What Is Income Tax Act 80c Filing an income tax and benefit return can help you access benefit and credit payments like the GST HST credit up to 533 for an eligible individual the Canada child

The Canada Disability Benefit provides direct financial support to people with disabilities who are between 18 and 64 years old The program is administered by Service Canada The first If your net world income exceeds the threshold amount 86 912 for 2023 you have to repay part or your entire OAS pension Part or your entire OAS pension is reduced as a monthly recovery

What Is Income Tax Act 80c

What Is Income Tax Act 80c

https://cdn-scripbox-wordpress.scripbox.com/wp-content/uploads/2020/01/section-80c.jpg

All About Deduction Under Section 80C Of The Income Tax Act Ebizfiling

https://ebizfiling.com/wp-content/uploads/2022/02/section-80c-1.png

Deductions U S 80C Under Schedule VI Of Income Tax IFCCL

https://www.caindelhiindia.com/blog/wp-content/uploads/2021/07/80c.jpg

How to determine your income When applying for the Guaranteed Income Supplement and the Allowance you or in the case of a couple you and your spouse or common law partner must NETFILE is a fast and convenient option for filing your income tax and benefit return online You ll be asked to enter an access code when using NETFILE certified tax software Your eight

Do not report tax exempt employment income you paid to your employee who is registered or entitled to be registered under the Indian Act using box 14 use code 71 or for a 2 49 In broad terms the enhanced dividend gross up and dividend tax credit apply to dividends distributed to an individual from corporate income taxed at the general corporate income tax

More picture related to What Is Income Tax Act 80c

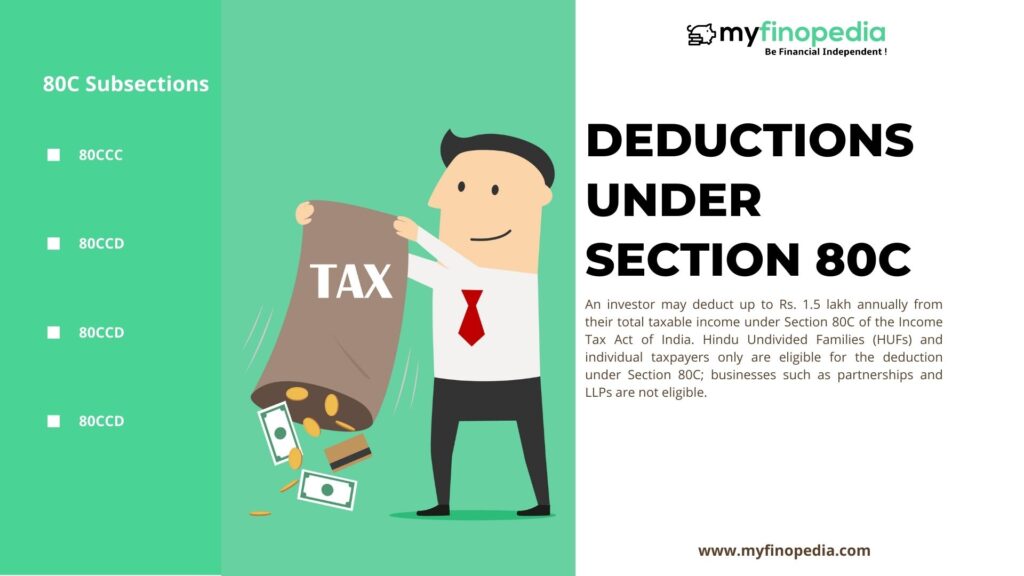

Deductions Under Section 80C Benefits Works Myfinopedia

https://www.myfinopedia.com/wp-content/uploads/2023/01/Deductions-Under-Section-80C-1024x576.jpg

