What Is Income Tax Law And Accounts What Is Income Tax Accounting Income tax accounting is required to recognize the income tax payable in the books of

There are two types of taxes Direct Tax and Indirect Tax Tax of which incidence and impact fall on the same person is known as Direct Tax such as Income Tax The accounting for income taxes is to recognize tax liabilities for estimated income taxes payable and determine the tax expense for the current period

What Is Income Tax Law And Accounts

What Is Income Tax Law And Accounts

https://online.pubhtml5.com/kcvf/pxvi/files/large/1.jpg

Income Tax Introduction Income Tax Law And Accounts Studocu

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/752f2cc9164ff0bcef824826122528ff/thumb_1200_848.png

Income Tax Law And Accounts pdf Google Drive

https://lh4.googleusercontent.com/JhxNam8U8PhetnMiNR44loiRd98WJ0j-lJPNI6Ak11sHpKEnSaNPo5F4xsZTb9sygI0=w1200-h630-p

Our in depth guide explains the accounting for various forms of tax credits in accordance with US GAAP Latest edition KPMG explains the accounting for income taxes in detail providing The primary purpose of tax accounting is to ensure compliance with tax laws and regulations implemented by the government with accurate and timely preparation of tax returns It is an important part of financial planning

Taxation focuses on collecting taxes and complying with government tax laws while accounting aims to record and analyze a company s financial transactions to assess its performance and make informed decisions about its financial Tax accounting dictates the specific set of rules that income tax assessees such as businesses and individuals should follow when preparing their tax returns The Indian income tax law

More picture related to What Is Income Tax Law And Accounts

Income Tax Law And Accounts Previous Year Question Paper With Answer

https://i.ytimg.com/vi/dokbi1GmiXc/maxresdefault.jpg

Income Tax Law And Accounts BCom Second Internal 2020 Pages 3

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/5542aff3761efd0f857d024bf5ad04c2/thumb_1200_1697.png

Income Tax Law And Accounts Revised Edition

https://images-na.ssl-images-amazon.com/images/S/compressed.photo.goodreads.com/books/1678296436i/87284773.jpg

The primary objective of income tax accounting is to determine taxable profits and tax liabilities by making adjustments to book profits derived from accounting U S GAAP specifically ASC Topic 740 Income Taxes requires income taxes to be accounted for by the asset liability method The asset and liability method places emphasis on the valuation of current and deferred tax

Explore essential principles of income tax accounting including deferred taxes valuation allowances and the impact of tax rate changes Income tax accounting is a key Taxes are payments collected from the government for a variety of social security health and infrastructural purposes These include Income Tax Corporation Tax and Council Tax What

