What Is Higher Tax Bracket Ireland Higher rate of tax Any income above your standard rate band is taxed at the higher rate of Income Tax which is currently 40 What is your rate band The amount of your tax

Her weekly tax is calculated by applying the standard rate of tax 20 to the first 10 19 23 up to the limit of Sarah s rate band The higher rate of tax 40 is applied to the There are currently two rates of tax in Ireland one at 20 and a higher rate of 40 for earnings over 36 800 for individuals and 45 800 for married earners in one income households

What Is Higher Tax Bracket Ireland

What Is Higher Tax Bracket Ireland

https://i.pinimg.com/originals/df/14/df/df14dfaf8b937029b340e94fd7156217.jpg

What Happens When You Go Into A Higher Tax Bracket YouTube

https://i.ytimg.com/vi/cq5wmAdvCVE/maxresdefault.jpg

The 2023 Tax Brackets By Income Modern Husbands Free Nude Porn Photos

https://substackcdn.com/image/fetch/f_auto,q_auto:good,fl_progressive:steep/https://bucketeer-e05bbc84-baa3-437e-9518-adb32be77984.s3.amazonaws.com/public/images/e23b505f-ffa6-4e69-9c23-dde3138f86cc_2100x1500.png

In Ireland the higher tax bracket kicks in for individuals earning above 42 000 Income above this threshold is taxed at the higher rate of 40 This is subject to change depending on your Rate paid by individuals increases as they earn higher wages The highest tax rate individuals pay differs significantly across European countries The top statutory personal income tax rate applies to the share of income that

These examples show how your tax is calculated in 2025 and how tax credits reduce the amount of tax you have to pay Tax credits Joan is single and earns 28 000 a year The Income tax rates and personal allowances in Ireland are updated annually with new tax tables published for Resident and Non resident taxpayers The Tax tables below include the tax rates thresholds and allowances included in the

More picture related to What Is Higher Tax Bracket Ireland

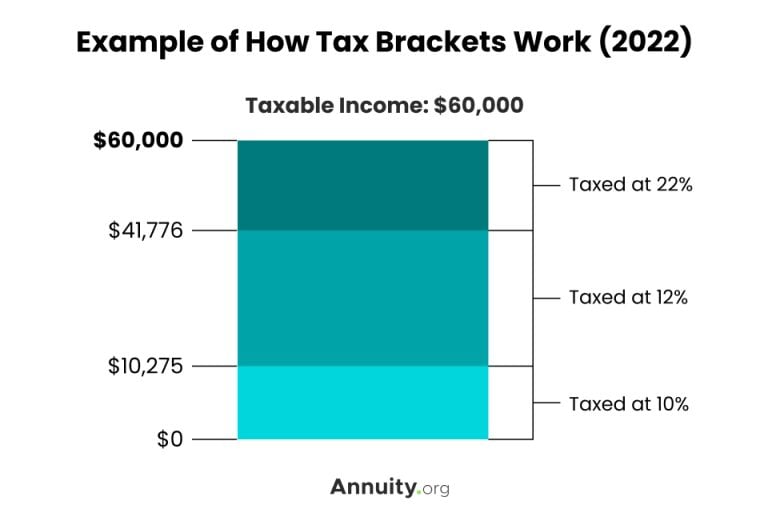

Understanding The Impact Of Moving To A Higher Tax Bracket In The US

http://www.pelhamplus.com/wp-content/uploads/2023/05/2DPNRZGUSNO45BHUUTP3MY5KSE-scaled.jpg

Buy Heavy Duty Blind Shelf Bracket 125 Pounds Per Pair Hidden

https://m.media-amazon.com/images/I/81TEsteoseL.jpg

2022 Income Tax Brackets Chart Printable Forms Free Online

https://ocdn.eu/pulscms-transforms/1/qTck9ktTURBXy8xMDA3MTBjYS1jNzY0LTQ0OTQtOTJhNy0xNjRkNDc0NzU0YzMucG5nkIGhMAA

