What Is Income Tax Rules 127 And 127a The middle class tax cut would reduce the tax rate that is applied to the first 57 375 in 2025 of an individual s taxable income regardless of their income level As shown

The Canada Disability Benefit provides direct financial support to people with disabilities who are between 18 and 64 years old The program is administered by Service Canada The first Filing an income tax and benefit return can help you access benefit and credit payments like the GST HST credit up to 533 for an eligible individual the Canada child

What Is Income Tax Rules 127 And 127a

:max_bytes(150000):strip_icc()/Term-Definitions_Income-tax-blue-9a708041207743b5a57cfdae08df2b10.jpg)

What Is Income Tax Rules 127 And 127a

https://www.investopedia.com/thmb/vmecxtzh3YtlhkIY783GtuYo7Ds=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/Term-Definitions_Income-tax-blue-9a708041207743b5a57cfdae08df2b10.jpg

Tax Rates 2024 Kacie Joelly

https://taxfoundation.org/wp-content/uploads/2024/01/CIT_Rates_24.png

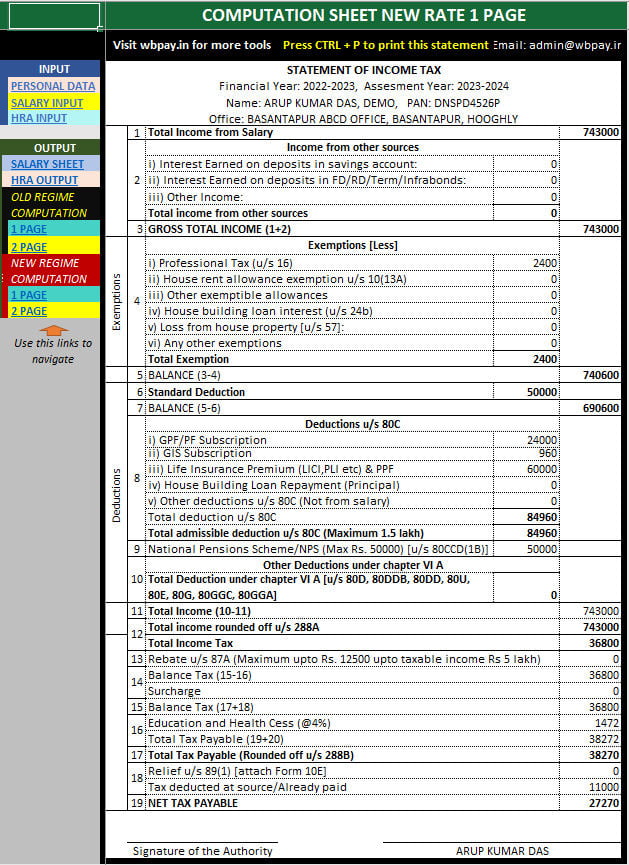

Income Tax Calculator For Company Ay 2023 24 Image To U

https://wbpay.in/wp-content/uploads/2023/01/All-in-one-income-tax-calculator-2022-23.jpg

The CRA will mail the 2024 income tax package to approximately 500 000 individuals this tax season The package will be mailed to certain vulnerable individuals who NETFILE is a fast and convenient option for filing your income tax and benefit return online You ll be asked to enter an access code when using NETFILE certified tax software Your eight

Only 25 000 of his income is considered for the benefit calculation 35 000 10 000 Dan s income after subtracting the working income exemption is 2 000 over the singles threshold of SARS allows you to invest up to 27 5 of your income capped at R350 000 per year and deduct it from your taxable income This table shows the maximum tax savings you can achieve for

More picture related to What Is Income Tax Rules 127 And 127a

Section 127 Income Tax Kimberly Cornish

https://i.pinimg.com/736x/57/11/df/5711dfc16523f99aa4dfe2136e183d7a.jpg

Income Tax Kya Hai All About Income

https://seekhoaccounting.com/wp-content/uploads/2022/08/आयकर-क्या-है-What-is-Income-Tax-In-hindi-1.png

