How Many Types Of Taxes Are There This page a companion page to tax lists different taxes by economic design For different taxes by country see Tax rates around the world Taxes generally fall into the following broad categories Income tax Payroll tax Property tax Consumption tax Tariff taxes on international trade Capitation a fixed tax charged per person Fees and tolls

Presently the tax system in Pakistan is primarily based on the Income Tax Ordinance of 1979 a comprehensive framework divided into 11 parts and 245 sections This extensive law covers diverse topics including income definition taxable income determination tax liability calculation and tax collection This article aims to provide a comprehensive overview of the tax system in Pakistan covering the different types of taxes their rates and the process of filing and paying them What are Taxes At its core a tax is a mandatory financial contribution levied by the government on individuals and businesses

How Many Types Of Taxes Are There

How Many Types Of Taxes Are There

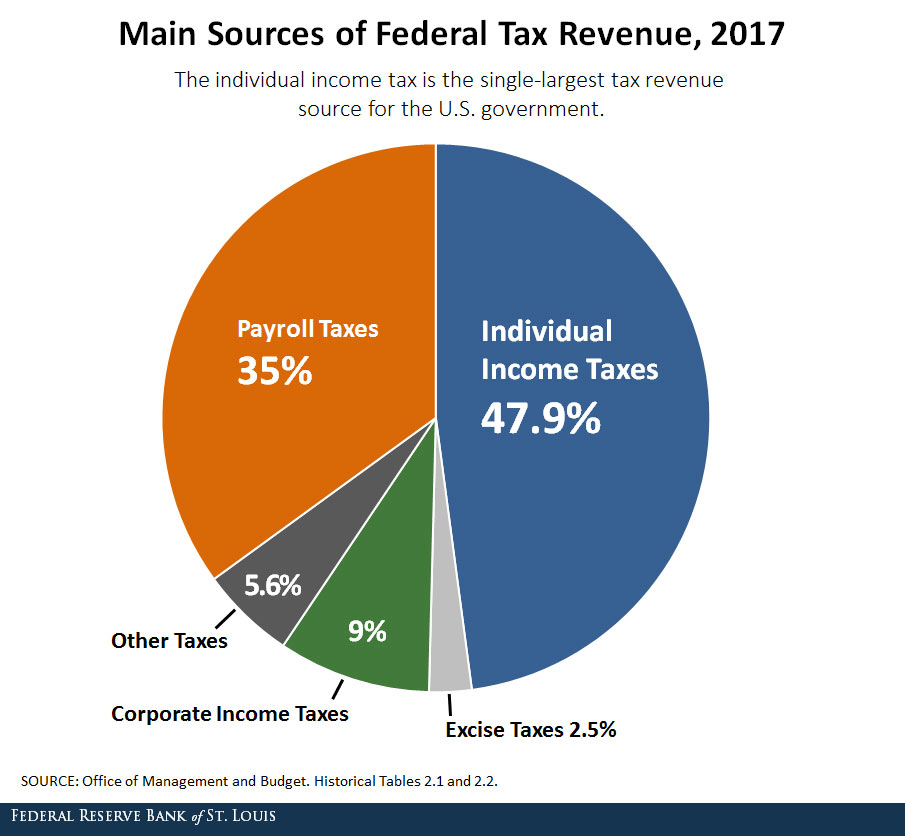

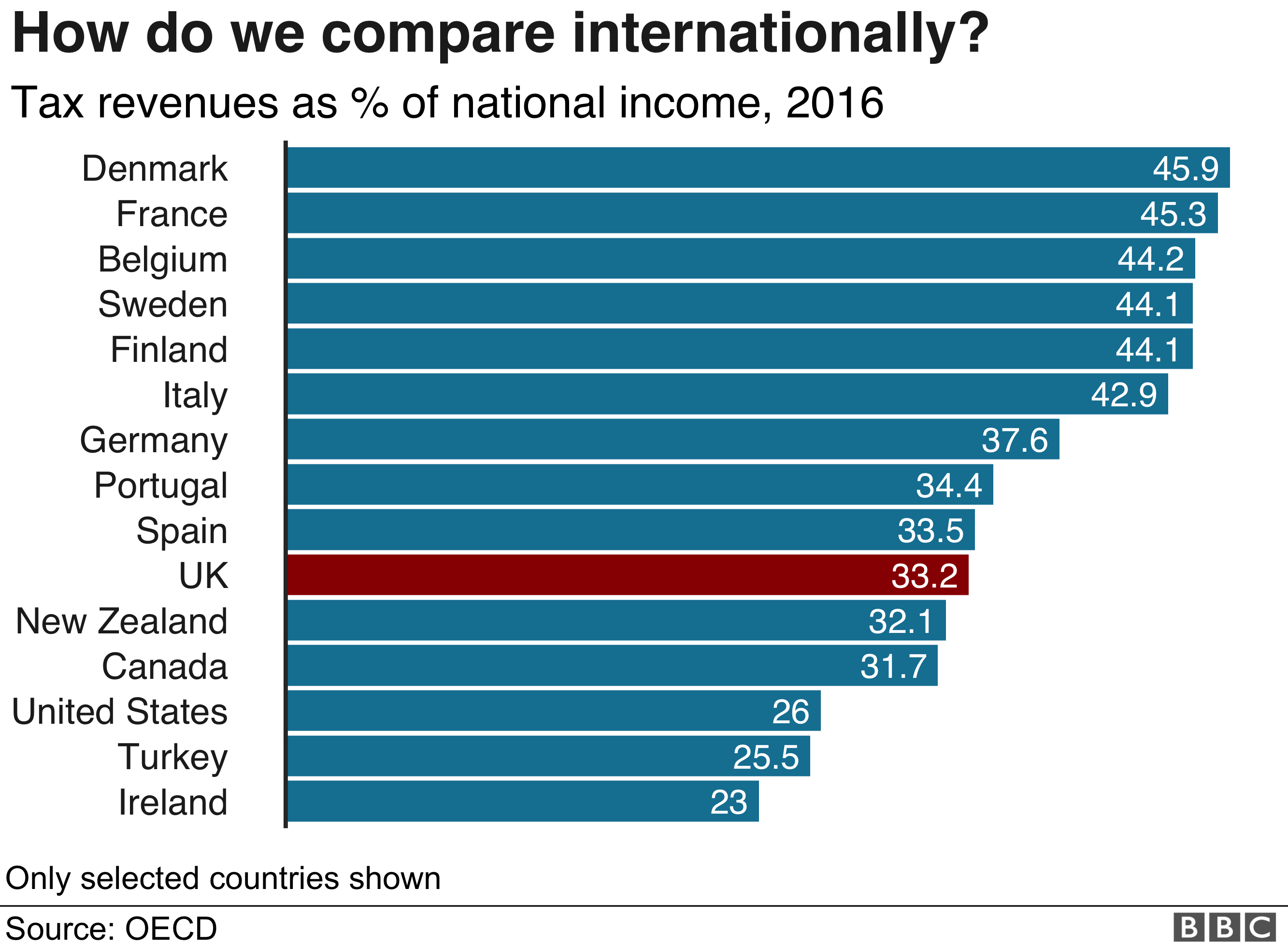

https://www.stlouisfed.org/-/media/project/frbstl/stlouisfed/blog/2018/march/ovtax_part1_taxsources-piechart_blog.jpg