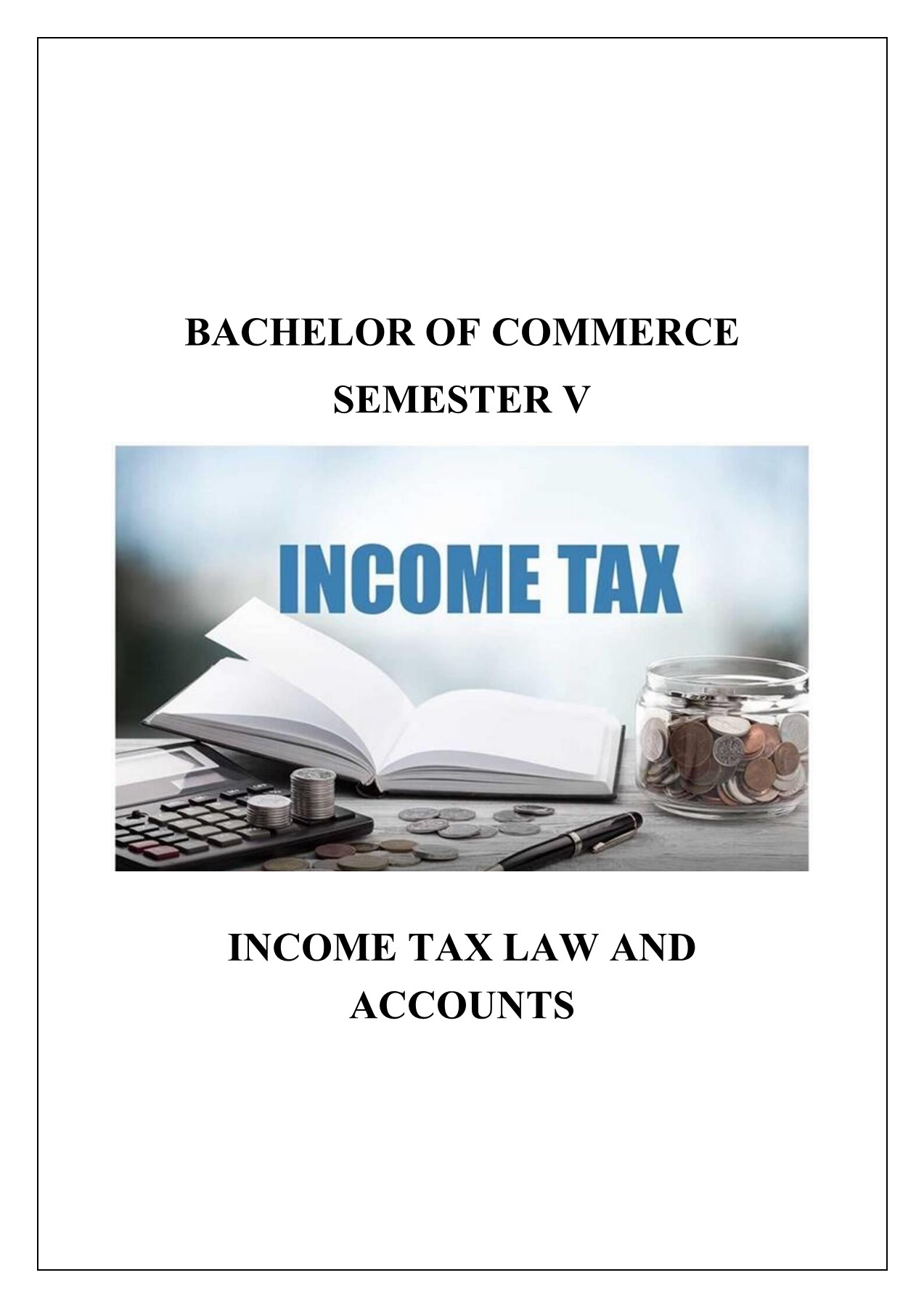

Income TAX LAW AND Accounts INCOME TAX LAW AND ACCOUNTS FIRST

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/3110e74b5a71a216b60822003f867f79/thumb_1200_1698.png

INCOME TAX LAW AND ACCOUNTS Previous Year Question Papper important

https://i.ytimg.com/vi/y-D_r4DaAGA/maxresdefault.jpg?sqp=-oaymwEmCIAKENAF8quKqQMa8AEB-AH-CYAC0AWKAgwIABABGGUgZShlMA8=&rs=AOn4CLBffT7xCMeXoYMLZnsqNINOkhUnRQ

https://www.wallstreetmojo.com › income-t…

What Is Income Tax Accounting Income tax accounting is required to recognize the income tax payable in the books of

https://sde.uoc.ac.in › sites › default › files › sde...

There are two types of taxes Direct Tax and Indirect Tax Tax of which incidence and impact fall on the same person is known as Direct Tax such as Income Tax

