Solve 3x 5 6x 4 11 X You may generally know you can pay for qualified medical expenses with money from your health savings account HSA but dig into the specifics and you might find some unexpected

How do I pay with my HSA To pay for qualified medical expenses choose the option that s most convenient for you Use your Optum Financial debit card Use online bill pay Pay out of Learn the ins and outs of HSA reimbursements and how to pay for qualified expenses using your HSA funds whether paying directly from your HSA account or by reimbursing your out of

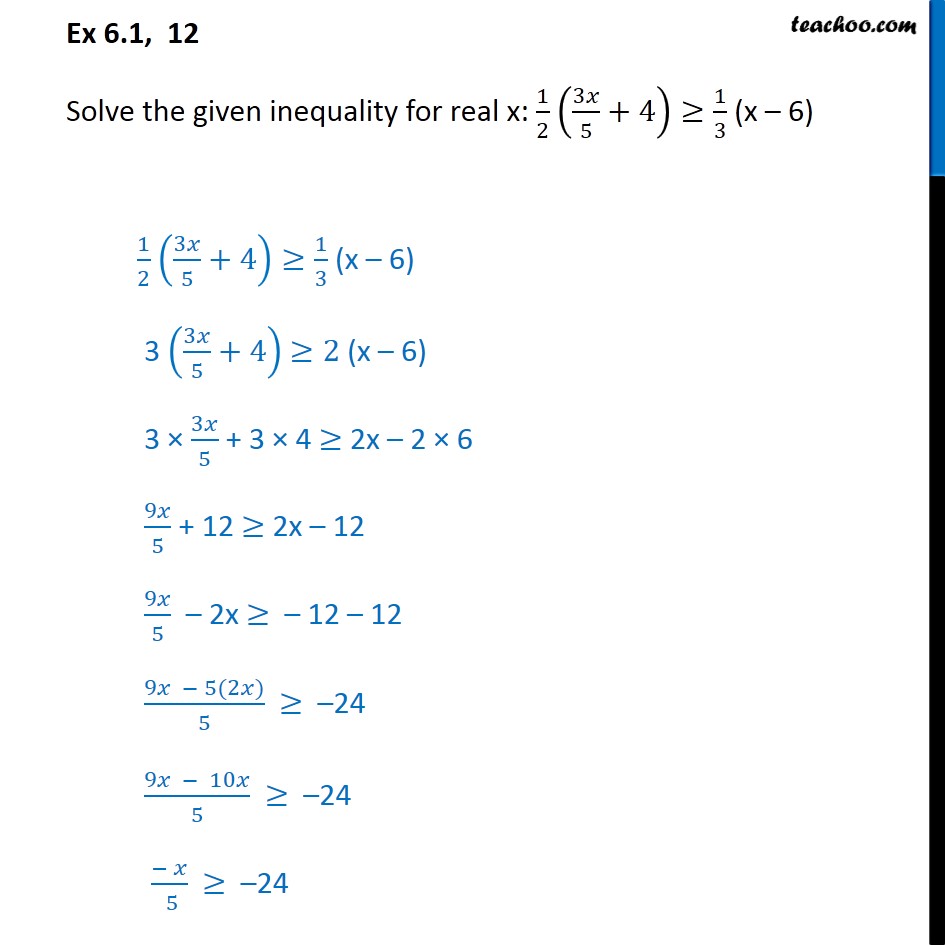

Solve 3x 5 6x 4 11 X

Solve 3x 5 6x 4 11 X

https://d77da31580fbc8944c00-52b01ccbcfe56047120eec75d9cb2cbd.ssl.cf6.rackcdn.com/1c986d36-96d0-4c60-bfc2-16e27b7ecfee/slide17.jpg

