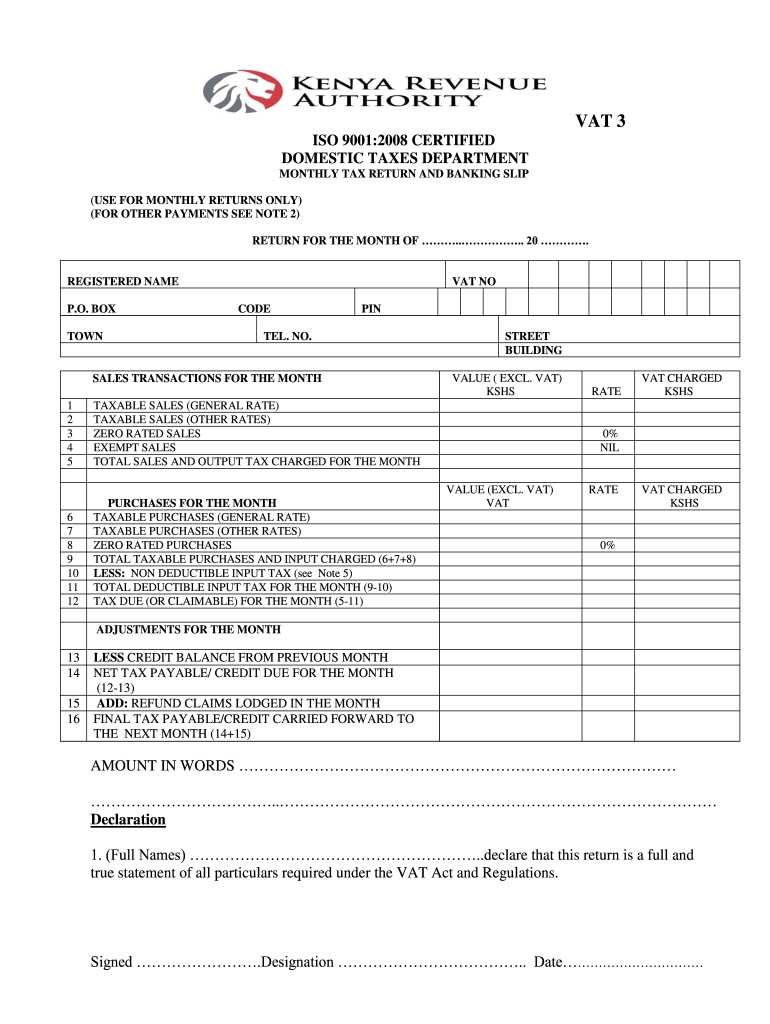

What Is A Vat 3 Return This guidance tells you how to submit a VAT return for a company You must file a VAT return for every tax period even if your company has not had any VAT liable activities

