What Is Earned Income Credit Find if you qualify for the Earned Income Tax Credit EITC with or without qualifying children or relatives on your tax return

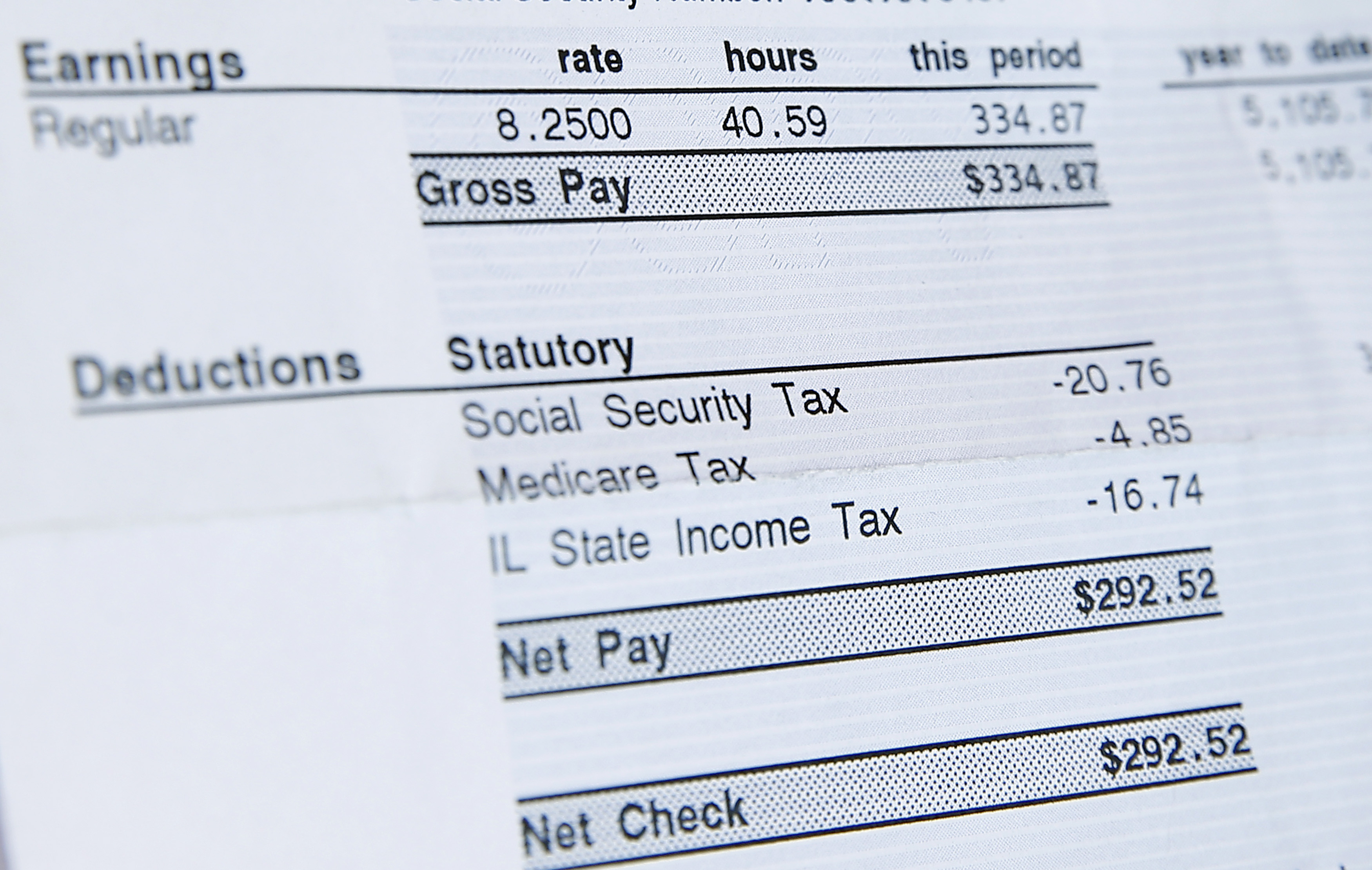

To claim the Earned Income Tax Credit EITC you must have what qualifies as earned income and meet certain adjusted gross income AGI and credit limits for the current The earned income tax credit EIC or EITC is for low and moderate income workers In general the less you earn the larger the credit Families with children often qualify

