Mileage And Miles Difference However when I lodge my last year s tax return I found that both the taxable and non taxable mileage reimbursements are included in my taxable income In this case I would have to pay tax for the whole mileage reimbursement that I received including the part below 78 cents as this is considered as part of my taxable income at the

Hi just wondering whether someone could clarify as to whether GST applies to the reimbursements calculated using the cents per kilometer mileage method based on the actual business kilometers travelled Hiya TinaJ I m confused are you the employer In which case you follow the ATO guidance I don t know why you would reference a state payroll tax matter that has nothing to do with PAYG withholding to vary the withholding to nil on the part of the rate that doesn t exceed the ATO reasonable rate For the current FY 2025 2026 any c km allowances you

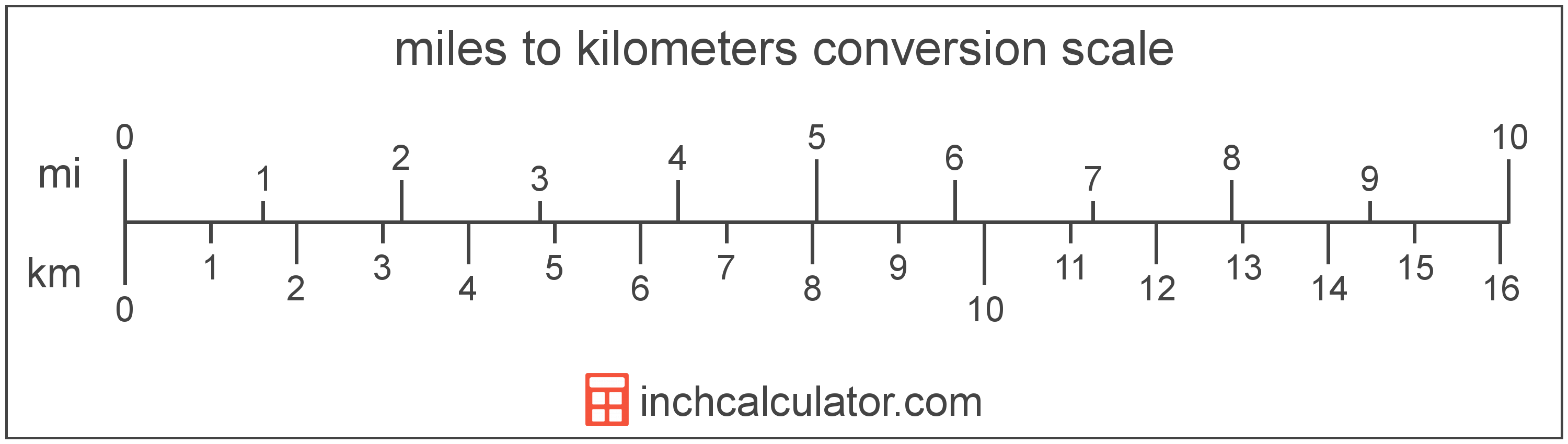

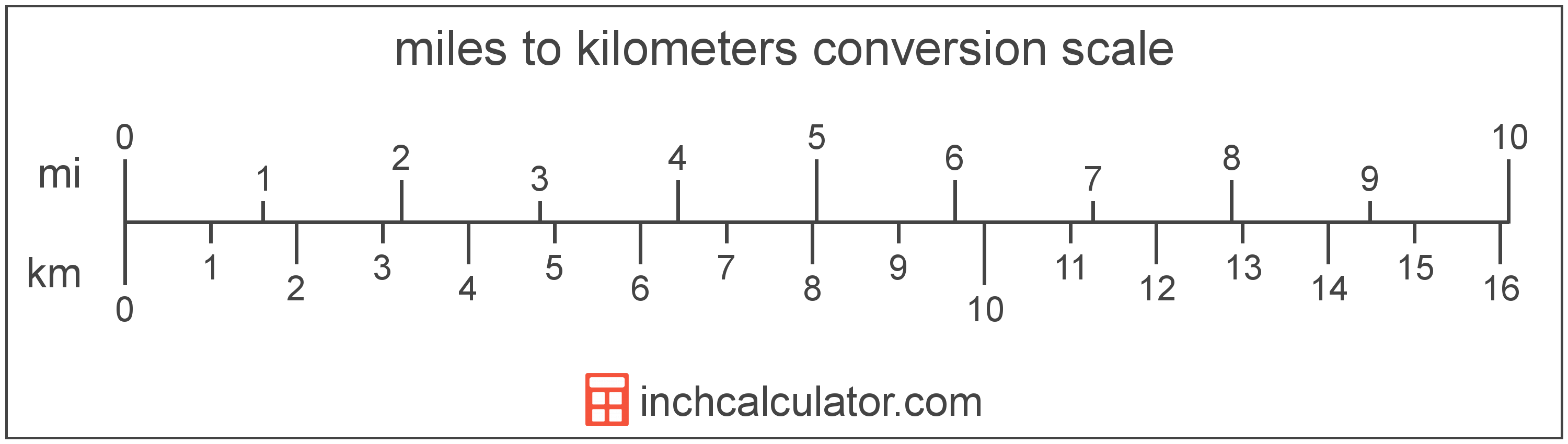

Mileage And Miles Difference

Mileage And Miles Difference

https://image.cnbcfm.com/api/v1/image/107417173-1716209132723-Hims-and-Hers-photo.jpg?v=1716209252&w=1920&h=1080

And The New Show Member Is Free Beer And Hot Wings

https://www.freebeerandhotwings.com/wp-content/uploads/2023/02/And-The-New-Show-Member-Is.jpg

Segment 17 Where s Kelly Weekend Plans Some Big Dumps The Sorority

https://www.freebeerandhotwings.com/wp-content/uploads/2023/04/Segment-17-Wheres-Kelly-Weekend-Plans-Some-Big-Dumps-The-Sorority-Email-And-Facts-Of-The-Day.jpg

Previously I used logbook method for vehicle and claimed appropriate percentage for GST Thinking of using cents km Can I still claim same percentage of GST for vehicle Hi my employer reimburse employees work related car expenses during cents per kilometer method The current rate for 2021 2022 is 72 cents per km according to ATO however our industry award lists 85 cents per km for motor vehicle allowance If we use 85 cents per km do we have to list this on employees payslips because it s an allowance And employees

If an employee makes a reimbursement request for mileage using the cents per kilometre method and the total reimbursement request is for 143 52 do we break this into 130 47 pre GST 13 05 GST 143 52 total Or is the amount a GST free expense on our end We pay our employee 80cents Per KM for any business travel using their own car paid via payroll fortnightly is this mileage payment taxable income should we withhold income tax for this payment If it s taxable income then can employee to claim business related mileage deductions in cents per kilometer method

