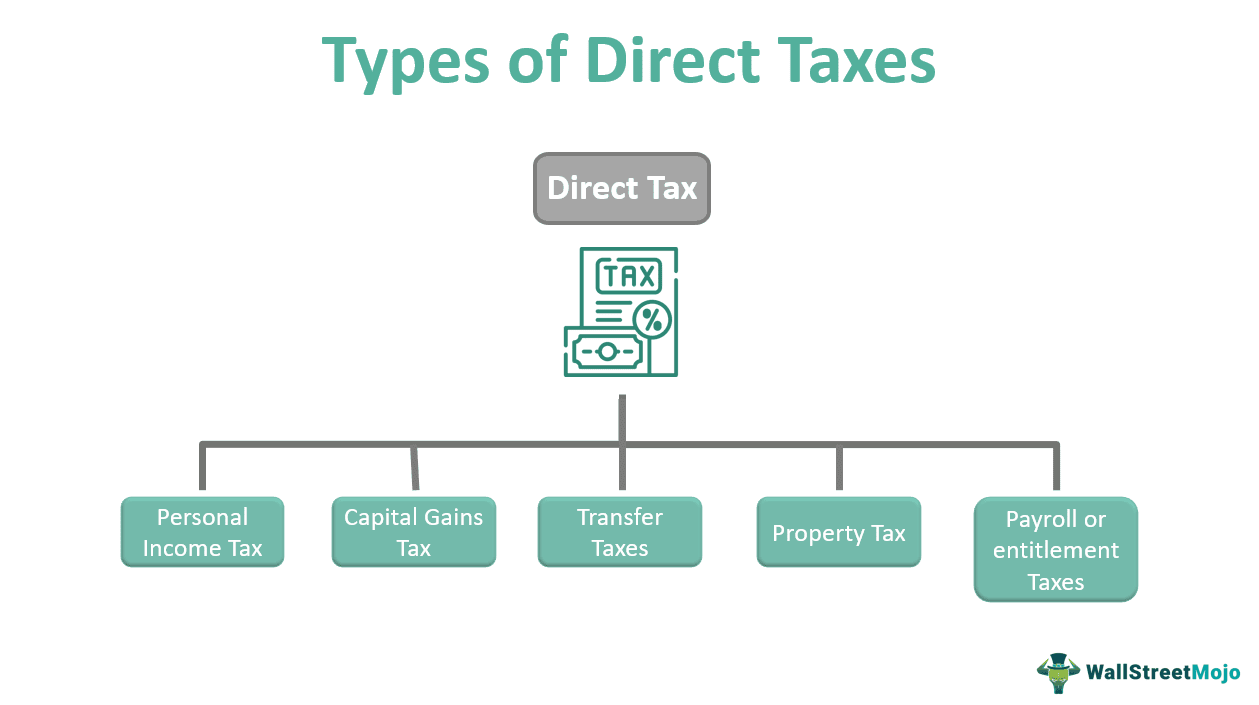

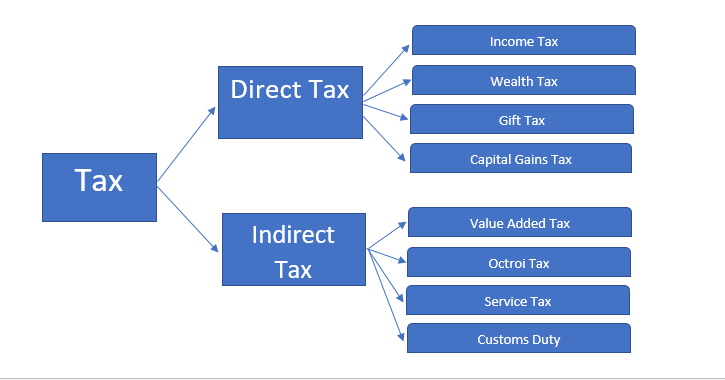

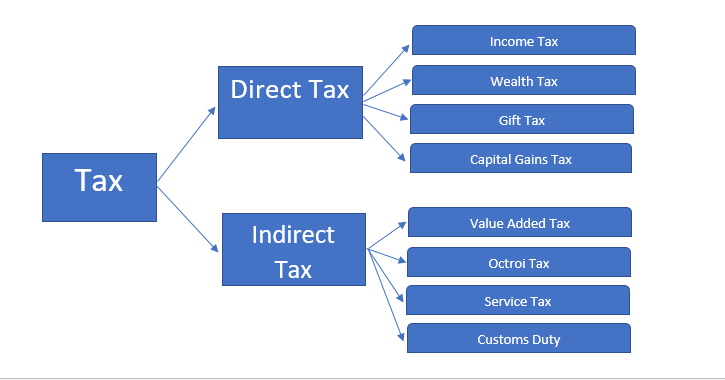

How Many Types Tax In India Types of Taxes in India Different types of taxes in India are broadly classified into two types Direct Taxes Indirect Taxes Direct Tax A direct tax is imposed directly upon the taxpayer and is paid by individuals who are

