Is Gst Applicable On Salt 264 rowsGST Rates HSN Codes on Salts Sands Graphite Quartz

Is GST applicable on salt Salt attracts no GST As per GST Law there is no GST payable on Salt all types So the rate of GST payable on Salt all types is nil rate 36 rowsGST Rates HSN Codes for Salts And Marbles Unroasted iron

Is Gst Applicable On Salt

Is Gst Applicable On Salt

https://i.ytimg.com/vi/wHWjxofmkEM/maxresdefault.jpg

GST Rates On Construction Materials GST Construction Materials Gst

https://i.ytimg.com/vi/pqTCns6rTno/maxresdefault.jpg

How To Export Salt From India Complete Procedure About Salt Export

https://i.ytimg.com/vi/g0DcdRSGBQw/maxresdefault.jpg

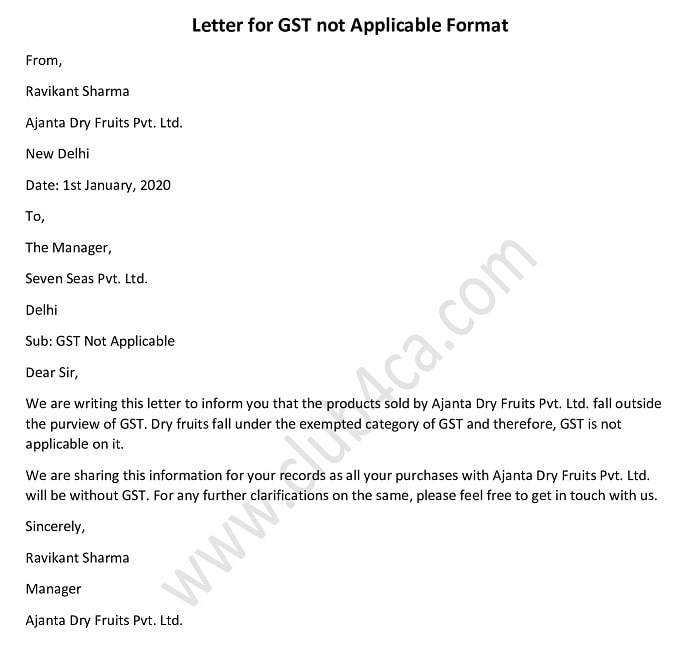

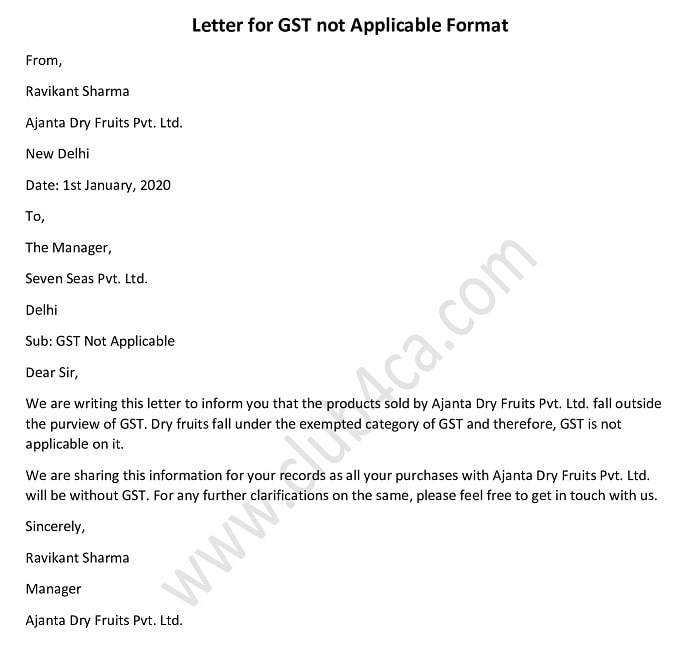

HS code is classified under chapter 25 Salt sulphur earths and stones plastering materials lime and cement of ITC Indian Tariff Code Chapter 25 is classified under Section 05 MINERAL GST rate for both goods and services are applicable in 5 slabs namely 0 5 12 18 and 28 In this article let us look at the GST rate for sugar salt chocolate and spices in detail Sugar and sugar confectioneries

Common salt is not taxable under GST Under the GST regime most spices attract a GST rate of 5 However fresh ginger and fresh turmeric other than in processed form are exempt from GST Also Read How to Start HSN codes and GST rates for Salts Sands that fall under HSN chapter 25 includes Graphite Quartz Cement Clay Marble HSN Codes for Graphite Quartz

