What Are Filing Fees In Accounting COMMON ITR ISSUES AND FAQ S FOR FILING RETURN FOR AY 2024 25 Q 1 Taxpayer is unable to choose ITR 1 4 from drop down for AY 2024 25 as the option is greyed off while filing return Ans In case taxpayer has special rate of Income and TDS is deducted for such income For Ex 115BB then ITR 1 and ITR 4 are not applicable for such taxpayer

E Filing of Income Tax Return or Forms and other value added services Intimation Rectification Refund and other Income Tax Processing Related Queries 1800 103 0025 or 1800 419 0025 E Filing of Income Tax Return or Forms and other value added services Intimation Rectification Refund and other Income Tax Processing Related Queries 1800 103 0025 or 1800 419 0025

What Are Filing Fees In Accounting

What Are Filing Fees In Accounting

https://i.ytimg.com/vi/iXyvlsnKLMI/maxresdefault.jpg

2022 IRS Form 1040 Walkthrough Married Filing Jointly YouTube

https://i.ytimg.com/vi/Kv0IH0dN9DU/maxresdefault.jpg

How To Fill Out IRS Form W4 Married Filing Jointly 2023 YouTube

https://i.ytimg.com/vi/UVnXQVOu3Jw/maxresdefault.jpg

E Filing of Income Tax Return or Forms and other value added services Intimation Rectification Refund and other Income Tax Processing Related Queries 1800 103 0025 or 1800 419 0025 E Filing of Income Tax Return or Forms and other value added services Intimation Rectification Refund and other Income Tax Processing Related Queries 1800 103 0025 or 1800 419 0025

Please note vide Notification No 5 2022 dated 29 07 2022 w e f 01 08 2022 the time limit for e verification or submission of ITR V shall be 30 days from the date of filing the return of income However where the return is filed on or before 31 07 2022 the earlier time limit of 120 days would continue to apply Form 10 IEA should be filed on or before the due date of filing of return as specified u s 139 1 of the Income Tax Act 1961 8 Can I submit Form 10 IEA after filing of Income Tax Return In order to get the benefit of filing of Form 10 IEA it is advisable to

