What Is Income Tax Act 1962 File non resident corporations income tax file non residents income tax get information on tax treaties country by country reporting Doing taxes for someone who died Report the date of

The personal income levels used to calculate your Ontario tax have changed The amount of most provincial non refundable tax credits have changed The alternative minimum tax rate was How to determine your income When applying for the Guaranteed Income Supplement and the Allowance you or in the case of a couple you and your spouse or common law partner must

What Is Income Tax Act 1962

What Is Income Tax Act 1962

https://legiteye.com/media/uploads/legiteyeindian/Income-Tax-Act.jpg

S 40A 3 Of Income Tax Act Cannot Be Invoked When No Single

https://www.taxscan.in/wp-content/uploads/2023/01/Income-Tax-Act-Income-Tax-Transaction-ITAT-taxscan.jpg

What Do You Need To Know About Income Tax Glazers Blog

https://blog.glazers.co.uk/accountants-london/wp-content/uploads/2023/05/What-do-you-need-to-know-about-Income-Tax-1-5000x2500.png

Enter net income or loss after income tax and extraordinary items at amount A page 1 of Schedule 1 Add the taxable items and the non allowable expenses listed on lines 101 to 199 The income level cut offs do not include the OAS pension the first 5 000 of employment or self employment income and 50 of employment or self employment income

If you are reporting only Canadian source income from taxable scholarships fellowships bursaries research grants capital gains from disposing of taxable Canadian property or from Do not report tax exempt employment income you paid to your employee who is registered or entitled to be registered under the Indian Act using box 14 use code 71 or for a

More picture related to What Is Income Tax Act 1962

The Income Tax Act 1961 Bare Act Pocket For AIBE Exams

http://mandjservice.com/cdn/shop/files/9789356035508.jpg?v=1693288122

Penalty Chart Under Income Tax Act 1961 Ebizfiling

https://ebizfiling.com/wp-content/uploads/2023/02/Penalty-chart-under-Income-Tax-Act-1961.jpg

10 Essential Documents Required For Income Tax Return Filing In

https://www.viralbake.com/wp-content/uploads/Income-Tax-1.jpg

If your net world income exceeds the threshold amount 86 912 for 2023 you have to repay part or your entire OAS pension Part or your entire OAS pension is reduced as a monthly recovery 2 49 In broad terms the enhanced dividend gross up and dividend tax credit apply to dividends distributed to an individual from corporate income taxed at the general corporate income tax

[desc-10] [desc-11]

Section 194B Of Income Tax Act 1961 Sorting Tax

https://sortingtax.com/wp-content/uploads/2022/08/Section-194B-of-Income-Tax-Act-TDS-on-Winning-from-Lottery-or-Crossword-Puzzles.png

Income Tax Act 1 3 Notes On Law Of Taxation PART THE INCOME

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/4f4b2caa6eb2579afccf97f0ae69d7d2/thumb_1200_1854.png

https://www.canada.ca › en › services › taxes › income-tax

File non resident corporations income tax file non residents income tax get information on tax treaties country by country reporting Doing taxes for someone who died Report the date of

https://www.canada.ca › en › revenue-agency › services › forms...

The personal income levels used to calculate your Ontario tax have changed The amount of most provincial non refundable tax credits have changed The alternative minimum tax rate was

