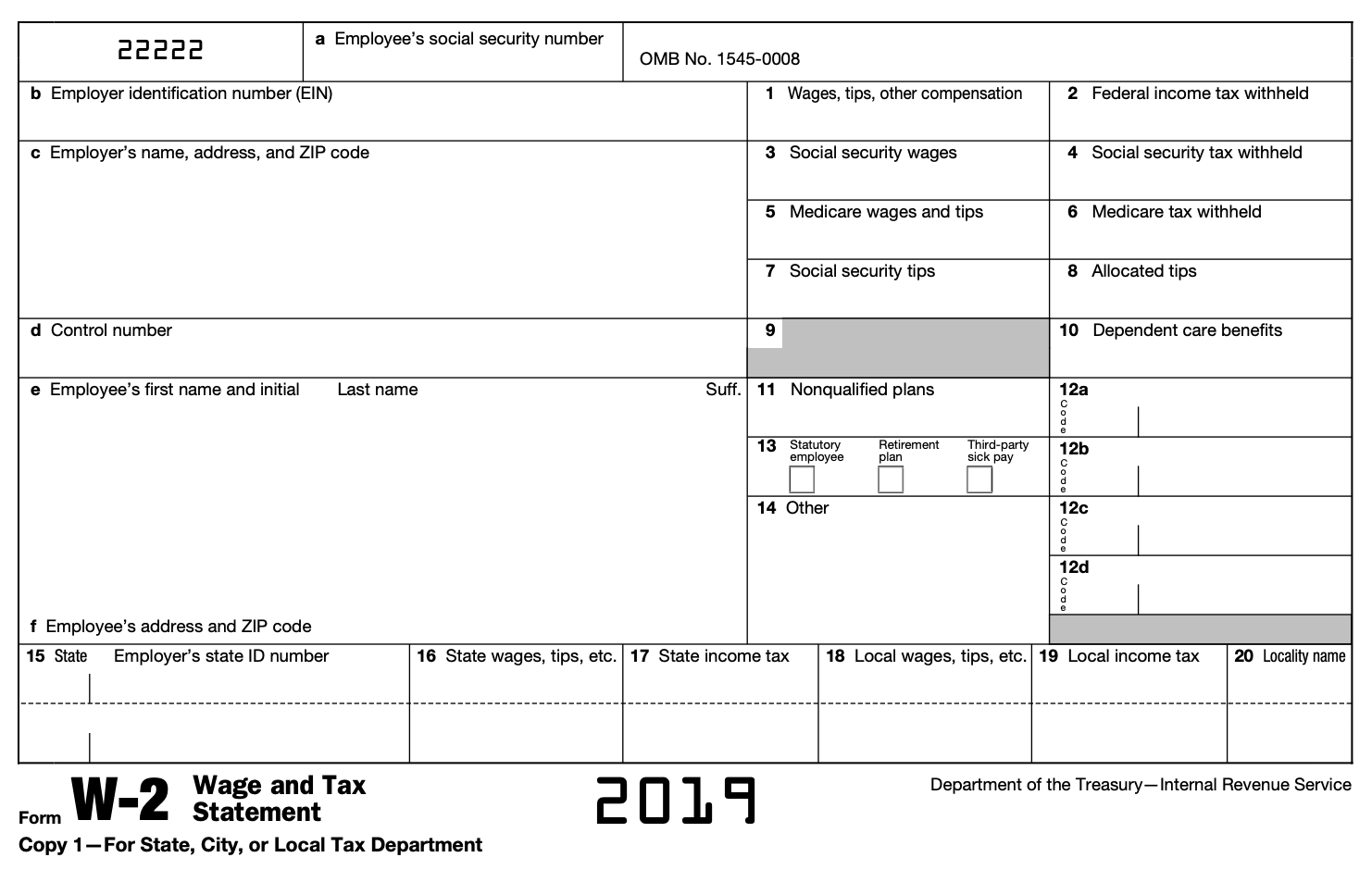

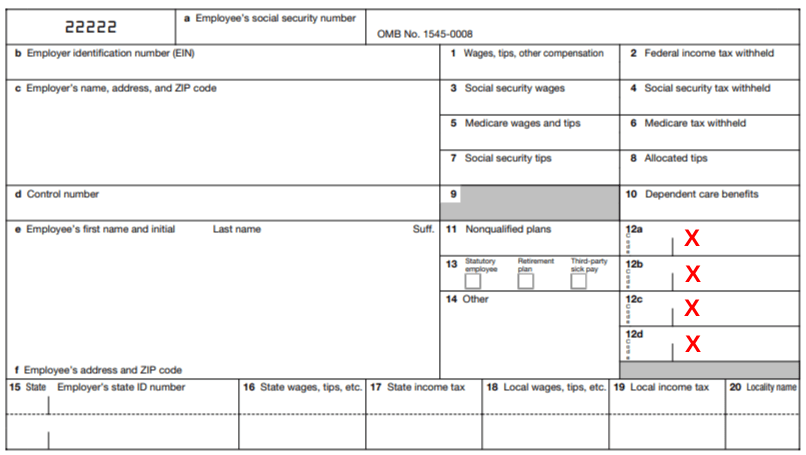

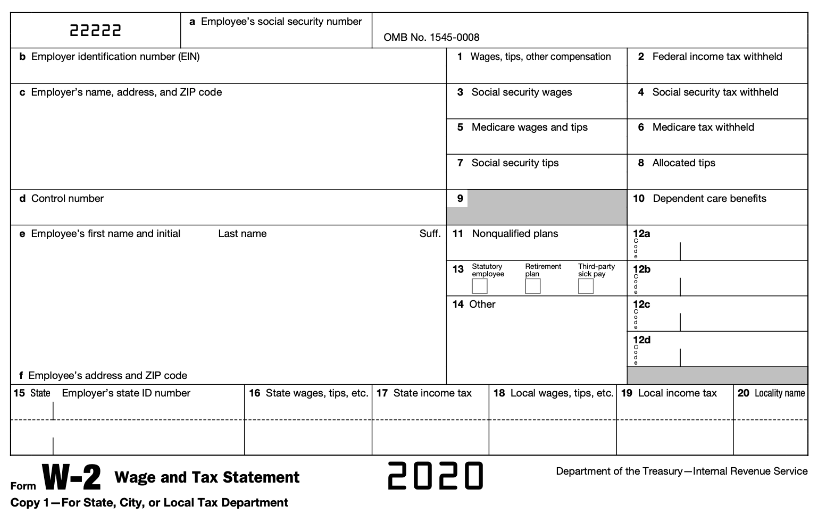

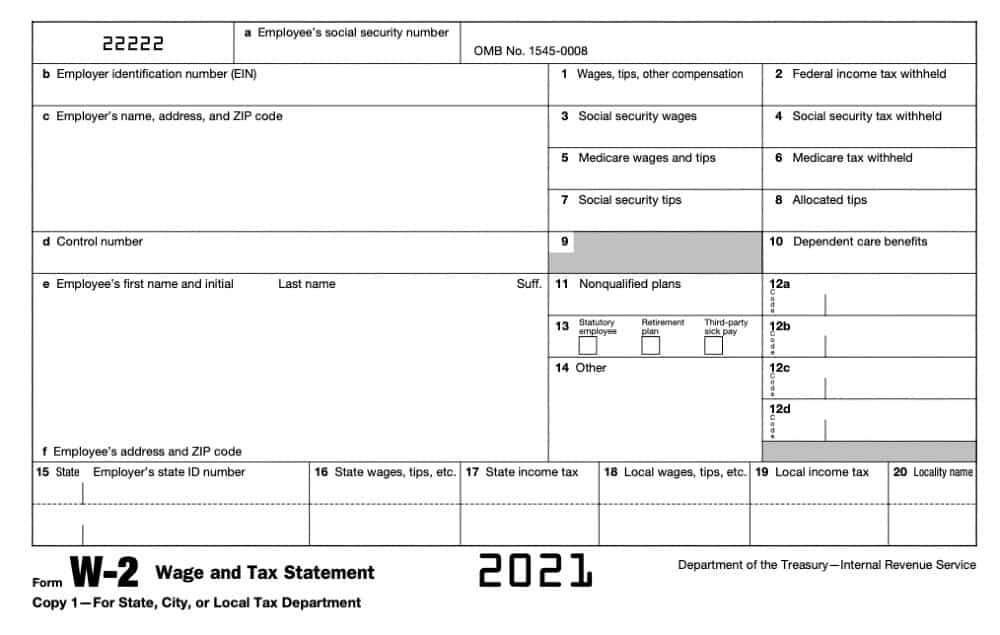

2020 W2 Form With Boxes 12a Through 12d Outlined

https://studentaid.gov/sites/default/files/2020-w-2-form-boxes-12a-12d.PNG

New box 12 code II for Medicaid waiver payments excluded from gross income under Notice 2014 7 There is a new code II for box 12 used to report Medicaid waiver payments not Form W 2 Instructions continued Form W 2 Reference Guide for Common Box 12 Codes For Boxes 12 and 14 choose the code from the drop down menu and enter the dollar amount If

