What Is Vat Exempt For Disabled You should provide the information according to parameters and according to the requirements for the structure of the files defined in Appendix No 12 to the Regulations for Application of the

Learn how to check and validate a VAT number check the cross border VAT rules and the rules in your country and see if your business can claim a refund When and how is VAT refunded VAT is subject to refund as a result of exercising the right to tax credit The right to tax credit is the possibility to deduct the VAT paid for the

What Is Vat Exempt For Disabled

What Is Vat Exempt For Disabled

https://i.ytimg.com/vi/E-B4m-tfoFs/maxresdefault.jpg

What Is The Difference Between Zero Rated And Vat Exempt Vat Ex

https://i.ytimg.com/vi/CC5ZvdasbHQ/maxresdefault.jpg

Certificate Of TAX Exemption PAFPI

http://pafpi.org/wp-content/uploads/2017/07/2017-PAFPI-Certificate-of-TAX-Exemption.jpg

A value added tax VAT or goods and services tax GST general consumption tax GCT is a consumption tax that is levied on the value added at each stage of a product s production and The VIES system guarantees the right of tax liable persons carrying out intra Community supplies of goods or services to receive electronic confirmation of the validity of the VAT identification

Value Added Tax VAT is a consumption tax on the value added to nearly all goods and services bought and sold in and into the European Union VAT is an important own resource for the EU Value Added Tax VAT is a consumption tax that is applied to nearly all goods and services that are bought and sold for use or consumption in the EU The EU has standard

More picture related to What Is Vat Exempt For Disabled

Tax Exempt Letter Sample Template With Examples In Pdf Word

https://i0.wp.com/templatediy.com/wp-content/uploads/2023/01/Printable-Tax-Exempt-Letter.jpg?w=1414&ssl=1