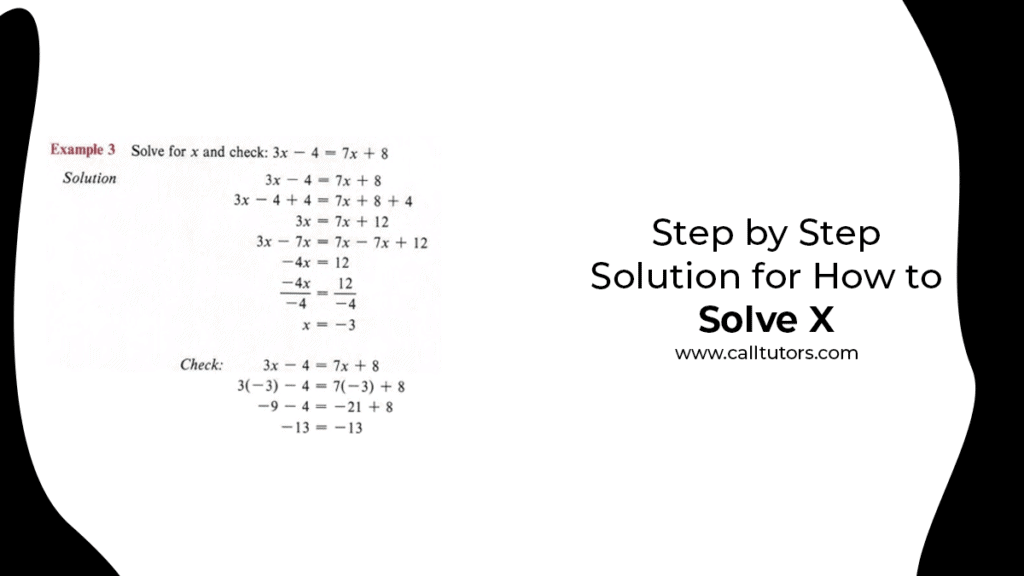

Step By Step Solution For How To Solve X Calltutors

https://www.calltutors.com/blog/wp-content/uploads/2020/08/how-to-solve-x-1024x576.png

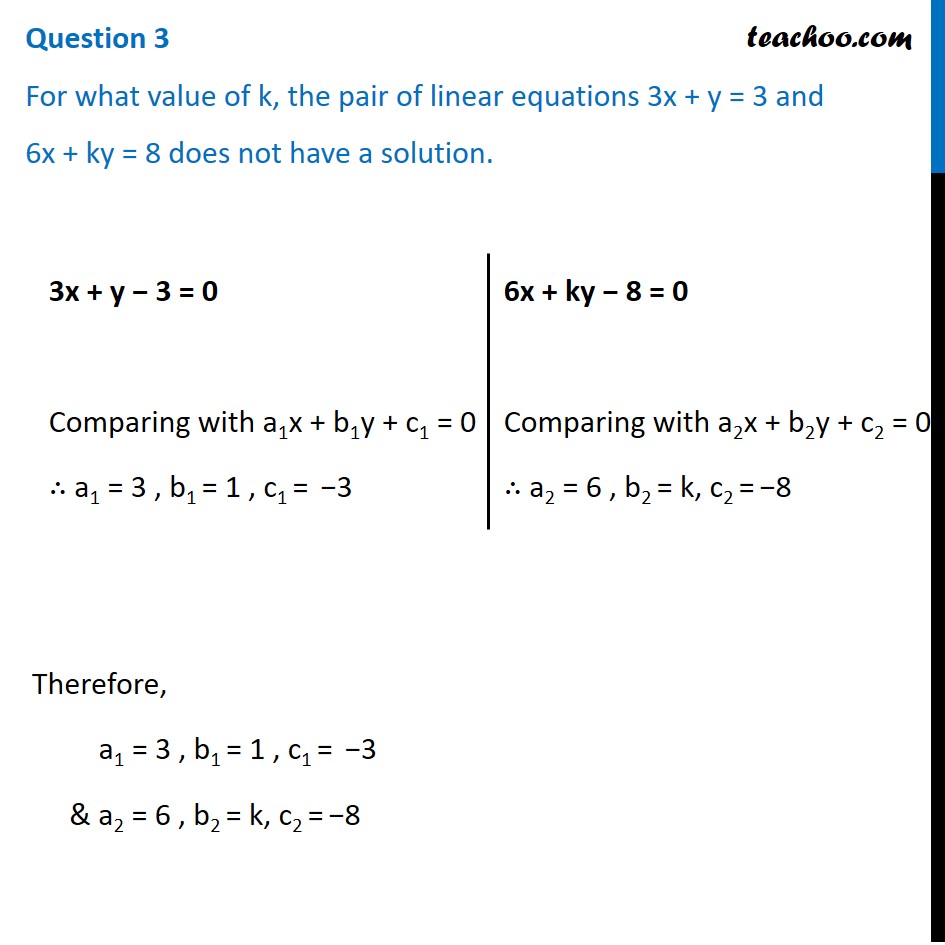

For What Value Of K The Pair Of Linear Equations 3x y 3 And 6x ky 8

https://d77da31580fbc8944c00-52b01ccbcfe56047120eec75d9cb2cbd.ssl.cf6.rackcdn.com/82323baa-e5bc-4c0c-9c25-d676d1748fa6/slide4.jpg

