What Is Mileage Rate For 2024 Hi just wondering whether someone could clarify as to whether GST applies to the reimbursements calculated using the cents per kilometer mileage method based on the actual

We pay our employee 80cents Per KM for any business travel using their own car paid via payroll fortnightly is this mileage payment taxable income should we withhold Was reading a post of yours and I have 2 mileage scenarios that I d appreciate your assistance with interpreting PAYG and STP 2 reporting implications When our award based

What Is Mileage Rate For 2024

What Is Mileage Rate For 2024

https://uploads-ssl.webflow.com/60882c80d0ef9737f2ee0911/63af21f1de517056bf96579c_Screenshot 2022-12-30 at 18.18.35.png

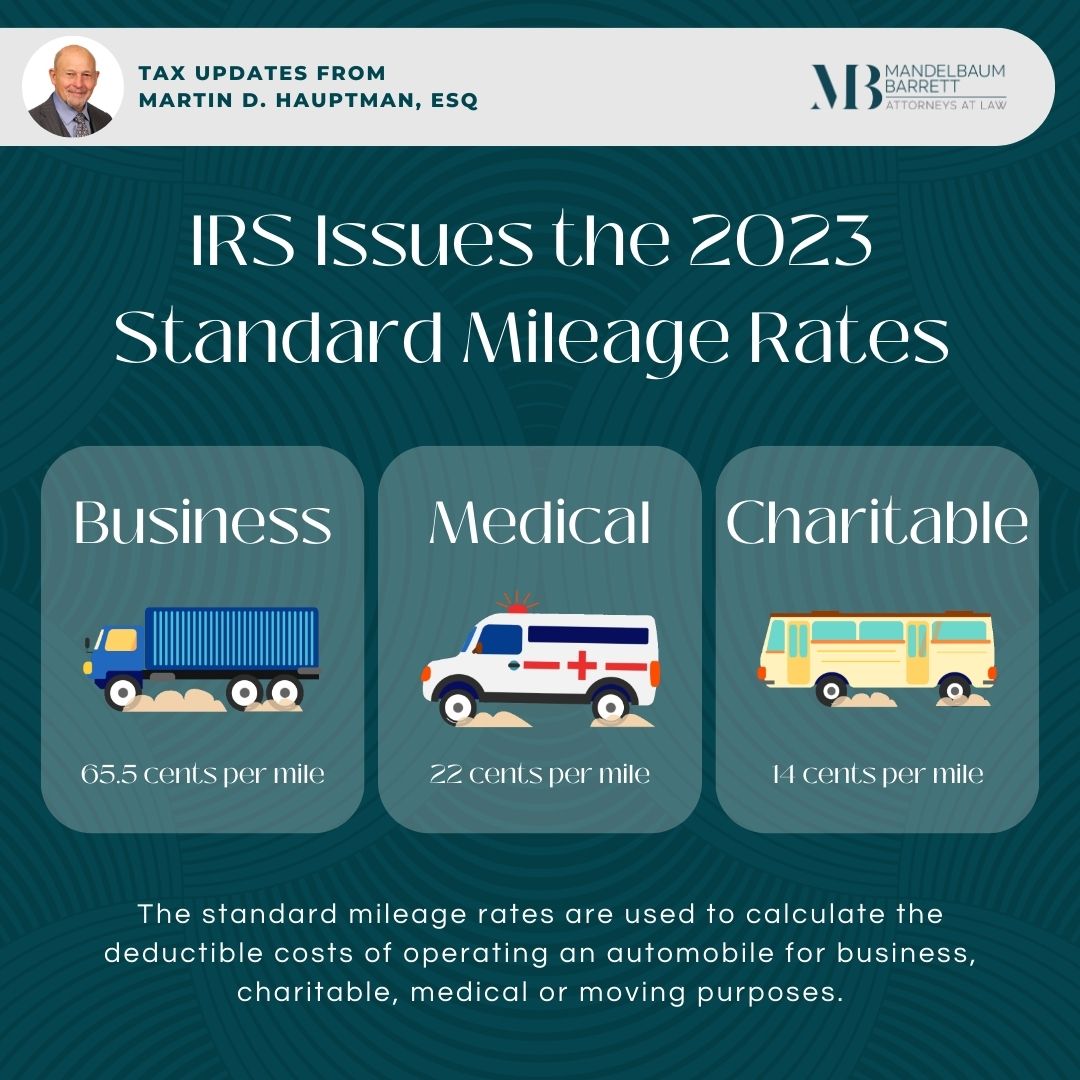

Irs Mileage Rate 2025 Forms Gregory L Burnett

https://templatelab.com/wp-content/uploads/2020/02/IRS-Compliant-Mileage-Log-TemplateLab.com_.jpg

Mileage Irs 2024 Rate Tera Kimmie

https://media.smallbiztrends.com/2023/12/irs-announces-2024-mileage-reimbursement-rate.png

RE Mileage reimbursement of 0 99 greater than ATO rate 0 88 Save this post KaraATO Community Support Community Support 29 June 2025 Previously I used logbook method for vehicle and claimed appropriate percentage for GST Thinking of using cents km Can I still claim same percentage of GST for vehicle

When reimbursing an employee for work related travel while using their private vehicle can I split the Award travel reimbursement rate of 0 95c into 0 85c non taxable and If an employee makes a reimbursement request for mileage using the cents per kilometre method and the total reimbursement request is for 143 52 do we break this into

More picture related to What Is Mileage Rate For 2024

/medriva/media/post_banners/content/uploads/2023/12/irs-2024-standard-mileage-rates-20231216051023.jpg)

Irs Standard Gas Mileage 2025 Paula T McLeod

