What Is Income Tax Act 1961 In Hindi Change in individual income tax rate The Government of Canada has tabled legislation proposing to reduce the lowest income tax rate effective July 1 2025 For more information Government

Your net income is used to calculate your federal and provincial or territorial non refundable tax credits The CRA also uses your net income and your spouse s or common law partner s net The Government of Canada has tabled legislation proposing to reduce the lowest income tax rate effective July 1 2025 For more information Government tables a Motion to bring down costs

What Is Income Tax Act 1961 In Hindi

What Is Income Tax Act 1961 In Hindi

https://img.jagranjosh.com/imported/images/E/GK/cbdt.webp

Section 139 Of Income Tax Act 1961

https://www.cabkgoyal.com/wp-content/uploads/2023/06/Section-139-of-Income-Tax-Act-1961.png

Advocate Act 1961 In Hindi Bar Council Of India Vs Bar Council Of

https://i.ytimg.com/vi/MdMaFTVv-n8/maxresdefault.jpg

As an employee you complete this form if you have a new employer or payer and will receive salary wages or any other remuneration or if you wish to increase the amount of If your net world income exceeds the threshold amount 86 912 for 2023 you have to repay part or your entire OAS pension Part or your entire OAS pension is reduced as a monthly recovery

Enter net income or loss after income tax and extraordinary items at amount A page 1 of Schedule 1 Add the taxable items and the non allowable expenses listed on lines 101 to 199 The personal income levels used to calculate your Ontario tax have changed The amount of most provincial non refundable tax credits have changed The alternative minimum tax rate was

More picture related to What Is Income Tax Act 1961 In Hindi

Definition Of Persons Under Income Tax Act 1961 Definition Of

https://www.legalwindow.in/wp-content/uploads/Definition-of-Persons-under-Income-Tax-Act-1961.png

1961 10 IPleaders

https://hindi.ipleaders.in/wp-content/uploads/2022/06/Section-10-of-Income-Tax-Act-1961.jpg

Section 11 Of Income Tax Act 1961 Exemption For Trusts

https://vakilsearch.com/blog/wp-content/uploads/2022/08/Section-11-Income-Tax-Act.png

The type of Canadian income that you receive during the tax year determines which income tax package you should use If you receive only income from employment or business use the Income tax Information on taxes including filing taxes and get tax information for individuals

[desc-10] [desc-11]

Section 281 Of The Income tax Act 1961

https://sortingtax.com/wp-content/uploads/2022/08/blogimg2.png

:max_bytes(150000):strip_icc()/Term-Definitions_Income-tax-blue-9a708041207743b5a57cfdae08df2b10.jpg)

Income Tax

https://www.investopedia.com/thmb/vmecxtzh3YtlhkIY783GtuYo7Ds=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/Term-Definitions_Income-tax-blue-9a708041207743b5a57cfdae08df2b10.jpg

https://www.canada.ca › en › revenue-agency › services › e-services › di…

Change in individual income tax rate The Government of Canada has tabled legislation proposing to reduce the lowest income tax rate effective July 1 2025 For more information Government

https://www.canada.ca › ... › deductions-credits-expenses

Your net income is used to calculate your federal and provincial or territorial non refundable tax credits The CRA also uses your net income and your spouse s or common law partner s net