What Are The Income Tax Brackets In Ireland Who Is Liable To Pay Taxes In Ireland What Are The Tax Classes In Ireland When Does One Have To Change Tax Class In Ireland How To Change One s Tax Class In Ireland Review the latest income tax rates thresholds and personal allowances in Ireland which are used to calculate salary after tax when factoring in social security contributions pension

Irish income tax is separated into two tax rates The standard rate refers to the part of your income that s taxed at 20 The higher rate is the rest of your income which is Here you can access details of the annual key tax rates and bands for Ireland and the UK The tax rates and bands are displayed in a table format per year and by country Tax rates and bands

IRS Inflation Adjustments Taxed Right

https://taxedright.com/wp-content/uploads/2022/10/2023-Tax-Brackets-768x510.jpg

Tax Filers Can Keep More Money In 2023 As IRS Shifts Brackets Andrews

https://thehill.com/wp-content/uploads/sites/2/2022/10/Tax-Bracket-form-3.png?w=900

https://www.revenue.ie › ... › tax-rate-band.aspx

Higher rate of tax Any income above your standard rate band is taxed at the higher rate of Income Tax which is currently 40 What is your rate band The amount of your tax

https://www.revenue.ie › en › jobs-and-pensions › ...

Her weekly tax is calculated by applying the standard rate of tax 20 to the first 10 19 23 up to the limit of Sarah s rate band The higher rate of tax 40 is applied to the

What Is Higher Tax Bracket In The UK Accotax

IRS Inflation Adjustments Taxed Right

Tax Brackets 2024 Married Jointly California Myrle Tootsie

The IRS Just Adjusted Its Tax Income Brackets Are You Ready A Dime

5 Reasons A Higher Tax Bracket Is Good For You 2023

Income Tax

Income Tax

What Happens When You Go Into A Higher Tax Bracket LiveWell

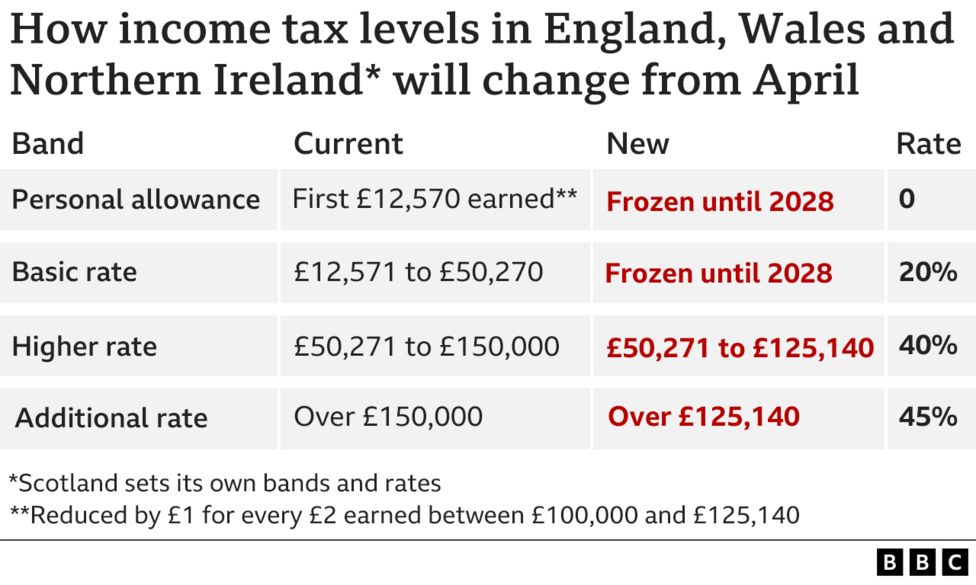

Income Tax How Will Thresholds Change And What Will I Pay BBC News

Tax Brackets For 2023 2024 Federal Income Tax Rates 2024

What Is Higher Tax Bracket Ireland - The taxation of pensions in Ireland at retirement is not one size fits all Rather each retirees tax position will depend on the pension s that they ve accumulated and or become entitled to over