A Comprehensive Guide To Section 43B Of The Income Tax Act Ebizfiling

Section 194B Of Income Tax Act 1961 Sorting Tax

Income Tax Act POCKET Edition Finance Act 2023 By Taxmann s

Section 127 Income Tax Act 1967 Malaysia Compensation For Loss Of

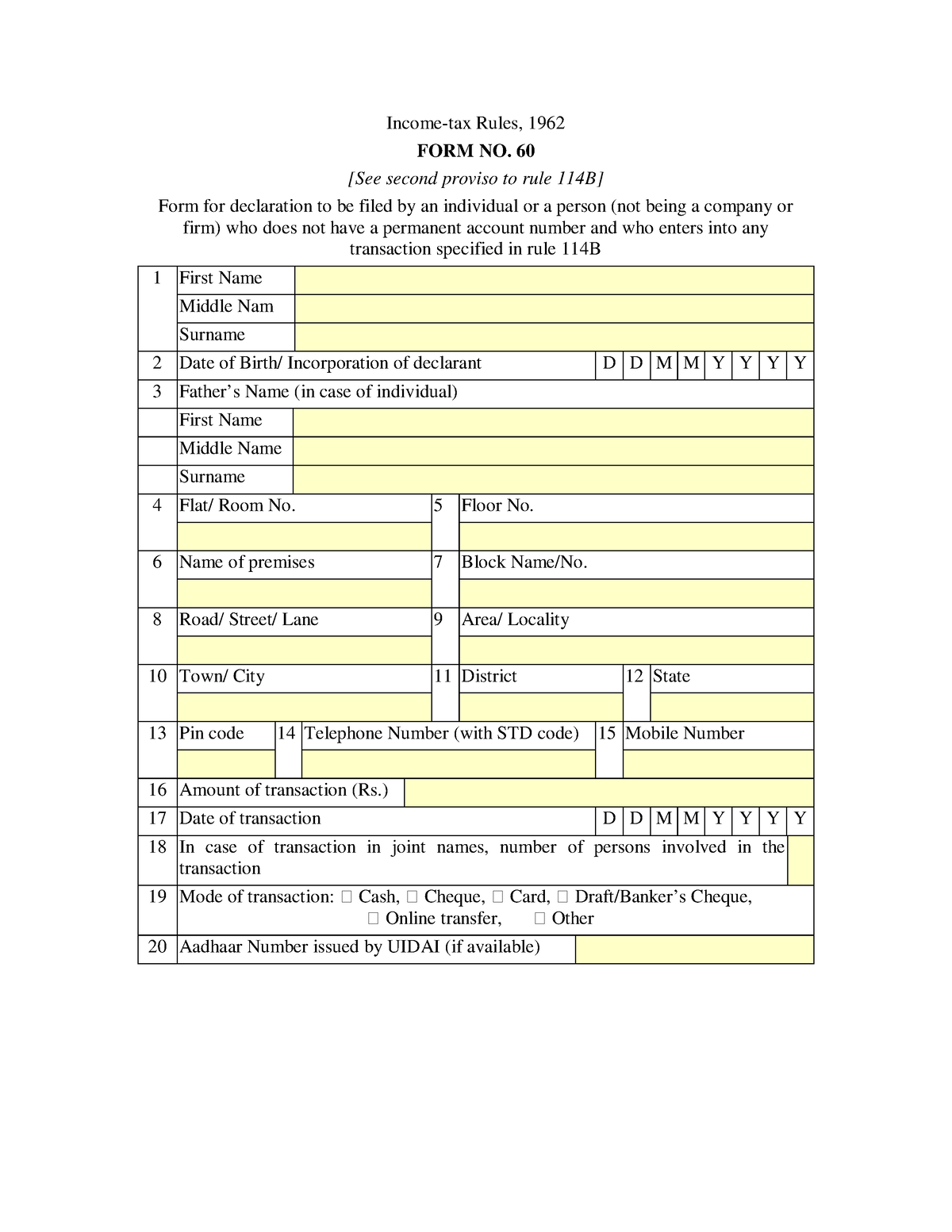

