What Is Income Tax On 4000 Today you can start filing your 2024 income tax return online For most individuals the deadline to file is April 30 2025 and any amounts owed must also be paid by

The Canada Disability Benefit is a monthly payment for working age persons with disabilities who have low income General information for corporations on how to complete page 3 of the T2 Corporation Income Tax Return

What Is Income Tax On 4000

What Is Income Tax On 4000

https://media.cheggcdn.com/media/b7d/b7d221bd-ac73-47cd-b797-c3fcc4660b9d/phpXiskta.png

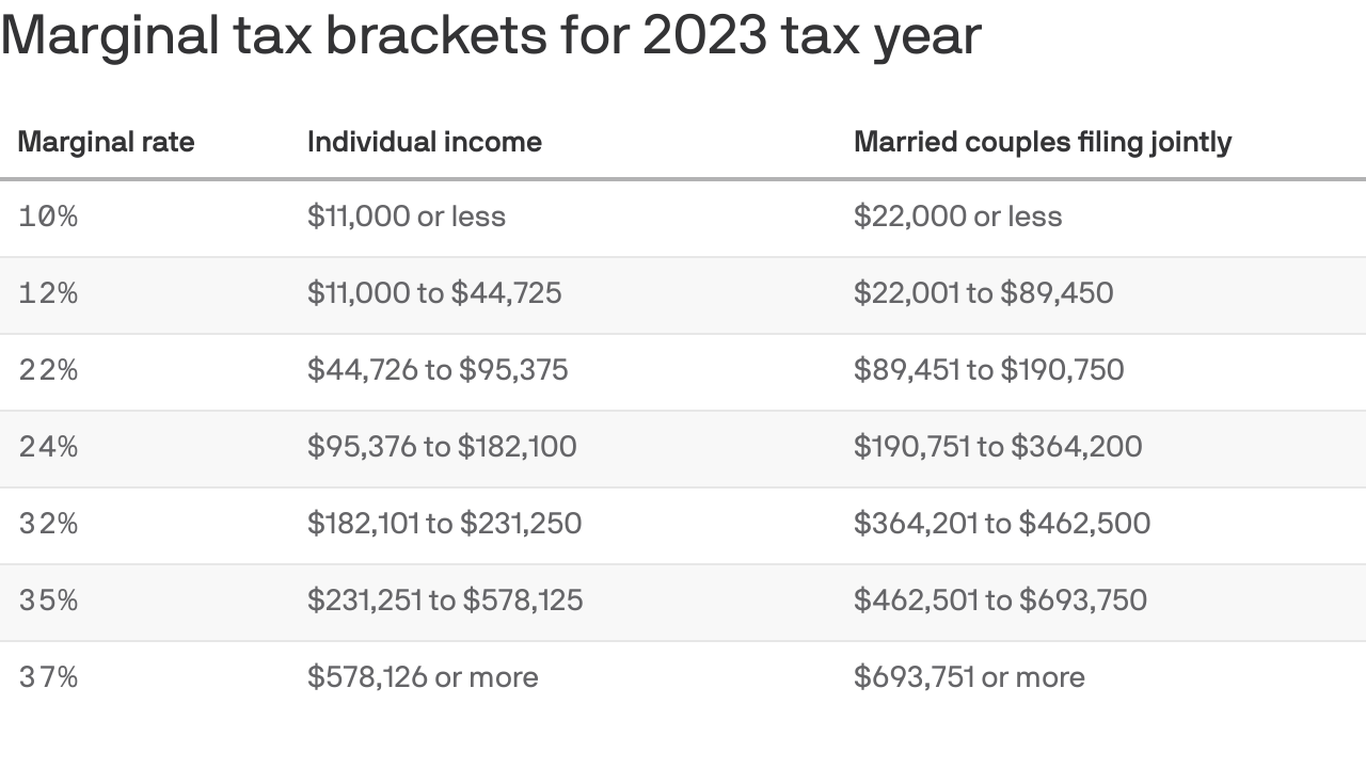

Income Tax Rates And Allowances 2023 24 Image To U

https://images.axios.com/FeF3kXyZuSjEVWj-265DifJa2hw=/0x0:1280x720/1366x768/2022/10/19/1666195709283.png

