Ayurvedic Treatment For Hair Fall And Dandruff Use the Simple tax calculator to work out just the tax you owe on your taxable income for the full income year Use the Income tax estimator to work out your tax refund or

From 1 July 2025 ATO interest charge s General and Shortfall will no longer be tax deductible Announced measures are subject to the passage of legislation This page was last modified In Australia financial years run from 1 July to 30 June the following year so we are currently in the 2025 26 financial year 1 July 2025 to 30 June 2026 The income tax brackets and rates

Ayurvedic Treatment For Hair Fall And Dandruff

Ayurvedic Treatment For Hair Fall And Dandruff

https://live.staticflickr.com/65535/53198405643_6bb421b795_b.jpg

Hair Fall And Thinning Of Hair Are Common Issues Today Modern

https://i.pinimg.com/originals/b8/e4/e2/b8e4e23f9f974a770bc71a583ae271a7.jpg

Ayurvedic Treatment For Hair Loss

https://www.totalayurveda.in/wp-content/uploads/2018/01/Ayurvedic-Treatment-for-Hair-loss-1024x512.jpeg

Tax and salary calculator for the 2025 2026 financial year Also calculates your low income tax offset HELP SAPTO and medicare levy Last year the Government cut two rates and lifted two thresholds to deliver tax cuts for all Australian taxpayers including cutting the rate that applies to taxable income earned between

Currently at 16 for the 2024 25 and 2025 26 income years this rate will reduce to 15 for the 2026 27 income year and to 14 for the 2027 28 and future income years The thresholds Tax brackets set the rates applied to your taxable income each financial year from 1 July to 30 June Australia uses a progressive tax system meaning higher income faces higher rates but

More picture related to Ayurvedic Treatment For Hair Fall And Dandruff

Best Ayurvedic Treatment For Hair Fall In Calicut She Ayurveda

https://www.sheayurveda.com/blog/wp-content/uploads/2020/08/Untitled-design.png

Neelambari Ayurvedic Hair Care Adivasi Herbal Hair Oil Made By Pure

https://m.media-amazon.com/images/I/610Ive5GbZL.jpg

Natural Ways To Do Dandruff Treatment At Home TOP 5 DIY

https://3.bp.blogspot.com/-0oGyNZjeuXc/W5D7AWvPCXI/AAAAAAAAHAA/4jMUolWI26MM6-hKfHjjQ7cKs1y_txEEwCLcBGAs/s1600/2.jpg

24 25 to 2 25 in 2025 26 and 2 5 in 2026 27 Inflation is expected to be 2 5 through the year to the June quarter 2025 0 25 of a percentage point lower than the Mid Year Economic The current 16 tax rate will be reduced to 15 from 1 July 2026 and will be further reduced to 14 from 1 July 2027 A taxpayer earning between 18 201 and 45 000 will get a tax cut of

[desc-10] [desc-11]

Ayurvedic Treatment For Hair Regrowth

https://www.totalayurveda.in/wp-content/uploads/2023/10/Ayurvedic-Treatment-for-Hair-Regrowth.jpeg