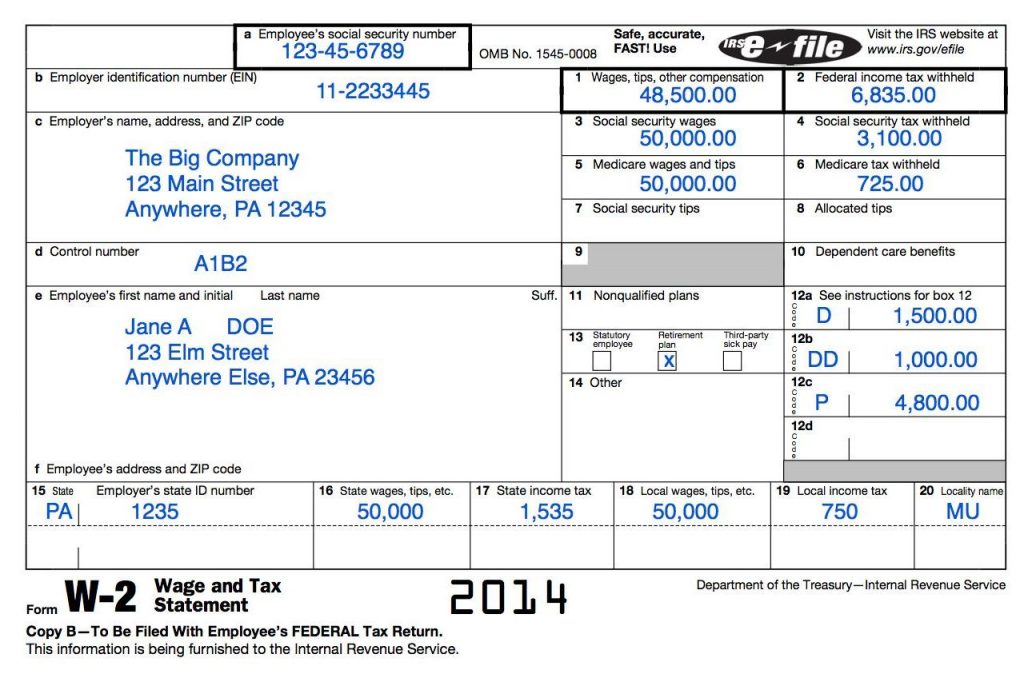

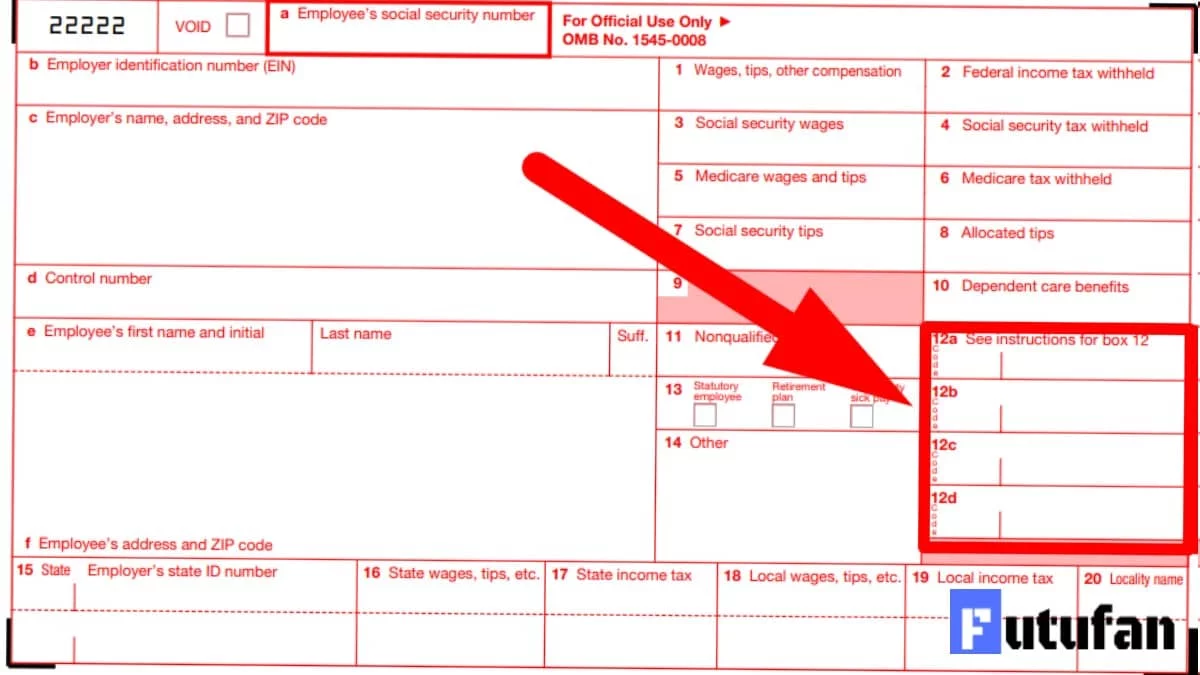

Healthcare and Insurance Instructions For Box 12 Reporting Healthcare and insurance related entries in Box 12 are increasingly relevant in today s tax landscape Codes like DD reporting the cost of employer The W 2 you got from your employer will have four lines for box 12 labeled 12a 12b 12c and 12d Any amount on a box 12 line will also have an uppercase capital letter code associated with it If there aren t any capital letter codes

More picture related to Instructions For Box 12 Dd

Fw2 Page 2 pdf PDF Host

https://pdfhost.io/api/preview/5c20caee-3bcd-4042-b417-259a3bf091bc

2024 W2 Irs Agace Ariadne

https://avocadoughtoast.com/wp-content/uploads/2020/01/Code-D-1024x694.jpg

Blank W2 Forms 2024 Aggy Lonnie

https://www.creditosenusa.com/wp-content/uploads/Formulario-W2-del-IRS-1024x650.png

See the table below for details on which coverage to report or not report on Form W 2 Box 12 using code DD Box 12 W 2 Instructions The Form W 2 has 29 codes for reporting compensation and benefit amounts These codes cover everything from elective deferrals to a section 401 k to income from qualified equity grants In Box 12

According to the W 2 instructions from the IRS the following list explains the codes shown in box 12 on the W 2 Elective deferrals to a section 401 k cash or deferred arrangement Also Box 12 amounts with the code DD signify the total cost of what you and your employer paid for your employer sponsored health coverage plan Code DD amounts are for informational

