What Are Implied Shares Outstanding Implied shares outstanding is a measure of how many shares of a company s stock are currently being traded in the market It s calculated by dividing the current market capitalization of a company by its stock price

Shares outstanding or outstanding shares are any shares that are held by shareholders and company insiders Floating shares indicate the number of shares actually available Outstanding shares include share blocks held by institutional investors and restricted shares owned by the company s officers and insiders These shares appear on

What Are Implied Shares Outstanding

What Are Implied Shares Outstanding

https://i.pinimg.com/originals/03/c3/25/03c325dc4f9b57bece582c7eee370c8f.jpg

:max_bytes(150000):strip_icc()/Outstanding-Shares-66e3dfdfa97140b59e4ad86fb2e70905.jpg)

Equity P In K Treasury Stock Re Online Dakora co

https://www.investopedia.com/thmb/OX-Sp5eYzE9SsBCofHM92Uv2ty4=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/Outstanding-Shares-66e3dfdfa97140b59e4ad86fb2e70905.jpg

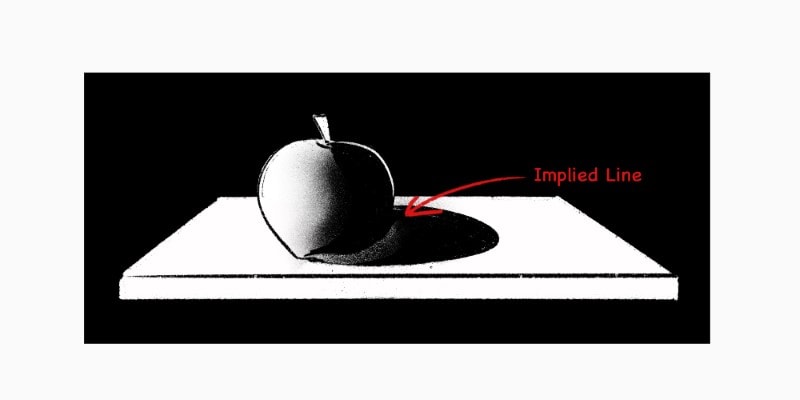

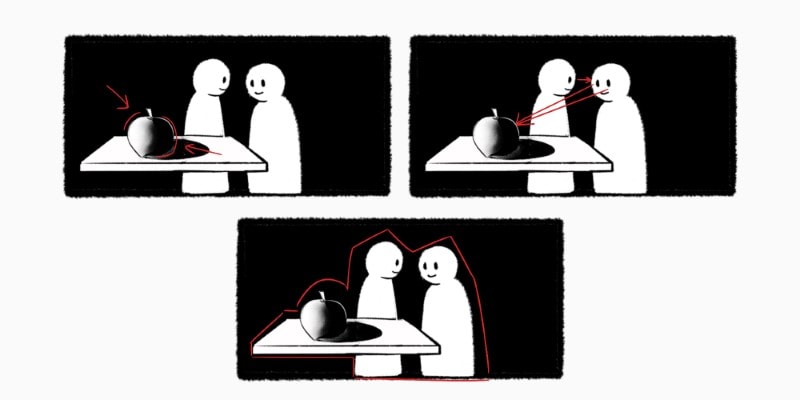

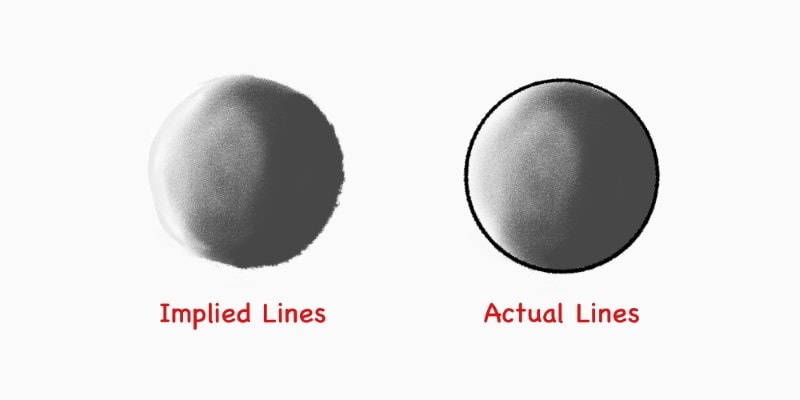

What Are Implied Lines In Art And How To Use Them Examples Implied

https://i.pinimg.com/originals/92/ff/a3/92ffa3a28dd66f06a4948f488423d7c0.png

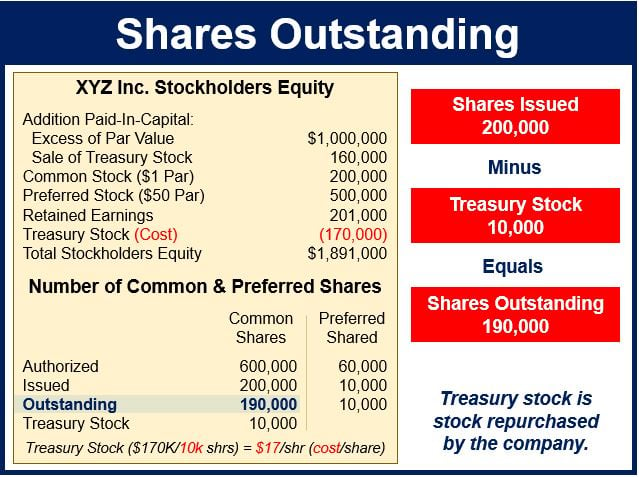

Market cap or market capitalization refers to the total value of all a company s shares of stock Market cap equals the current share price multiplied by the number of weighted shares outstanding The implied value per share depends upon the number of outstanding shares along with net earnings available to shareholders To determine this amount complete the following Calculate the company s preferred dividends Subtract the preferred dividends from net income Divide the adjusted net income by the outstanding common shares

Shares outstanding are the basis of several key financial metrics and can be useful for tracking a company s operating performance Two different ways to analyze a company through its shares outstanding are earnings per share EPS and cash flow per share CFPS Shares outstanding are company issued shares that can be traded on the market held by investors and owned by company insiders Unrestricted shares or those available on the market are called the float