More picture related to Is Gst Applicable On Salt

GST Calculation Both Inclusive And Exclusive Tax YouTube

https://i.ytimg.com/vi/7LlfYE45QmU/maxresdefault.jpg

Is GST Applicable On NGO Or Trusts Or Section 8 Companies In India

https://i.ytimg.com/vi/b1MjTCscu3M/maxresdefault.jpg

GST Applicable On RICE WHEAT And PULSES I GST UPDATES I Pre Packaged

https://i.ytimg.com/vi/z8se7Cpfuhs/maxresdefault.jpg

HS code is classified under chapter 25 Salt sulphur earths and stones plastering materials lime and cement of ITC Indian Tariff Code Chapter 25 is classified under Section 05 MINERAL Explore GST rates and HSN code 2501 for salt products Get comprehensive information on salt taxation and classification Stay compliant with updated rates

HS code is classified under chapter 25 Salt sulphur earths and stones plastering materials lime and cement of ITC Indian Tariff Code Chapter 25 is classified under Section 05 MINERAL Is GST exempted on Salt all types As per GST Law there is no GST payable on Salt all types So the rate of GST payable on Salt all types is nil rate The Goods and

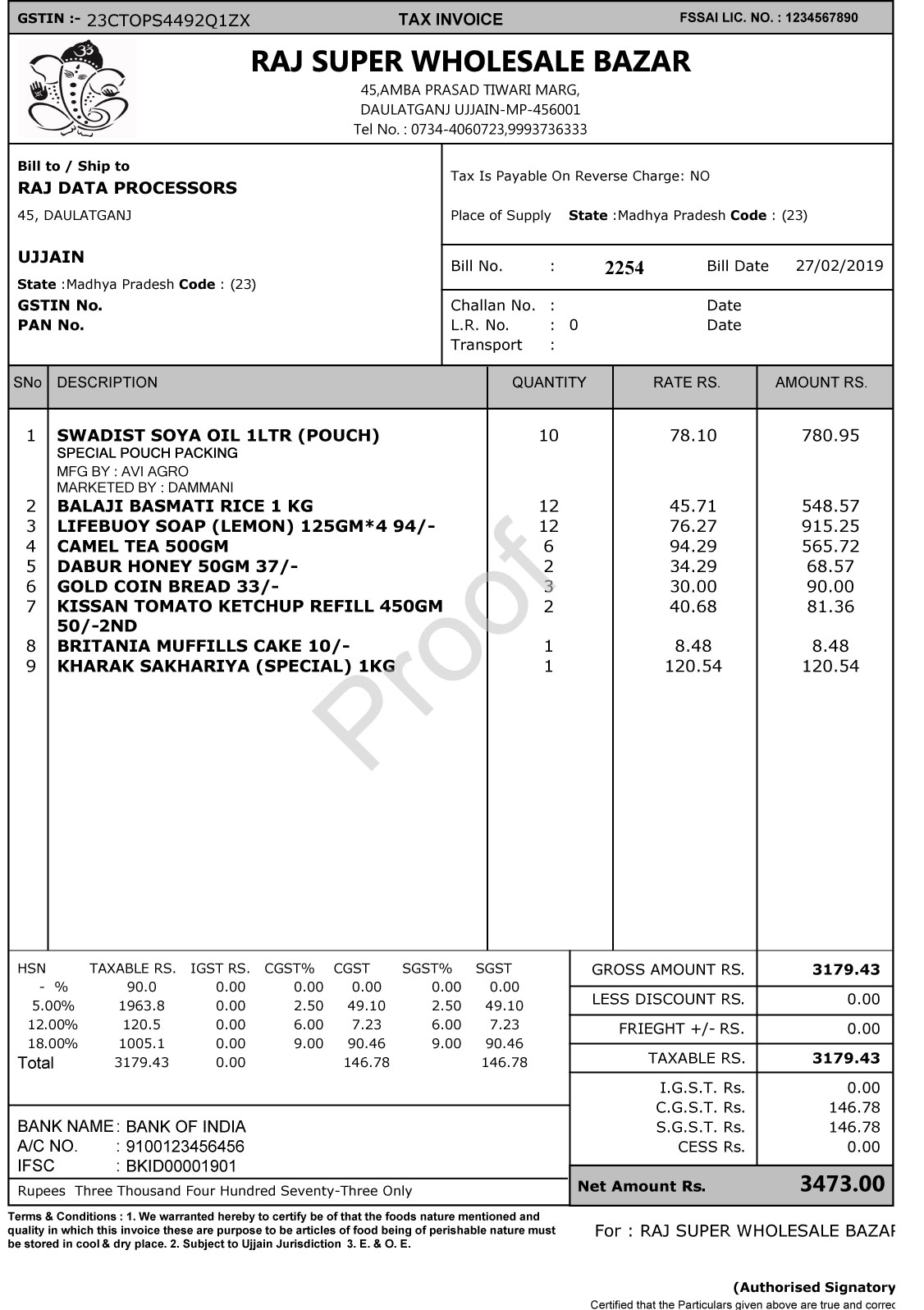

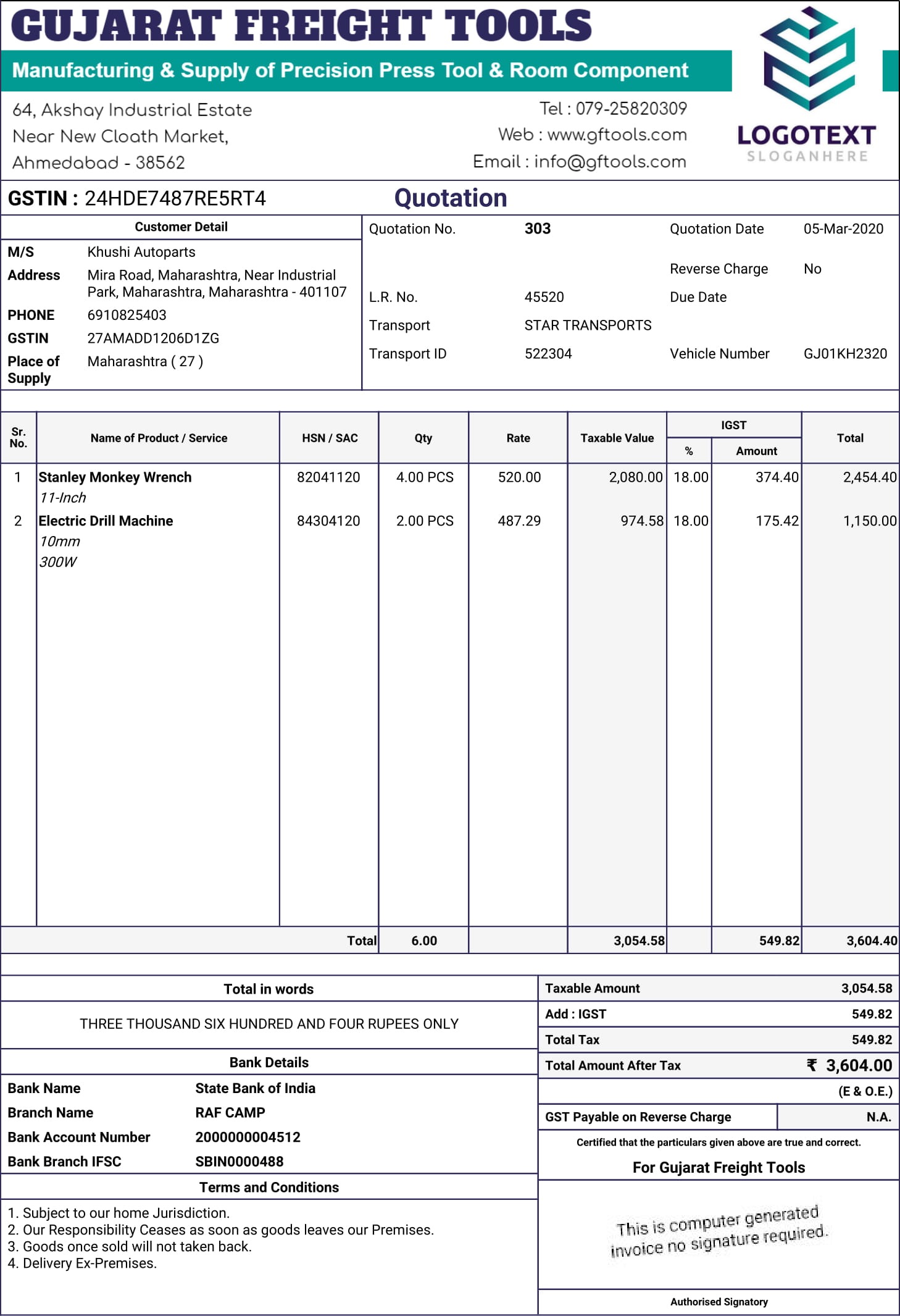

GST Billing Software SOFTWARE SOLUTION

https://ujjainwala.com/blogimages/000171mybillprint1.jpg

How GST Works example The Tax Chic

https://i1.wp.com/www.thetaxchic.com/wp-content/uploads/2017/09/How-GST-works-example-1.jpg

https://cleartax.in

264 rowsGST Rates HSN Codes on Salts Sands Graphite Quartz

https://learn.quicko.com

Is GST applicable on salt Salt attracts no GST As per GST Law there is no GST payable on Salt all types So the rate of GST payable on Salt all types is nil rate

