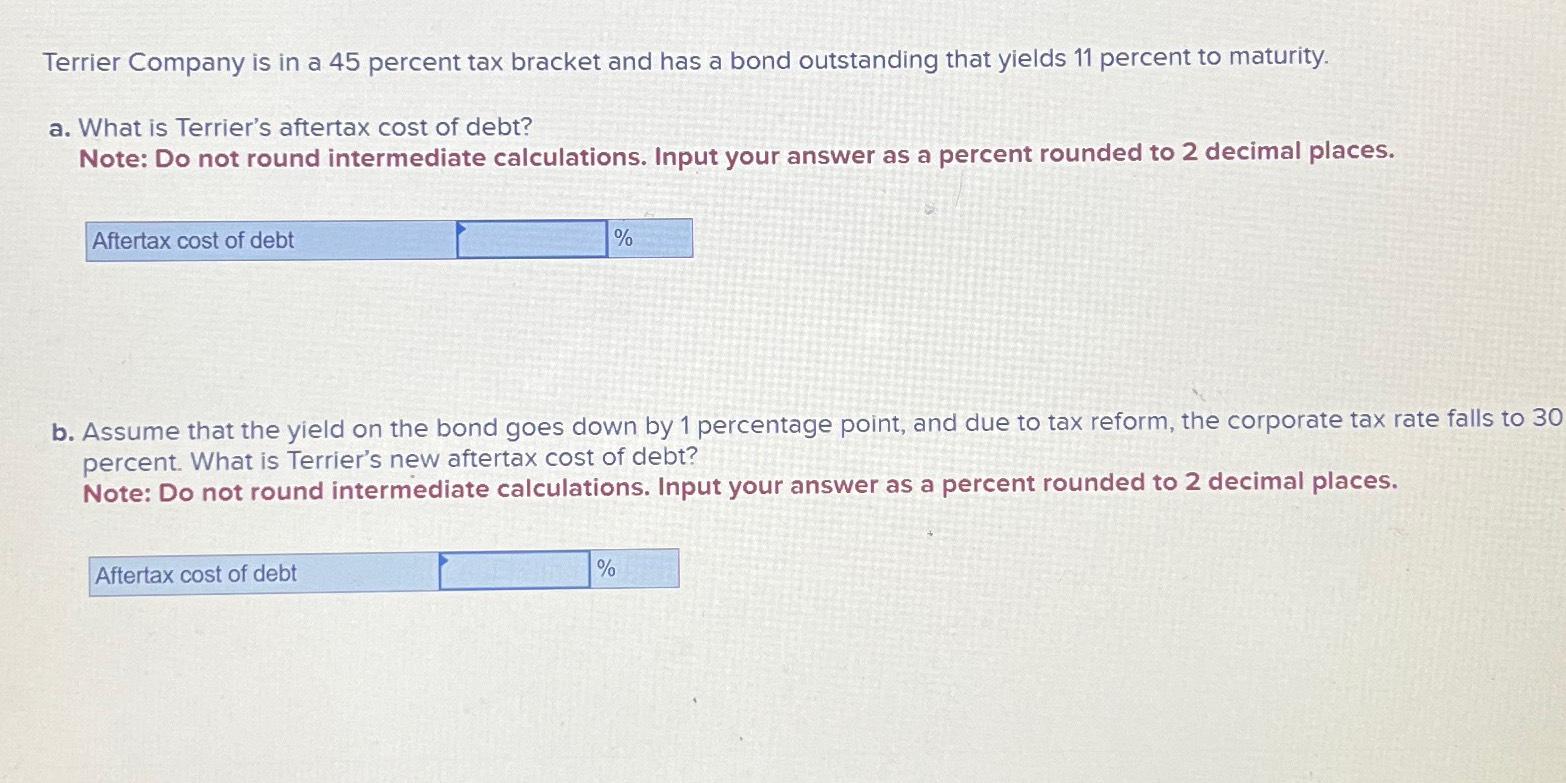

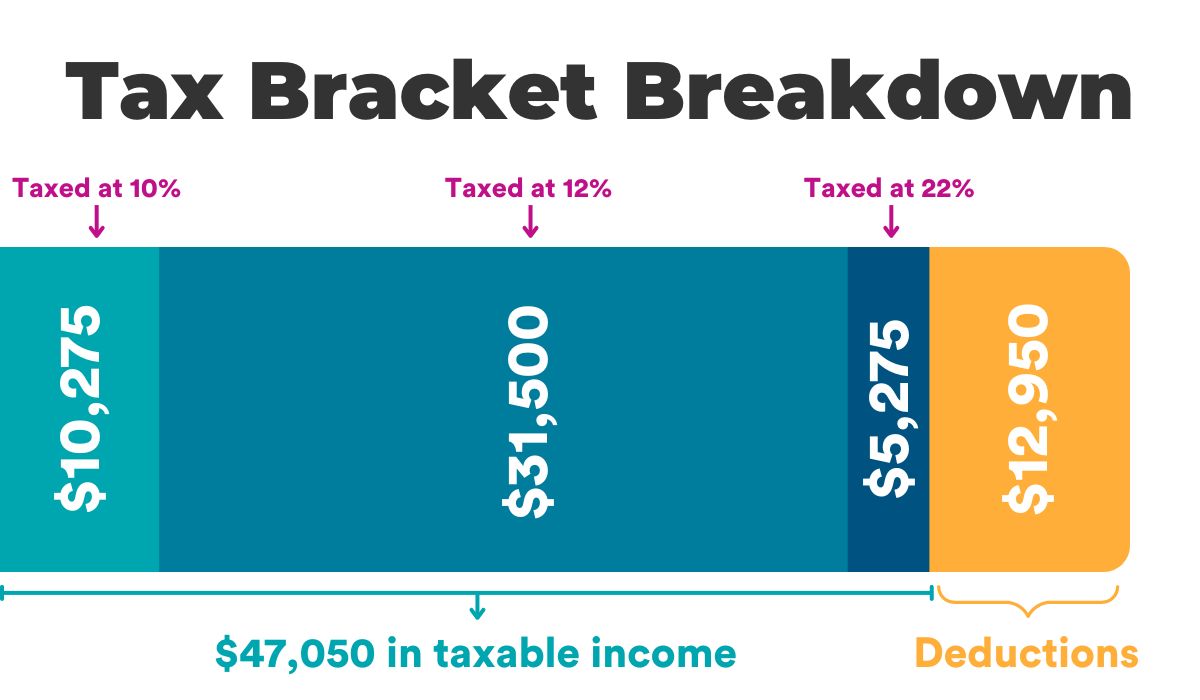

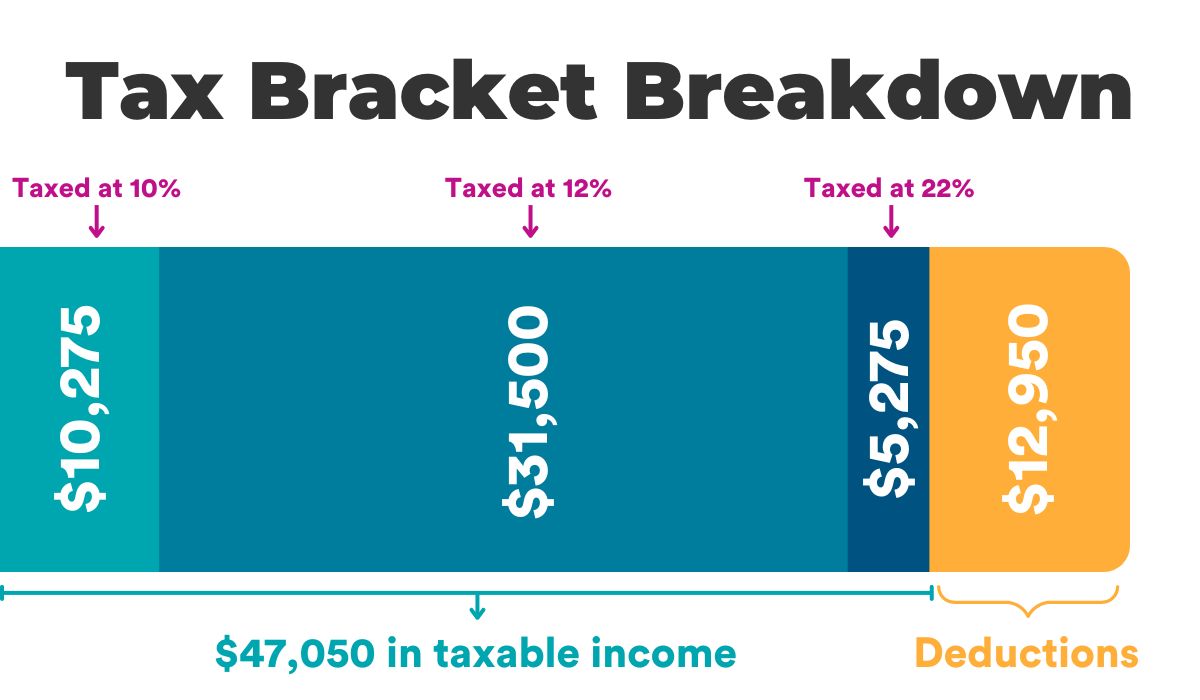

What Is 40 Percent Tax Bracket You pay tax as a percentage of your income in layers called tax brackets As your income goes up the tax rate on the next layer of income is higher When your income jumps to a higher tax bracket you don t pay the

The 40 tax bracket or Higher Rate applies to taxable income between 50 271 and 125 140 in the UK for 2025 The Personal Allowance of 12 570 is reduced for incomes above What is the 40 Tax Bracket The 40 tax bracket also known as the higher rate tax band It comes into play when you earn over a certain amount For the 2024 2025 tax year this amount is set at 50 270 If your income

What Is 40 Percent Tax Bracket

What Is 40 Percent Tax Bracket

https://media.cheggcdn.com/study/8d5/8d558ba1-3523-4047-a593-6d8bb16c5aa5/image

How To Take Advantage Of Your Zero Percent Tax Bracket Lucia Capital

https://i.ytimg.com/vi/JbSjhtMTDyQ/maxresdefault.jpg

What Is 1 5 Percent Of 100 Solution With Free Steps

https://www.storyofmathematics.com/wp-content/uploads/2022/11/What-Is-1.5-Percent-Of-100.png

