What Is Form 10 Income Tax Form 10 is essential for religious and charitable organizations for tax exemptions and setting apart income Form 10 provides information required filing instructions and due dates for exemption claims It is filed electronically after providing crucial data and is key for organizations to accumulate income within tax exempt frameworks

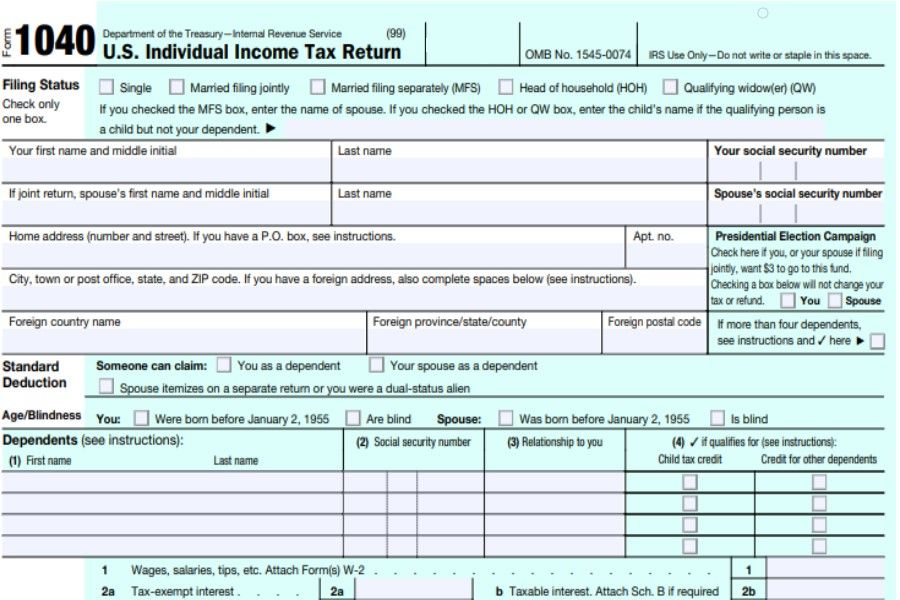

OVERVIEW OF FORM NO 10 Existing Provision before Amendment Applicable for Earlier Form No 10 was required to be filed by all the Trust Institution availing option under clause a of sub section 2 of section 11 i e registered u s 12AA 12AB of the Act Form 10 of income tax is crucial document in Indian taxation for financial disclosure often required by Securities Exchange Commission SEC It serves as registration statement for companies going public similar to SEC filings in U S

What Is Form 10 Income Tax

What Is Form 10 Income Tax

https://d3l793awsc655b.cloudfront.net/blog/wp-content/uploads/2022/09/Form-10-1086x1536.png

Form 10 Income Tax Kanakkupillai

https://www.kanakkupillai.com/learn/wp-content/uploads/2022/10/Form-10-Income-Tax-1024x576.png

10 Income Tax Rules That Will Come Into Effect From 1 April

https://images.thequint.com/thequint/2017-03/72f66ff7-bd0d-46e8-8b25-a49c8cba2c21/Tax.jpg?rect=0%2C0%2C1920%2C1008

