What Is Ssi Medical Term Supplemental Security Income or SSI is a federal benefit program administered by the Social Security Administration that provides safety net financial support for people in

The maximum federal SSI payment in 202 4 is 943 a month for an individual and 1 415 for a married couple who both qualify Benefits can be reduced based on income from El SSI o Seguridad de Ingreso Suplementario es un programa de beneficios federales que provee asistencia financiera para las personas necesitadas dirigido por la Administraci n del

What Is Ssi Medical Term

What Is Ssi Medical Term

https://ssalocator.com/static/img/blog/how-to-get-a-social-security-award-letter-1.jpeg

SSI Vs SSDI The Main Differences Explained Fitzpatrick Associates

https://lawrjf.com/wp-content/uploads/2020/06/ssi-approved.jpg

How Much Is Ssi In West Virginia 2024 Sunny Ernaline

https://www.clausonlaw.com/blog/wp-content/uploads/2021/12/2300-disability-benefit-calculator-PROMO-1024x683.jpg

Say you have 800 each in checking and savings accounts and no other financial assets You could qualify for SSI assuming you also meet the criteria for income and age or But you can t get SSI if what Social Security calls your countable income exceeds a federally set threshold which in 2025 is 967 a month for individuals and 1 450 for couples

The SSA is in the middle of a multi year project to streamline the SSI application process and provide a digital option for all applicants For now if you are filing for SSI because The COLA is applied to all Social Security payments survivor benefits family benefits and disability benefits as well as retirement benefits and to Supplemental