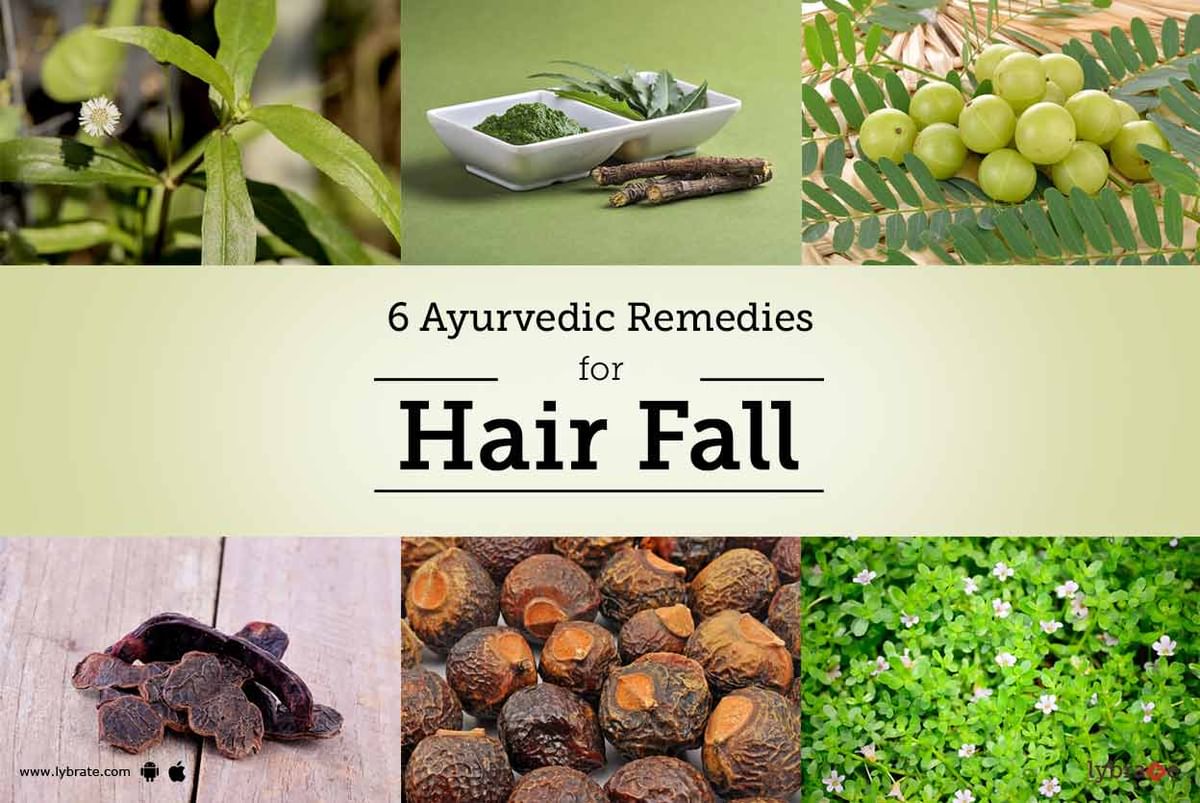

6 Ayurvedic Remedies For Hair Fall By Dr Sandhya Krishnamurthy Lybrate

https://assets.lybrate.com/q_auto,f_auto,w_1200/eagle/uploads/32d9699bc65e483234643dfbc6315da9/642f1b.jpg

https://www.ato.gov.au › tax-rates-and-codes › tax...

Use the Simple tax calculator to work out just the tax you owe on your taxable income for the full income year Use the Income tax estimator to work out your tax refund or

https://atotaxrates.info › individual-tax-rates-resident

From 1 July 2025 ATO interest charge s General and Shortfall will no longer be tax deductible Announced measures are subject to the passage of legislation This page was last modified

5 Useful Ayurvedic Tips To Manage Combination Skin

Ayurvedic Treatment For Hair Regrowth

7 Ayurvedic Herbs For Hair Loss And Hair Growth

10 Best Treatment For Hair Loss In Ayurveda

Best Ayurvedic Treatment For Hair Fall Dandruff Dr Yogesh Chavan MD

Types Of Dandruff And How To Prevent Them Head Shoulders IN

Types Of Dandruff And How To Prevent Them Head Shoulders IN

15 Ayurvedic Remedies For Hair Fall And Hair Regrowth Fab Beauty Tips

Hair Fall Treatment Flood Gates Plastic Surgery Clinic

Dr Mrinalini Gupta Best Ayurvedic Doctor In Mohali Best Ayurvedic

Ayurvedic Treatment For Hair Fall And Dandruff - Currently at 16 for the 2024 25 and 2025 26 income years this rate will reduce to 15 for the 2026 27 income year and to 14 for the 2027 28 and future income years The thresholds