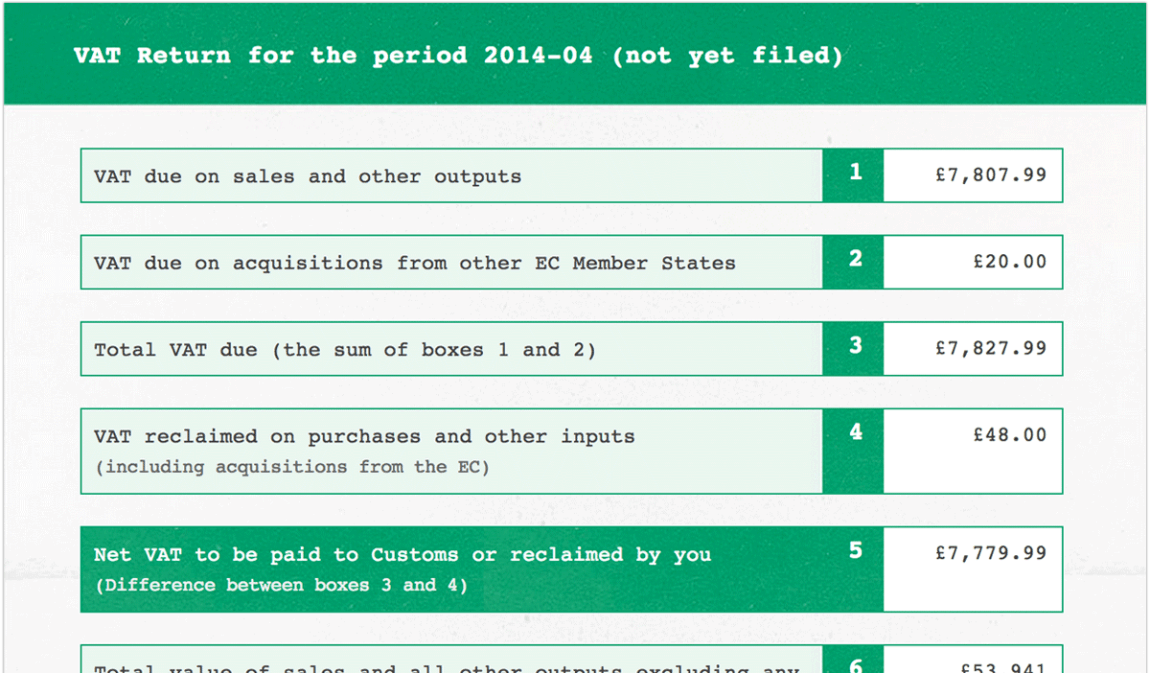

A VAT Return is a form you fill in to tell HM Revenue and Customs HMRC how much VAT you ve charged and how much you ve paid to other businesses You usually need to send a The accounting period is the period covered by the VAT return and is ordinarily three months in length Where businesses fall within the payments on account POA regime the extra seven days is lost and VAT returns should

What Is A Vat 3 Return

What Is A Vat 3 Return

https://sufio.com/content/media/images/vat-invoice.width-1980.png

.png)