The answer is yes you can be reimbursed for qualified medical expenses from your HSA This means that if you ve paid for medical services such as doctor visits prescription medications The same HSA eligibility status for medical office visits applies to flexible spending accounts FSAs and health reimbursement arrangements HRAs as well However while a high

Learn about HSA reimbursement rules how to track expenses in case of an IRS audit how distributions are taxed and what is reimbursable under the rules Section 213 of the Code generally allows a deduction for expenses paid during the taxable year for medical care if certain requirements are met Expenses for medical care under section 213

More picture related to Solve 3x 5 6x 4 11 X

Solved In Exercises 1 17 Determine Which Equations Are Exact Chegg

https://d2vlcm61l7u1fs.cloudfront.net/media/b95/b95e0b5a-b082-4141-bada-dc8564d0d554/phpiHAPL2.png

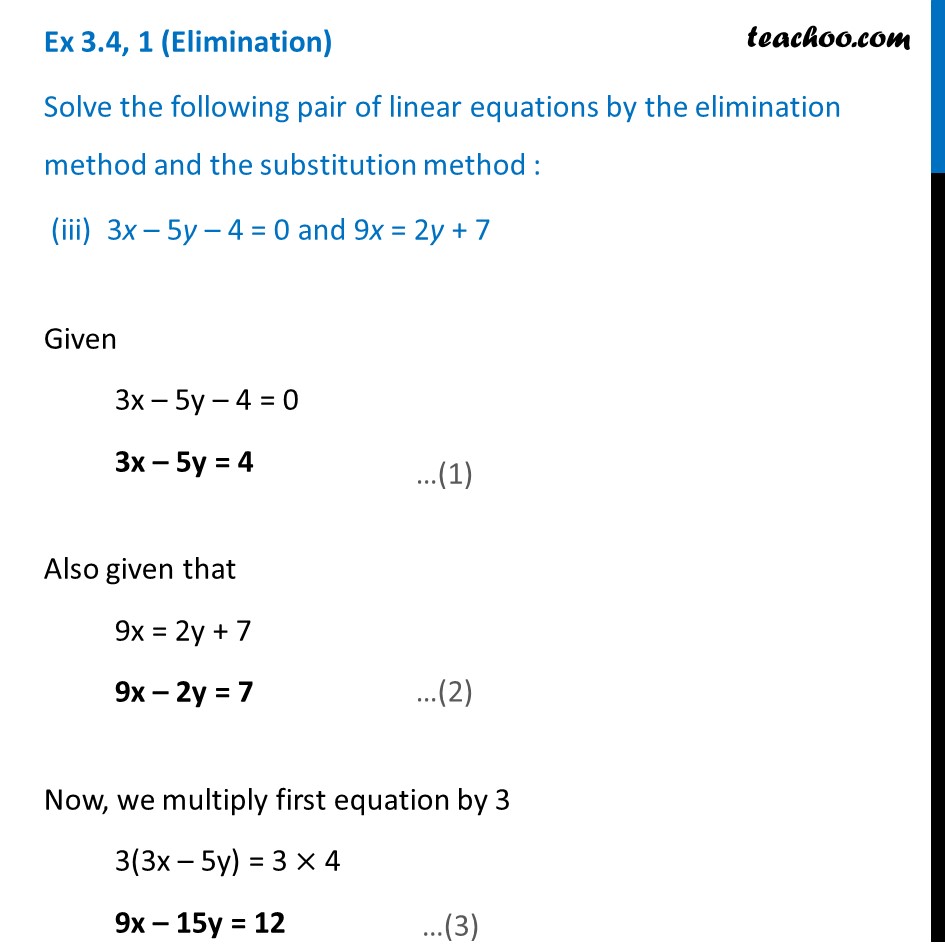

Solve Linear Equations 3x 5y 4 0 And 9x 2y 7 with Video

https://d77da31580fbc8944c00-52b01ccbcfe56047120eec75d9cb2cbd.ssl.cf6.rackcdn.com/bf13f6f4-d99d-4866-a73e-bc35c7ce931b/slide13.jpg