More picture related to What Are Implied Shares Outstanding

Understanding Actual And Implied Lines In Design

https://i.pinimg.com/originals/d9/d7/bb/d9d7bb7b4d167166816d7b9a7bef0b87.jpg

What Are Implied Lines In Art And How To Use Them Examples Implied

https://i.pinimg.com/originals/f6/d4/54/f6d4543b886d47eacec750f7a79a68f5.jpg

What Are Implied Lines In Art And How To Use Them Examples Implied

https://i.pinimg.com/originals/fe/66/37/fe6637349d319f16087cca25db678e5b.jpg

The simple difference between shares outstanding vs float is that shares outstanding refers to the total number of shares issued by a company while floating shares are shares that are publicly owned unrestricted and available on the open market Shares outstanding or outstanding shares are the total number of shares currently owned by a company s shareholders This number includes the number of shares that the public can buy and sell as well as restricted shares

At first glance you might think that calculating the implied value per share would be easy just take the proposed purchase price and divide it by the number of shares the target company has Outstanding shares refer to the authorized shares that have been issued to a company s shareholders excluding the treasury stock retained by the company itself

Outstanding Pictures

https://marketbusinessnews.com/wp-content/uploads/2015/07/Shares-Outstanding.jpg

Issues Vs Outstanding Shares Top 7 Differences

https://invyce.com/wp-content/uploads/2022/10/issued-vs-outstanding-shares-1.jpg

https://www.financereference.com › implied-shares-outstanding

Implied shares outstanding is a measure of how many shares of a company s stock are currently being traded in the market It s calculated by dividing the current market capitalization of a company by its stock price

:max_bytes(150000):strip_icc()/Outstanding-Shares-66e3dfdfa97140b59e4ad86fb2e70905.jpg?w=186)

https://www.investopedia.com › ask › answers › ...

Shares outstanding or outstanding shares are any shares that are held by shareholders and company insiders Floating shares indicate the number of shares actually available

