What Is Deferred Expenses With Example Hey all So Echo shares from the demerger of Tabcorp listed on the ASX today for the first time and there is currently Def Set following its name I ve discovered this means

I m looking at SPN and their dividends are 5 776c 0 872C FRANKED 30 3 288C TAX DEFERRED according to ASX au What implication does the tax deferred If I have pre orders and you ve accepted cash for them that is deferred revenue of 5mil and I ve already used 4mil before delivering those orders I only have 1m cash left

What Is Deferred Expenses With Example

What Is Deferred Expenses With Example

https://i.ytimg.com/vi/U70b6USByeA/maxresdefault.jpg

IAS 12 Example incl Deferred Tax ACCA Financial Reporting FR

https://i.ytimg.com/vi/bHmhVmLvnHA/maxresdefault.jpg

Accounting For Deferred Income Taxes IFRS And Future Income Taxes

https://i.ytimg.com/vi/UcavacJ_Rgs/maxresdefault.jpg

Trading during the deferred settlement period Importantly investors are reminded that during the period 12 August to 18 August 2021 inclusive the units in BBUS will trade Deferred management Fees Another great business opportunity made by and for Macquarie Bank and a host of other financial leeches The short story Ghoti is that the BIG

O As such any investor that is considering selling their units during the deferred settlement period and who may be concerned about the deferred settlement is encouraged to 1 Each entrant may choose one ASX listed stock or ETF Options warrants and deferred settlement shares are not permitted 2 Stocks with a price of less than 0 01 are

More picture related to What Is Deferred Expenses With Example

Deferred Tax Explained With Example Profit Loss Approach And

https://i.ytimg.com/vi/wE6wesfGGbw/maxresdefault.jpg

Accounting For Deferred Income Taxes IFRS And Future Income Taxes

https://i.ytimg.com/vi/gWfns0GcXXA/maxresdefault.jpg

:max_bytes(150000):strip_icc()/Terms-d-deferred-revenue-Final-a8fb680c51014901a4b8f88ac7fb7f77.jpg)

Revenue Definition Formula Calculation And Examples 49 OFF

https://www.investopedia.com/thmb/9R0Qsq4PgzyrHOAfjdMr6jMnGi8=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/Terms-d-deferred-revenue-Final-a8fb680c51014901a4b8f88ac7fb7f77.jpg

Tax Adj Dividend Calculated by including the effect of imputation credits from franked dividends or in the case of property trust dividends by including the effect of tax free Hey guys so I read the Boglehead s book a while ago and it talking about how you can invest a maximum of 4 000 every year tax deferred and you can withdraw from it

[desc-10] [desc-11]

Tasteshow Blog

https://www.deskera.com/blog/content/images/2021/01/Screen-Shot-2021-01-27-at-1.16.57-PM.png