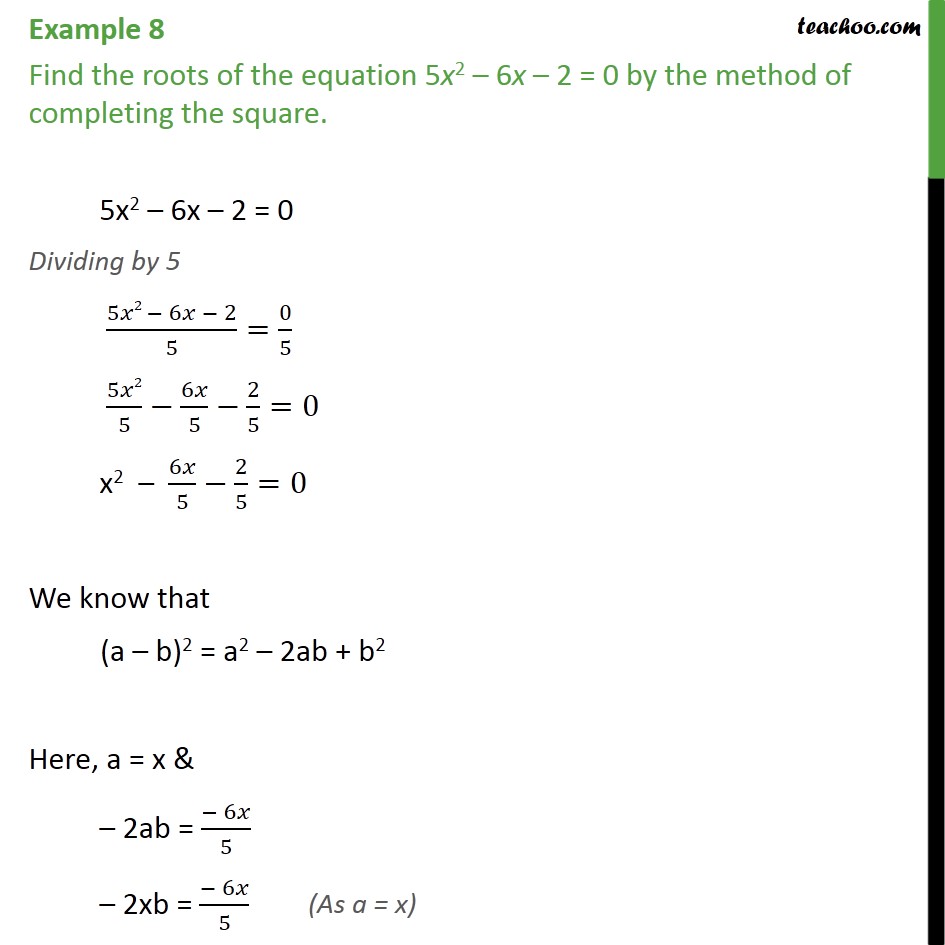

Question 2 Find Roots Of 5x2 6x 2 0 By Completing Sq

https://d77da31580fbc8944c00-52b01ccbcfe56047120eec75d9cb2cbd.ssl.cf6.rackcdn.com/bf8d4122-bdf3-4987-8933-1bb9b39a1403/slide20.jpg

Some expenses like weight loss programs or vitamins and supplements may be eligible for reimbursement only with a medical necessity letter from your health care provider Even Doctor visits are considered qualified medical expenses and are eligible for reimbursement from your HSA It s important to note that not all medical expenses may be covered so it s essential

[desc-10] [desc-11]