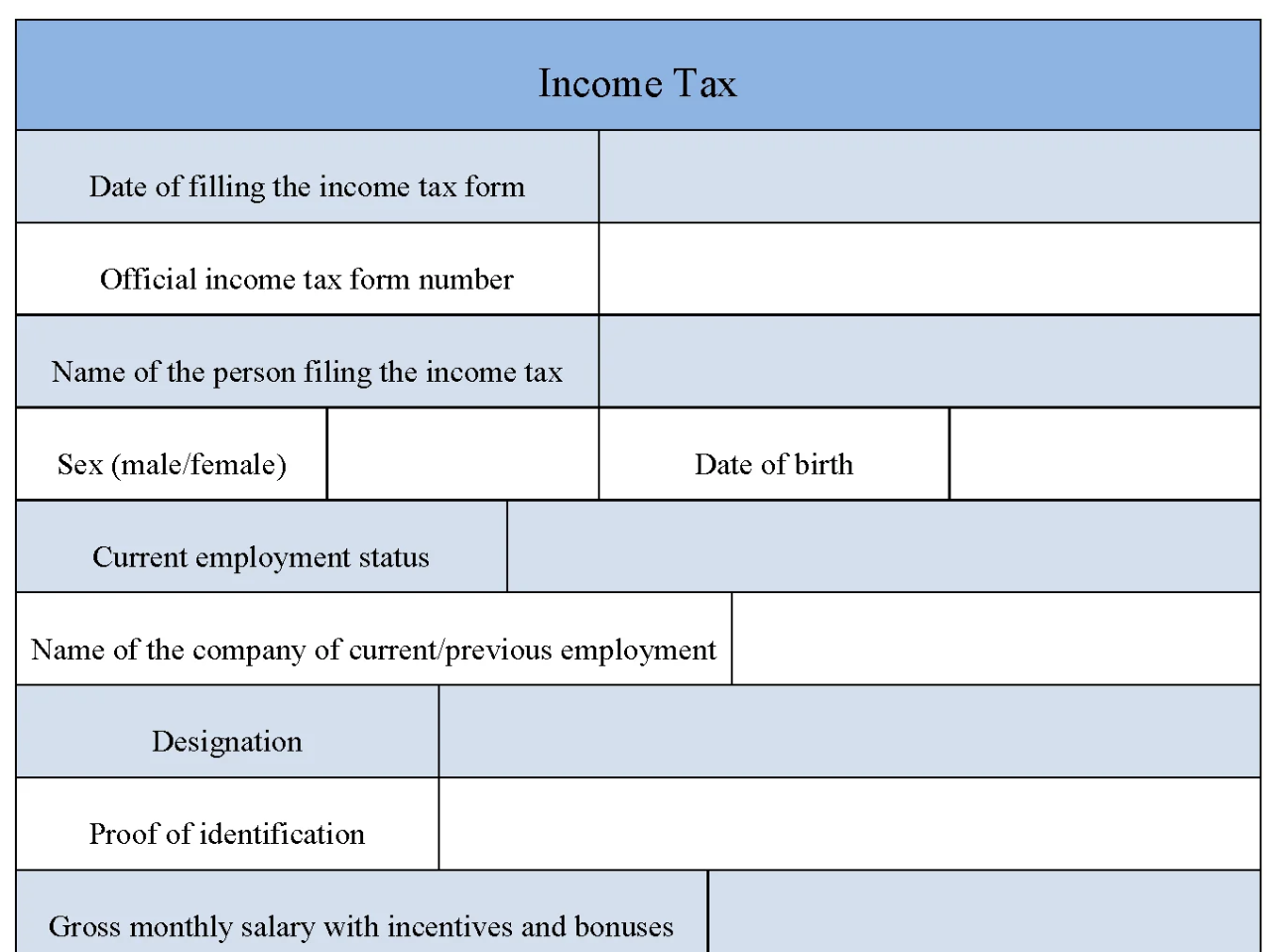

In Form 10 Income Tax individuals or Hindu undivided families can include previous year details for any assessment year after April 1 2021 The new form 10 IEA can be used to indicate the preference for the old tax regime by Individuals HUF AOP other than co operative societies BOI Artificial Judicial Persons AJP having income from business and profession

Form 10 of income tax is a critical document in Indian taxation for financial disclosure and is frequently needed by the Securities and Exchange Commission SEC It also functions as a registration statement for firms that want to go public in a similar fashion as the SEC filings operate within the U S This disclosure report includes 1 Substituted by the Income tax Twenty fifth Amendment Rules 2022 w e f 1 4 2023

More picture related to What Is Form 10 Income Tax

Irs Releases Form 1040 For 2020 Tax Year Free Download Nude Photo Gallery

https://www.taxgirl.com/wp-content/uploads/2021/01/Screen-Shot-2021-01-10-at-3.09.05-PM.png

Proper Filing Of Form 10 Manually With Income Tax Return ITAT Grants

https://www.taxscan.in/wp-content/uploads/2022/11/Form-10-Income-Tax-Return-ITAT-Income-Tax-Act-taxscan.jpg

Income Tax Form Editable PDF Forms

https://www.editableforms.com/wp-content/uploads/2017/10/Income-Tax-Form-Feature-image.webp

Non filing of Form 10 within the prescribed time u s 11 2 Exemptions are provided to Charitable Religious Trusts 1 Unconditionally u s 11 1 of the Act to the extent it does not exceed 15 of the income from such property The option to pay income tax at a rate of 25 of the entire income is an application under Section 115BA 4 of the Income Tax Act of 1961 If the assesse meets certain requirements something is delivered