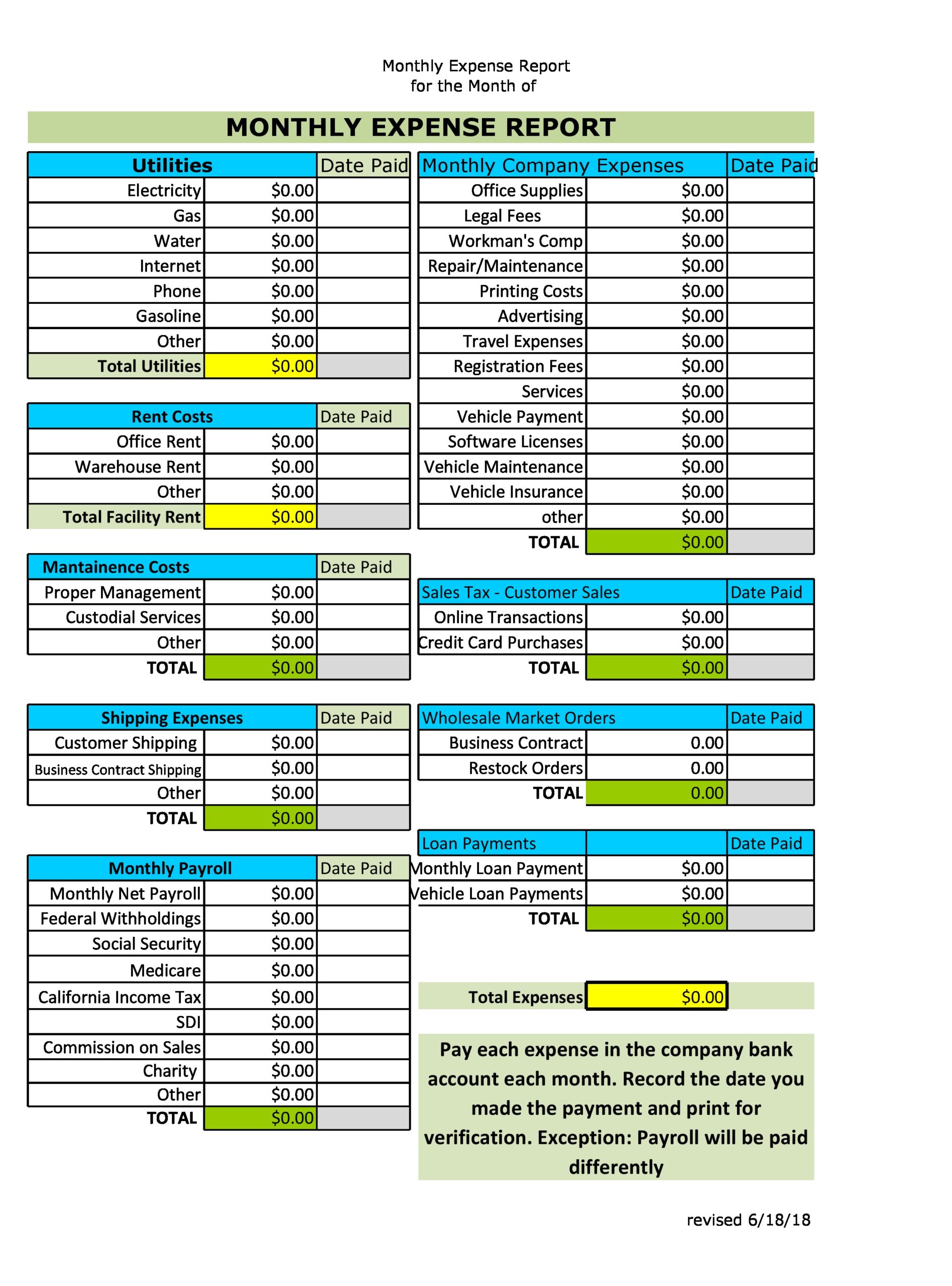

Expenses

https://templatearchive.com/wp-content/uploads/2020/12/monthly-expenses-template-05-scaled.jpg

https://www.aussiestockforums.com › threads

Hey all So Echo shares from the demerger of Tabcorp listed on the ASX today for the first time and there is currently Def Set following its name I ve discovered this means

https://www.aussiestockforums.com › threads

I m looking at SPN and their dividends are 5 776c 0 872C FRANKED 30 3 288C TAX DEFERRED according to ASX au What implication does the tax deferred