Income Tax Calculator For Salary Fy 2023 24 Image To U

https://i.ytimg.com/vi/z2YPRyH8_xo/maxresdefault.jpg

February 24 2025 You can start filing your 2024 income tax and benefit return online April 30 2025 Deadline for most individuals to file their income tax and benefit return and pay any Net Income Income ps Profit

[desc-10] [desc-11]

Here Are The Federal Income Tax Brackets For 2023 Axios NEWS DEMO

https://images.axios.com/FeF3kXyZuSjEVWj-265DifJa2hw=/0x0:1280x720/1366x768/2022/10/19/1666195709283.png

All About Form 60 And Form 61 Under IT Act Wint Wealth

https://www.wintwealth.com/blog/wp-content/uploads/2022/10/Copy-of-IMG_0011_3-1-scaled-e1665833865246.jpg

:max_bytes(150000):strip_icc()/Term-Definitions_Income-tax-blue-9a708041207743b5a57cfdae08df2b10.jpg?w=186)

https://www.canada.ca › en › department-finance › news › delivering-a-…

The middle class tax cut would reduce the tax rate that is applied to the first 57 375 in 2025 of an individual s taxable income regardless of their income level As shown

https://www.canada.ca › en › services › benefits › disability › canada-dis…

The Canada Disability Benefit provides direct financial support to people with disabilities who are between 18 and 64 years old The program is administered by Service Canada The first