Shares Outstanding Formula Calculator Examples With Excel Template

Outstanding Pictures

What Are Implied Lines In Drawing And How To Use Them

What Are Implied Lines In Drawing And How To Use Them

What Are Implied Lines In Drawing And How To Use Them

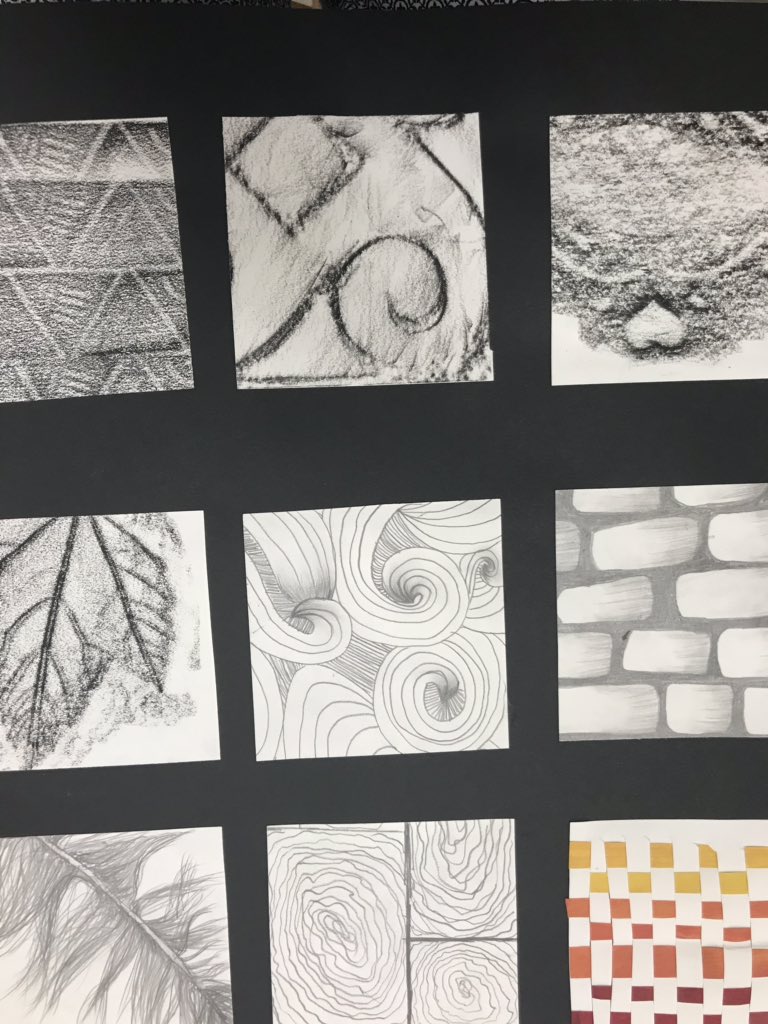

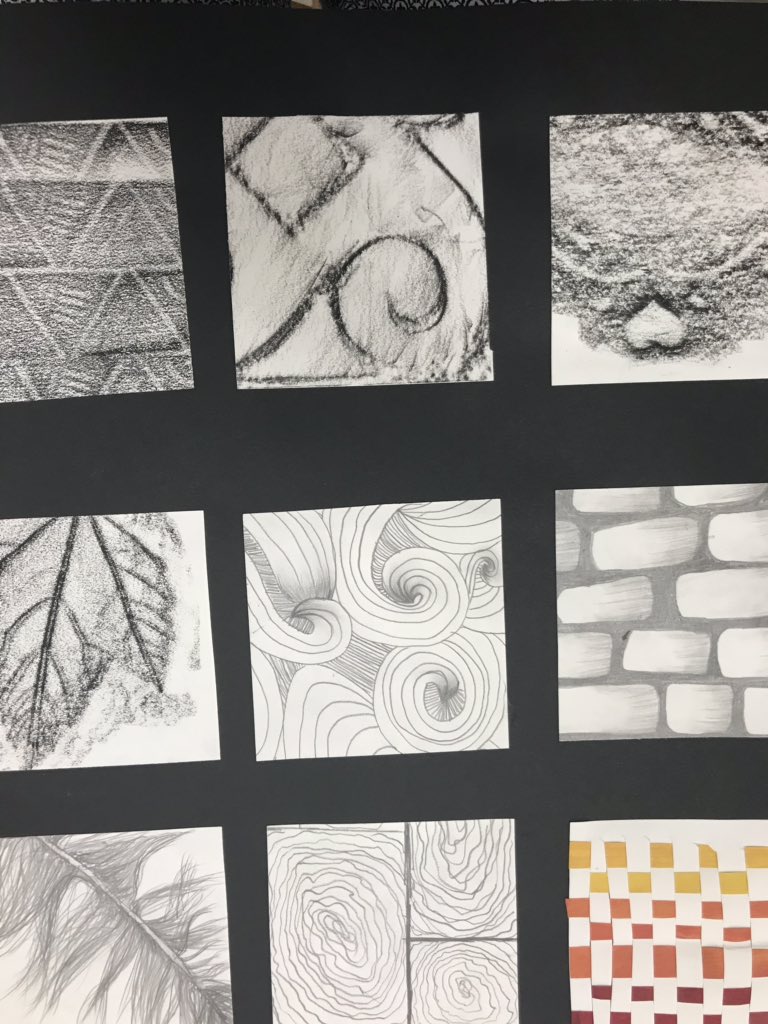

Implied Texture Art

Implied Texture Art

Implied Contract What Is It Example Terms Exception Types

Implied Powers Examples

Implied Contract AwesomeFinTech Blog

What Are Implied Shares Outstanding - Outstanding shares are all the shares issued and sold by a company that are not held by the company itself Outstanding shares include a company s common stock held by individual