Solved Solve For The Values Of X And Y In The System Of Equations Y

https://www.coursehero.com/qa/attachment/13011878/

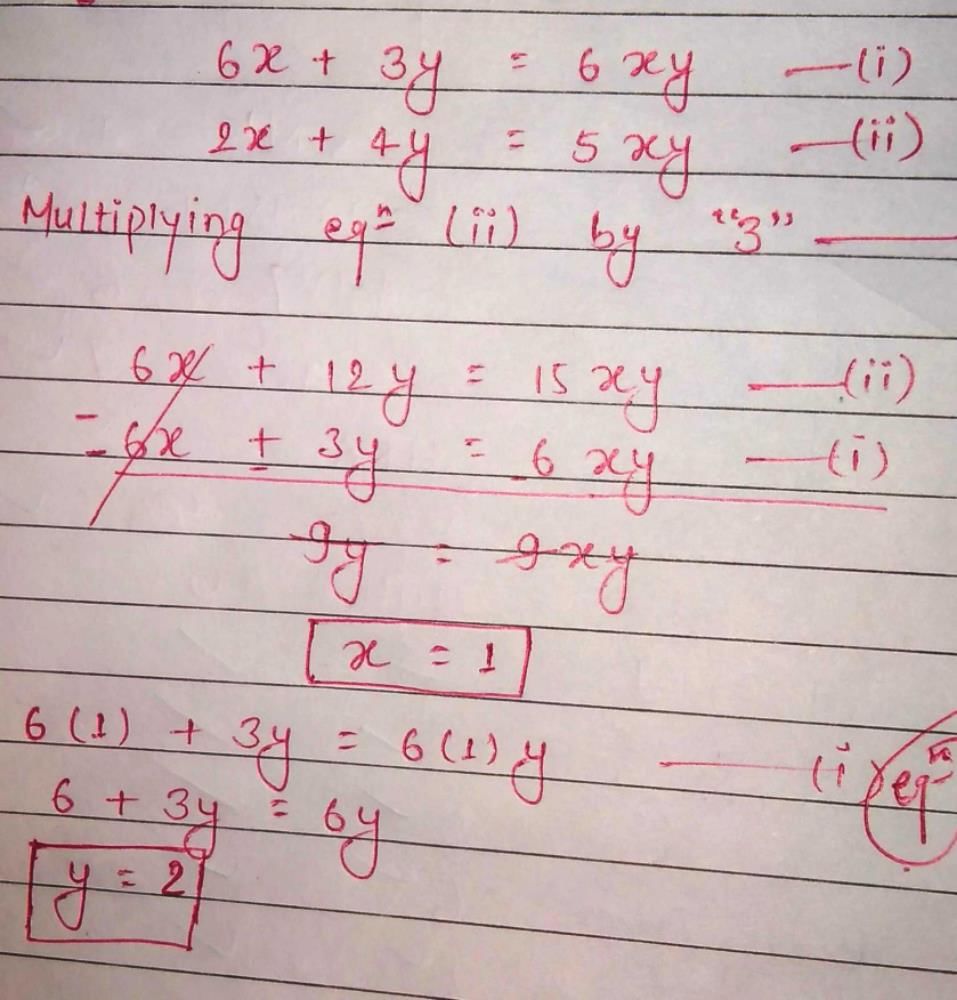

If 6x 3y 6xy 2x 4y 5xy Then The Values Of X And Y Area 1 And

https://edurev.gumlet.io/ApplicationImages/Temp/3240318_d2598eee-e575-4a8f-a78f-af80f4eae40c_lg.png

https://communications.fidelity.com › pdf › wi › pay...

You may generally know you can pay for qualified medical expenses with money from your health savings account HSA but dig into the specifics and you might find some unexpected

https://www.optum.com › content › dam › optum › consu…

How do I pay with my HSA To pay for qualified medical expenses choose the option that s most convenient for you Use your Optum Financial debit card Use online bill pay Pay out of