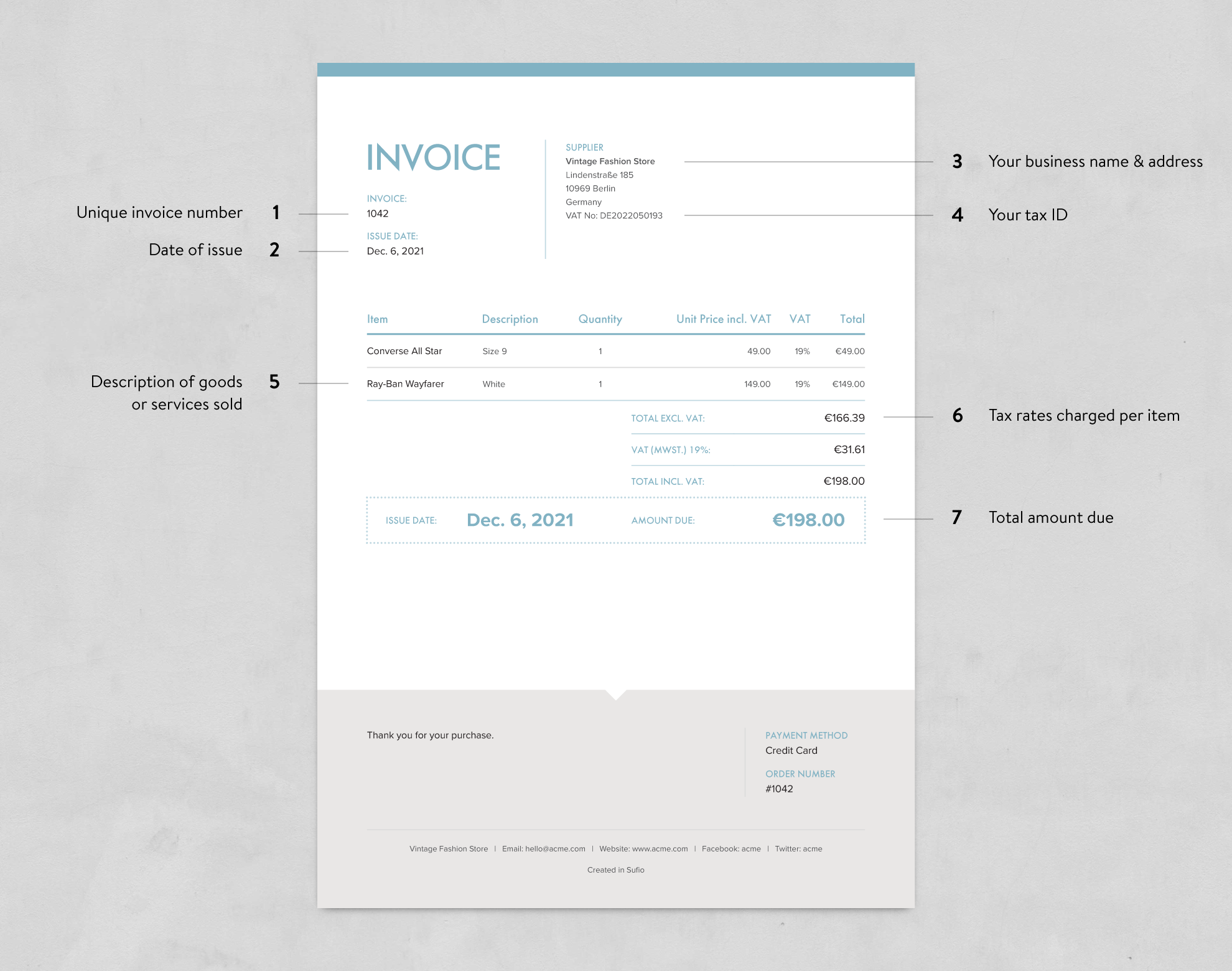

Invoices Explained What Are The Different Types Sufio

https://sufio.com/content/media/images/simplified-invoice_ri5Fx9Q.width-1980.png

Tax Exemption Form 2025 Pdf Ashley Buley

https://www.sanpatricioelectric.org/sites/sanpatricioelectric/files/inline-images/SPEC SALES TAX FORM Example.jpg

Value added tax VAT is collected on a product at every stage of the supply chain where value is added to it from production to point of sale VAT for building and construction VAT for builders Reclaim VAT on a self build home Check when you must use the VAT domestic reverse charge for building and construction services

[desc-10] [desc-11]