Income Tax Law And Practice Ryan Publishers

Income TAX LAW AND Accounts INCOME TAX LAW AND ACCOUNTS FIRST

Image To PDF 20221112 07 Income Tax Law Practice II Studocu

5 Income Tax Law And Accounts TAX PLANNING Reducing Tax Liability By

B Com 5th Semester Income Tax Law And Accounts Previous Year Question

What Is Income Tax PDF

What Is Income Tax PDF

INCOME TAX SLAB FOR FY 2022 23 BBNC

Income Tax Law And Accounts Assessment Year 2022 23 B Com Semester 5

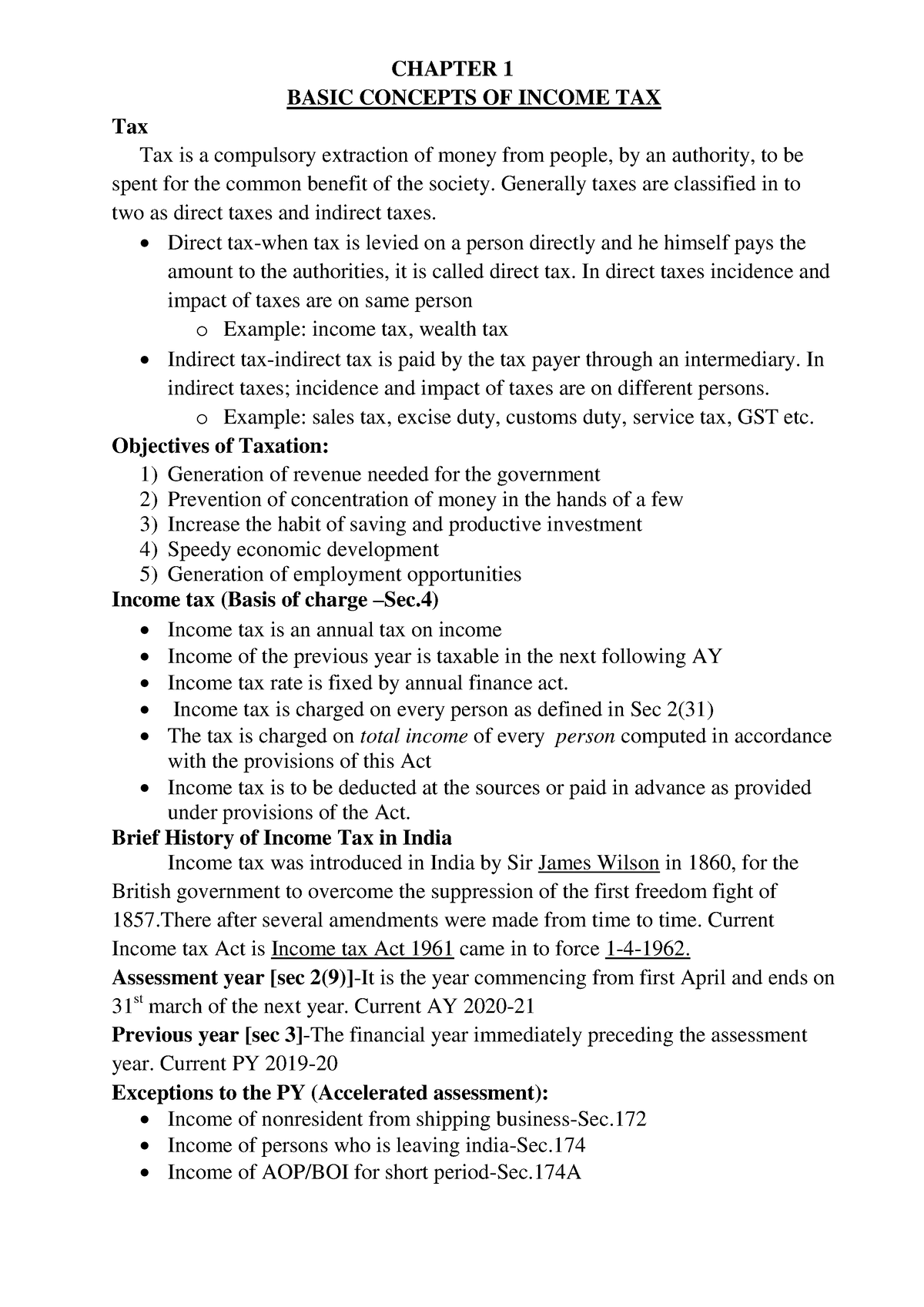

1 Income Tax Law And Accounts own CHAPTER 1 BASIC CONCEPTS OF

What Is Income Tax Law And Accounts - Tax accounting dictates the specific set of rules that income tax assessees such as businesses and individuals should follow when preparing their tax returns The Indian income tax law