What Is Vat Exempt Items What Is a Value Added Tax VAT The term value added tax VAT refers to a consumption tax on goods and services levied at each stage of the supply chain where value

The amount of VAT payable in respect of a taxable supply taxable import or reverse charged supply shall be calculated by applying the rate specified in Sub Article 2 of this Article to the Learn about Value Added Tax VAT Find out its definition how it works advantages and potential drawbacks Explore its mechanism and purpose

What Is Vat Exempt Items

What Is Vat Exempt Items

https://www.zeeliepasa.co.za/img/blog/498/What_is_VAT_Refundable.png

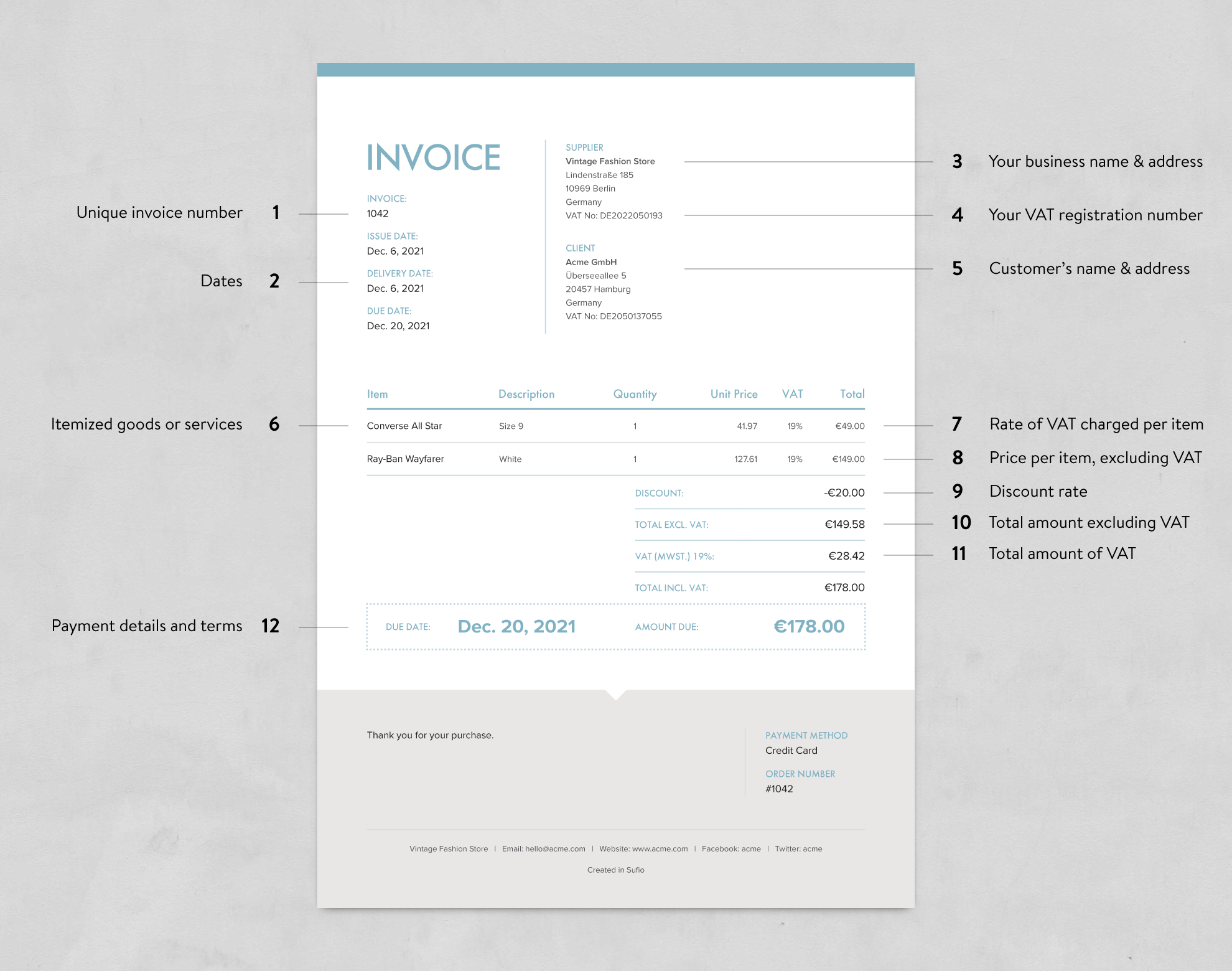

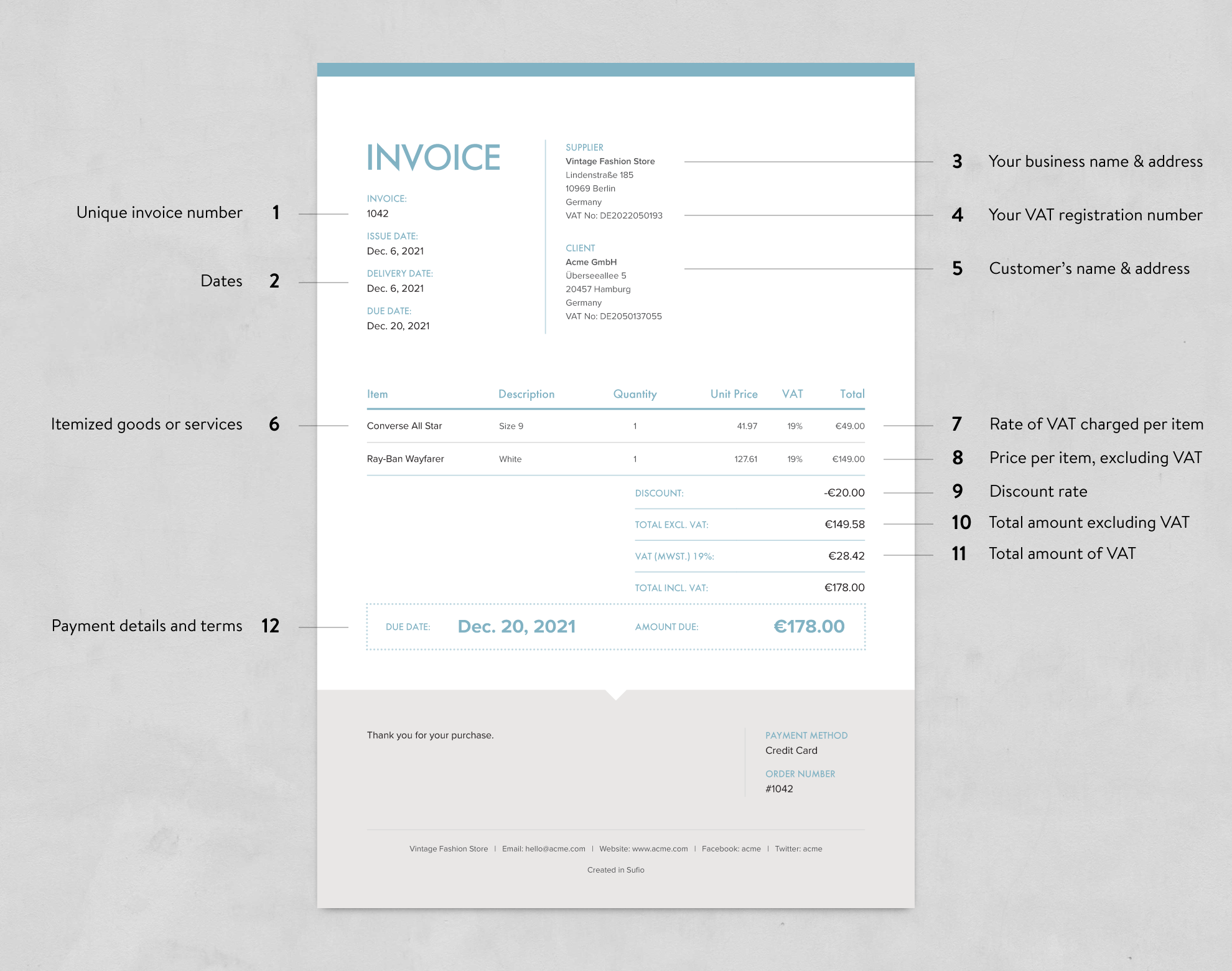

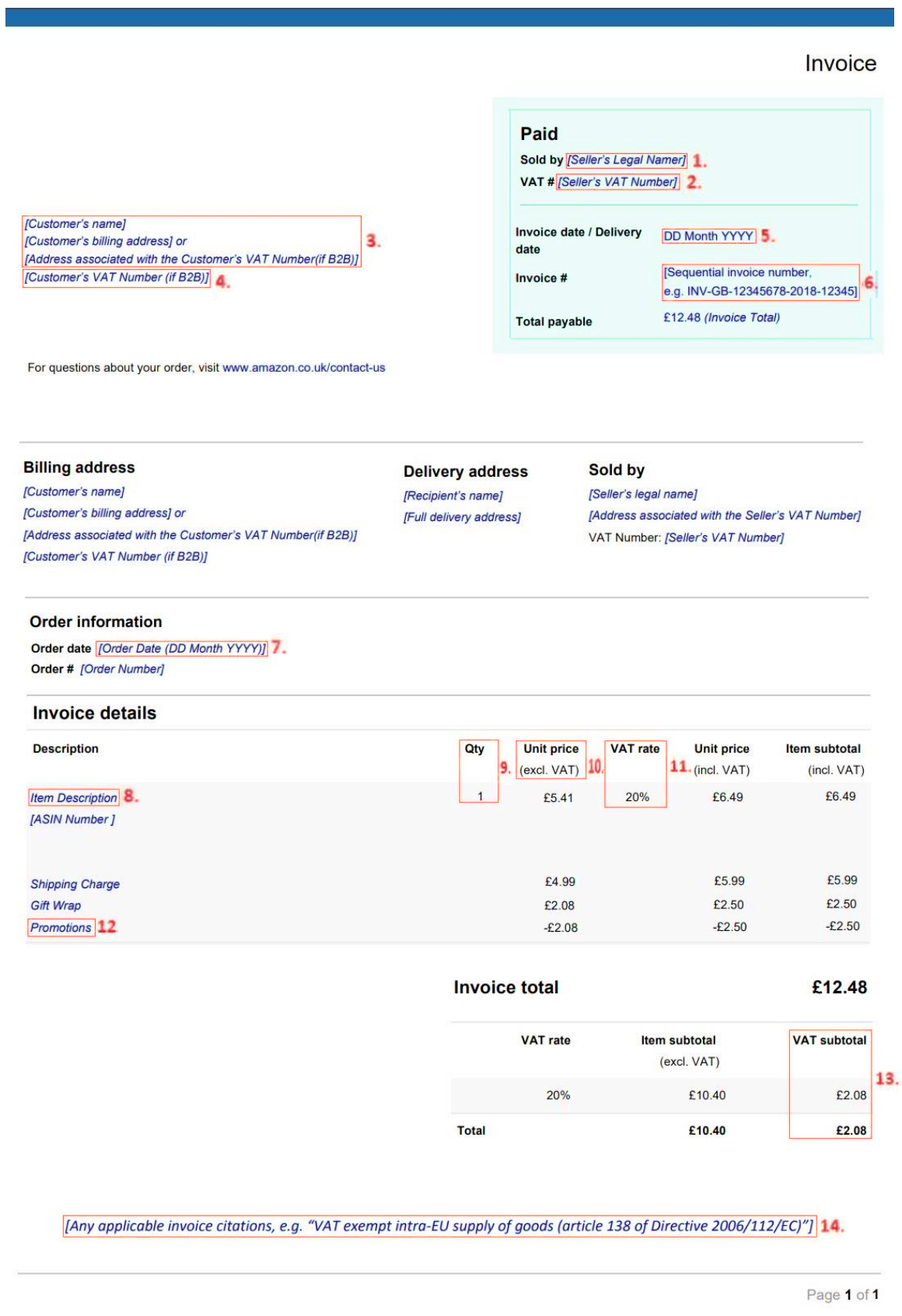

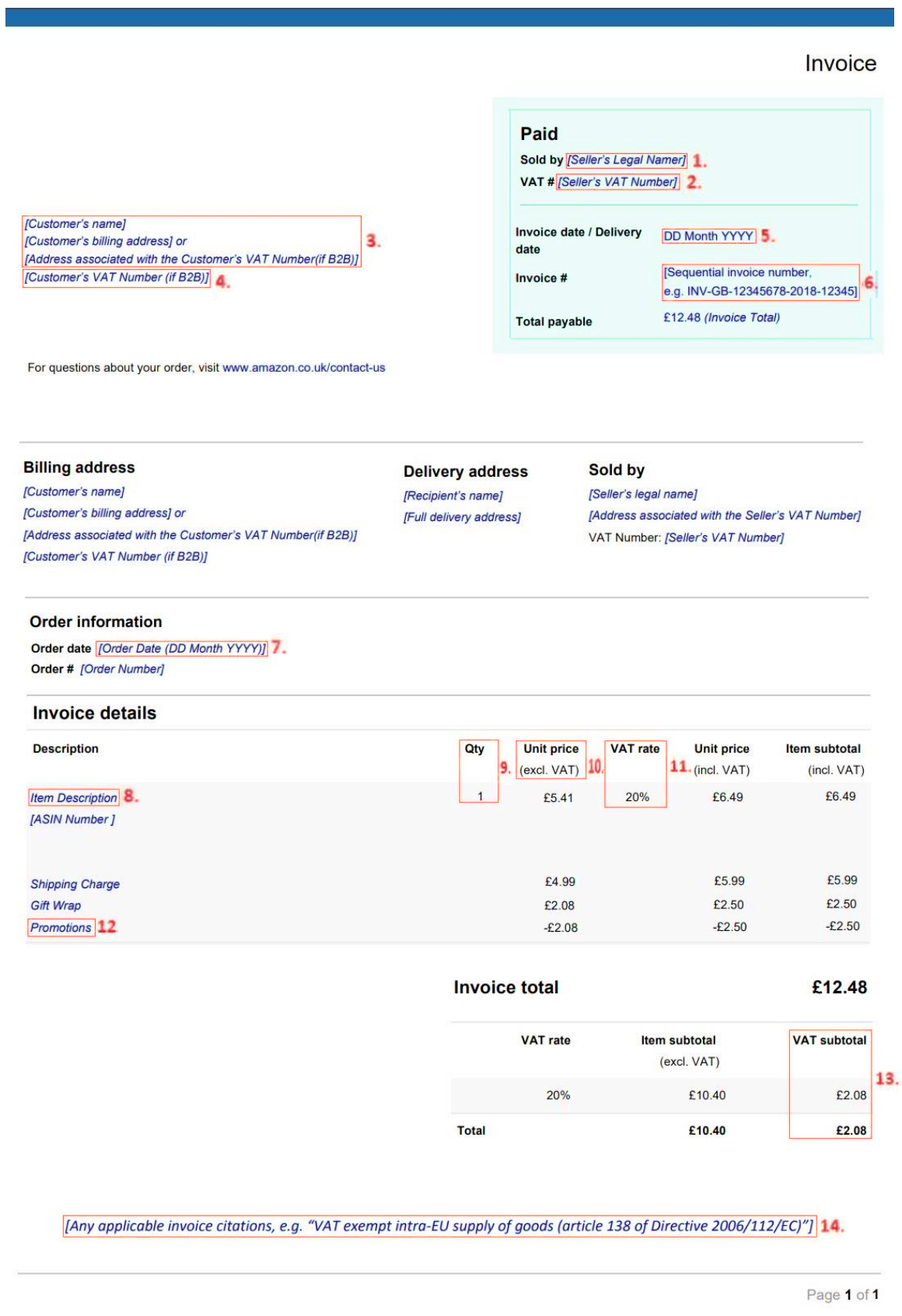

Invoices Explained What Are The Different Types Sufio