Get W 9 Form 2020 Print Calendar Printables Free Blank

https://calendargraphicdesign.com/wp-content/uploads/2020/01/what-is-a-w-2-form-turbotax-tax-tips-videos.png

W2 12 Codes

https://www.taxuni.com/wp-content/uploads/2020/09/W2-12-Codes.jpg

https://ttlc.intuit.com › ... › taxation

The UPPER CASE capital letters in box 12 report different things to the IRS Here s a list of what each one means Box 12 codes A Uncollected social security or RRTA tax on tips reported to

https://www.irs.gov › newsroom

Individuals employees do not have to report the cost of coverage under an employer sponsored group health plan that may be shown on their Form W 2 Wage and Tax Statement in Box 12

W 2 2022

Get W 9 Form 2020 Print Calendar Printables Free Blank

A What Error Has Been Made In Preparing Chips W 2 B How Should This

W2 Form Example Filled Out

Microsoft Office W2 Template

Dod Hazard Classification

Dod Hazard Classification

Missouri W 2 Form 2023 Printable Forms Free Online

Which W2 Do I Use For 2024 Nydia Arabella

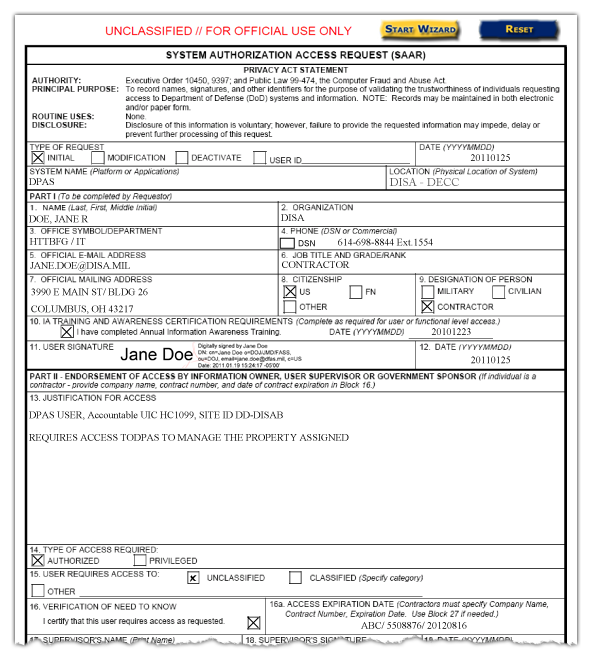

DD Form 2875 Information And Instructions

Instructions For Box 12 Dd - New box 12 code II for Medicaid waiver payments excluded from gross income under Notice 2014 7 There is a new code II for box 12 used to report Medicaid waiver payments not