https://img-cdn.thepublive.com/fit-in/1280x960/filters:format(webp)/medriva/media/post_banners/content/uploads/2023/12/irs-2024-standard-mileage-rates-20231216051023.jpg

.png)

Irs Moving Mileage Rate 2025 Chester Hall

https://assets-global.website-files.com/6019e7e56746527e9dcff3b8/657b752d5ae0f33c9549b4ad_IRS Mileage Rates 2014-2024 (1).png

Irs Allowable Mileage Rate 2022

https://www.mblawfirm.com/wp-content/uploads/2023/01/Marty-Mileage-Rates.jpg

Hi officer Workers are paid at 0 99 as per the award for every kilometre travelled during their shift Since we re paid for the actual KM travelled will that be considered Employee Reimbursement of mileage Is tax charged and Superannuation applied to this payment Save this post BossAccLady01 Newbie Newbie 30 June 2024

[desc-10] [desc-11]

Mileage Allowance 2025 Cra Christopher Nolan

https://cpaguide.ca/wp-content/uploads/2024/04/CRA-Mileage-Rates-2020-2024-1024x768.png

Understanding The 2024 IRS Standard Mileage Rates

https://img-cdn.thepublive.com/fit-in/1200x675/medriva/media/post_banners/content/uploads/2023/12/irs-2024-standard-mileage-rates-20231216051023.jpg

https://community.ato.gov.au › question

Hi just wondering whether someone could clarify as to whether GST applies to the reimbursements calculated using the cents per kilometer mileage method based on the actual

https://community.ato.gov.au › question

We pay our employee 80cents Per KM for any business travel using their own car paid via payroll fortnightly is this mileage payment taxable income should we withhold

Ontario Government Mileage Rate 2025 Carl Criswell

Mileage Allowance 2025 Cra Christopher Nolan

Irs Mileage Deduction 2025 Sally J Dollard

[img_title-11]

[img_title-12]

[img_title-13]

[img_title-13]

[img_title-14]

[img_title-15]

[img_title-16]

What Is Mileage Rate For 2024 - Previously I used logbook method for vehicle and claimed appropriate percentage for GST Thinking of using cents km Can I still claim same percentage of GST for vehicle