20 30 50 Rule Welcome to the Omni 50 30 20 rule calculator a convenient and straightforward tool that helps you ration your disposable income income that you receive after deduction of taxes into three categories needs wants and savings

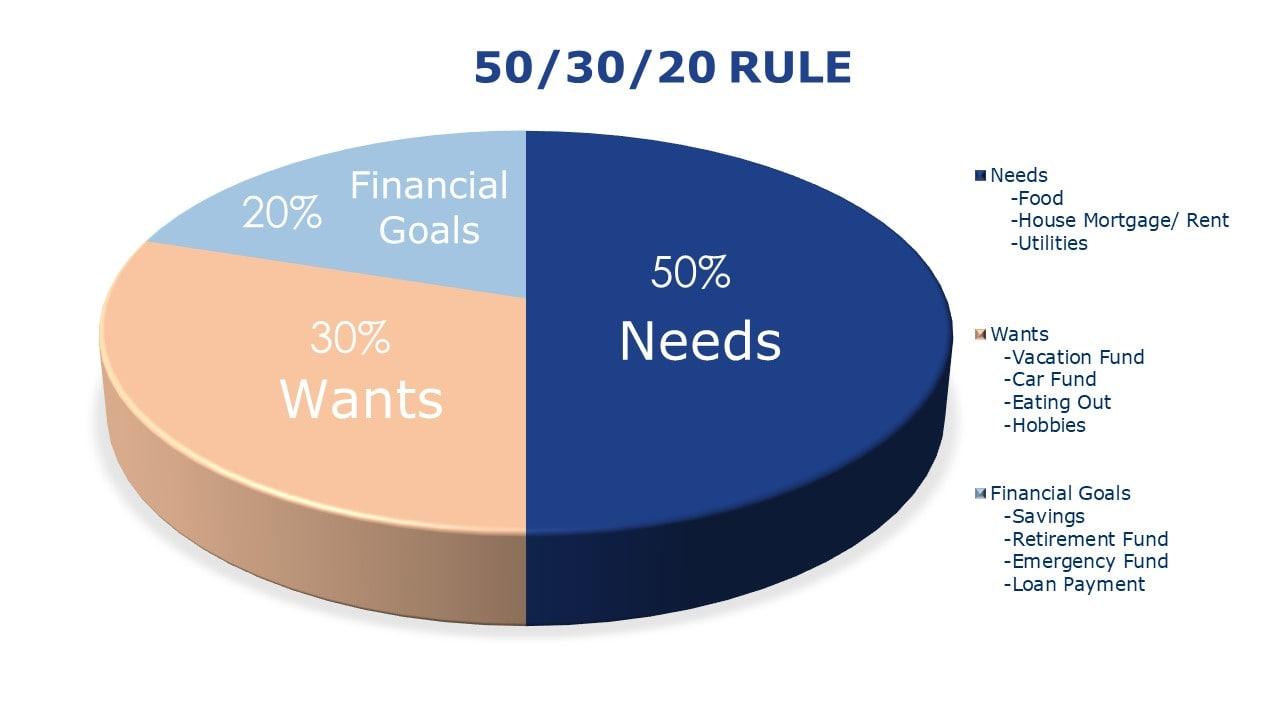

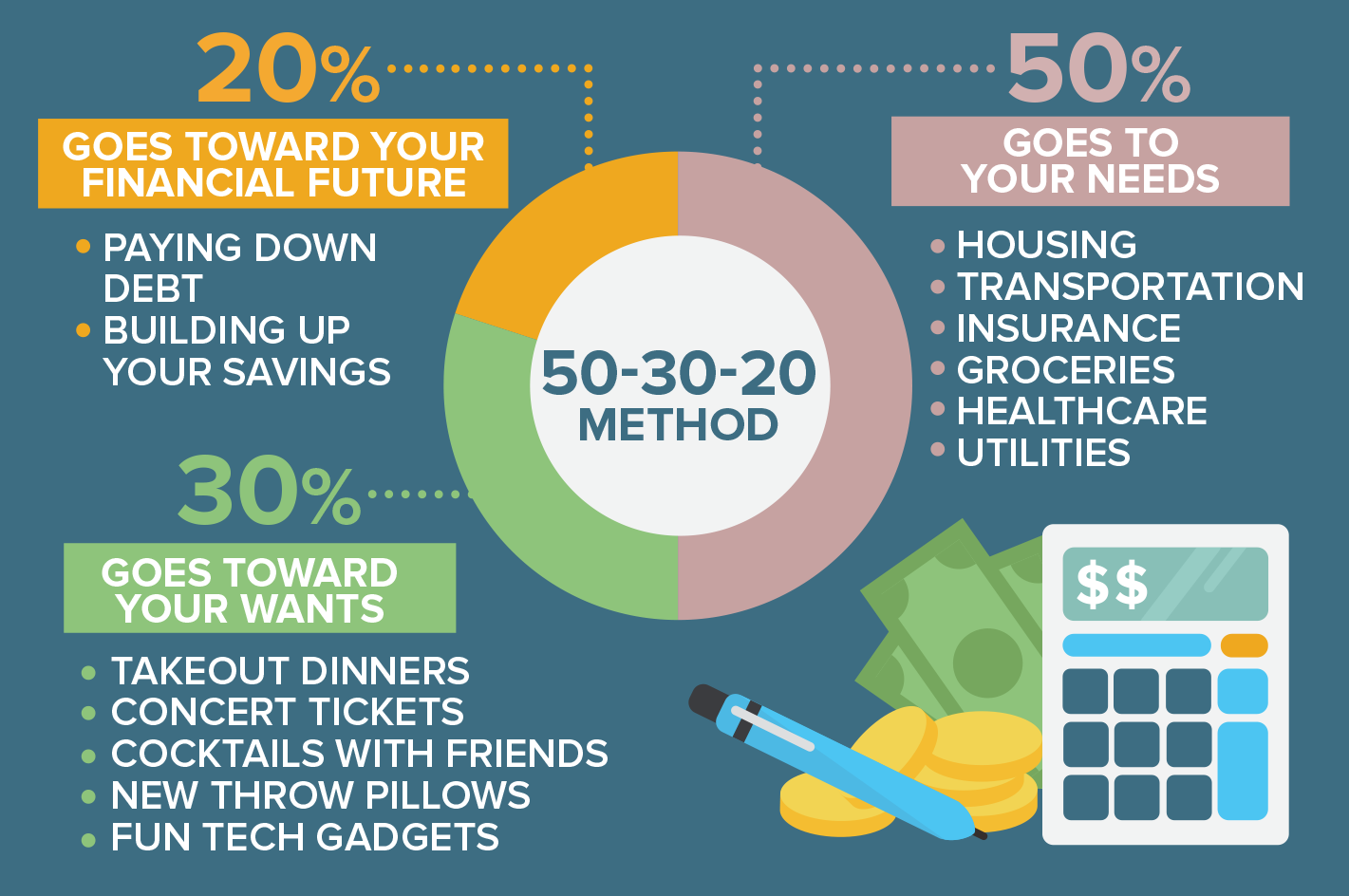

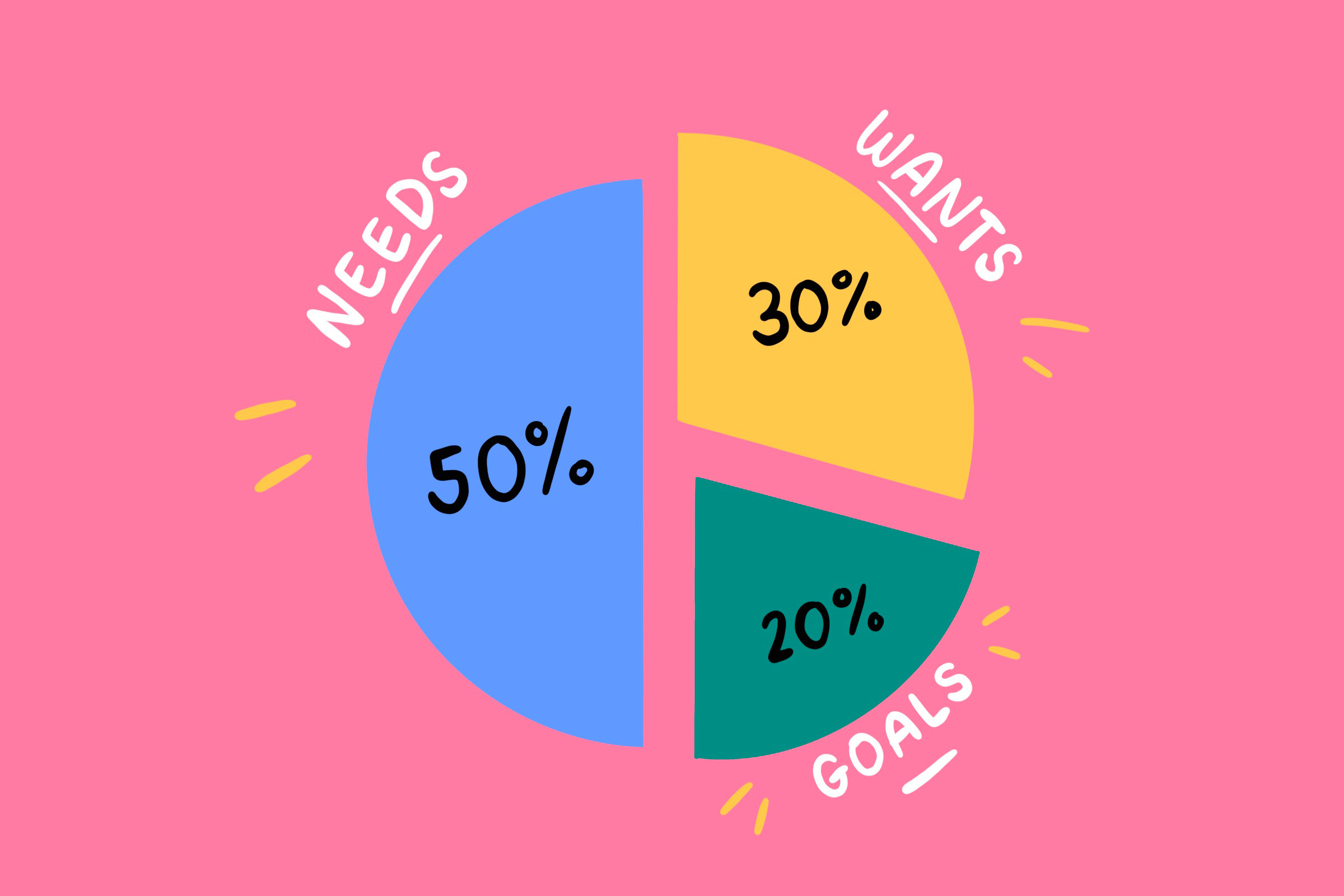