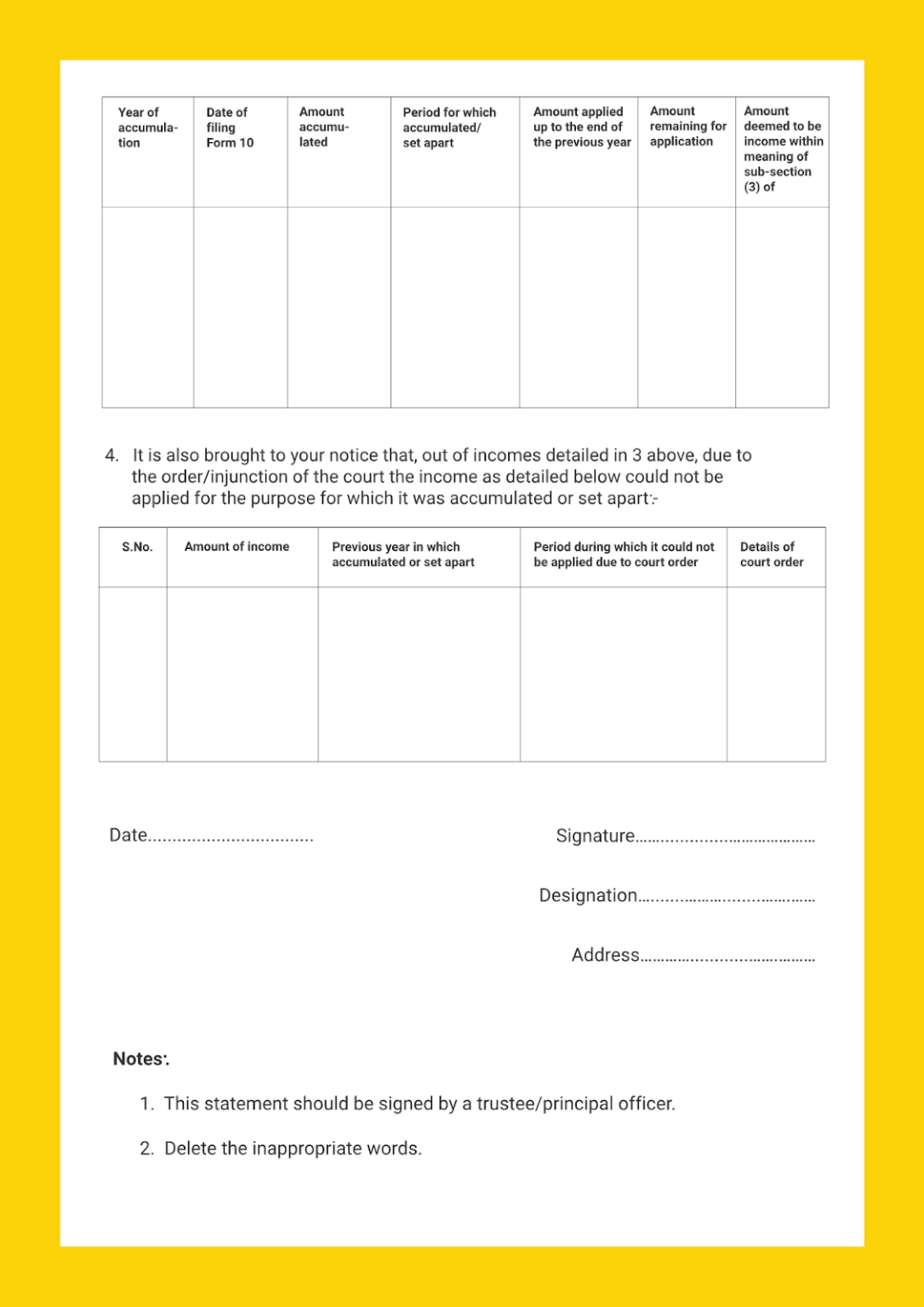

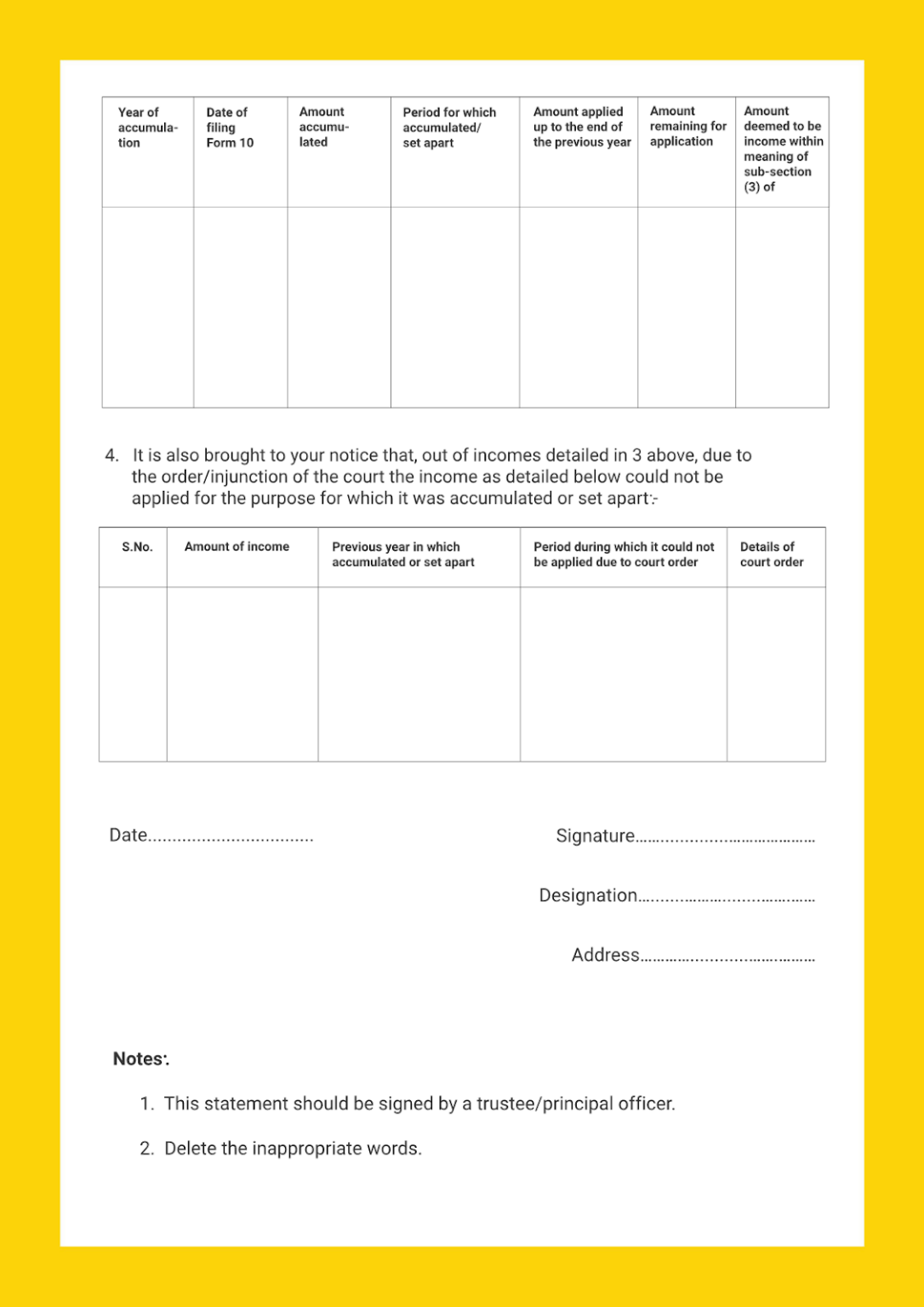

In case of Form 10 amount the amount can be utilised in any of the subsequent 5 years for the purpose for which it was accumulated In case of Form 9A amount i the amount has to be utilised in the FY in which it will be received or subsequent FY Last updated December 17th 2019 5 32 PM Form 10 Income Tax Statement to be furnished to the Assessing Officer Prescribed Authority under sub section 2 of section 11 of the Incomer tax Act 1961

