Sec 154 Of Income Tax Act 1961 The SEC s mission is to protect investors maintain fair orderly and efficient markets and facilitate capital formation The SEC has up to five Commissioners appointed by

For other information please view the Contact the SEC page Office of Public Affairs The Office of Public Affairs maintains SEC gov and the agency s intranet with the The SEC rulemaking process under the federal securities laws is designed to solicit significant public input and undergo rigorous analysis before any regulatory change

Sec 154 Of Income Tax Act 1961

Sec 154 Of Income Tax Act 1961

https://i.ytimg.com/vi/_fPGrUhnGvA/maxresdefault.jpg

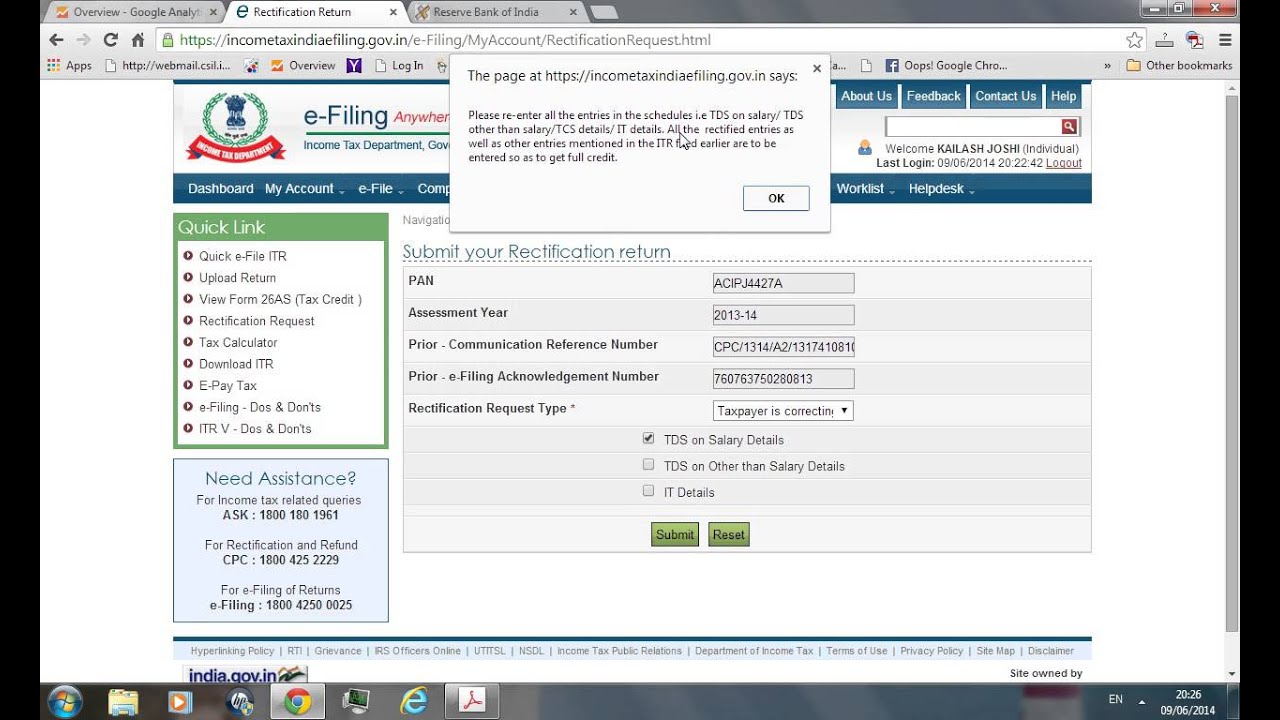

Income Tax Online Rectification Request U s 154 YouTube

https://i.ytimg.com/vi/o7LLkIcRpHQ/maxresdefault.jpg

How To Draft format And File Income Tax Rectification Request

https://i.ytimg.com/vi/49_UNlhrtL8/maxresdefault.jpg

The Electronic Data Gathering Analysis and Retrieval EDGAR system is the primary way for companies and individuals to submit filings to the SEC in accord with the At the Securities and Exchange Commission SEC we work together to make a positive impact on the U S economy our capital markets and people s lives Since our founding in 1934 at

The CETU led by Laura D Allaird replaces the Crypto Assets and Cyber Unit and is comprised of approximately 30 fraud specialists and attorneys across multiple SEC offices This listing includes periodic SEC reports and publications See also FOIA Frequently Requested Documents and SEC Data Resources for periodic data reports and

More picture related to Sec 154 Of Income Tax Act 1961

Rectification Order Under Section 154 Of Income Tax Act 1961 How To

https://i.ytimg.com/vi/NMEnX3Afig0/maxresdefault.jpg

Rectification Of Mistakes Under Section 154 Of Income Tax Act 1961

https://i.ytimg.com/vi/92JJD9xyO0I/maxresdefault.jpg

Section 10 10D Of Income Tax Act LIP Amount Received From LIP Taxable

https://i.ytimg.com/vi/oea7tKa-_qQ/maxresdefault.jpg

The adopting release is published on SEC gov and will be published in the Federal Register The final rules will become effective 60 days following publication of the adopting Following today s Commission vote SEC staff sent a letter to the court stating that the Commission withdraws its defense of the rules and that Commission counsel are no longer

[desc-10] [desc-11]