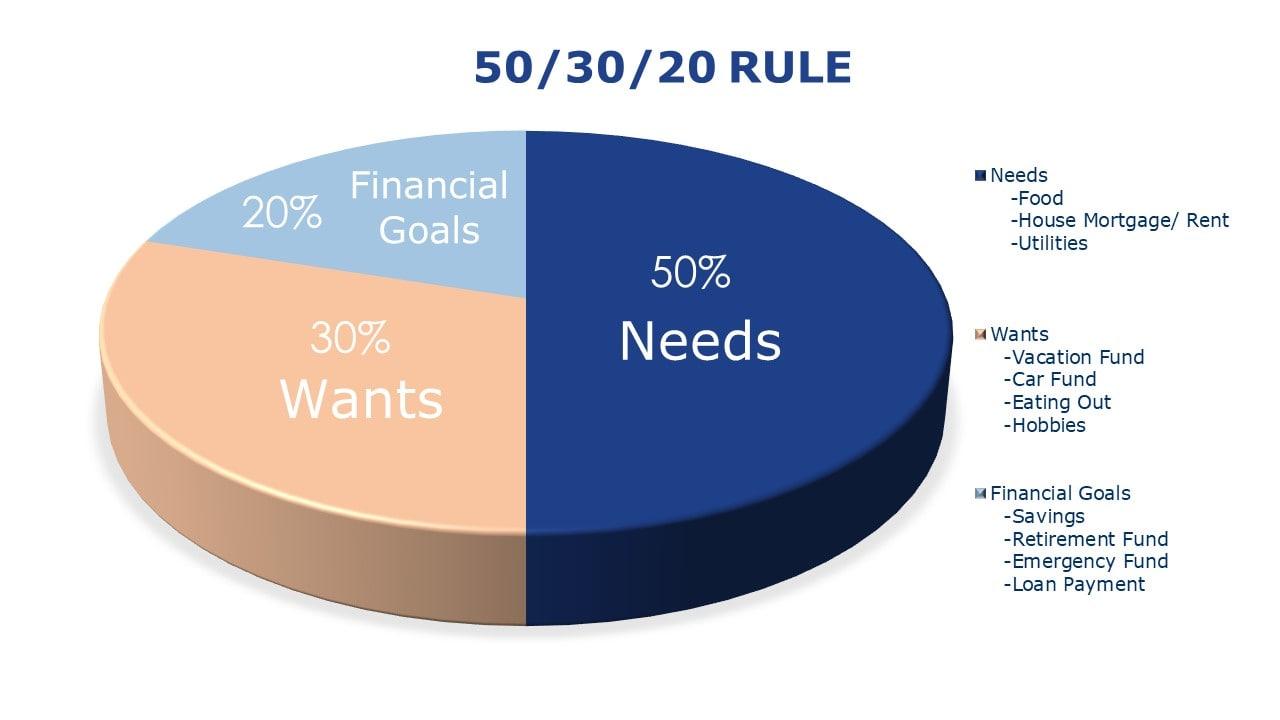

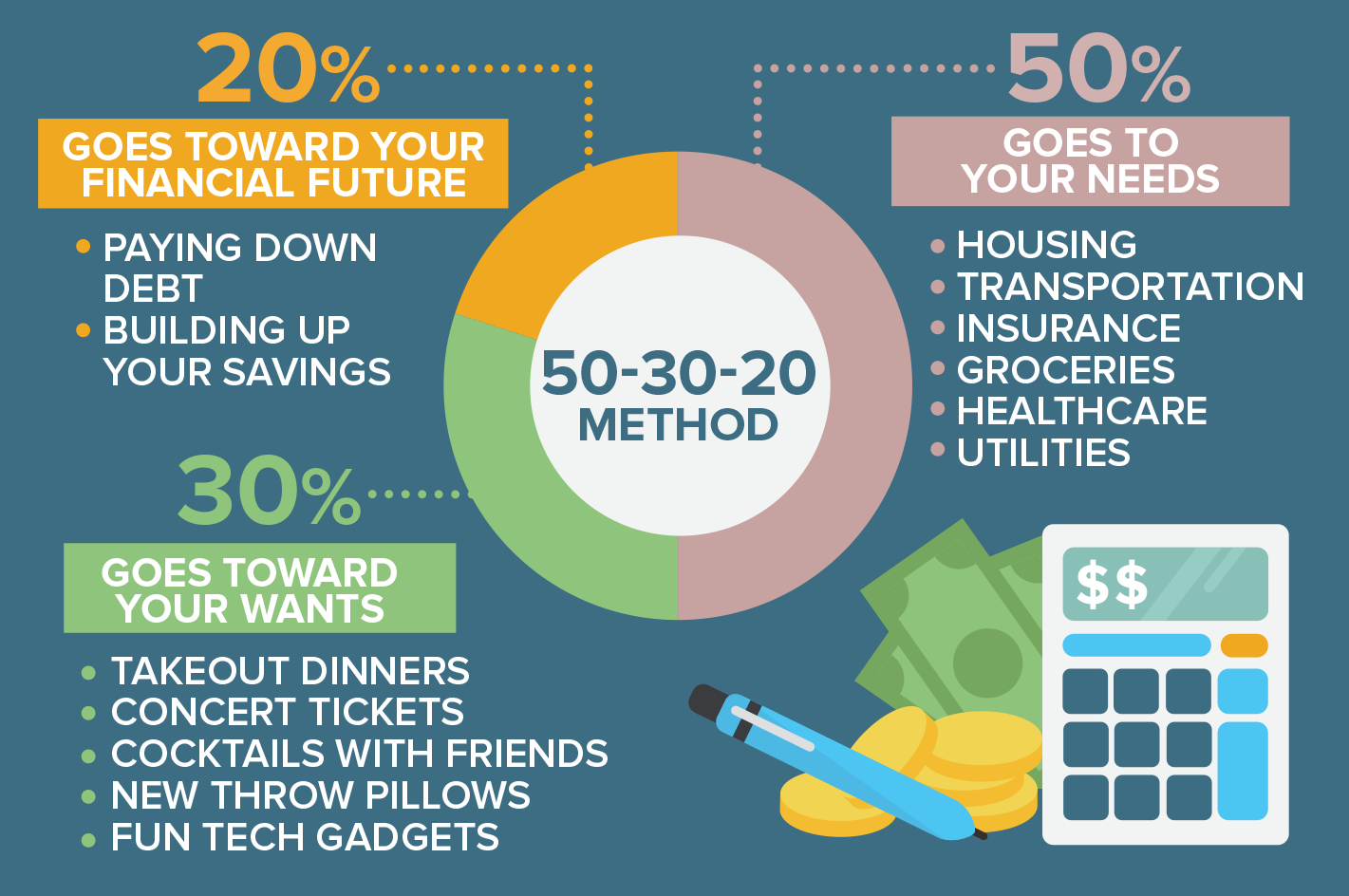

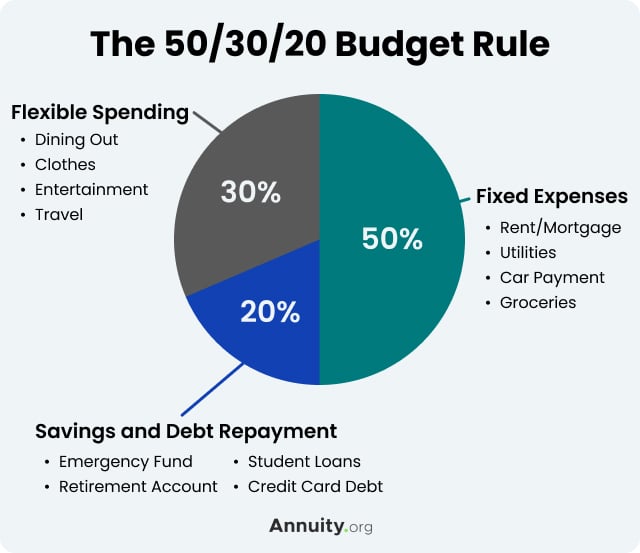

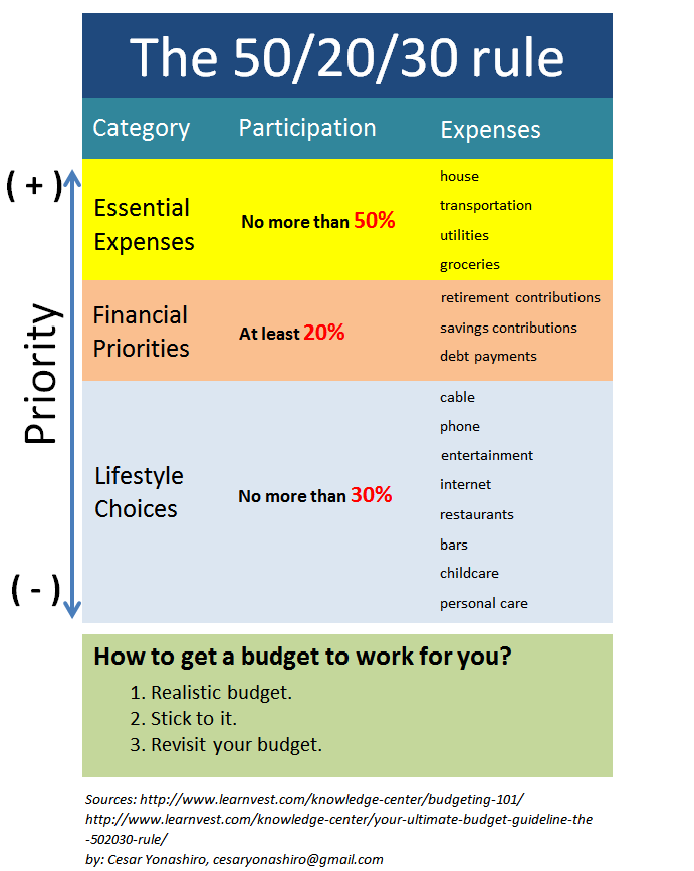