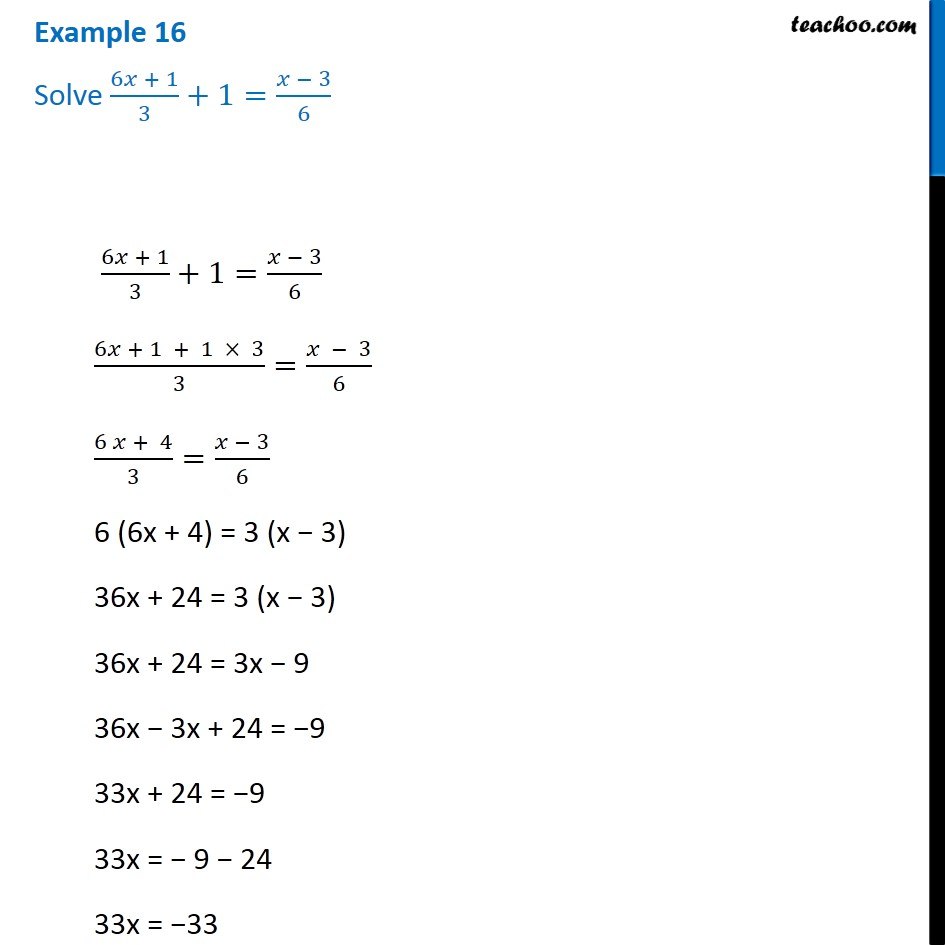

Example 16 Solve 6x 1 3 X 3 6 Chapter 2 Class 8 Teachoo

Solved Solve For The Values Of X And Y In The System Of Equations Y

Example 4 Find Roots Of 6x2 X 2 0 Chapter 4 Class 10

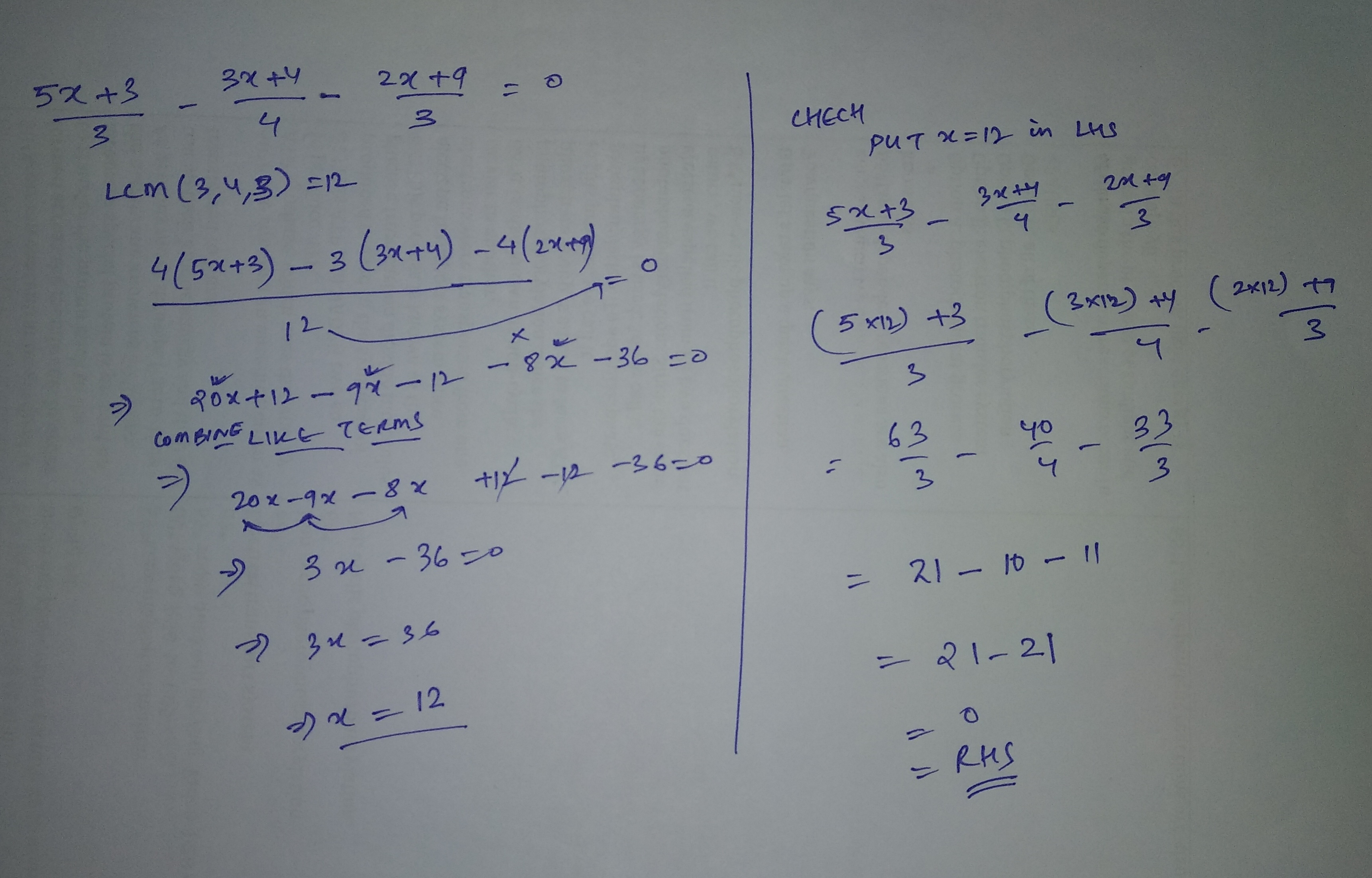