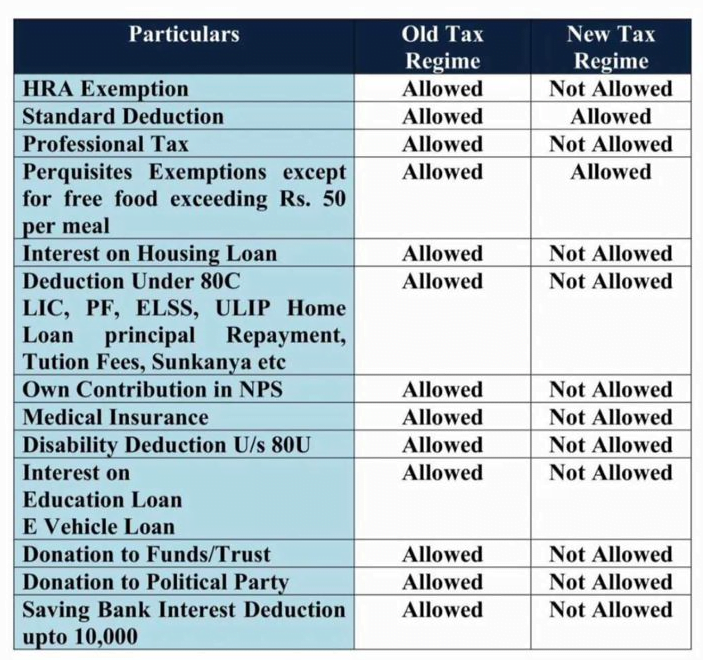

New And Old Tax Regime Comparision For FY 2023 24 Income Tax Slab FY

Here Are The Federal Income Tax Brackets For 2023 Axios NEWS DEMO

Extended Compliance Due Date Under Income Tax Act 1961 And Income Tax

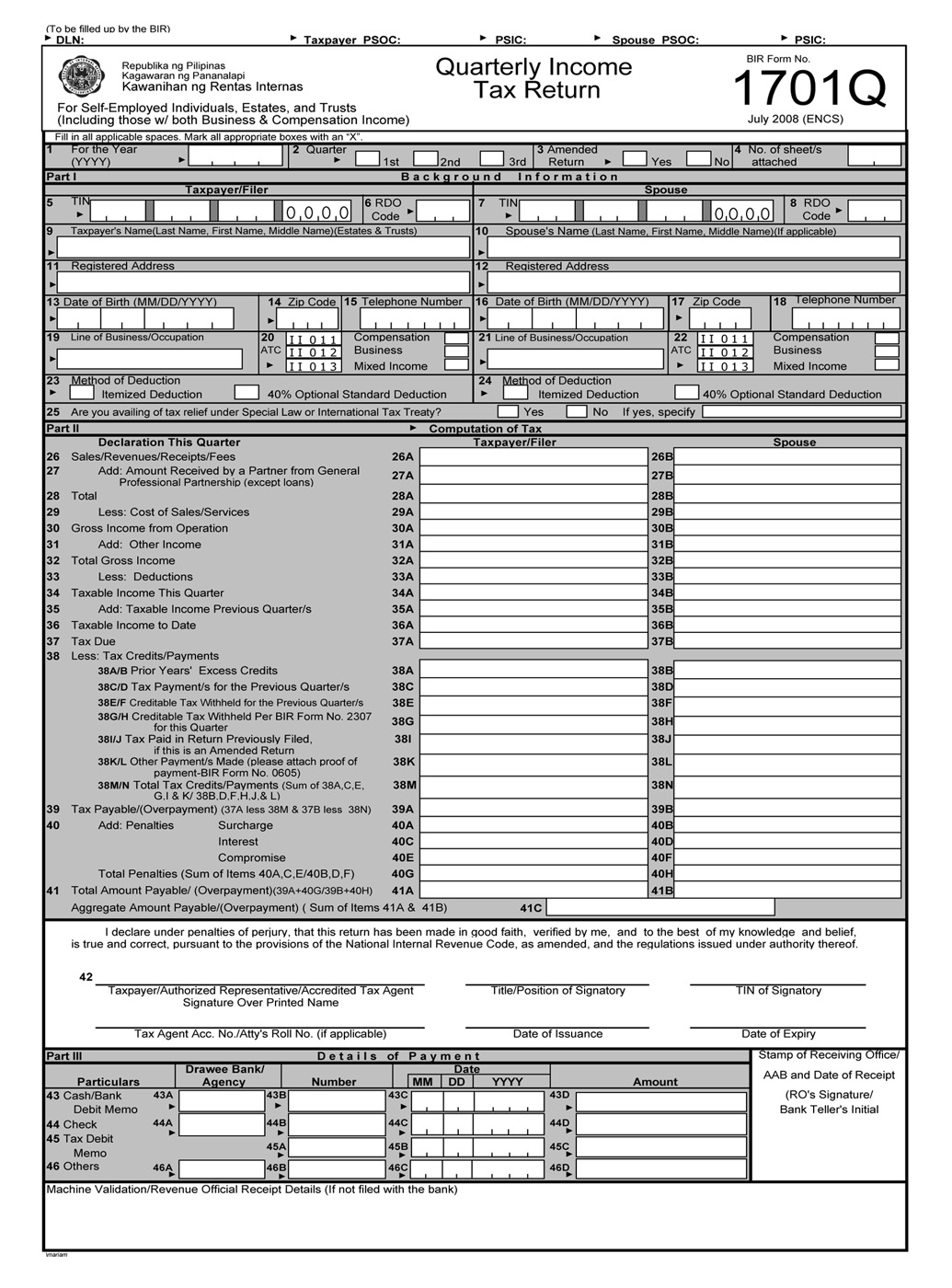

Quarterly Tax Payments 2024 Llc Deane Estelle

RCT 127A 2014 Public Utility Realty Tax Report Free Download

The Financial Insurance Investment Blog Income Tax Exemption No

The Financial Insurance Investment Blog Income Tax Exemption No

The Financial Insurance Investment Blog Income Tax Exemption No

[img_title-15]

[img_title-16]

What Is Income Tax Rules 127 And 127a - Only 25 000 of his income is considered for the benefit calculation 35 000 10 000 Dan s income after subtracting the working income exemption is 2 000 over the singles threshold of