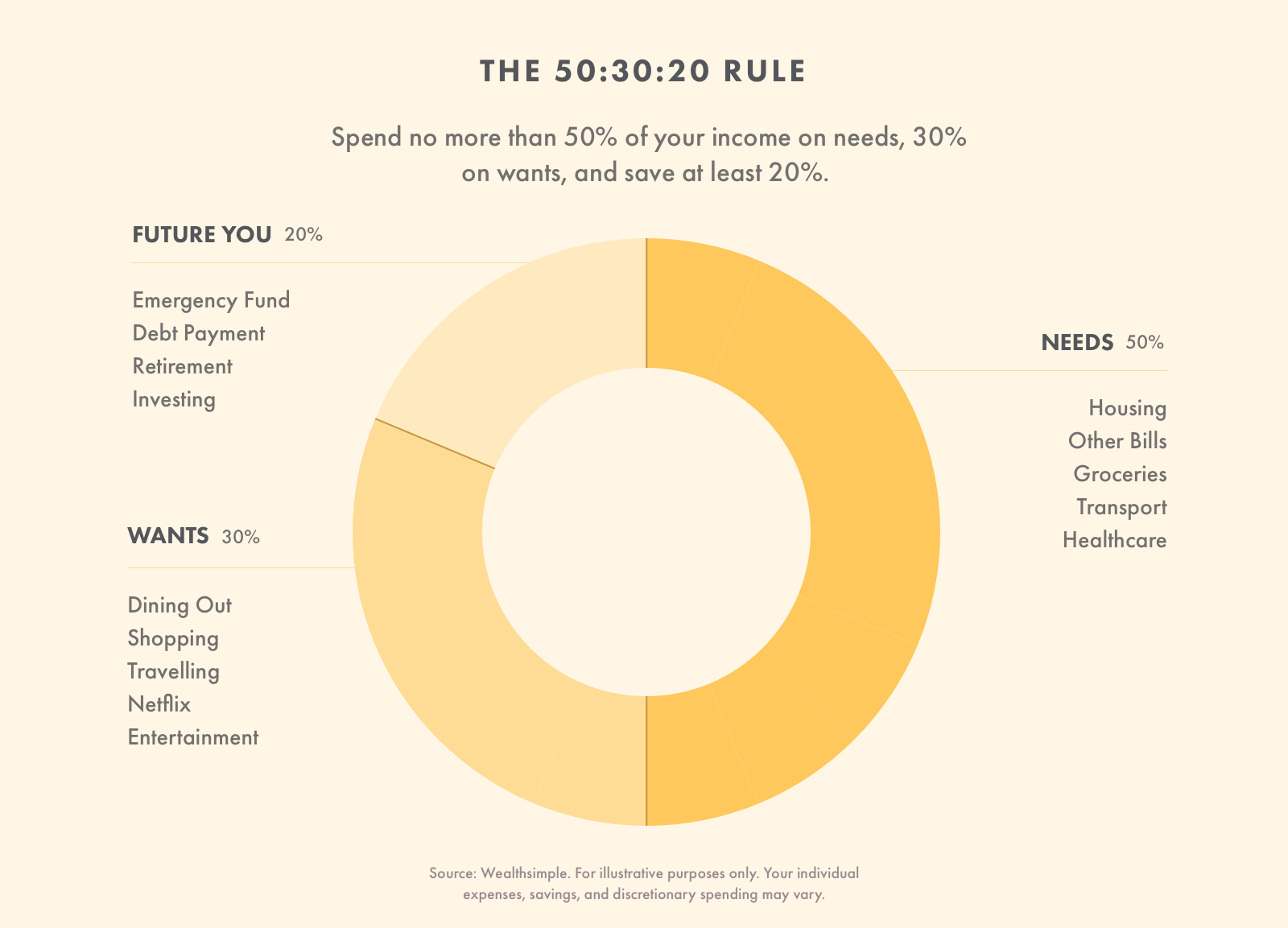

What Is the 50 30 20 Budget Rule The 50 30 20 budget rule is a simple and effective method for managing personal finances This rule allocates after tax income into three main categories 50 for needs 30 for wants and 20 for savings and debt repayment The 50 30 20 system was designed to make budgeting more accessible to people who get overwhelmed by complicated spreadsheets and budgeting apps It was popularized by Senator Elizabeth Warren in her book All Your Worth The Ultimate Lifetime Money Plan