1 5x 3 3 3x 4 4 2x 9 3 0 2 X 4 6x 9x x 4 2 3 256rzrss

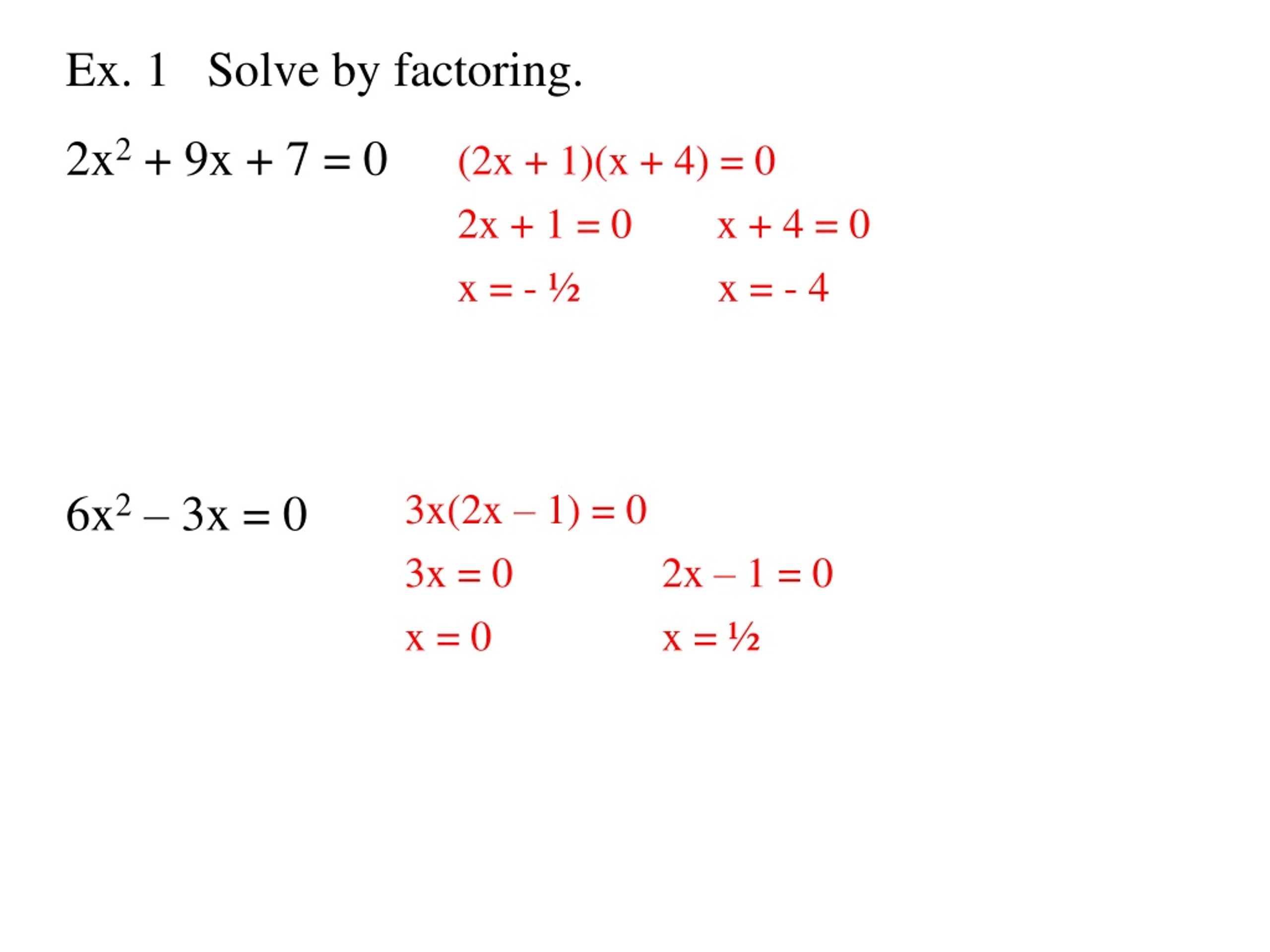

PPT Ex 1 Solve By Factoring 2x 2 9x 7 0 6x 2 3x 0

Question 5 Solve X2 3x 5 0 Chapter 5 Class 11 Quadaratic E