More picture related to What Is Ssi Medical Term

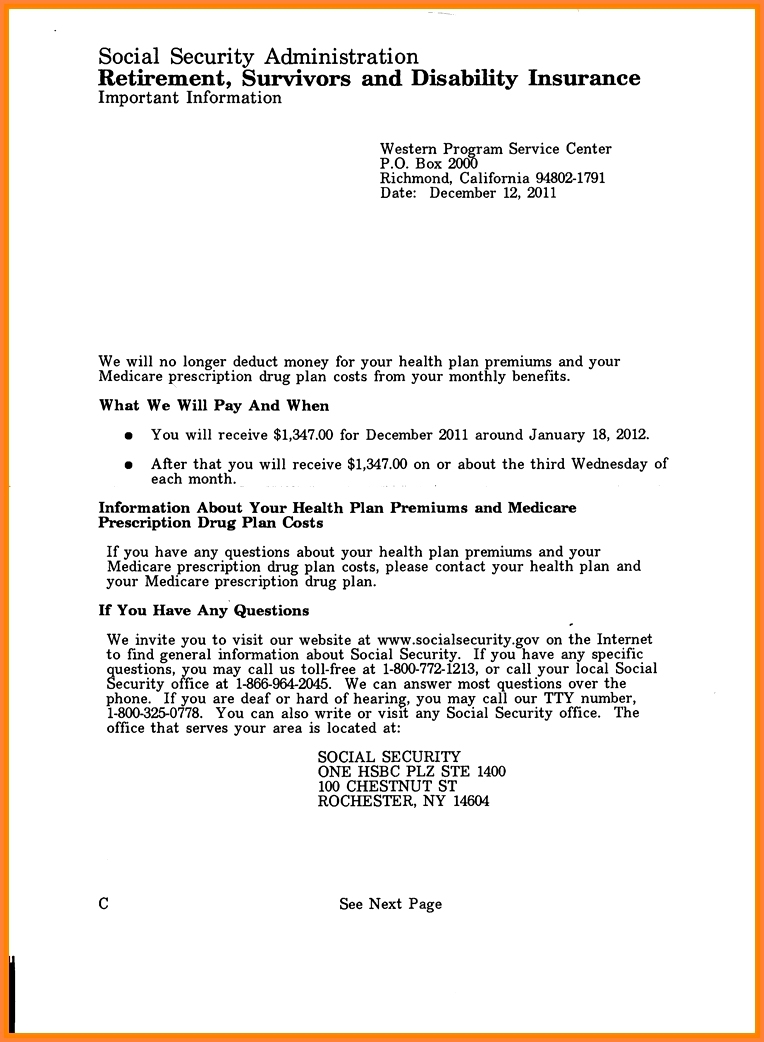

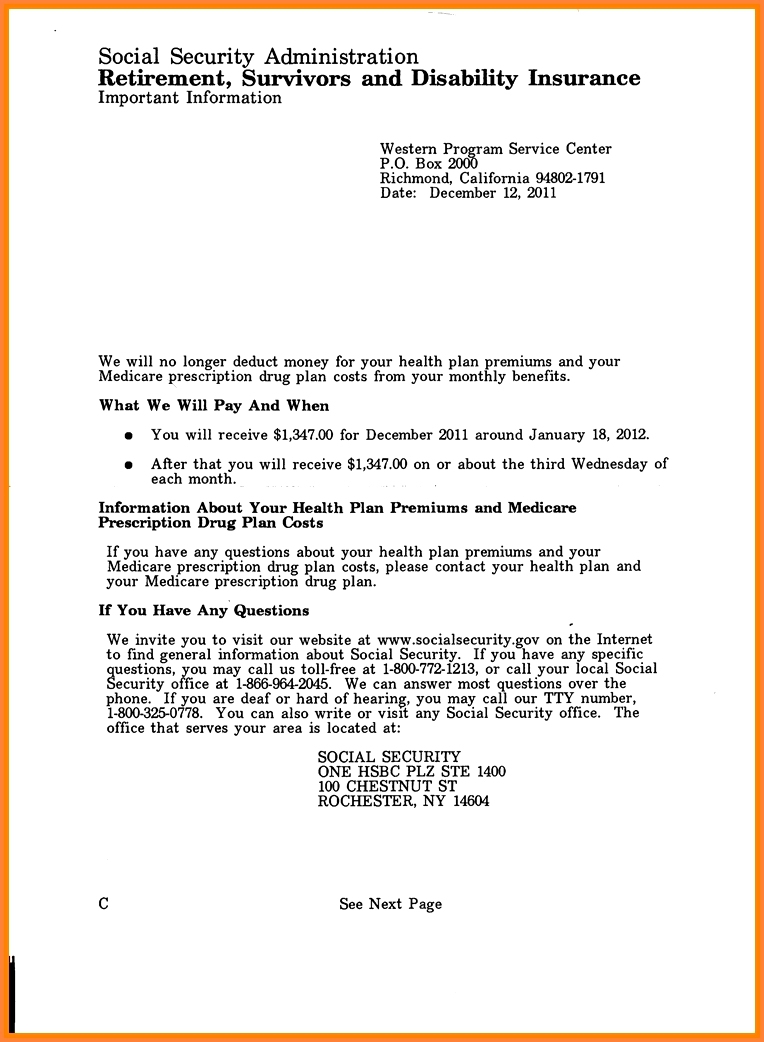

Social Security Calendar Payment 2024 Felipa Cassandry

https://www.uzio.com/resources/wp-content/uploads/2021/09/Social-Security-Wage-Base-Table-2023-1024x791.png