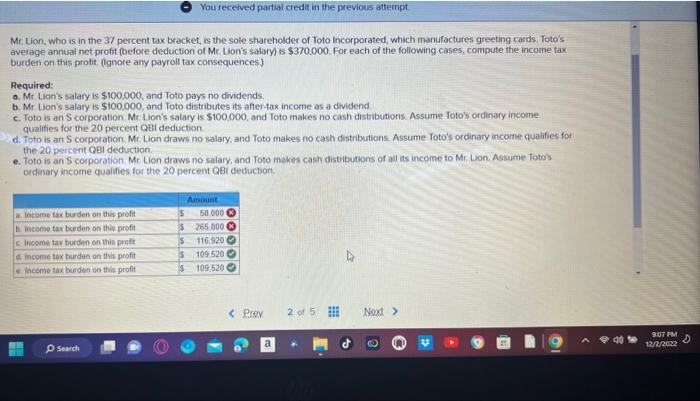

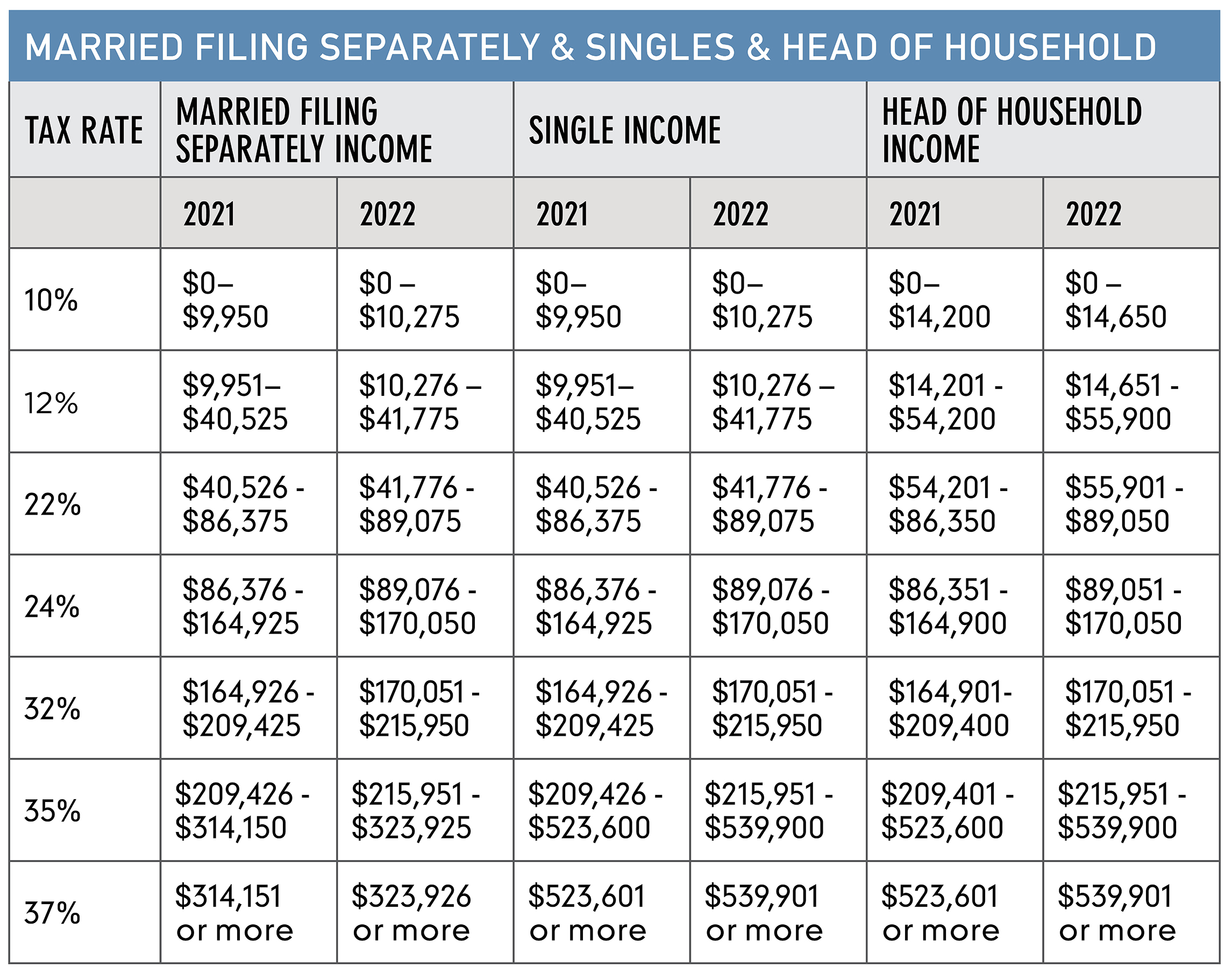

Who does the 40 tax bracket apply to The 40 tax bracket also known as the higher rate comes into play when an individual s income exceeds a certain threshold For the tax year 2024 25 this threshold is set at To hit the 40 tax bracket when your total annual income for the tax year exceeds 50 271 The higher rate of income tax will be charged for income between 50 271 125 140

What Is the 40 Tax Bracket The 40 tax bracket is officially referred to as the higher rate of income tax in the UK For the tax year 2024 25 individuals earning between The 40 tax bracket is one of the highest tax brackets in the UK with a high tax rate for individuals earning more than 50 270 as of 2023 In this blog we will analyse the fundamentals of the 40 tax bracket implications for