10312000 0000007944 Dvdgqhdvdv Income tax Rules 1962 FORM NO 60

Last minute Income Tax Saving Options Ebizfiling

Last minute Income Tax Saving Options Ebizfiling

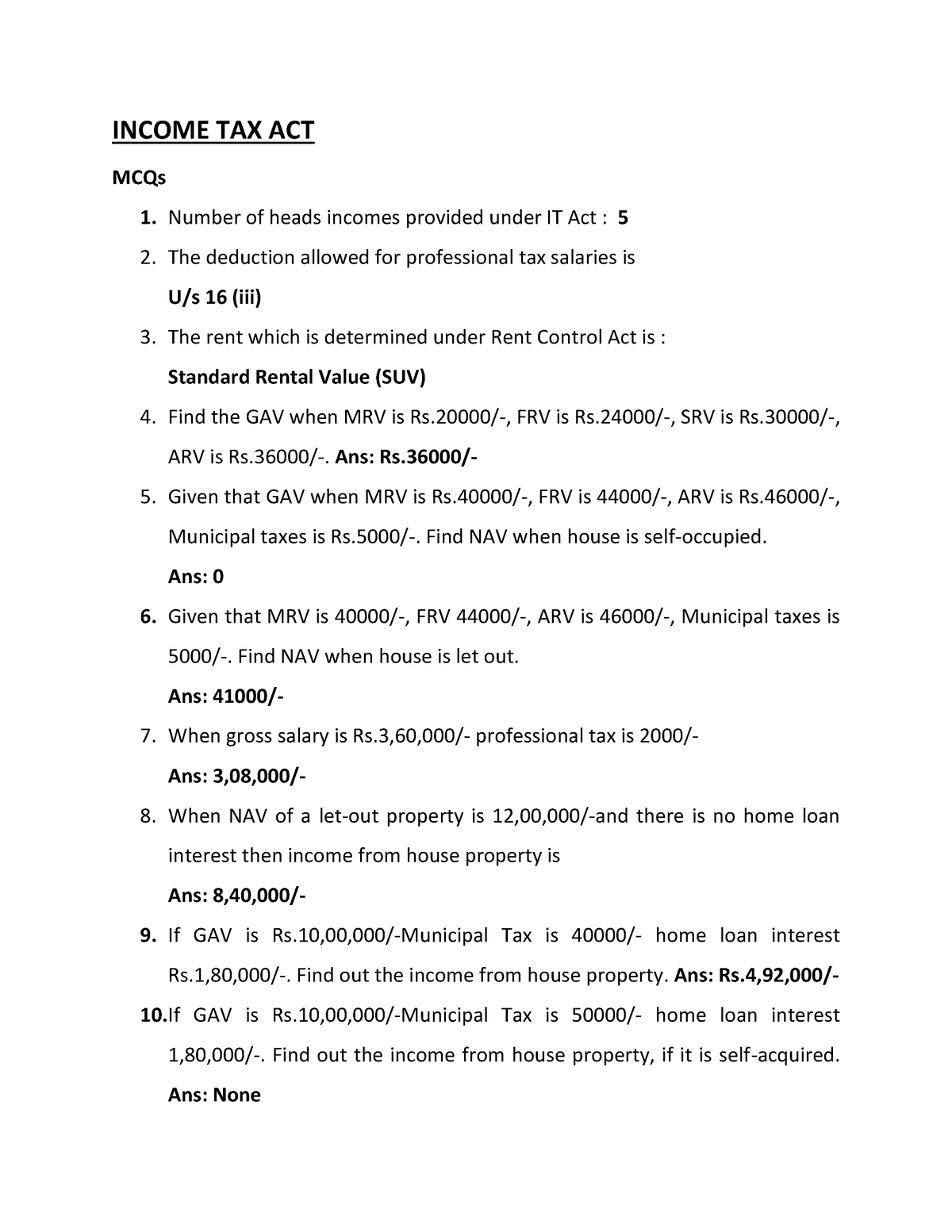

Income TAX ACT MCQs INCOME TAX ACT MCQs 1 Number Of Heads Incomes

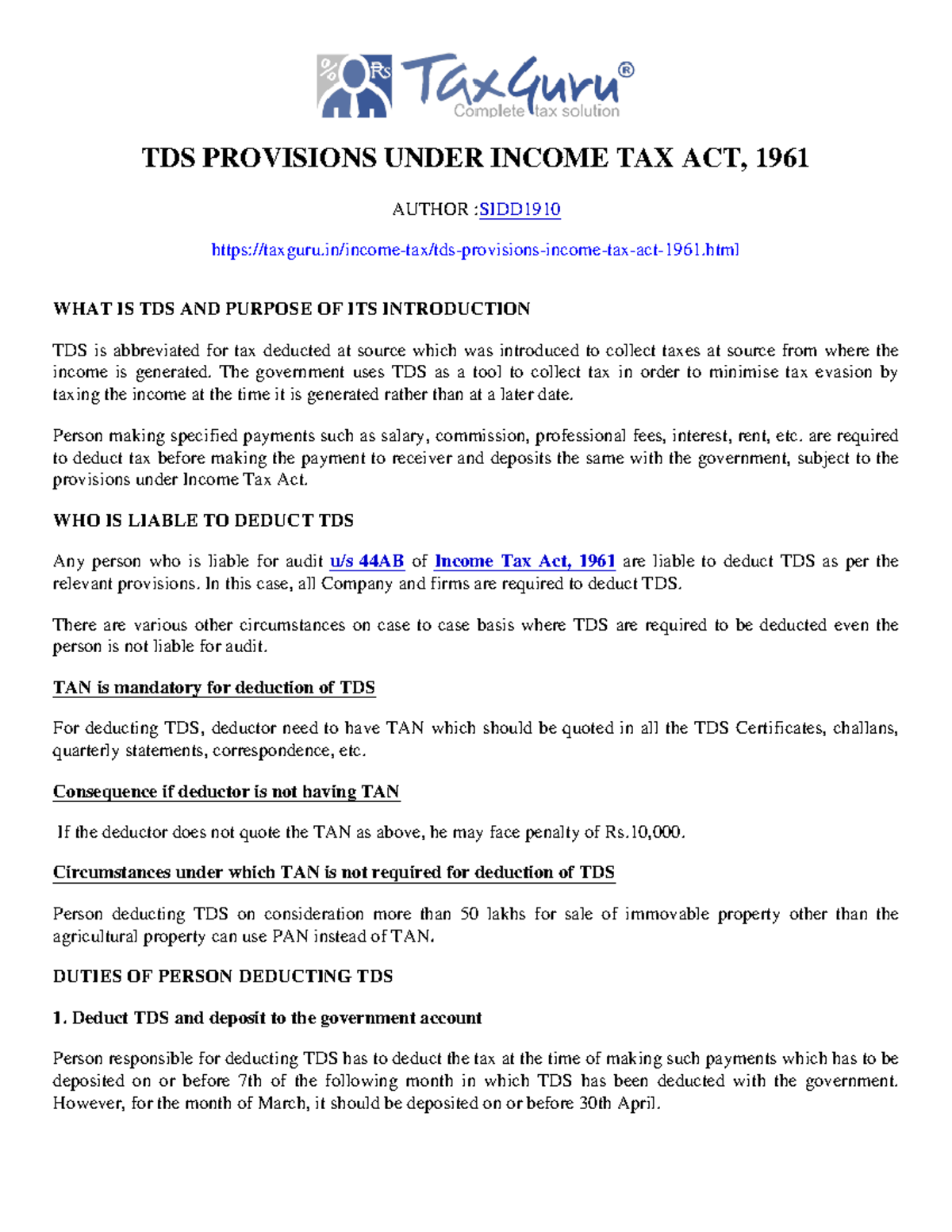

TDS Provisions Under Income Tax Act 1961 Taxguru in TDS PROVISIONS

About Income Tax In Hindi Seekhoaccounting

What Is Income Tax Act 1962 - Do not report tax exempt employment income you paid to your employee who is registered or entitled to be registered under the Indian Act using box 14 use code 71 or for a