More picture related to Mileage And Miles Difference

Spiderman Logo Wallpaper For Pc Infoupdate

https://img.uhdpaper.com/wallpaper/spider-man-across-the-spider-verse-miles-morales-logo-999@[email protected]

Spider Man Into The Spider Verse Marvel Image By Ali Shimhaq

https://static.zerochan.net/Spider-Man:.Into.the.Spider-Verse.full.4019777.jpg

Appreciate 3 Tumblr Gallery

https://64.media.tumblr.com/94e289fc3557bfb03e1a29a4ec38d539/tumblr_p4znqud1Hh1umw9vlo1_1280.jpg

Hi Team I just would like to know when an employee reimburse themselves for the mileage Suppose the employee travelled for 200kms 0 88 cents per km 176 he is able to claim for 176 which is GST inc 10 right so when we record this as a bill it will be 160 16 GST 176 Total amount Hope this makes sense Please also if you could share where can Hello Ryan1998 If travel is less than 5 000 kilometres for business each year you can use the set rate formula or log book methods The set rate method To use this method you can claim a percentage of GST credits based on the total kilometres travelled 0 1 250 km 5 1 251 2 500 km 10 2 501 3 750 km 15 3 751 5 000 km 20 The formula method

[desc-10] [desc-11]

Standard Mileage Deduction 2024 Barry Jessalyn

http://www.eitcoutreach.org/wp-content/uploads/which-miles-count.png

IPhone Flight Miles

https://images.sftcdn.net/images/t_app-cover-l,f_auto/p/1982666b-261d-44cf-be67-aa2b7a516d83/2889901125/flight-miles-screenshot.png

https://community.ato.gov.au › question

However when I lodge my last year s tax return I found that both the taxable and non taxable mileage reimbursements are included in my taxable income In this case I would have to pay tax for the whole mileage reimbursement that I received including the part below 78 cents as this is considered as part of my taxable income at the

https://community.ato.gov.au › question

Hi just wondering whether someone could clarify as to whether GST applies to the reimbursements calculated using the cents per kilometer mileage method based on the actual business kilometers travelled