More picture related to What Is 40 Percent Tax Bracket

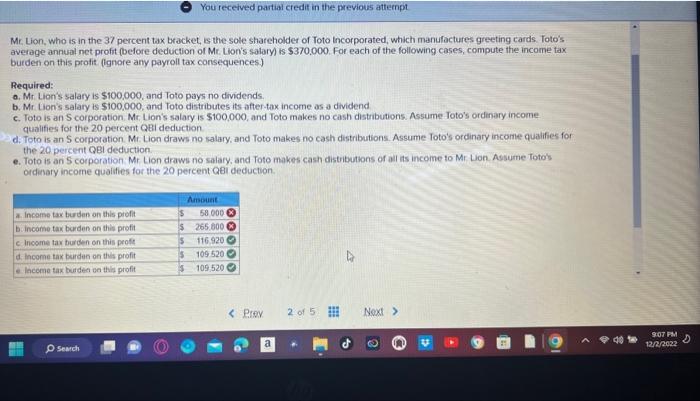

Solved Callan Patel Is In The 24 percent Tax Bracket A Chegg

https://media.cheggcdn.com/study/178/1782bc9e-e26f-4f3a-98b8-b9baa53a5245/image

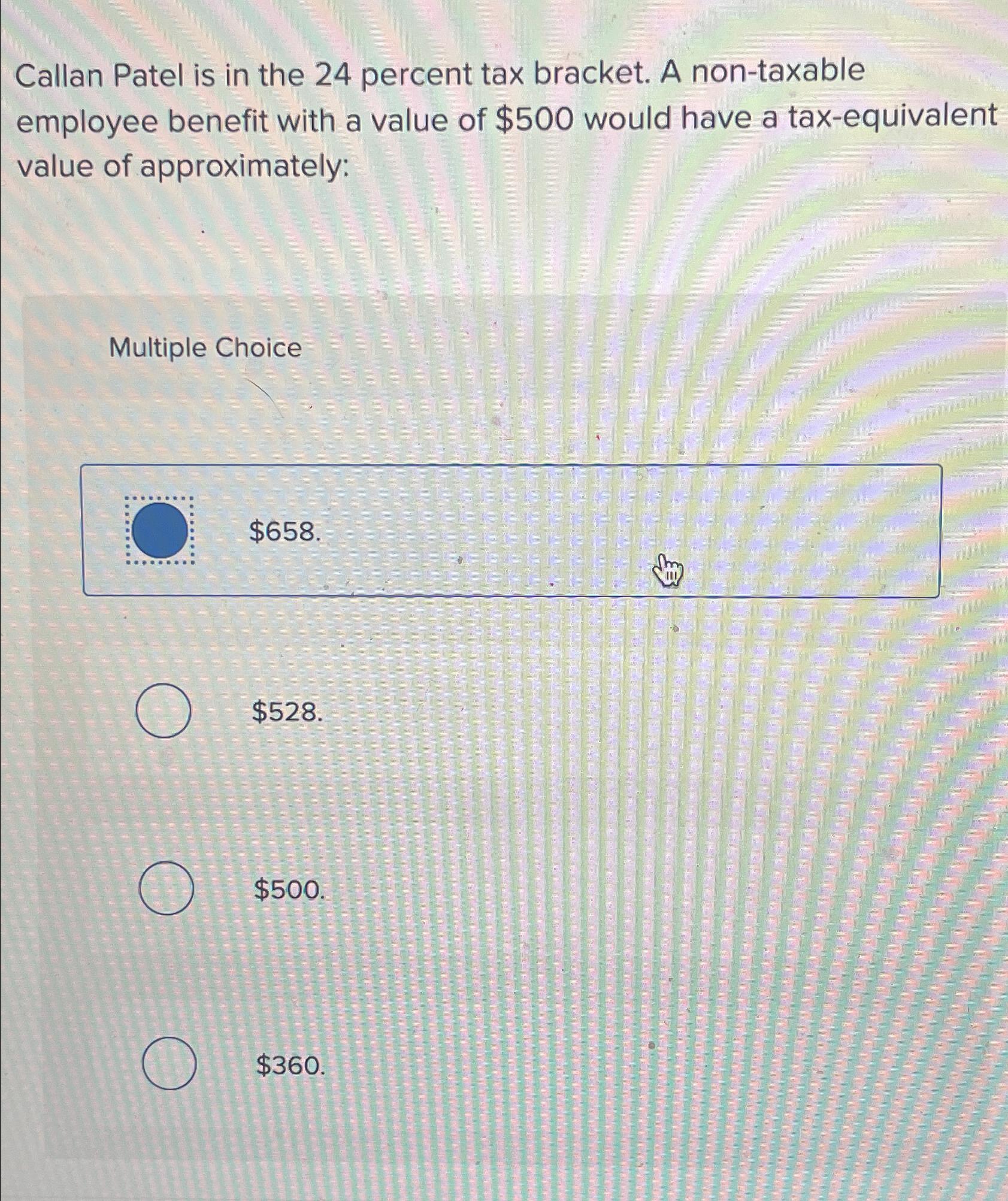

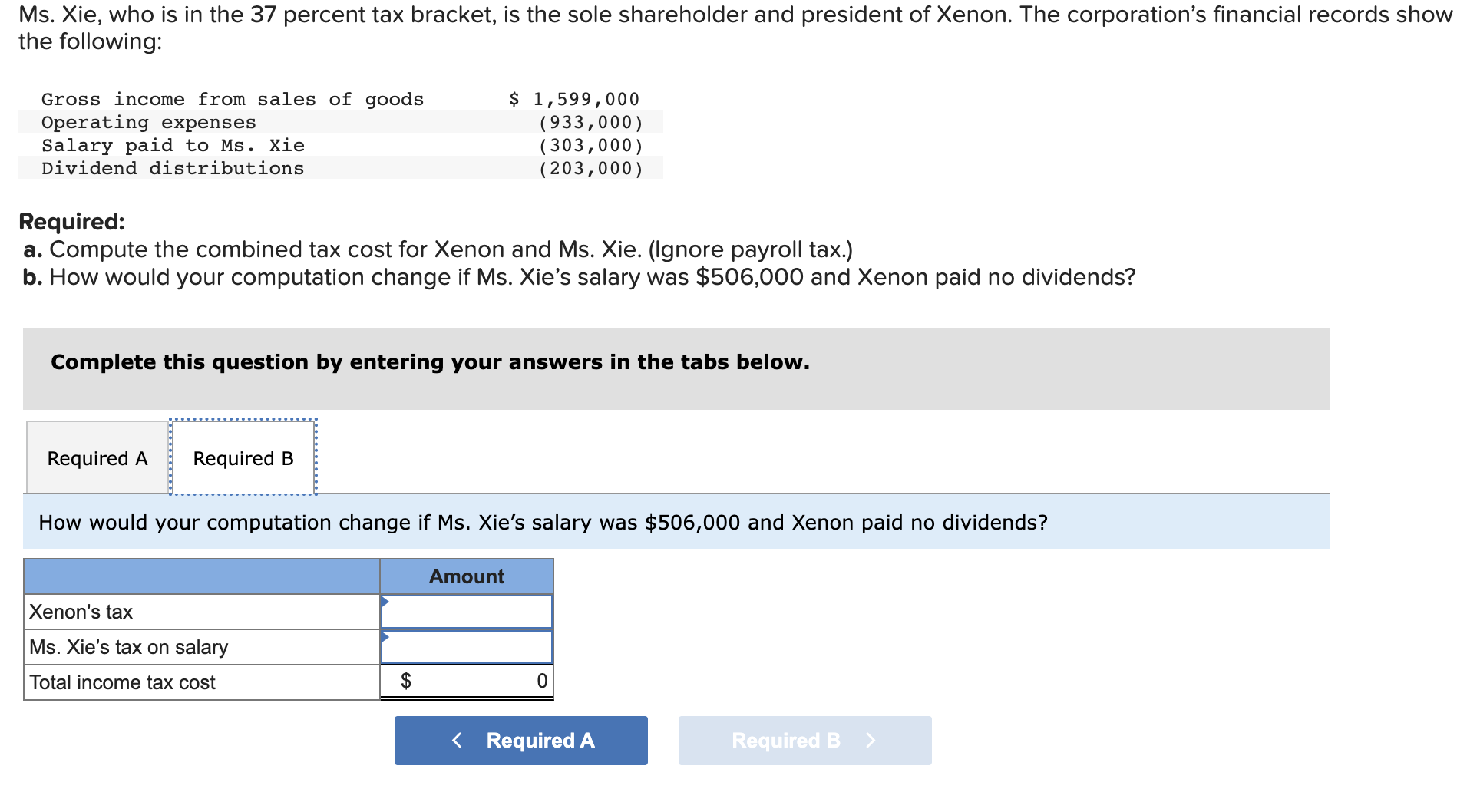

Solved Ms Xie Who Is In The 37 percent Tax Bracket Is Chegg

https://media.cheggcdn.com/study/d90/d901d48f-bc63-4dba-82af-7ed500bfb7ab/image

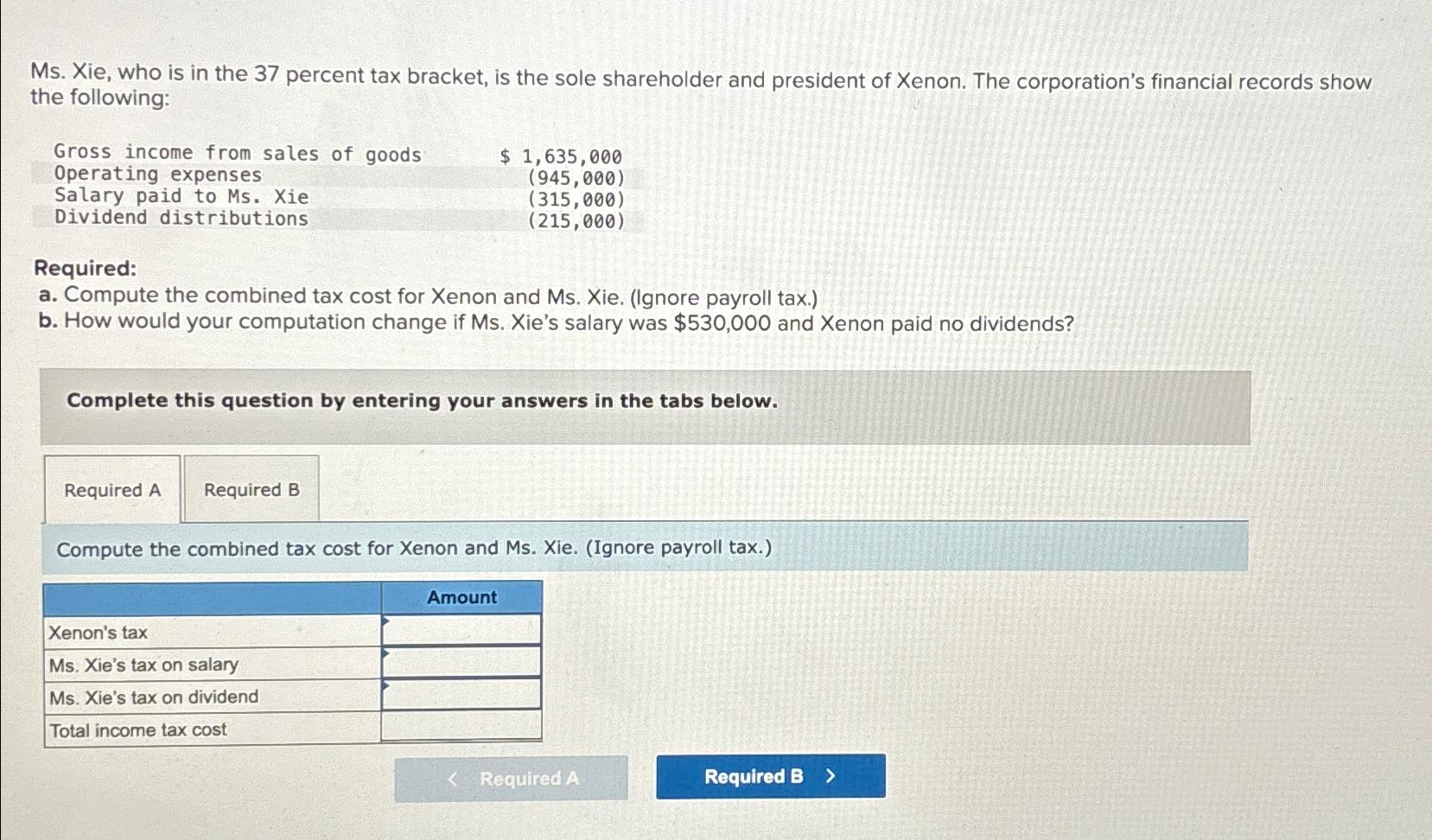

Solved Terrier Company Is In A 45 percent Tax Bracket And Chegg

https://media.cheggcdn.com/study/497/4971ae1d-46b5-4c84-a8eb-3005619598cc/image