What Is Earned Income Credit

What Is Earned Income Credit

https://i.ytimg.com/vi/HlT8jB0IRlA/maxresdefault.jpg?sqp=-oaymwEmCIAKENAF8quKqQMa8AEB-AH-CYAC0AWKAgwIABABGGUgZShlMA8=&rs=AOn4CLCGyORX_cencNqAeJP65qN0oqzPWA

Understanding The Earned Income Tax Credit EITC YouTube

https://i.ytimg.com/vi/gJdWQ4_sUG0/maxresdefault.jpg

What Is The Earned Income Tax Credit EIC Tax Lingo Defined YouTube

https://i.ytimg.com/vi/Iqv37RnXnAY/maxresdefault.jpg

The Earned Income Tax Credit is designed to help low to moderate income taxpayers get a tax break Which workers qualify depends on factors like income and It s a work credit so you have to be employed to get it and it may erase or reduce any federal income tax that you owe if you qualify The earned income tax credit provides tax

What is the Earned Income Tax Credit The Earned Income Tax Credit or EITC helps low to moderate income workers save on federal taxes The EITC was established by The earned income tax credit EITC provides substantial support to low and moderate income working parents who claim a qualifying child based on relationship age residency and tax

More picture related to What Is Earned Income Credit

EITC TAX CREDIT 2022 EARNED INCOME TAX CREDIT CALCULATOR 2022 YouTube

https://i.ytimg.com/vi/X1SvVe3_JzA/maxresdefault.jpg

What Is Earned Income Credit EIC Limits Eligibility ExcelDataPro

https://d25skit2l41vkl.cloudfront.net/wp-content/uploads/2018/02/Earned-Income-Credit.jpg

:max_bytes(150000):strip_icc()/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

2018 Standard Deduction Chart

https://www.investopedia.com/thmb/4dyX6UgPOTCm8bJejZRZyBS2c4E=/4350x2338/filters:no_upscale():max_bytes(150000):strip_icc()/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg

The EIC is a tax credit designed to support low to moderate income workers It can significantly reduce your tax liability and in some cases even result in a refund However the Let s start with a basic description of the Earned Income Tax Credit which is also commonly referred to as the EITC Earned Income Credit or EIC The EITC is a significant tax

[desc-10] [desc-11]

Eic Worksheets A

https://www.irs.gov/pub/xml_bc/15173a21.gif

Sources Of Real Wage Stagnation

https://www.brookings.edu/wp-content/uploads/2016/06/minimum_wage006.jpg

https://www.irs.gov › credits-deductions › individuals › ...

Find if you qualify for the Earned Income Tax Credit EITC with or without qualifying children or relatives on your tax return

https://www.irs.gov › credits-deductions › individuals...

To claim the Earned Income Tax Credit EITC you must have what qualifies as earned income and meet certain adjusted gross income AGI and credit limits for the current

Form 8867 Amulette

Eic Worksheets A

All About The Earned Income Tax Credit Account Abilities LLC

T19 0137 Tax Benefit Of Self Employed Health Insurance Deduction By

Irs 2021 Eic Worksheet

The Earned Income Tax Credit EITC A Primer Tax Foundation

The Earned Income Tax Credit EITC A Primer Tax Foundation

Earned Income Credit Table 2018 Brokeasshome

Eic Worksheet 2022

2017 Eic Table Head Of Household Cabinets Matttroy

What Is Earned Income Credit - What is the Earned Income Tax Credit The Earned Income Tax Credit or EITC helps low to moderate income workers save on federal taxes The EITC was established by