Question 5 Solve X2 3x 5 0 Chapter 5 Class 11 Quadaratic E

Solve For X 6x 7 3x 2 4x 13 2x 5 Linear Equations Class 8 YouTube

Example 3 Solve 4x 3

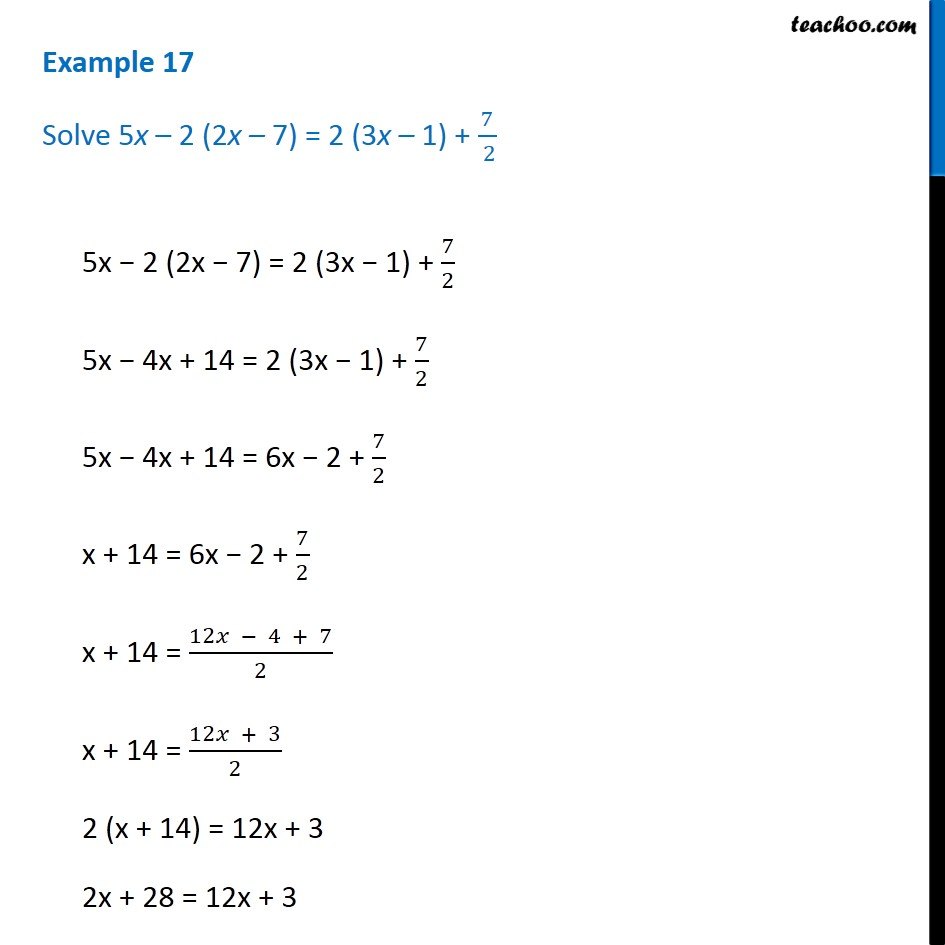

Example 17 Solve 5x 2 2x 7 2 3x 1 7 2 Chapter 2

Solve 3x 5 6x 4 11 X - [desc-14]