The table below shows the tax brackets and corresponding rates Income tax year 2023 assessment year 2024 Income tax year 2024 assessment year 2025 Tax rate Income tax The 40 tax bracket also known as the Higher Rate tax applies to anyone earning over 50 270 per year However it s crucial to understand that only the portion of your

The 40 tax bracket applies a 40 tax deduction to an individual s income This tax bracket deducts a significant portion of a taxpayer s income Individuals with an annual income In the United Kingdom the 40 tax bracket is a critical threshold that affects how much income tax you pay on your earnings above a certain level Here s a

What Are Tax Brackets How Do They Affect Your Money SaverLife

https://partner.saverlife.org/wp-content/uploads/2023/02/Entrepreneur-Content-Series-2.jpg

The 40 Tax Bracket 3 Ways To Avoid It

https://goselfemployed.co/wp-content/uploads/2023/04/40-percent-tax-bracket.png

https://www.irs.gov › filing › federal-incom…

You pay tax as a percentage of your income in layers called tax brackets As your income goes up the tax rate on the next layer of income is higher When your income jumps to a higher tax bracket you don t pay the

https://www.mytaxaccountant.co.uk › post

The 40 tax bracket or Higher Rate applies to taxable income between 50 271 and 125 140 in the UK for 2025 The Personal Allowance of 12 570 is reduced for incomes above