More picture related to What Are Filing Fees In Accounting

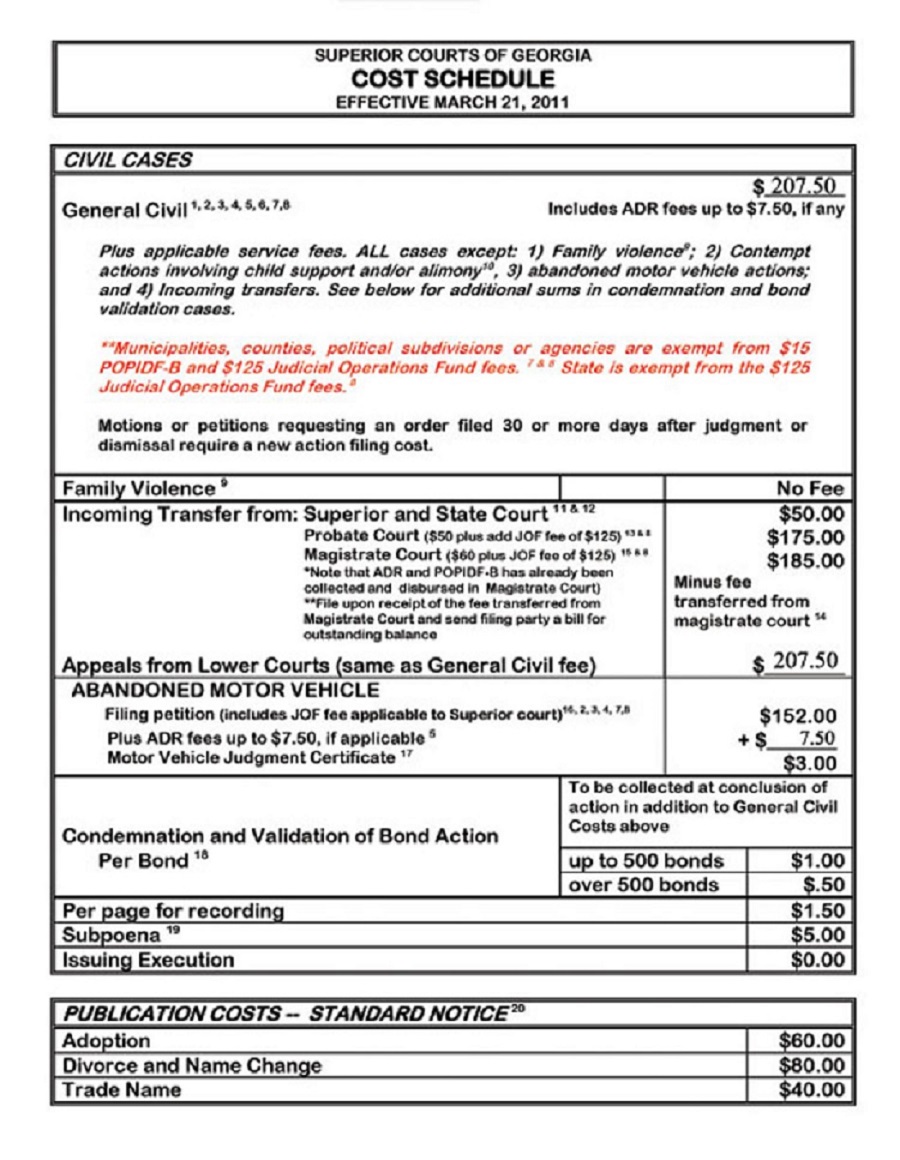

Court Fees Toombs County Commission

https://www.toombscountyga.gov/wp-content/uploads/2015/03/court_costs_page11.jpg

:max_bytes(150000):strip_icc()/mfs.asp-final-92d6cd107fec480fa0bcbe2343401c9f.jpg)

Married Filing Separately Explained How It Works And Its 56 OFF

https://www.investopedia.com/thmb/vKzr833HrbdnpThdxkOjKjEm5o4=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/mfs.asp-final-92d6cd107fec480fa0bcbe2343401c9f.jpg

Management Fee Meaning Formula Example Taxation Vs MER

https://www.wallstreetmojo.com/wp-content/uploads/2022/11/Management-Fee.jpg

E Filing of Income Tax Return or Forms and other value added services Intimation Rectification Refund and other Income Tax Processing Related Queries 1800 103 0025 or 1800 419 0025 At least one ITR filed on the e Filing portal with valid acknowledgement number Valid mobile number for OTP Post Login Registered user on the e Filing portal with valid user ID and password At least one ITR filed on the e Filing portal 3 Process Step by Step Guide 3 1 ITR Status Pre Login Step 1 Go to the e Filing portal homepage

[desc-10] [desc-11]

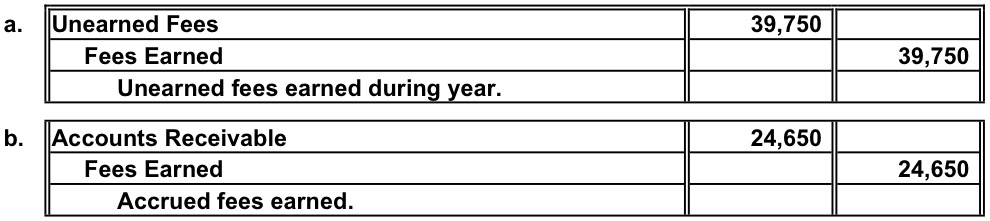

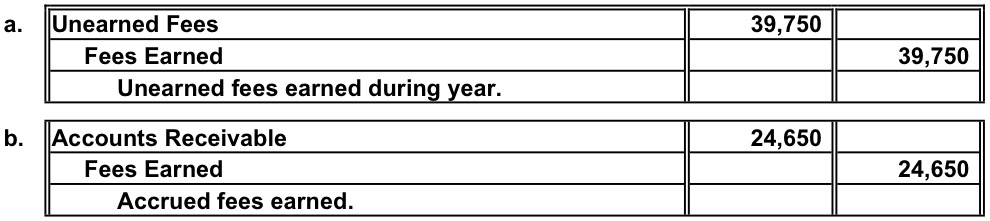

Accounting Questions And Answers EX 3 16 Adjusting Entries For

https://3.bp.blogspot.com/-frhENttZorM/XBhYxOTs0pI/AAAAAAAAEEg/FyMFRZVjFMkAQBVDboBIK9LIPf2Q4Yq3QCK4BGAYYCw/s1600/Untitled.jpeg

Ca Llc Fees 2024 Tamra Simonette

https://blogstudio.s3.theshoppad.net/utpatents/abd4ef39d31c13df96165f0d2239047b.jpg

https://www.incometax.gov.in › iec › foportal › sites › defaul…

COMMON ITR ISSUES AND FAQ S FOR FILING RETURN FOR AY 2024 25 Q 1 Taxpayer is unable to choose ITR 1 4 from drop down for AY 2024 25 as the option is greyed off while filing return Ans In case taxpayer has special rate of Income and TDS is deducted for such income For Ex 115BB then ITR 1 and ITR 4 are not applicable for such taxpayer

https://www.incometax.gov.in › iec › foportal › help › all-topics › brochures

E Filing of Income Tax Return or Forms and other value added services Intimation Rectification Refund and other Income Tax Processing Related Queries 1800 103 0025 or 1800 419 0025