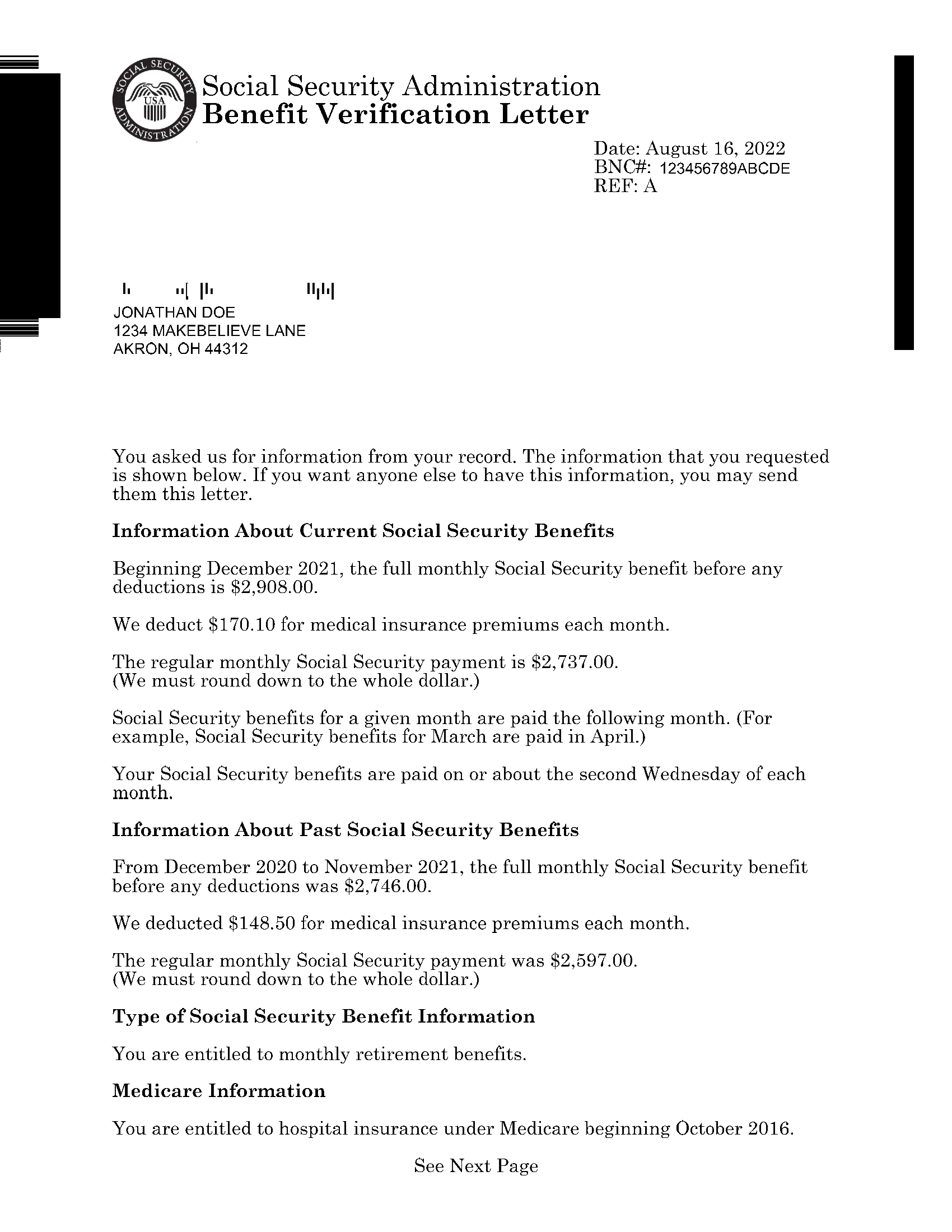

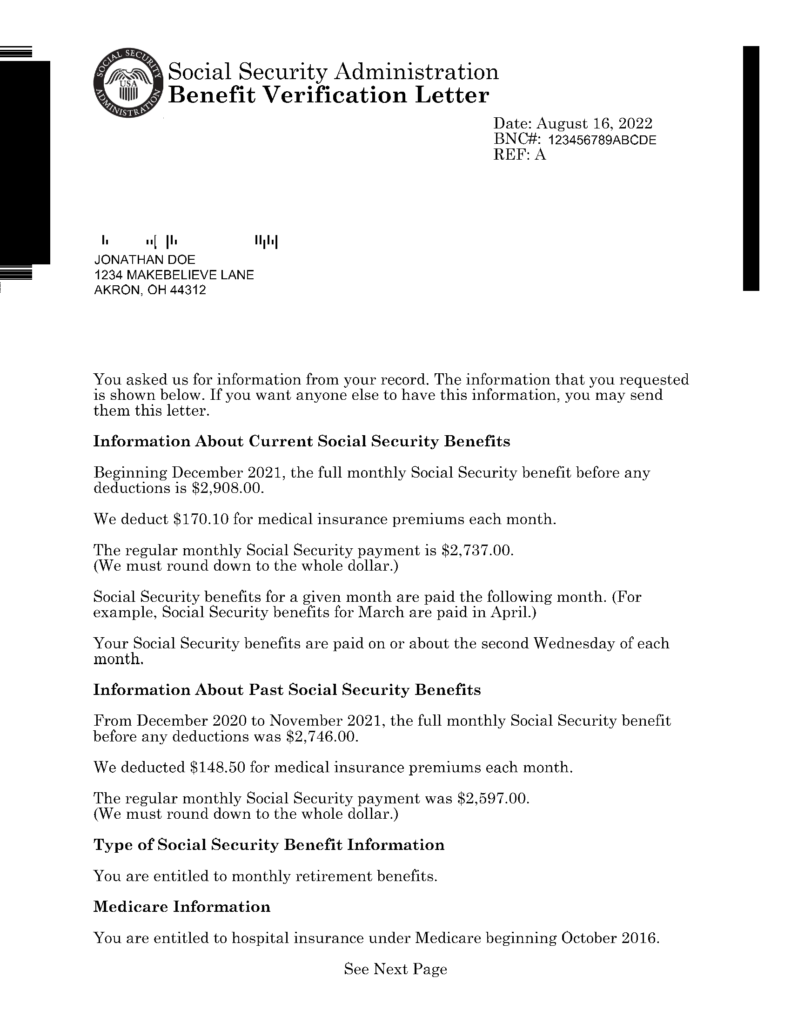

How To Get An Apostille For A Social Security Benefit Verification

https://floridadocument.com/wp-content/uploads/2022/09/EXAMPLE_SOCIAL_SECURITY_BENEFIT_LETTER_1.png

How To Get An Apostille For A Social Security Benefit Verification

https://floridadocument.com/wp-content/uploads/2022/09/EXAMPLE_SOCIAL_SECURITY_BENEFIT_LETTER_1-791x1024.png

La SSI no est vinculada al historial laboral del beneficiario Puedes recibir los beneficios de la SSI si nunca has trabajado ni pagado impuestos del Seguro Social Pero tus ingresos y otros For SSI Social Security defines income much more broadly It can include not just earnings from work but also money received from other sources such as other government

[desc-10] [desc-11]

[img_title-7]

[img-7]

[img_title-8]

[img-8]

https://www.aarp.org › social-security › faq › ssi-eligibility

Supplemental Security Income or SSI is a federal benefit program administered by the Social Security Administration that provides safety net financial support for people in

https://www.aarp.org › social-security

The maximum federal SSI payment in 202 4 is 943 a month for an individual and 1 415 for a married couple who both qualify Benefits can be reduced based on income from

[img_title-9]

[img_title-7]

[img_title-10]

[img_title-11]

[img_title-12]

[img_title-13]

[img_title-13]

[img_title-14]

[img_title-15]

[img_title-16]

What Is Ssi Medical Term - But you can t get SSI if what Social Security calls your countable income exceeds a federally set threshold which in 2025 is 967 a month for individuals and 1 450 for couples