Mileage Rate In 2025 James Idris

Standard Mileage Deduction 2024 Barry Jessalyn

Arbor Support Strictly Education

Discussion Thread For The Polls Only Thread 9273 By Hatchie

2025 Irs Mileage Rate Reimbursement Gabriel Everett

2800 Miles To Km

2800 Miles To Km

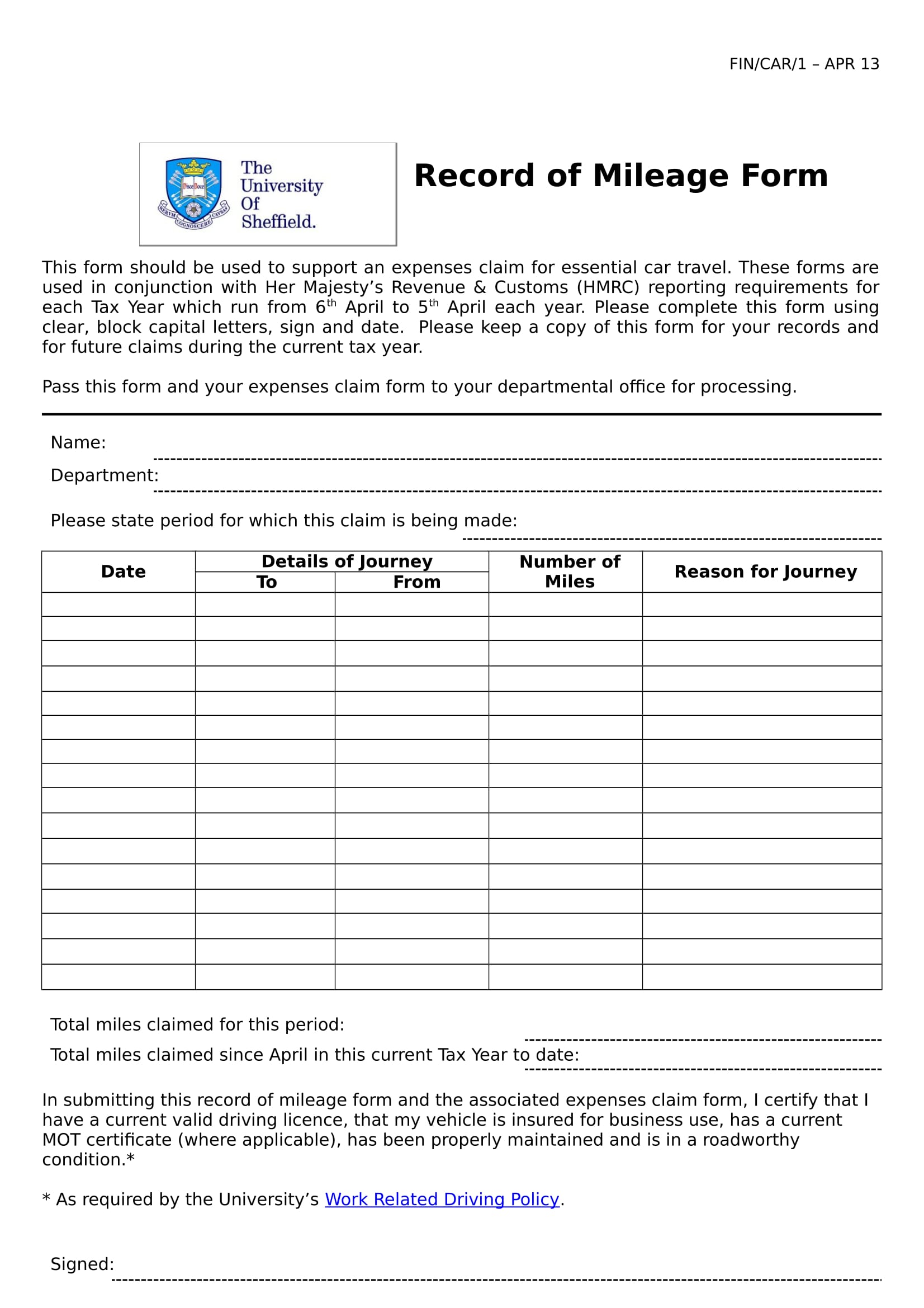

Printable Mileage Form

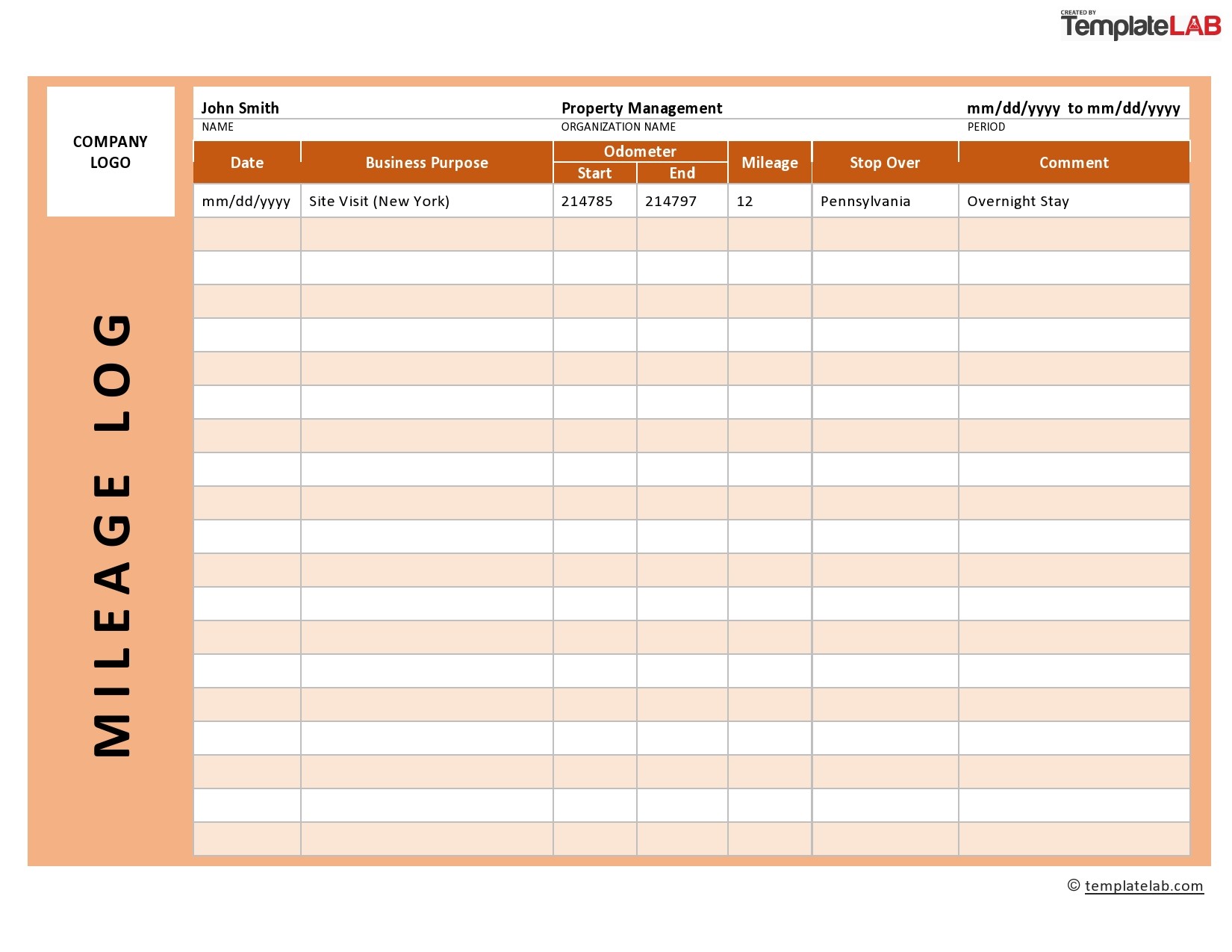

Printable Mileage Log Sheet

Download C0C0C0 Male And Female Children Icons SVG FreePNGImg

Mileage And Miles Difference - [desc-14]