Accounting Fee Increase Letter Sample Culturo Pedia

Accounting Questions And Answers EX 3 16 Adjusting Entries For

Unearned Revenue Journal Entry LizethkruwSmith

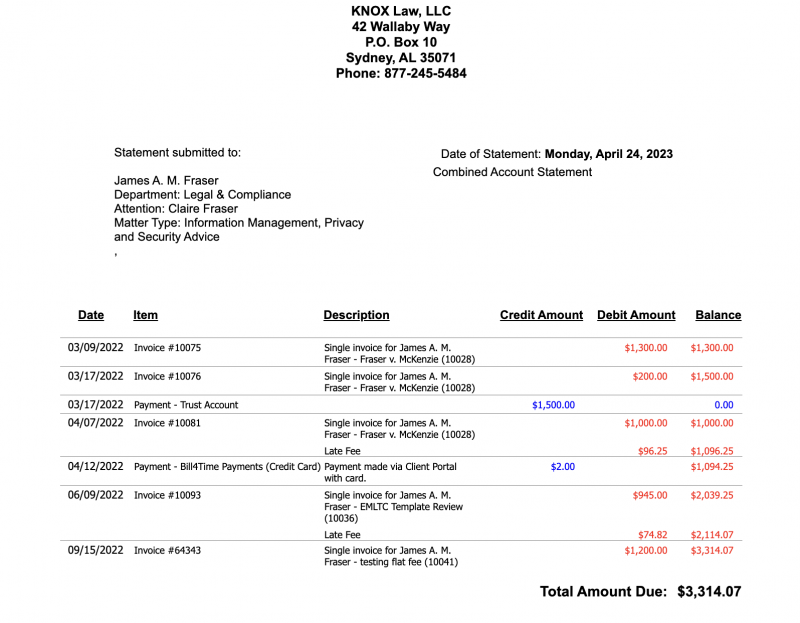

How To Create An Attorney Billing Statement EXAMPLES

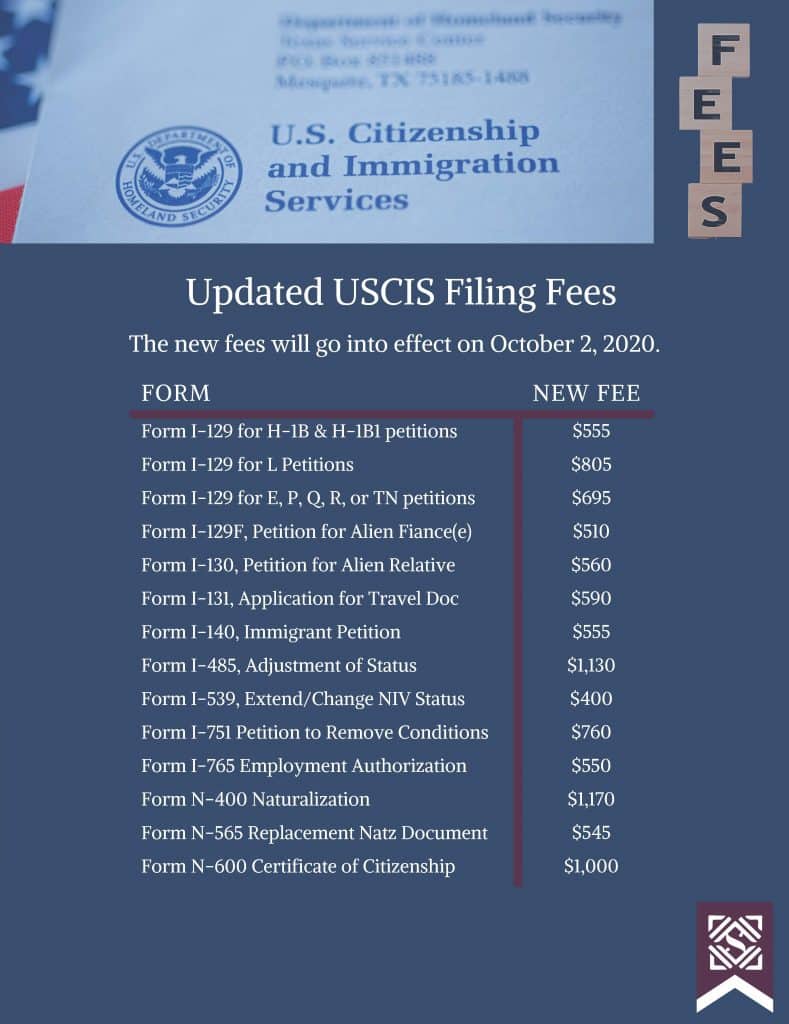

Uscis Forms Versions Printable Form Templates And Letter

Standard Deduction 2025 Married Sara Jasper

Standard Deduction 2025 Married Sara Jasper

2025 California Tax Calculator Jennifer J Brown

2024 Medicare Fee Schedule Pdf Free Nicki Amabelle

.jpg?width=8333&name=tax graphic_2020 (1).jpg)

2025 Irs Standard Deduction Over 65 Age Yuka Devries

What Are Filing Fees In Accounting - Form 10 IEA should be filed on or before the due date of filing of return as specified u s 139 1 of the Income Tax Act 1961 8 Can I submit Form 10 IEA after filing of Income Tax Return In order to get the benefit of filing of Form 10 IEA it is advisable to