Income Tax Calculator For Salary Fy 2023 24 Image To U

https://i.ytimg.com/vi/z2YPRyH8_xo/maxresdefault.jpg

Income tax calculator Updated for 2024 25 tax year how much tax will you pay on your salary in South Africa find out with the SARS income tax calculator updated for 2024 25 tax year The Federal income tax and benefit information webpage contains general information needed to complete an income tax return for the 2024 taxation year

The Government of Canada sets the federal income tax rates for individuals Each province and territory determines their own income tax rates Provincial or territorial income Personal income tax Manitoba tax information for 2024 Use the information on this page to help you complete your provincial tax and credits form

More picture related to What Is Income Tax On 4000

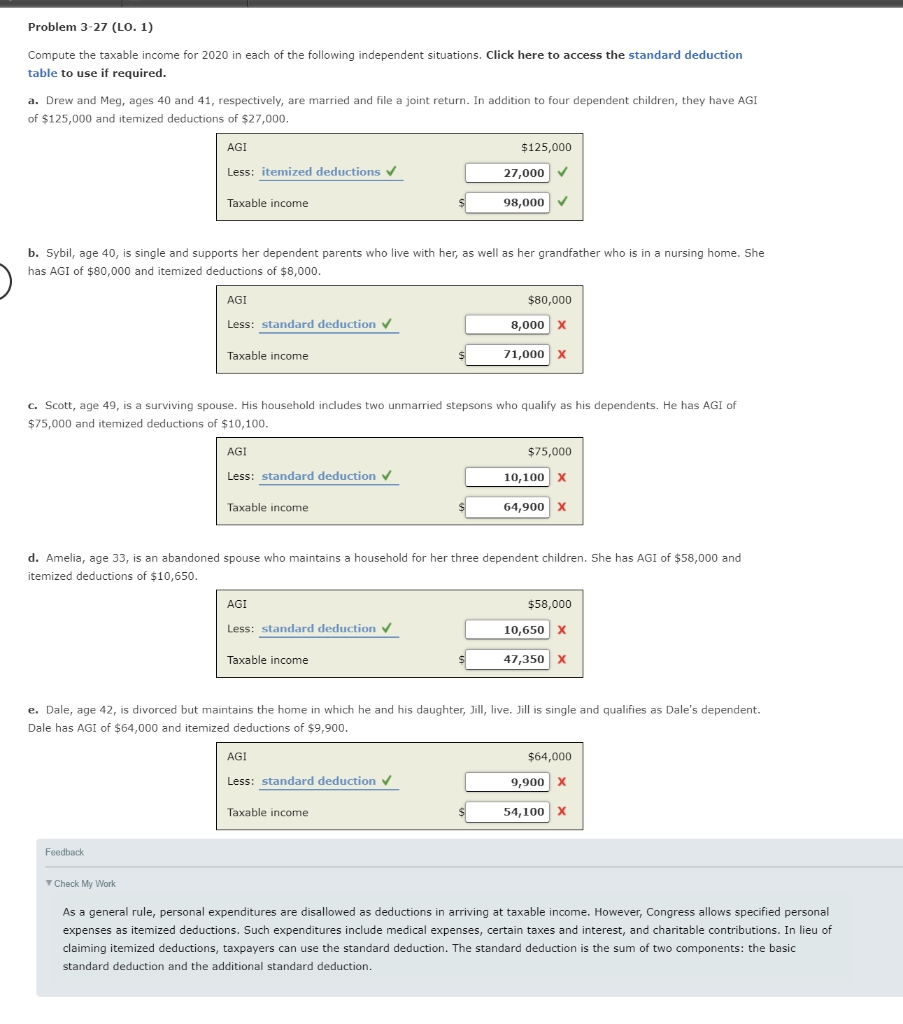

Federal Income Tax Exemptions 2024 Aime Jackelyn