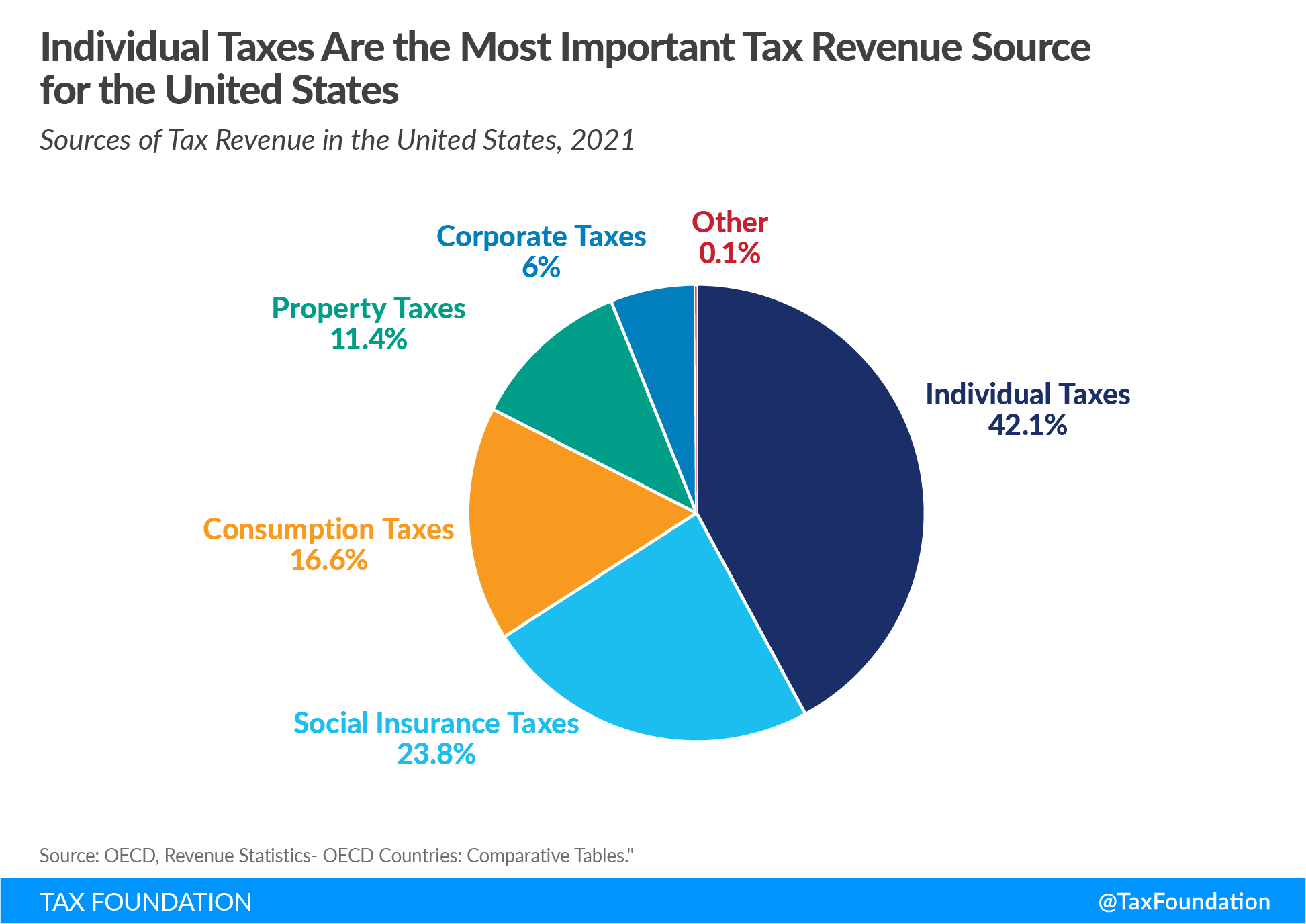

Different Types Of Taxes We Pay In The US If You Want To Know What

https://i.pinimg.com/736x/b3/f8/0e/b3f80e5fd621a84c87c68e9e3f2ed053.jpg

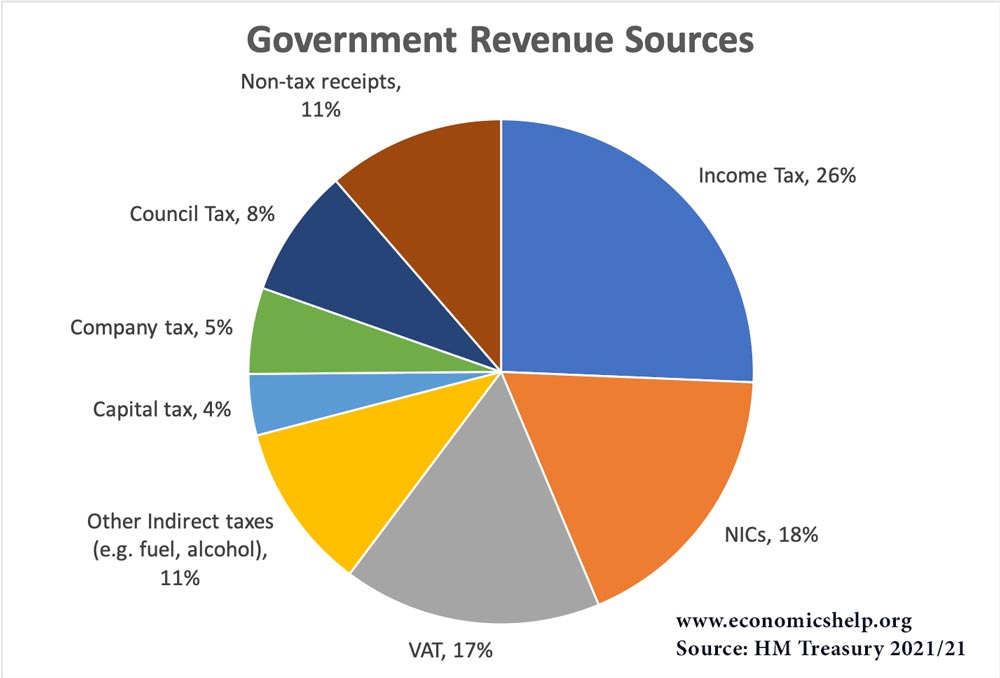

Types Of Tax In UK Economics Help

https://www.economicshelp.org/wp-content/uploads/2014/12/tax-pie-chart.jpg

In Pakistan taxes are imposed on various entities including individuals corporations and businesses In this article we will discuss the different types of taxes in Pakistan Income Tax In Pakistan there are mainly following types of taxes Income Tax Tax on individuals and businesses on income and payments against goods and services Sales Tax Sales Tax is charged on the goods and services Federal Excise Duty It is tax on some particular goods and services Customs Duty This tax is on imported goods