Is GST Applicable On Gifts By Employer To Employee

GST Billing Software SOFTWARE SOLUTION

GST Sales With Discount At The Item Level

Goods And Services Tax GST Meaning An Overview Tutor s Tips

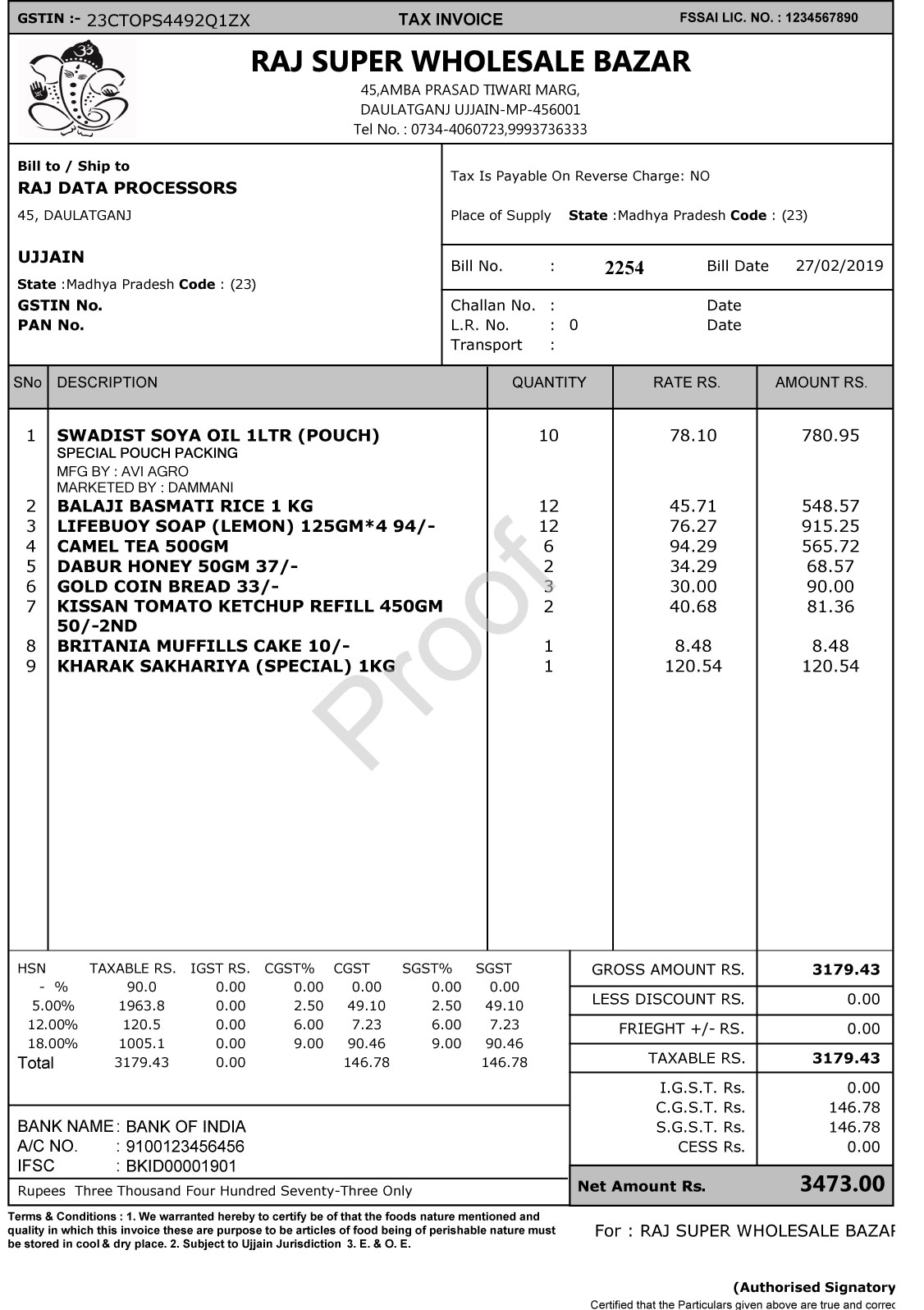

Quotation 303 1 100 Free GST Billing Software For Every Businesses

CA Club India Chartered Accountant In India Taxpayers And

CA Club India Chartered Accountant In India Taxpayers And

Understanding Goods Service Tax GST

Is GST Applicable On Import Of Goods In India IndiaFilings

Is GST Applicable On Gifts By Employer To Employee

Is Gst Applicable On Salt - HS code is classified under chapter 25 Salt sulphur earths and stones plastering materials lime and cement of ITC Indian Tariff Code Chapter 25 is classified under Section 05 MINERAL