http://www.taxpolicycenter.org/sites/default/files/publication/137756/01_6.png

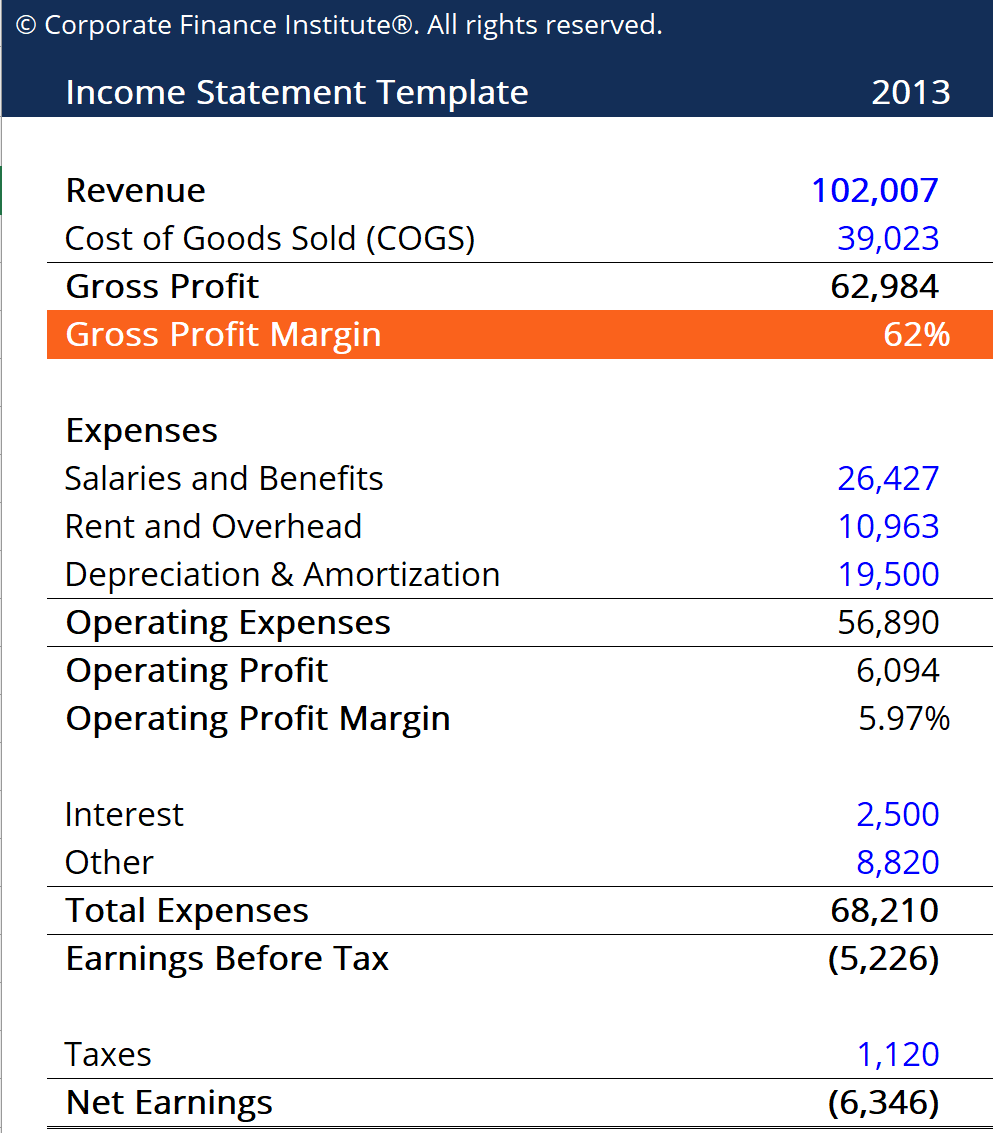

Gross Margin Ratio Learn How To Calculate Gross Margin Ratio

https://cdn.corporatefinanceinstitute.com/assets/Gross-Margin-Ratio-1.png

Federal Withholding Tax Table For Payroll Review Home Decor

https://lh5.googleusercontent.com/z7rwjcQisu3xUBdWM5bDxYGh62UAbbnvWWeupsKWPLIukAhAsTTOCNd-aHgtYmkmxYn1HBNpn9QA6w7m0wz2UUi9QZrVwdt-LWpXE8TZXcb_Ua12ASnpXrFOqX1k7-hK7DHt5btr

This Chapter discusses the tax implications of receiving a taxable dividend from a corporation resident in Canada focusing on dividends received by individuals and corporations who are This guide contains information needed to elect under section 216 of the Income Tax Act as well as general information for non residents receiving Canadian source rental income This guide

[desc-10] [desc-11]