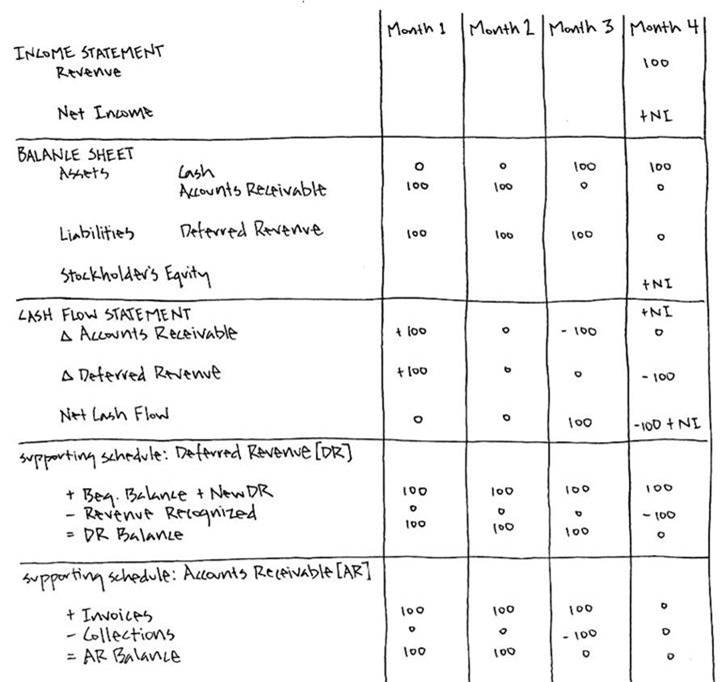

Deferred Revenue A Simple Model

Tasteshow Blog

Income Tax Expense Silopevital

Deferred Expenses Complete Guide On Deferred Expenses

Accrued Expenses Wize University Introduction To Financial Accounting

10 Delayed Gratification Examples 2025

10 Delayed Gratification Examples 2025

What Is A Deferred Tax Liability DTL Definition Meaning Example

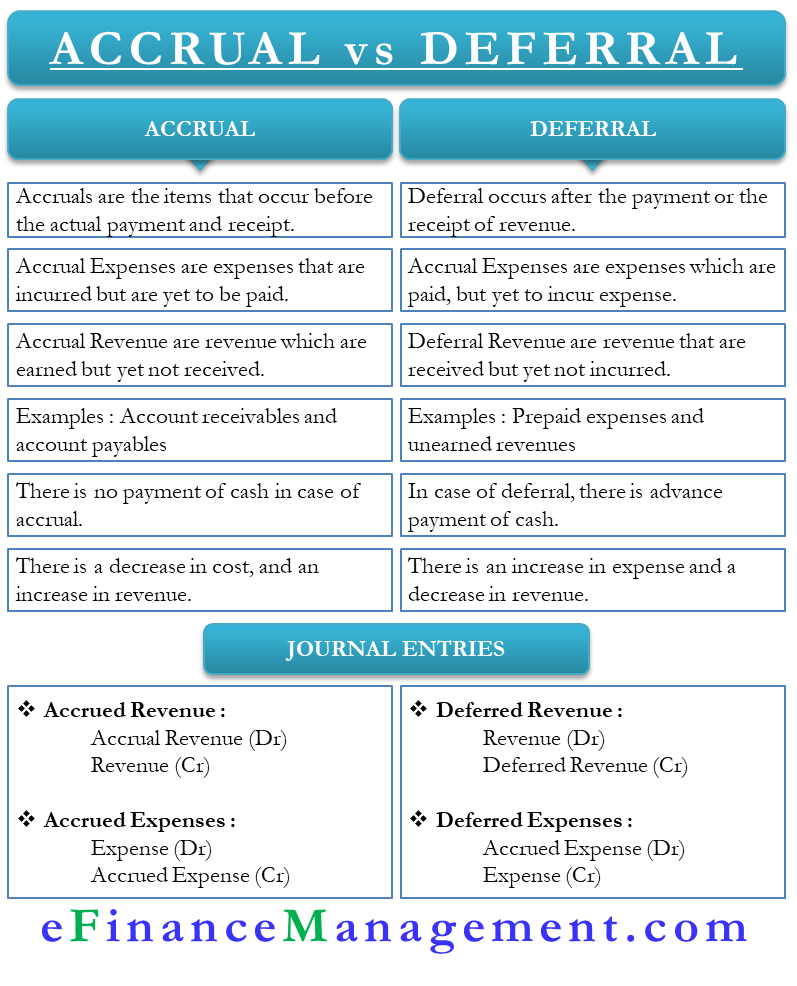

Accrual Vs Deferral Meaning And Differences EFianaceManagement

Equipment Purchase Via Loan Journal Entry Double Entry Bookkeeping

What Is Deferred Expenses With Example - [desc-12]