Understanding Section 49C Of The Income Tax Act

https://www.kanakkupillai.com/learn/wp-content/uploads/2023/09/section-80c-of-income-tax-act.jpg

Understanding Section 49C Of The Income Tax Act

https://i.ytimg.com/vi/8nGFyMGNJdE/maxresdefault.jpg

https://www.sec.gov › about

The SEC s mission is to protect investors maintain fair orderly and efficient markets and facilitate capital formation The SEC has up to five Commissioners appointed by

https://www.sec.gov › news

For other information please view the Contact the SEC page Office of Public Affairs The Office of Public Affairs maintains SEC gov and the agency s intranet with the

Residential Status Income Tax I Section 6 Of Income Tax Act 1961 I

Understanding Section 49C Of The Income Tax Act

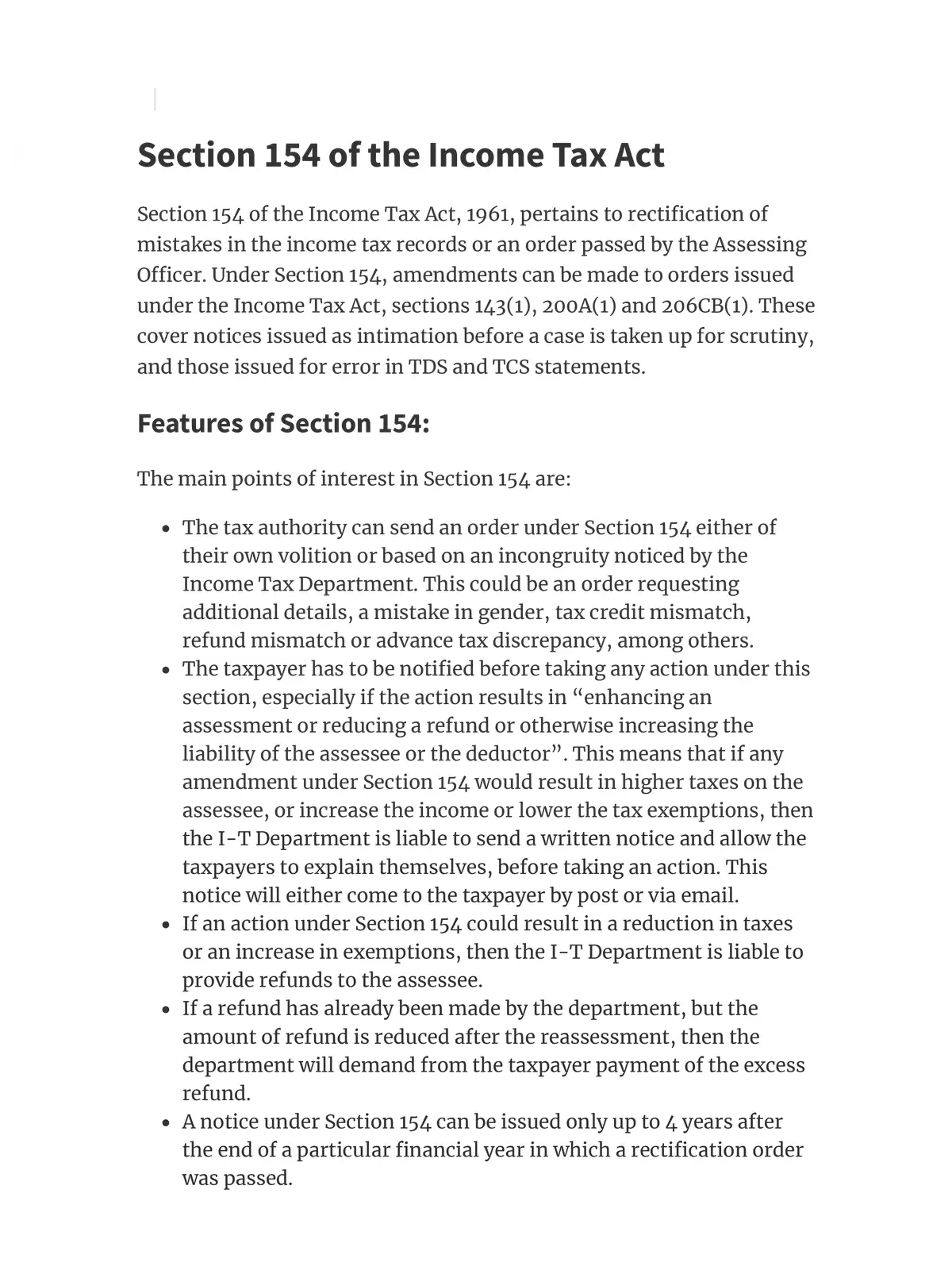

Section 154 Of Income Tax Act Detail PDF InstaPDF

Section 154 Of Income Tax Act 1961 Rectification Of Mistake

ALL ABOUT SECTION 234 OF INCOME TAX ACT 1961

Summary Of Income Tax Deduction Under Chapter VI A CA Rajput

Summary Of Income Tax Deduction Under Chapter VI A CA Rajput

Rectification Under Section 154 Of Income Tax Act 1961 Chandan

Maternity Benefit Act 1961 Applicability Eligibility Provision

CHARTERED PROFESSIONAL Rectification Under Section 154 Of Income Tax

Sec 154 Of Income Tax Act 1961 - This listing includes periodic SEC reports and publications See also FOIA Frequently Requested Documents and SEC Data Resources for periodic data reports and