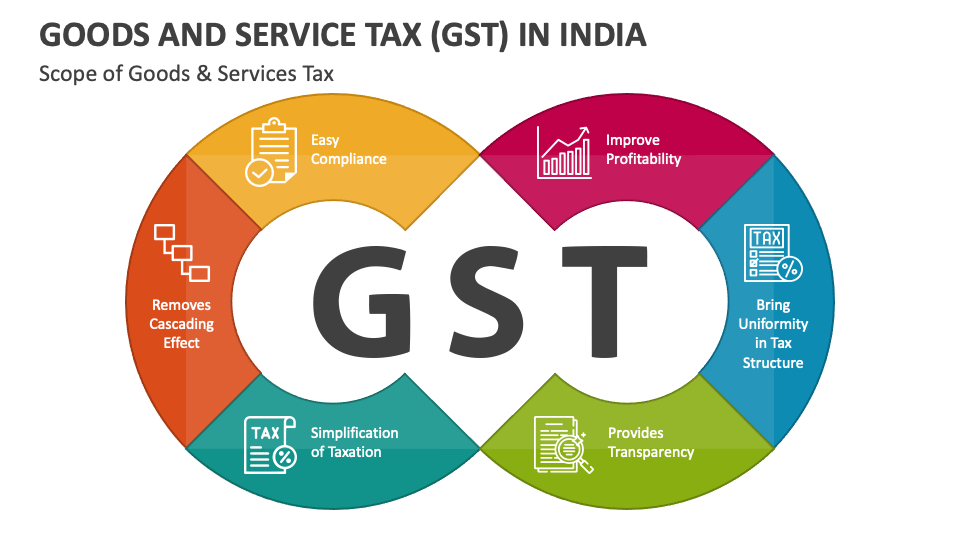

Goods and Services Tax GST is an indirect tax or consumption tax levied in India on the supply of goods and services It is levied at every A tax is a compulsory fee that is levied by a government on an individual or an organization to collect revenue for public works Know more about the types of taxes recent reforms income

How Many Types Tax In India

How Many Types Tax In India

https://lookaside.instagram.com/seo/google_widget/crawler/?media_id=3523400437032964031

Lycra Align Textile

https://aligntex.com/wp-content/uploads/2024/01/永瀧CI彩色@4x-8.png

Eurohinca News Eurohinca

https://eurohinca.com/wp-content/uploads/2024/02/LOGO-eurohinca-group.png

The tax structure in India is bifurcated into two primary types direct taxes and indirect taxes Taxes form the backbone of government revenue playing a crucial role in There are mainly two types of taxes Direct and Indirect Taxes The blog explains both types of taxes in the Indian taxation context

In general there are two types of taxes direct taxes and indirect taxes Both taxes are implemented differently Some are paid directly such as income tax corporate tax wealth Prevalence of various kinds of taxes is found in India Taxes in India can be either direct or indirect However the types of taxes even depend on whether a particular tax is being

More picture related to How Many Types Tax In India

Direct Tax Definition Explained Types Features Examples 43 OFF

https://www.wallstreetmojo.com/wp-content/uploads/2023/01/Types-of-Direct-Taxes.png

Coca Cola 1 Jeopardy Template

https://static.wikia.nocookie.net/shrek/images/6/61/Shrek3-disneyscreencaps.com-2156.jpg/revision/latest?cb=20200923230043

Income Tax Types

https://files.taxfoundation.org/20190415173451/FF649_1.png

Let s take a look at the different types of taxes in India India has two types of taxes direct tax and indirect tax The difference between both the taxes lies in their implementation 1 Direct Tax Direct taxes are a blend of Some common types of direct taxes in India include Income Tax Corporate Tax Property Tax Transfer Tax Entitlement Tax These taxes help fund essential public services

What are the two main types of taxes in India India has two major types of taxes direct taxes levied on your income and indirect taxes included in the price of goods and services Are there any tax benefits or Explore the different types of taxes in India including direct and indirect taxes Learn about income tax GST customs duty and more with this comprehensive guide

