Tax Rates 24 25 Income tax Personal business corporation trust international and non resident income tax

The Government of Canada sets the federal income tax rates for individuals Each province and territory determines their own income tax rates Provincial or territorial income Sign in or register for My Account My Business Account or Represent a Client with the CRA and get help with using the CRA sign in services

Tax Rates 24 25

Tax Rates 24 25

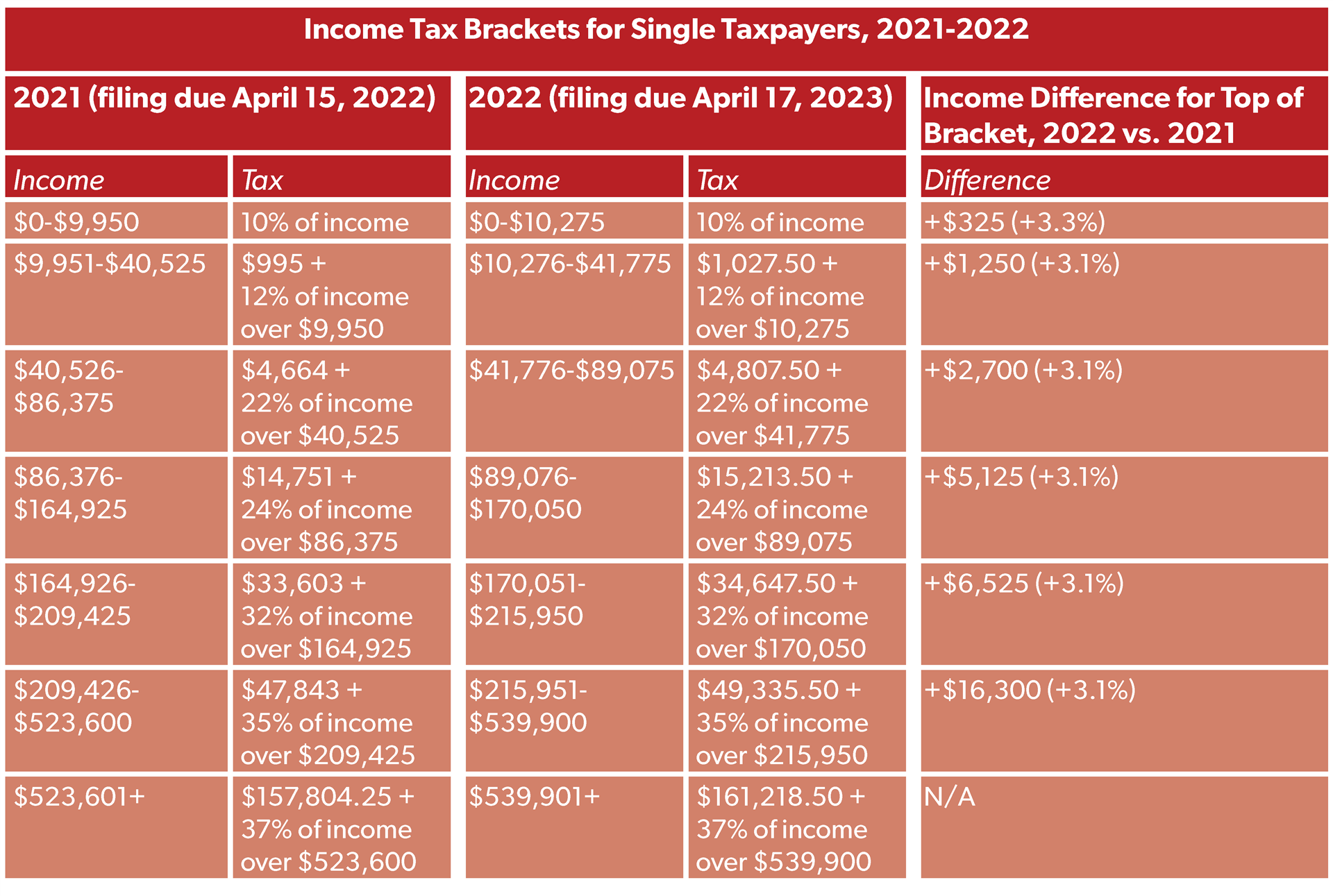

https://www.ntu.org/Library/imglib/2021/11/2021-22-single-tax-brackets-2-.png

Tim Scott Tax Plan Details Analysis Tax Foundation

https://taxfoundation.org/wp-content/uploads/2023/11/Tim_Scott_3-3-2022-scaled.jpg

MTC QS NSR Management

https://www.nsrm.co.uk/wp-content/uploads/2024/07/2025-NSRM-Cover-SMM7-Buildings-1.png

Information on taxes including filing taxes and get tax information for individuals businesses charities and trusts Income tax Who should file a tax return how to get ready for taxes filing and payment due dates reporting your income and claiming deductions and how to make a payment or check the status of your

Personal income tax Ways to do your taxes The Digital File My Return service is no longer available To file your tax return select one of the options listed below The middle class tax cut would reduce the tax rate that is applied to the first 57 375 in 2025 of an individual s taxable income regardless of their income level As shown

More picture related to Tax Rates 24 25

Special Tax Rates For AY 2024 25 Comprehensive Guide To Applicable

https://financesaathi.com/adm/uploads/Basic to Advance_500_Green Simple Professional Corporative Business Consulting Services Instagram Post.png

MTC QS NSR Management

https://www.nsrm.co.uk/wp-content/uploads/2024/07/2025-NSRM-Cover-SMM7-Mechanical-1-1200x1760.png

MTC QS NSR Management

https://www.nsrm.co.uk/wp-content/uploads/2024/07/2025-NSRM-Cover-SMM7-Electrical.png

How much tax will I pay on my retirement lump sum withdrawals From age 55 you can take up to one third of your retirement fund Retirement Annuity Company Pension Fund or When using certified tax software the Auto fill my return service automatically fills in parts of your income tax and benefit return with information that the CRA has available at

[desc-10] [desc-11]

https://tistory1.daumcdn.net/tistory/1758300/attach/24ec5236ed704451bc72ec9b455103cd

MTC QS NSR Management

https://www.nsrm.co.uk/wp-content/uploads/2024/07/2025-NSRM-Cover-SMM7-Electrical-1200x1760.png

https://www.canada.ca › en › services › taxes › income-tax

Income tax Personal business corporation trust international and non resident income tax

https://www.canada.ca › en › revenue-agency › services › tax › individual…

The Government of Canada sets the federal income tax rates for individuals Each province and territory determines their own income tax rates Provincial or territorial income

Flights Product Page Travclan

Influential Tax Reformer Ernest S Christian Jr Leaves Legacy Blueprint

Suzanne Somers Passes Away Day Before 77th Birthday Free Beer And Hot

A Breakdown Of Tax Rates For Summit County School Districts

SOP Penyusunan Laporan Keuangan Perusahaan

SOP Penyusunan Laporan Keuangan Perusahaan

Special Tax Rates For AY 2024 25 Comprehensive Guide To Applicable

The Start Of A One mill Tax For Duval County Teacher Salaries Is The

New Tax Rates 2024 25 Image To U

Tax Rates 24 25 - [desc-14]