What Is A VAT Return

https://www.zeeliepasa.co.za/img/blog/496/What_is_a_vat_return_(1).png

What Is VAT Return Form YouTube

https://i.ytimg.com/vi/KXWqWz4bpNk/maxresdefault.jpg

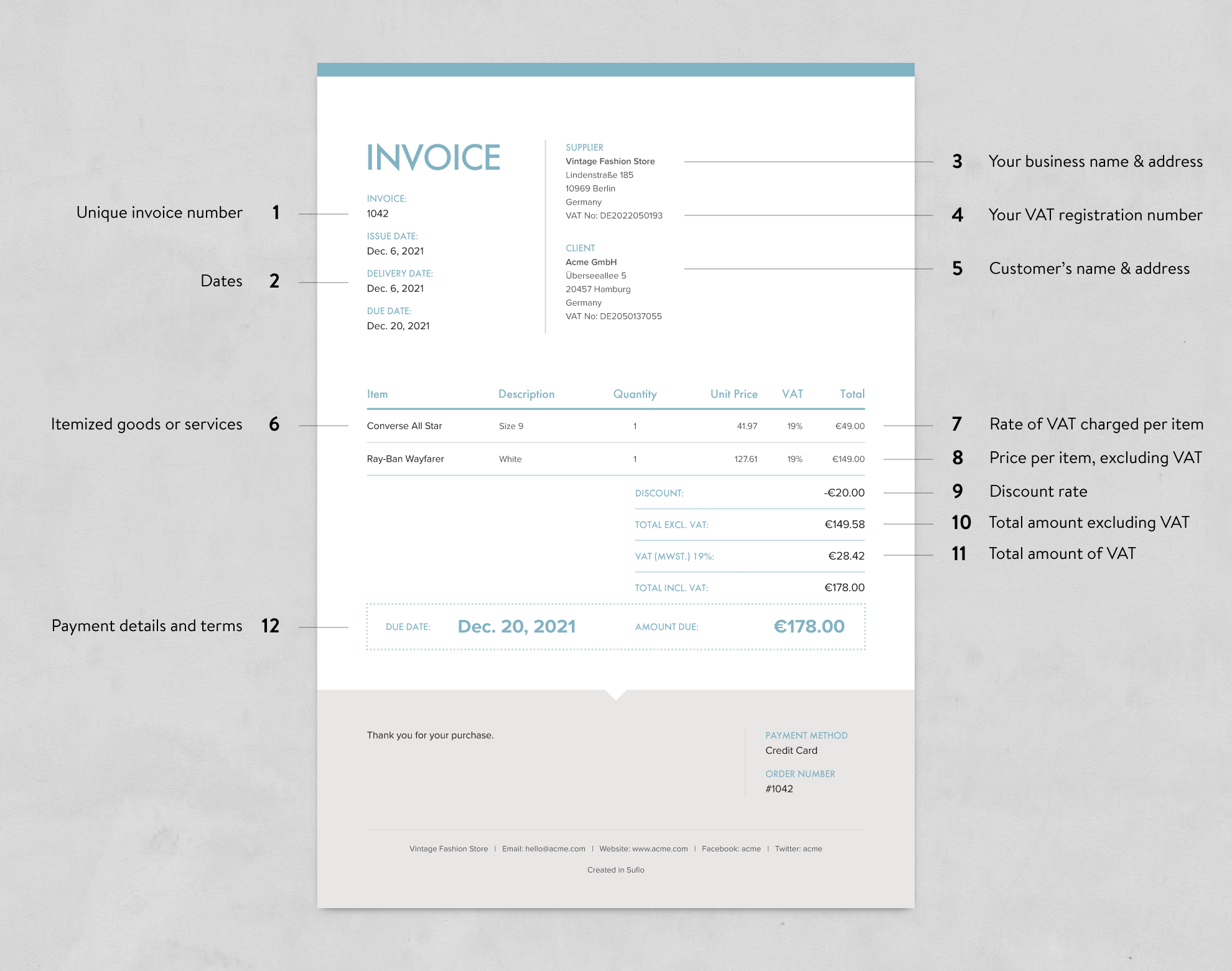

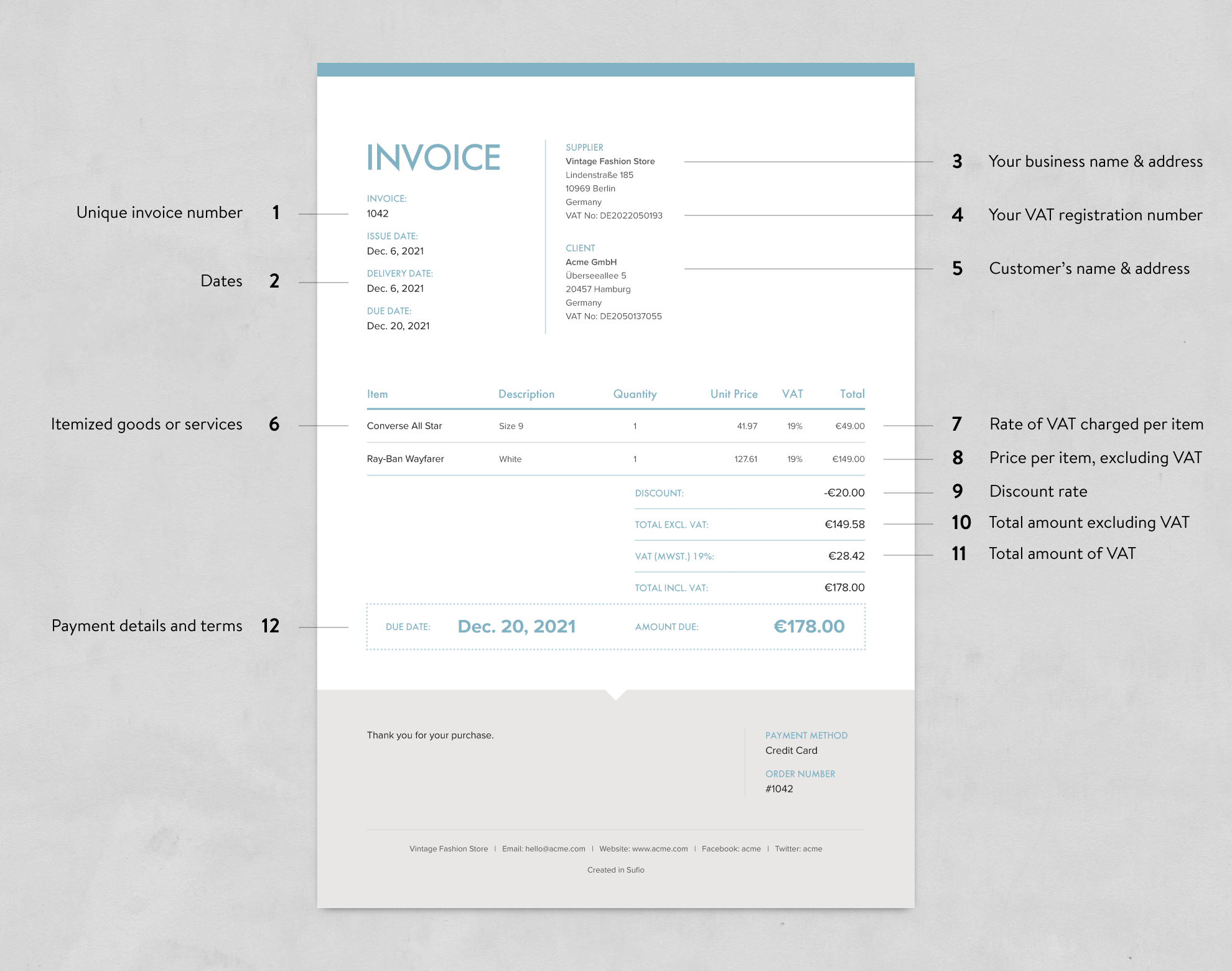

How do you complete a VAT 3 return This section outlines how VAT is repaid You must file and pay VAT by the 19th day of the month following the end of each period This What is a VAT Return A VAT return is the form VAT registered businesses or individuals fill in to inform HM Revenue and Customs HMRC how much VAT they have

A VAT return aims to calculate whether a business owes VAT to HMRC or is eligible for a VAT refund VAT returns are required for most businesses operating in the UK that meet specific turnover thresholds or A VAT return is a document that businesses in the UK submit to HMRC to report the amount of VAT they have charged on their sales output tax and the amount of VAT they have paid on their purchases input tax

More picture related to What Is A Vat 3 Return

VAT Return Form VAT 3 Kenya

https://help.tallysolutions.com/docs/te9rel64/Tax_International/Kenya_VAT/Images/VAT_Returns_2.gif

What Is VAT Main Types Advantages And Disadvantages For

https://i.ytimg.com/vi/E-B4m-tfoFs/maxresdefault.jpg

Download Vat 3 Returns Form Complete With Ease AirSlate SignNow

https://www.signnow.com/preview/35/948/35948804/large.png

A VAT return is a type of digital form that gets sent to HMRC showing how much VAT tax you owe them VAT returns show your total sales and purchases across a specific period usually A VAT return is a digital form you send to HMRC showing how much VAT you owe It includes how much VAT you ve charged on sales minus the amount you can reclaim on goods and services you ve paid for