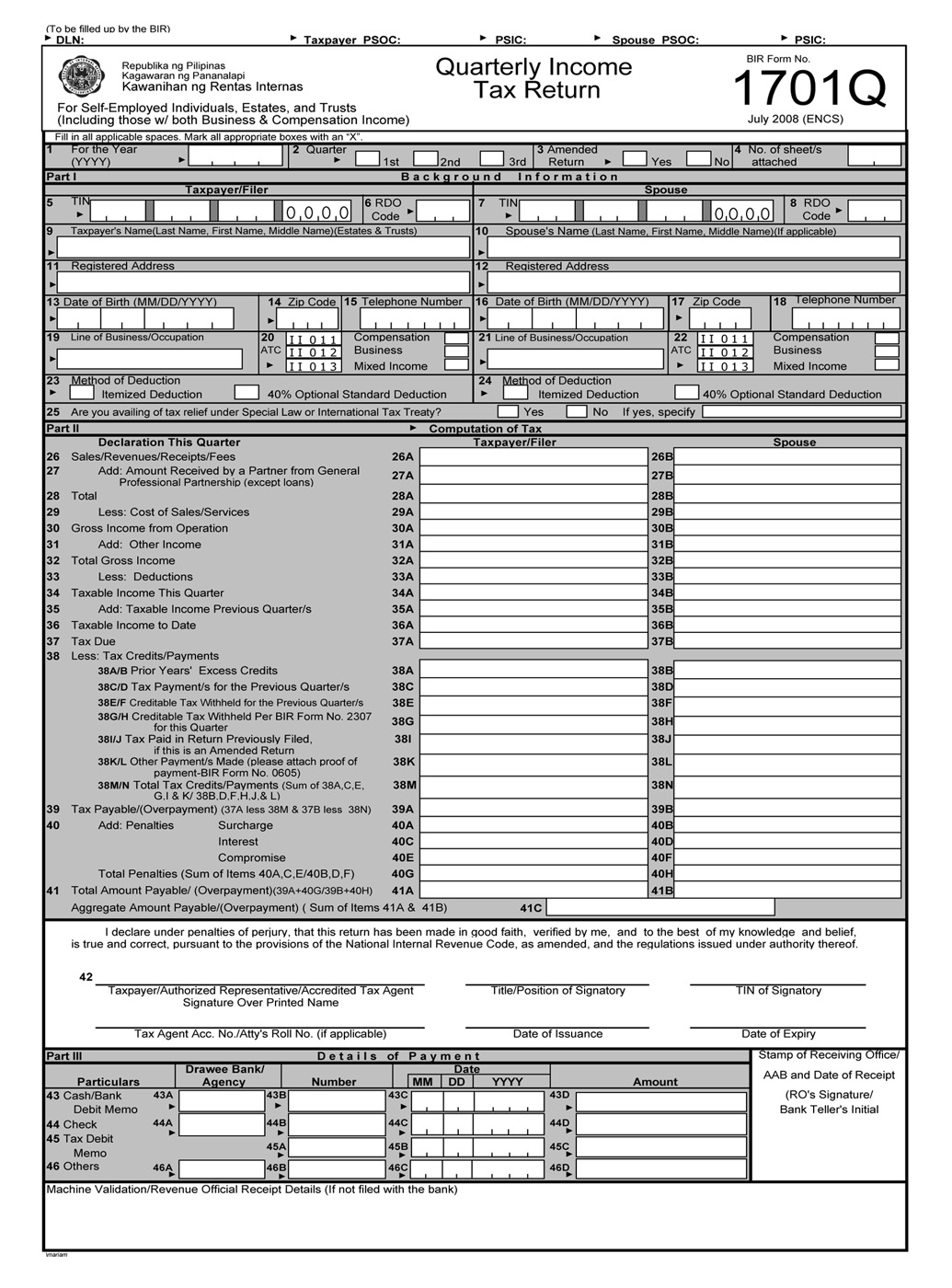

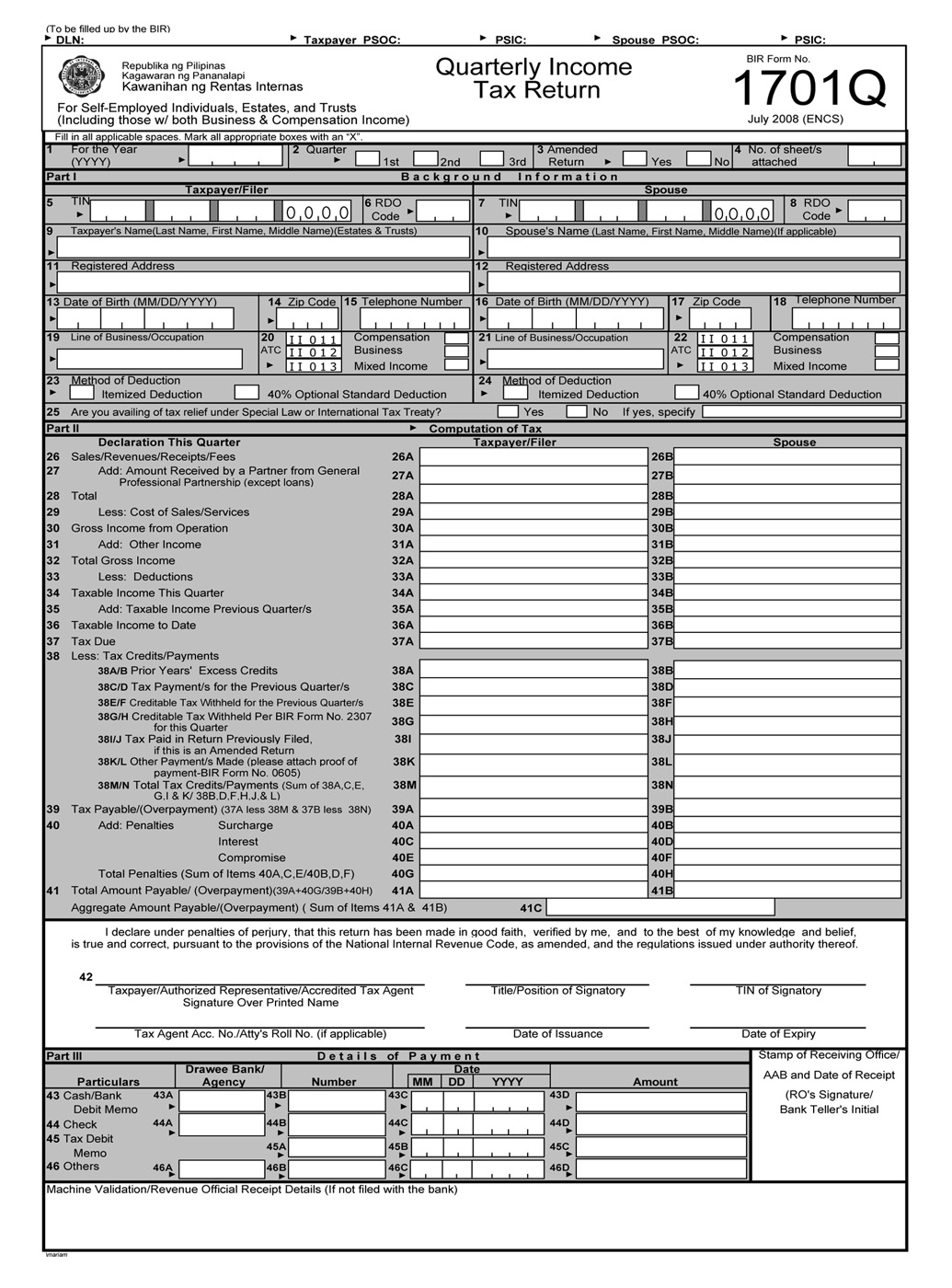

Quarterly Tax Payments 2024 Llc Deane Estelle

https://ifranchise.ph/wp-content/uploads/2017/06/BIR-Form-1701Q-Quarterly-Income-Tax-Return.jpg

[img_title-8]

[img-8]

https://www.canada.ca › en › revenue-agency › news › tax-season-start…

Today you can start filing your 2024 income tax return online For most individuals the deadline to file is April 30 2025 and any amounts owed must also be paid by

https://www.canada.ca › en › services › benefits › disability › canada-dis…

The Canada Disability Benefit is a monthly payment for working age persons with disabilities who have low income

[img_title-9]

Quarterly Tax Payments 2024 Llc Deane Estelle

[img_title-10]

[img_title-11]

[img_title-12]

[img_title-13]

[img_title-13]

[img_title-14]

[img_title-15]

[img_title-16]

What Is Income Tax On 4000 - Income tax calculator Updated for 2024 25 tax year how much tax will you pay on your salary in South Africa find out with the SARS income tax calculator updated for 2024 25 tax year