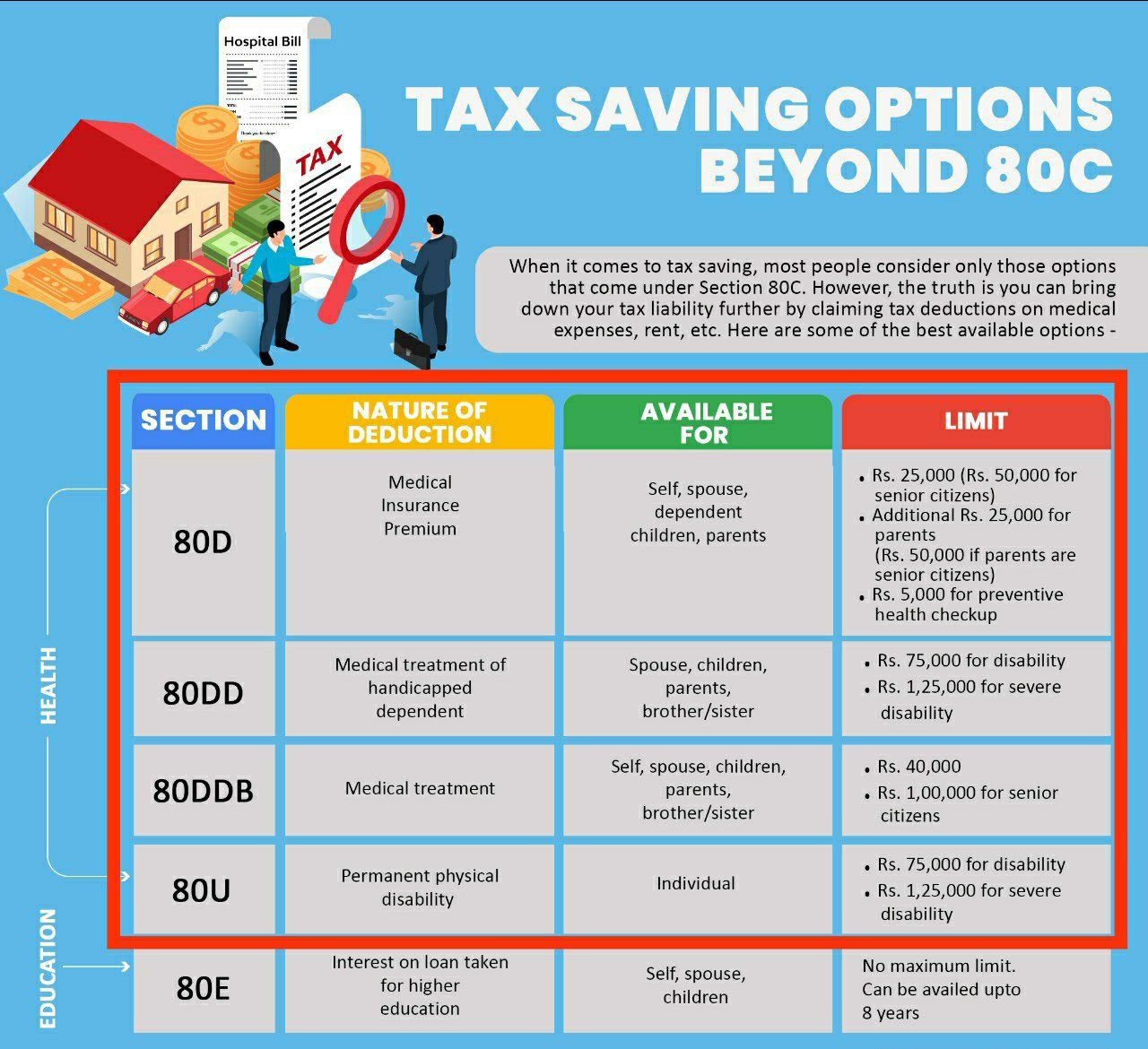

Income Tax Deduction Under Section 80C To 80U FY 2022 23 41 OFF

https://navi.com/blog/wp-content/uploads/2022/05/Section-80-of-the-Income-Tax-Act.webp

Top 8 Deductions Under Section 80C Income Tax Act 1961

https://taxzona.in/wp-content/uploads/2022/05/income-tax-act-1961.png

The Government of Canada has tabled legislation proposing to reduce the lowest income tax rate effective July 1 2025 For more information Government tables a Motion to Enter net income or loss after income tax and extraordinary items at amount A page 1 of Schedule 1 Add the taxable items and the non allowable expenses listed on lines 101 to 199

[desc-10] [desc-11]

80c Deductions

https://www.taxhelpdesk.in/wp-content/uploads/2022/07/DEDUCTIONS-UNDER-SECTION-80C-80CCC-80CCD1-80CCD1b-80CCD2--819x1024.png

:max_bytes(150000):strip_icc()/Term-Definitions_Income-tax-blue-9a708041207743b5a57cfdae08df2b10.jpg)

Income Tax

https://www.investopedia.com/thmb/vmecxtzh3YtlhkIY783GtuYo7Ds=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/Term-Definitions_Income-tax-blue-9a708041207743b5a57cfdae08df2b10.jpg

https://www.canada.ca › en › revenue-agency › news › tax-season-start…

Filing an income tax and benefit return can help you access benefit and credit payments like the GST HST credit up to 533 for an eligible individual the Canada child

https://www.canada.ca › en › services › benefits › disability › canada-dis…

The Canada Disability Benefit provides direct financial support to people with disabilities who are between 18 and 64 years old The program is administered by Service Canada The first

80c Tax Benefit Section 80C Of Income Tax Act Helps You In Saving Tax

80c Deductions

How To Save Tax Under Section 80C Deduction Under Section 80C

Exemption Under Section 10 10d

Things To Know About Section 80C Of The Income Tax Act What Is

80C Deduction Under Incometax Act 80C Deduction Rs 1 50 000

80C Deduction Under Incometax Act 80C Deduction Rs 1 50 000

Deduction Under Section 80C Of Income Tax Act 1961 Latest

Summary Of Income Tax Deduction Under Chapter VI A CA Rajput

Section 80C Deduction For Tax Saving Investments Learn By Quicko

What Is Income Tax Act 80c - [desc-13]