What Is 2 5 Percent Of 100 Solution With Free Steps

What Are Tax Brackets How Do They Affect Your Money SaverLife

2022 Income Tax Brackets Chart Printable Forms Free Online

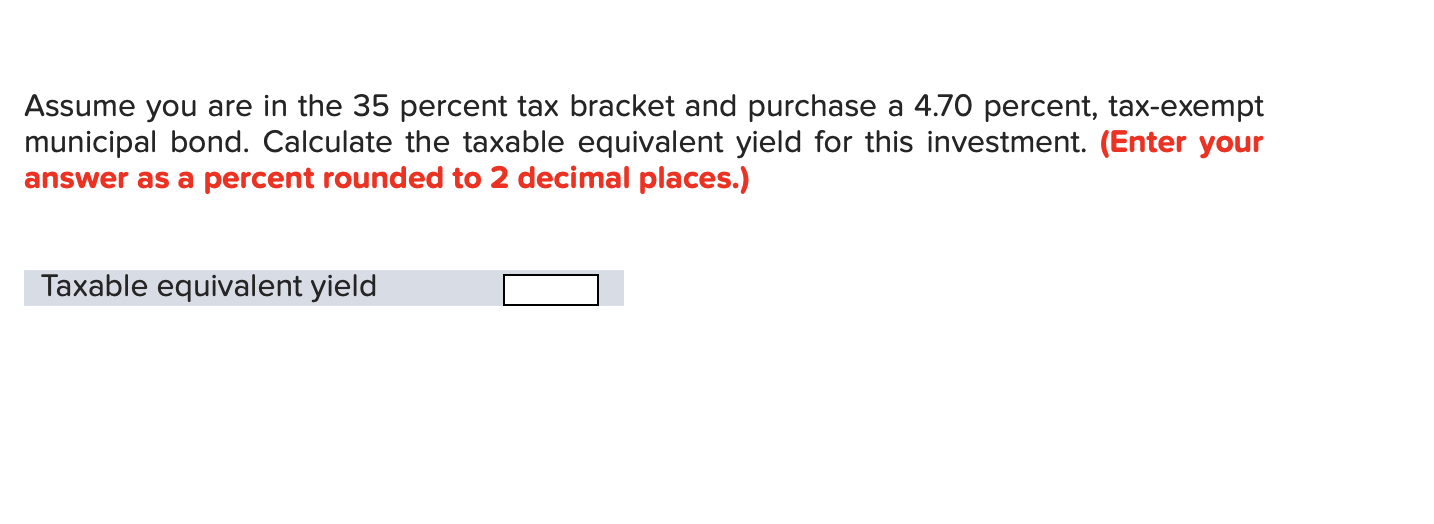

Solved Assume You Are In The 35 Percent Tax Bracket And Chegg

Solved Ms Xie Who Is In The 37 Percent Tax Bracket Is The Chegg

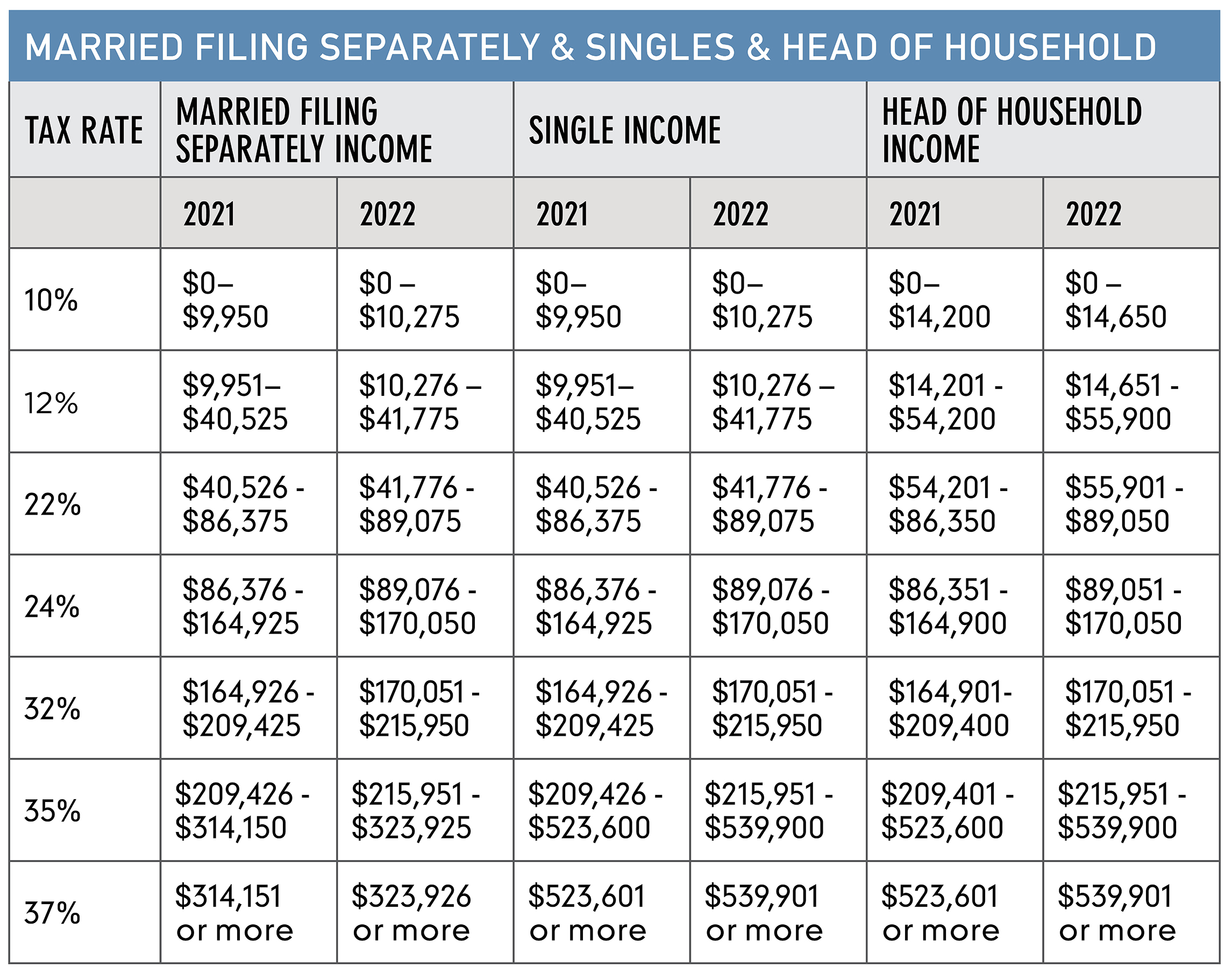

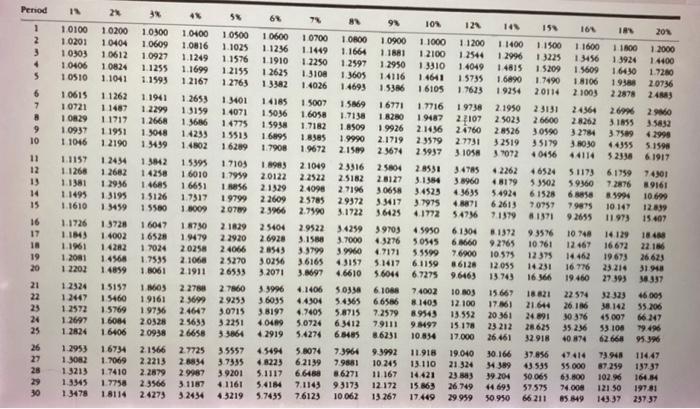

Cuddy Financial Services s Tax Planning Guide 2022 Tax Planning Guide

Cuddy Financial Services s Tax Planning Guide 2022 Tax Planning Guide