A VAT return is used to calculate how much Value Added Tax a company should pay or be reimbursed by HM Revenue and Customs HMRC Most times this is to be This new guide will teach you everything you need to know about VAT Returns in 2024 First I ll show you what VAT is and the basics of how it works Then I ll help you get ready to file a VAT Return with Making Tax Digital And if you re

What Is A VAT Return FreeAgent

https://freeagent-res.cloudinary.com/image/upload/c_limit,w_1000/dpr_auto,f_auto/website-images/netlify/guides__making-tax-digital__vat-return-example-mtd-q-and-a.png

How To File A VAT Return To HMRC YouTube

https://i.ytimg.com/vi/FODDLhG03GI/maxresdefault.jpg

https://www.vero.fi › en › businesses-and-corporations › ...

This guidance tells you how to submit a VAT return for a company You must file a VAT return for every tax period even if your company has not had any VAT liable activities

.png?w=186)

https://www.gov.uk › submit-vat-return

A VAT Return is a form you fill in to tell HM Revenue and Customs HMRC how much VAT you ve charged and how much you ve paid to other businesses You usually need to send a

Co To Jest Deklaracja VAT FreeAgent I m Running

What Is A VAT Return FreeAgent

VAT Return Form VAT 3 Kenya

Importing Goods Into Ireland From EU And Non EU Countries How VAT Is

FreeAgent VAT Online Submission 1Stop Accountants

What Is A VAT Number WPX

What Is A VAT Number WPX

How To Apply For A VAT Number Step By Step VAT Registration UK

VAT SME

How To Check A VAT Number Xero

What Is A Vat 3 Return - What is a VAT Return A VAT Return is a tax form showing how much VAT you are required to pay HMRC based on the goods and services are selling with each item