The Chamber Of Tax Consultants Anr V Union Of India Ors 2017

https://blog.ipleaders.in/wp-content/uploads/2019/07/income-tax-basics.jpg

Income Tax Submission Service Services Others On Carousell

https://media.karousell.com/media/photos/products/2023/2/10/income_tax_submission_service_1676037772_74efaad9_progressive.jpg

https://cleartax.in

Form 10 is essential for religious and charitable organizations for tax exemptions and setting apart income Form 10 provides information required filing instructions and due dates for exemption claims It is filed electronically after providing crucial data and is key for organizations to accumulate income within tax exempt frameworks

https://www.caclubindia.com › articles

OVERVIEW OF FORM NO 10 Existing Provision before Amendment Applicable for Earlier Form No 10 was required to be filed by all the Trust Institution availing option under clause a of sub section 2 of section 11 i e registered u s 12AA 12AB of the Act

2023 Irs Tax Form 1040 Printable Forms Free Online

The Chamber Of Tax Consultants Anr V Union Of India Ors 2017

AOP Full Form And Difference Between AOP BOI

Direct Tax Collection

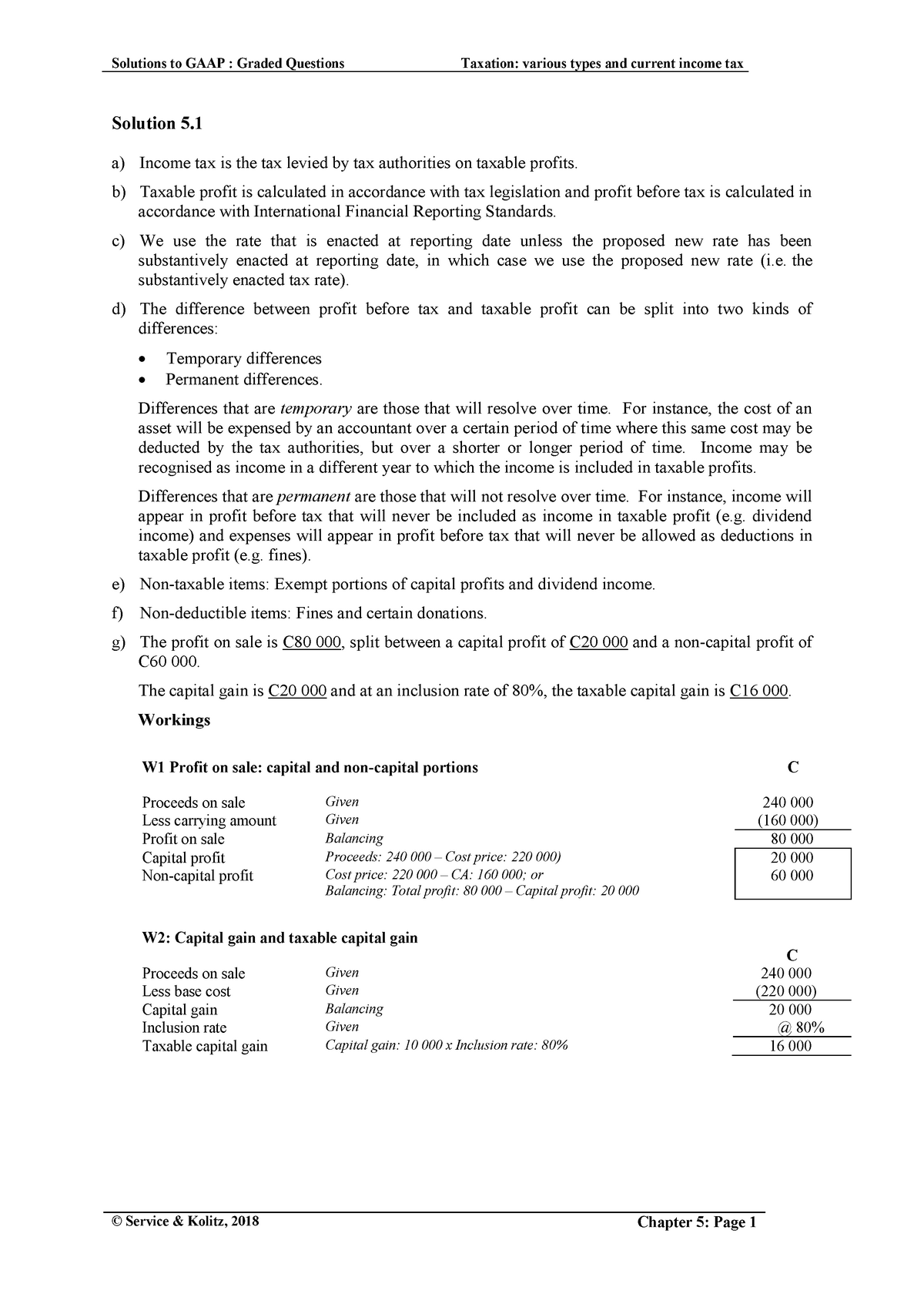

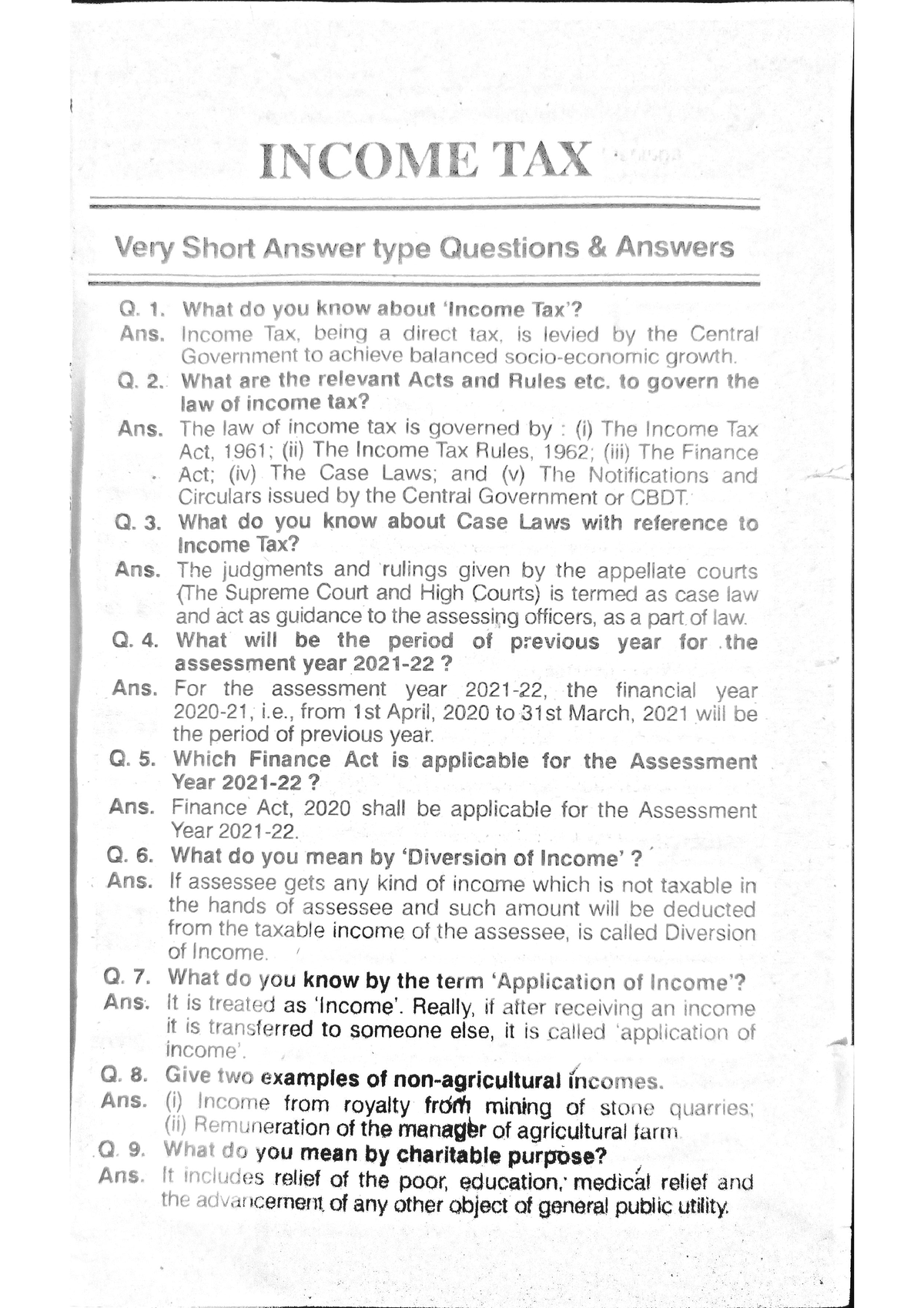

05 Current Taxation S18 Solution 5 A Income Tax Is The Tax Levied

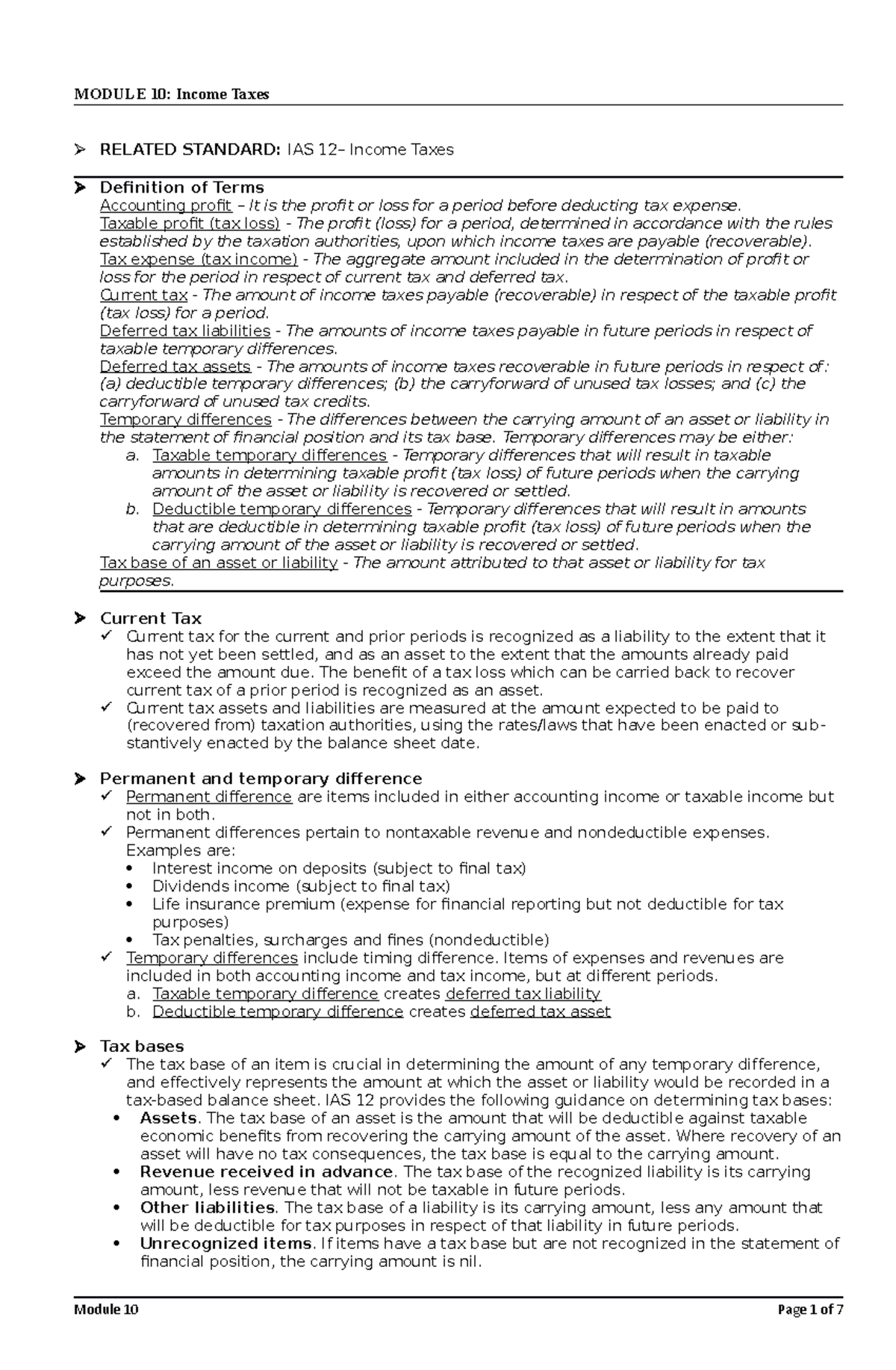

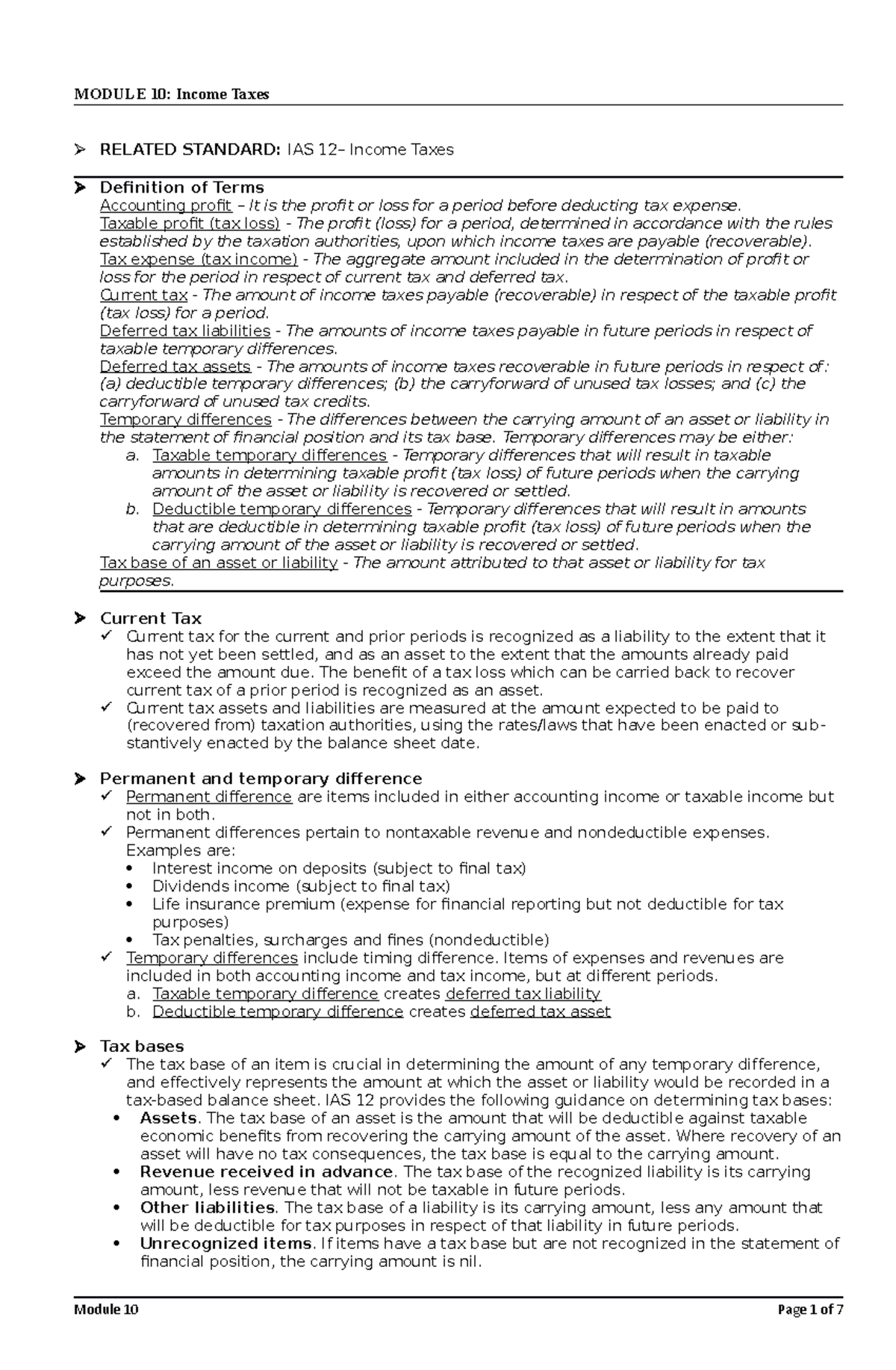

Module 10 Income Tax MODULE 10 Income Taxes RELATED STANDARD IAS

Module 10 Income Tax MODULE 10 Income Taxes RELATED STANDARD IAS

Govt Extends ITR Filing Deadline For Companies Till 7 November

South Carolina Form Fillable 1040x Printable Forms Free Online

2marks Question Income Tax B Eafm Hons Studocu

What Is Form 10 Income Tax - The new form 10 IEA can be used to indicate the preference for the old tax regime by Individuals HUF AOP other than co operative societies BOI Artificial Judicial Persons AJP having income from business and profession