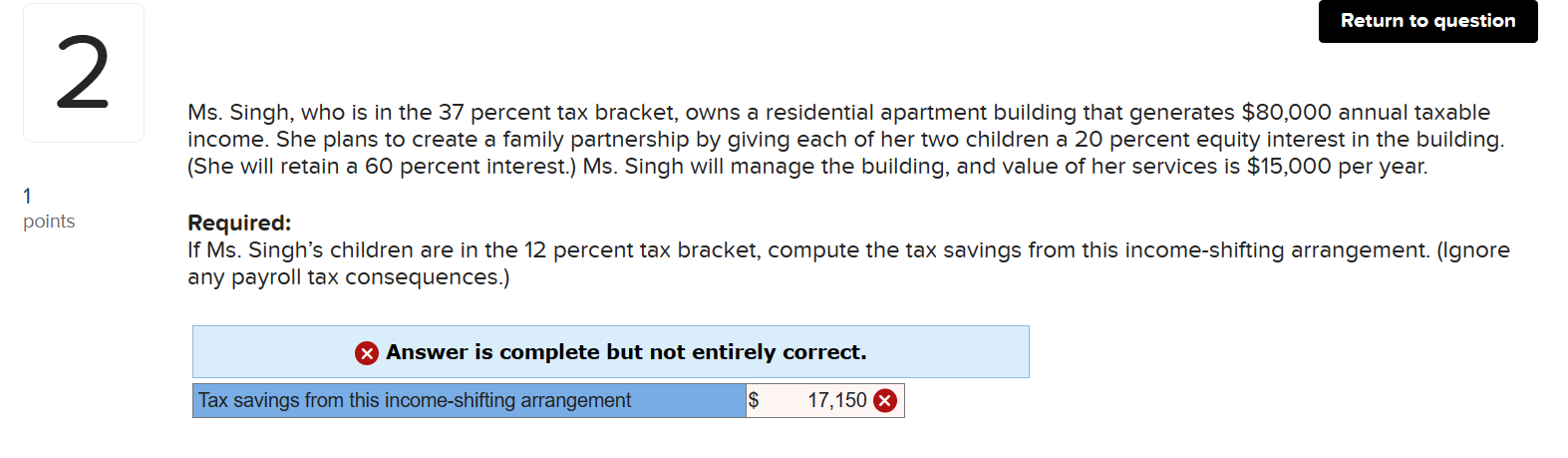

Solved Ms Singh Who Is In The 37 Percent Tax Bracket Owns Chegg

Solved A Someone In The 36 Percent Tax Bracket Can Eam 9 Chegg

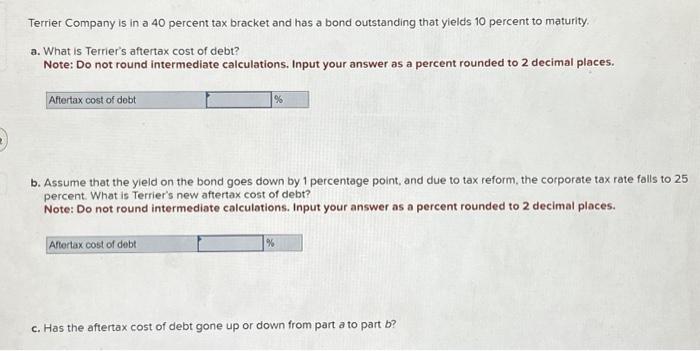

Solved Terrier Company Is In A 40 Percent Tax Bracket And Chegg

What Is 40 Percent Tax Bracket - The 40 tax bracket is one of the highest tax brackets in the UK with a high tax rate for individuals earning more than 50 270 as of 2023 In this blog we will analyse the fundamentals of the 40 tax bracket implications for