Penalty Chart Under Income Tax Act 1961 Ebizfiling

Section 281 Of The Income tax Act 1961

Proposal For Introduction Of Common Income Tax Return ITR Lawrbit

Section 196D Of Income Tax Act 1961 Ebizfiling

What Is Sec 139 Of Income Tax Act 1961 IN HINDI YouTube

Income Tax Act 1 3 Notes On Law Of Taxation PART THE INCOME

Income Tax Act 1 3 Notes On Law Of Taxation PART THE INCOME

Critical Analysis Of Section 37 Of The Income Tax Act 1961

Income Tax High Value Cash Transactions That Can Attract Income Tax

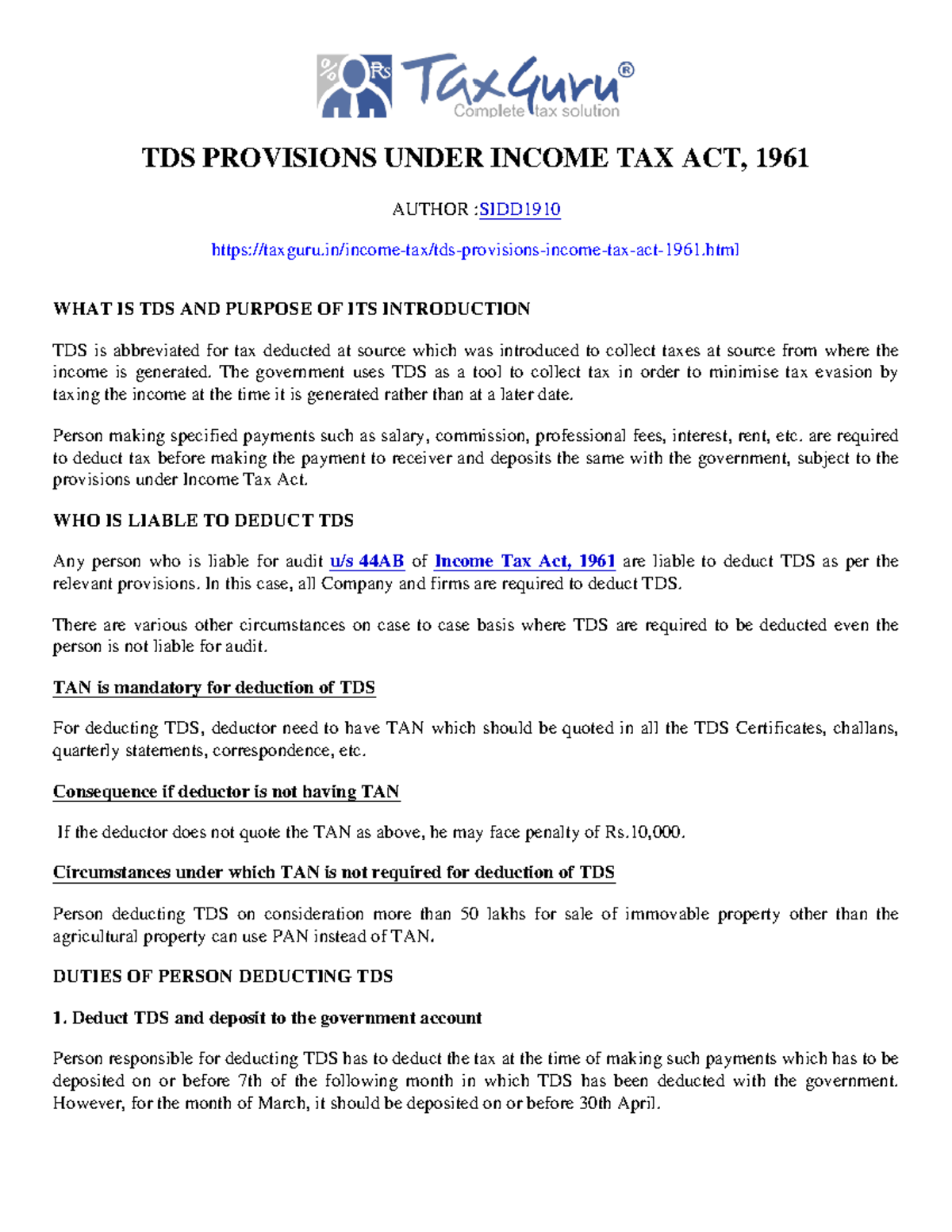

TDS Provisions Under Income Tax Act 1961 Taxguru in TDS PROVISIONS

What Is Income Tax Act 1961 In Hindi - [desc-13]