There are different types of taxes imposed by the government of Pakistan in the country to regulate and maintain financial records These taxes are If an individual s salary income exceeds 75 of his or her taxable income the following rates apply In other cases individuals and associations of persons or AOP the following tax rates apply Income Tax Income tax is imposed on individuals and businesses based on their income level The tax rate varies depending on the income bracket and can range from 2 5 to 35 Taxpayers are required to file their income tax returns annually Sales Tax Sales tax is imposed on the sale of goods and services at a rate of 17

More picture related to How Many Types Of Taxes Are There

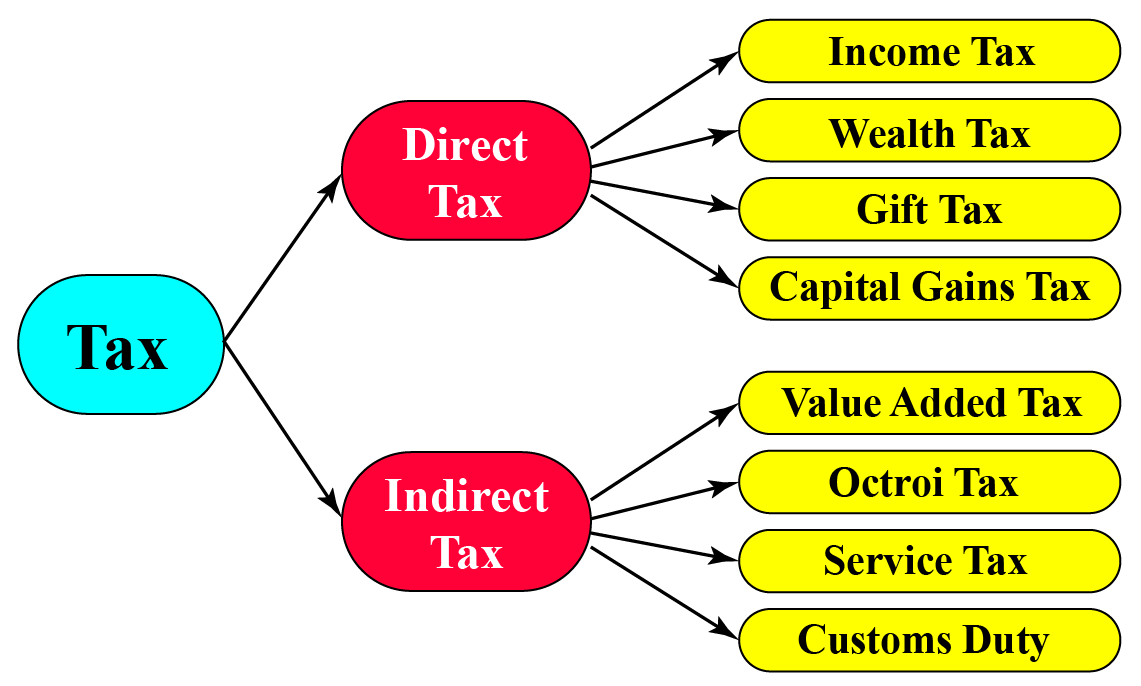

Indirect Tax

https://d138zd1ktt9iqe.cloudfront.net/media/seo_landing_files/priya-gupta-a-taxes-04-1609861613.png