20 30 50 Rule

20 30 50 Rule

https://pesowisemom.com/wp-content/uploads/2022/06/50-30-20-rule-on-budgeting.jpg

How 50 20 30 Rule Will Change Your Life Finance Expert

https://bankonus.com/finance-expert/wp-content/uploads/2018/11/d4b56bad34702ffb869c6e9628f996f6-1.png

How To Use The 50 30 20 Rule For Budgeting Your Money

https://www.kindafrugal.com/wp-content/uploads/50-30-20-rule-021.png

Our 50 30 20 calculator divides your take home income or the money that goes into your account after taxes into suggested spending in three categories 50 of net pay for needs 30 for The 50 30 20 rule is a budgeting technique that involves dividing your money into three primary categories based on your after tax income i e your take home pay 50 to needs 30 to

The 50 30 20 rule of thumb is a guideline for allocating your budget accordingly 50 to needs 30 to wants and 20 to your financial goals The rule was popularized in a book by U S Senator Elizabeth Warren and her daughter Amelia Warren Tyagi The 50 30 20 rule is a budgeting strategy developed by Senator Elizabeth Warren and her daughter Amelia Warren Tyagi introduced in their book All Your Worth The Ultimate Lifetime Money Plan This personal finance approach divides your after tax income the money you actually take home after taxes and other deductions into three main

More picture related to 20 30 50 Rule

How To Follow The 50 30 20 Rule

https://img.buzzfeed.com/buzzfeed-static/static/2021-04/17/1/asset/21e91fced15a/sub-buzz-16544-1618621303-8.jpg

50 30 20 Budget Rule How To Make A Realistic Budget Budget Planning

https://i.pinimg.com/originals/11/2a/60/112a60d1d8e14eaba23e6d1a255a893f.png

Understanding The 50 30 20 Rule To Help You Save MagnifyMoney

https://www.magnifymoney.com/wp-content/uploads/2019/06/Graphic-1.png

The 50 30 20 rule is a budgeting method where you divide your monthly after tax income into three categories needs 50 wants 30 and savings 20 While the 50 30 20 rule prioritizes needs before wants and encourages you to As the 50 30 20 rule dictates 20 percent of your post tax income must be saved and then utilized through investments Please note unlike needs and wants savings should be non negotiable and need to be a top priority

[desc-10] [desc-11]

The 20 30 50 Budgeting Rule

https://spotmoney.com/wp-content/uploads/2022/12/20-30-40-infographic-mobile-768x891.jpg

The 20 30 50 Budgeting Rule

https://spotmoney.com/wp-content/uploads/2022/12/20-30-50-infographic-desktop.jpg

https://www.omnicalculator.com › finance

Welcome to the Omni 50 30 20 rule calculator a convenient and straightforward tool that helps you ration your disposable income income that you receive after deduction of taxes into three categories needs wants and savings

https://www.financestrategists.com › financial-advisor › personal-finance

What Is the 50 30 20 Budget Rule The 50 30 20 budget rule is a simple and effective method for managing personal finances This rule allocates after tax income into three main categories 50 for needs 30 for wants and 20 for savings and debt repayment

The 50 30 20 Budget Rule And How To Apply It Estradinglife

The 20 30 50 Budgeting Rule

50 30 20 Budgeting Rule What It Is And How To Use It

Prinsip 50 30 20 David Wijaya

Keep Your Budget Simple With The 50 30 20 Rule

How To Budget Using The 50 20 30 Rule Investment Guru

How To Budget Using The 50 20 30 Rule Investment Guru

What Is The 50 30 20 Budget Rule Chip

Economy And Finance Box How To Budget Your Money The 50 20 30 Rule

HOW TO FOLLOW THE 50 30 20 RULE THE REBEL MAMA

20 30 50 Rule - [desc-12]