Income Tax Guide With Examples Tax Calculator

https://www.deskera.com/blog/content/images/2020/08/direct-tax.png

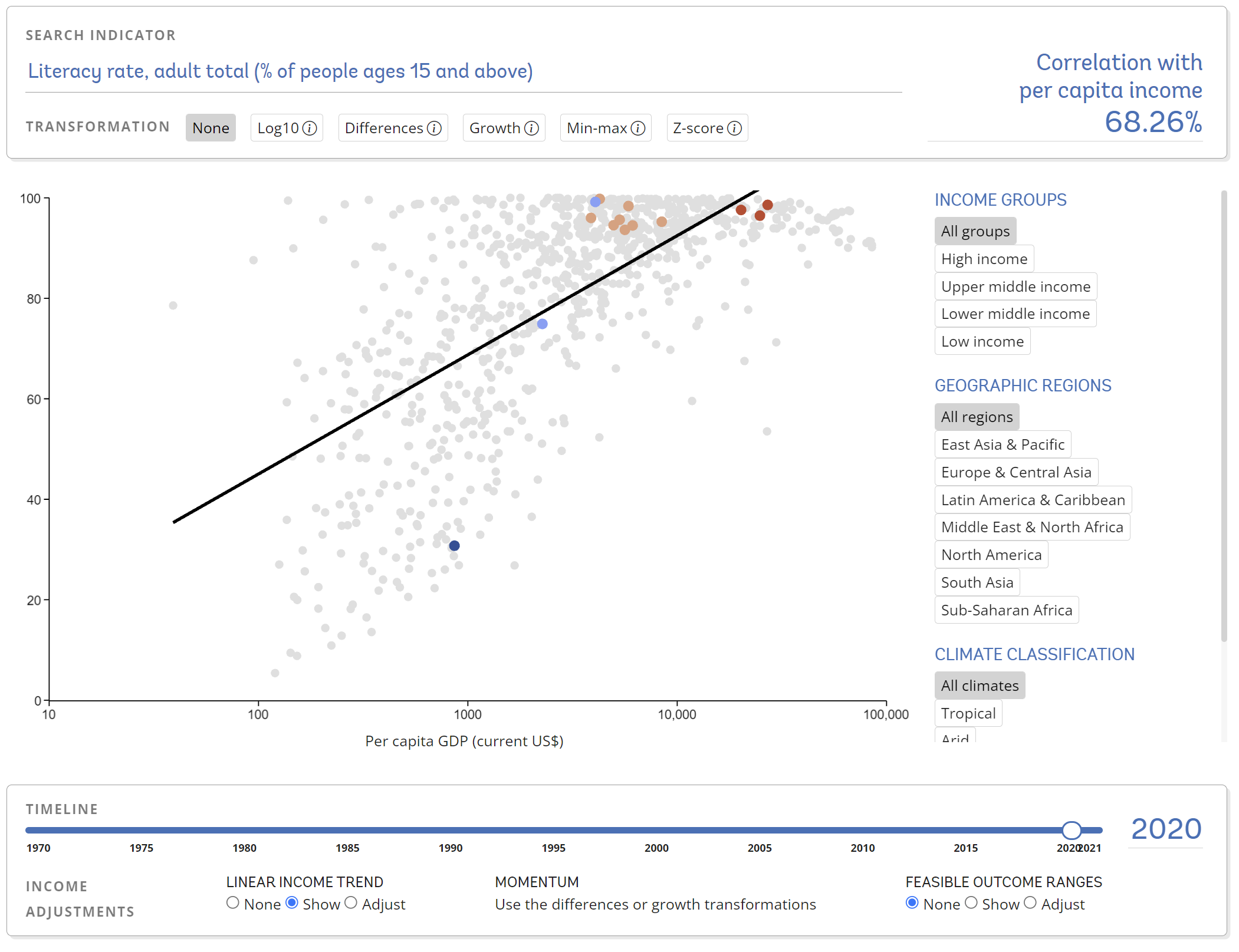

Income 2024 24 Claude Shanna

https://esgdata.worldbank.org/dist/content/img/stories/incomeadj.png

https://www.clearias.com › types-taxes-india

Types of Taxes in India Different types of taxes in India are broadly classified into two types Direct Taxes Indirect Taxes Direct Tax A direct tax is imposed directly upon the taxpayer and is paid by individuals who are

https://www.indiatoday.in › information › story › list...

Goods and Services Tax GST is an indirect tax or consumption tax levied in India on the supply of goods and services It is levied at every

Jil Discover The Secrets Of This Controversial Vegetable In Brazil

Income Tax Guide With Examples Tax Calculator

Spot The Difference Between Astigmatism Vs Nearsightedness

Goods And Service Tax GST In India PowerPoint And Google Slides

What Is Floor Stocks Tax Indian Constitution Viewfloor co

French Pronouns Types Usage And Examples Pronoms Fran ais

French Pronouns Types Usage And Examples Pronoms Fran ais

Understand Exempt Exempt Exempt EEE In Income Tax In India

Budget 2024 Income Tax Calculator Cahra Yasmin

Shanling Sono Hybrid Driver In Ear Monitor

How Many Types Tax In India - The taxation in India can be broadly classified into two types direct tax and Indirect tax Taxes in India are levied by the Central Government and the State Governments Read to know more