2025 To 2025 Tax Brackets Wesley Abbot

https://smartzonefinance.com/wp-content/uploads/2018/06/taxes-a03-g01.png

Estimating 2025 Federal Taxes Erinna Delores

https://taxfoundation.org/wp-content/uploads/2023/02/US_OECD_rev2023_3.png

Explore the 13 types of income tax in Pakistan including corporate tax personal income tax withholding tax property tax and more in this detailed guide Every government imposes taxes on almost every product service good firm income and business The federal tax system of Pakistan is simplified into two types direct tax and indirect tax The agencies automatically cut down some taxes on behalf of the government such as income tax

[desc-10] [desc-11]

State Taxes 2025 Mamie Kayley

https://staticweb.usafacts.org/media/images/1-highest-state-income-taxes-usafacts.width-1000.png

State Taxes 2025 Mamie Kayley

https://static4.businessinsider.com/image/5c084ad44598b50d593407c2-1200/income taxes per state.png

https://en.wikipedia.org › wiki › List_of_taxes

This page a companion page to tax lists different taxes by economic design For different taxes by country see Tax rates around the world Taxes generally fall into the following broad categories Income tax Payroll tax Property tax Consumption tax Tariff taxes on international trade Capitation a fixed tax charged per person Fees and tolls

https://www.faco.pk › types-of-taxes-in-pakistan

Presently the tax system in Pakistan is primarily based on the Income Tax Ordinance of 1979 a comprehensive framework divided into 11 parts and 245 sections This extensive law covers diverse topics including income definition taxable income determination tax liability calculation and tax collection