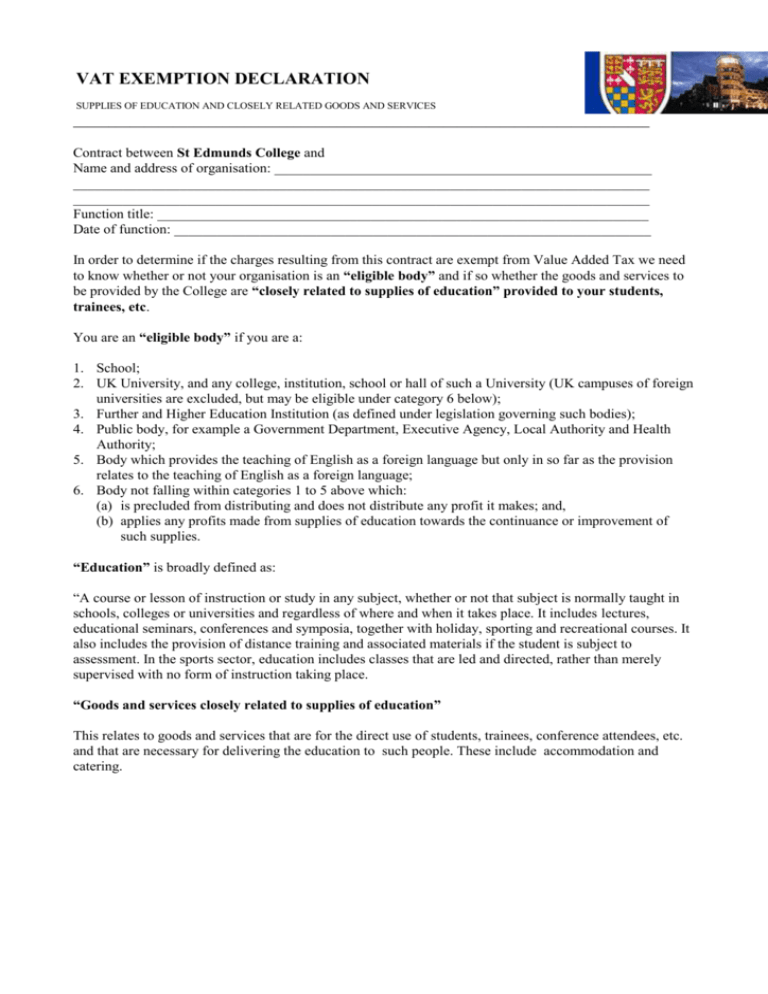

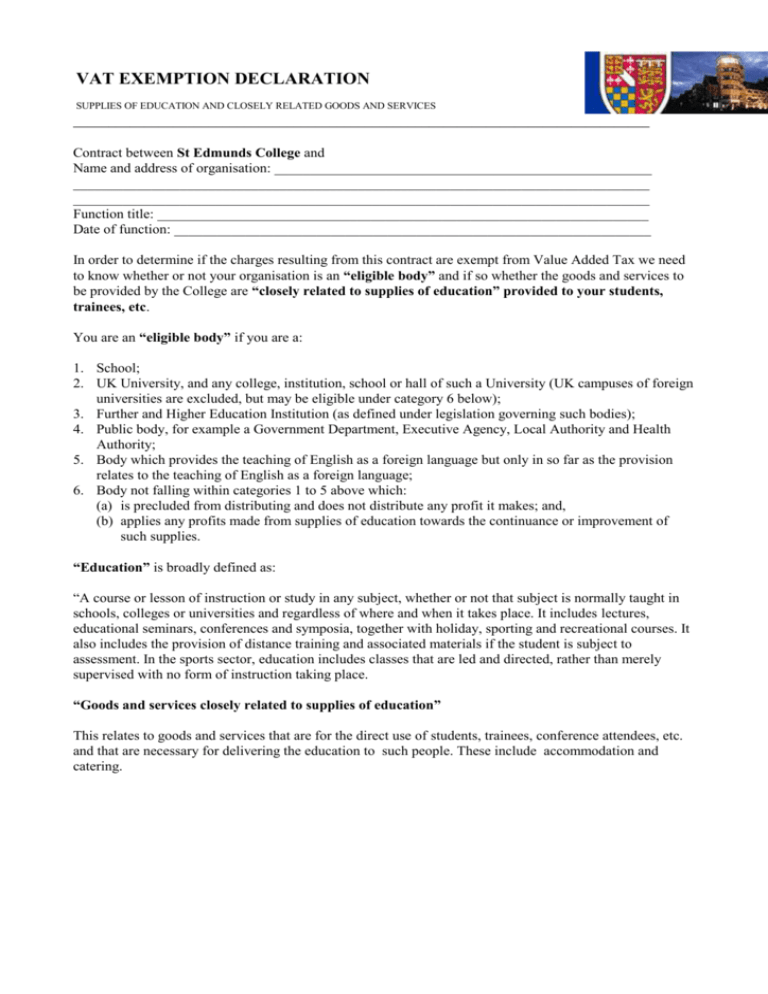

VAT Exemption Declaration Education Supplies

https://s3.studylib.net/store/data/005865607_1-5b279a0808c1f4bd31d5769ee6bc7eac-768x994.png

How To Apply For Vat Exemption Insightx

https://cdn.prod.website-files.com/654b8277b6b0e1f95922bde3/65749fa0de9d869e85f691f0_VAT_Exempt_and_VAT_Zero_Rated_What_s_the_Difference_200d7881af.png

https://www.minfin.bg › en

You should provide the information according to parameters and according to the requirements for the structure of the files defined in Appendix No 12 to the Regulations for Application of the

https://commission.europa.eu › business-economy-euro › ...

Learn how to check and validate a VAT number check the cross border VAT rules and the rules in your country and see if your business can claim a refund

How Taxes Impact Your Financial Planning Process

VAT Exemption Declaration Education Supplies

What Is Exempt VAT Searche

Minimum Salary For Non Exempt Employees 2025 Rebecca Stewarts

Are Salaries Exempt From VAT Searche

Zero Rated VAT Items In UK AccountingFirms

Zero Rated VAT Items In UK AccountingFirms

Minimum Salary For Non Exempt Employees 2025 Sandra Mitchell

Exempt Disabled Children From Private School VAT Peer Urges

Comparing Zero Rated VAT Items And Exempt Items CruseBurke

What Is Vat Exempt For Disabled - [desc-14]