Canada Tax Increase 2025 Nabil Naomi

State Taxes 2025 Mamie Kayley

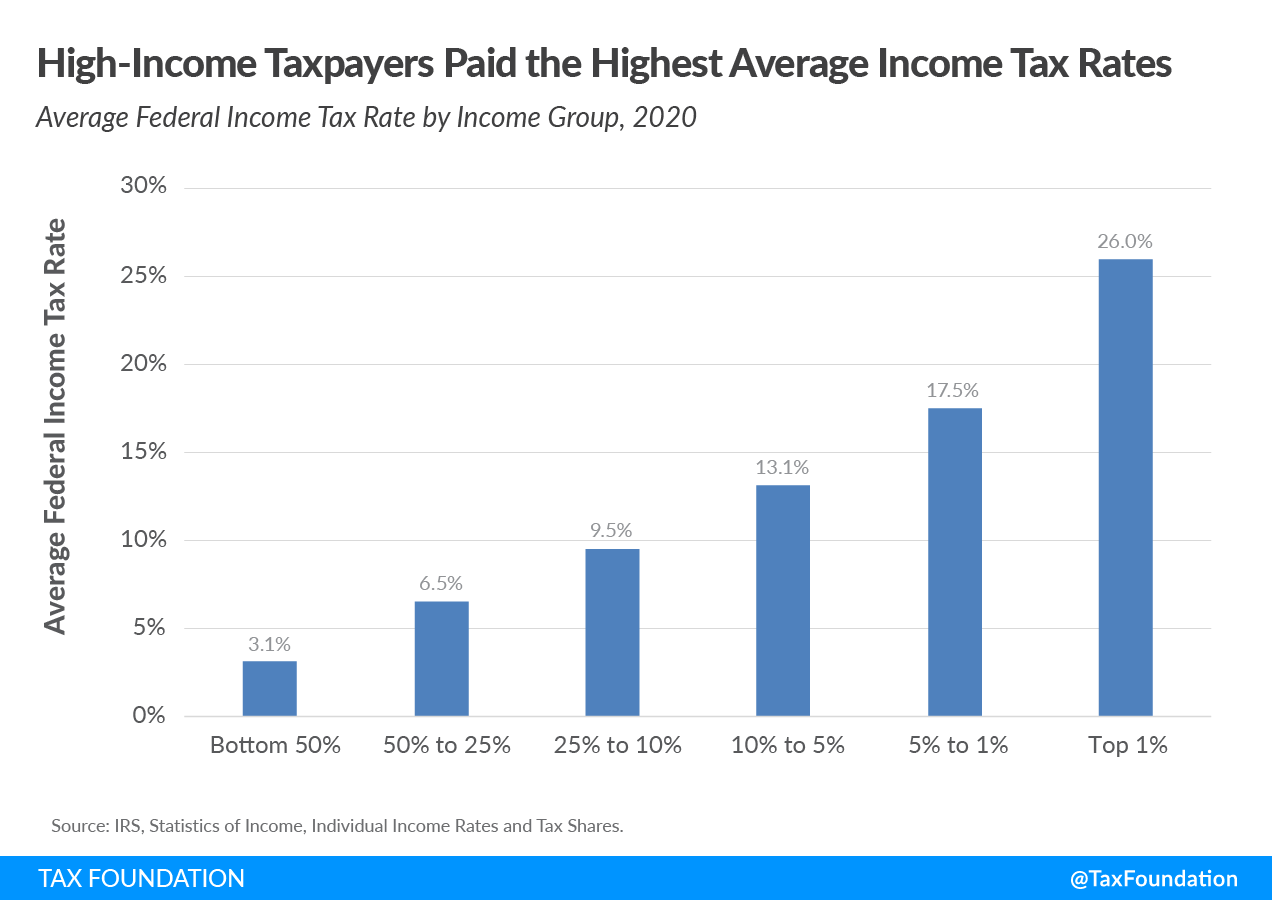

Tax Revenue Sources In UK Economics Help

Dividend Tax Rate 2025 Usa Sora Vanlinden

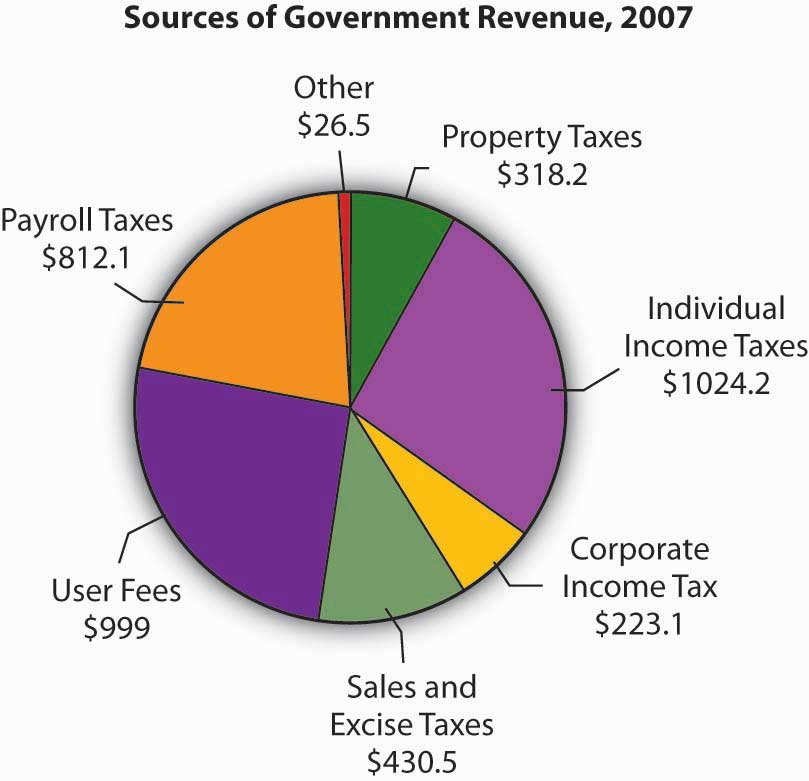

Progressive Tax Definition TaxEDU Tax Foundation

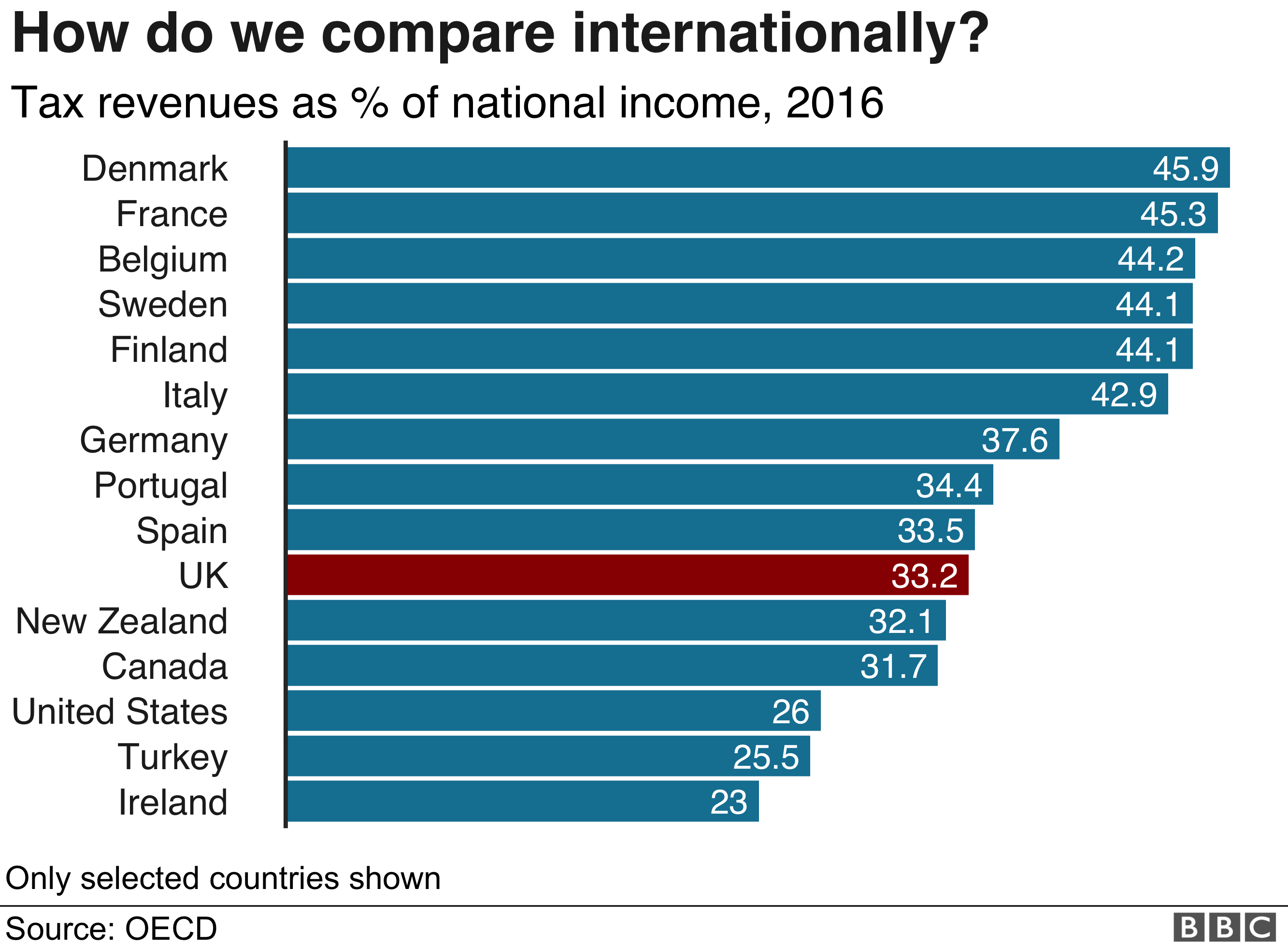

General Election 2019 How Much Tax Do British People Pay BBC News

General Election 2019 How Much Tax Do British People Pay BBC News

Lectura Tipos De Impuestos Microeconom a Kompremos

What Is A Capital Gains Tax Michael Lodge The Business Advisor

Nuevas Tasas Del IRS 2025 Impacto Fiscal The Us Marketer

How Many Types Of Taxes Are There - There are different types of taxes imposed by the government of Pakistan in the country to regulate and maintain financial records These taxes are If an individual s salary income exceeds 75 of his or her taxable income the following rates apply In other cases individuals and associations of persons or AOP the following tax rates apply