https://sufio.com/content/media/images/vat-invoice_Plh3KEf.width-1980.png

BIR Certificate Of Tax Exemption AMPC

https://agdaocoop.com/wp-content/uploads/2023/01/page-1-768x1086.png

Learn what VAT is its purpose and how it functions in modern taxation VAT explained in simple terms for consumers and businesses plus its global significance Value Added Tax VAT is a consumption tax on the value added to nearly all goods and services bought and sold in and into the European Union VAT is an important own resource for the EU

VAT is a comprehensive indirect consumption tax imposed by more than 170 countries on sales or exchanges and imports In some countries it s referred to as the goods What is value added tax VAT A value added tax VAT is a tax on products or services when sellers add value to them In some countries VAT is also called a goods and

More picture related to What Is Vat Exempt Items

What Is VAT Exempt

https://www.zeeliepasa.co.za/img/banner-blog.jpg

Zero rated And Exempt Supplies

https://www.yumpu.com/en/image/facebook/2958320.jpg

What Is Vat Exemption Intelhub

https://www.accountingfirms.co.uk/wp-content/uploads/2021/10/What-is-VAT-Exempt-in-the-UK.png

VAT is an incremental tax form which is levied at every stage of production from distribution to shipment to the sale of the products Also known as the Goods and Services Tax GST in Value added tax VAT is a tax on goods and services not unlike a sales tax but with some major differences While the U S doesn t levy a VAT this type of tax exists in many

[desc-10] [desc-11]

VAT Exempt Items What You Need To Know Sovos

https://sovos.com/en-gb/wp-content/uploads/sites/5/2024/10/GettyImages-1441231058-1536x1024.jpg.optimal.jpg

VAT Exempt Items What You Need To Know Sovos

https://sovos.com/en-gb/wp-content/uploads/sites/5/2023/07/Sovos-Logo-White.svg

https://www.investopedia.com › terms › valueaddedtax.as

What Is a Value Added Tax VAT The term value added tax VAT refers to a consumption tax on goods and services levied at each stage of the supply chain where value

https://www.mofed.gov.et › ...

The amount of VAT payable in respect of a taxable supply taxable import or reverse charged supply shall be calculated by applying the rate specified in Sub Article 2 of this Article to the

VAT Exempt Items What You Need To Know Sovos

VAT Exempt Items What You Need To Know Sovos

VAT Exempt Items What You Need To Know Sovos

VAT Exempt Items What You Need To Know Sovos

How To Apply For Vat Exemption Insightx

Vat Invoice

Vat Invoice

What Are Zero Rated VAT Items Searche

What Are Zero Rated VAT Items Searche

What Are Zero Rated VAT Items Searche

What Is Vat Exempt Items - Learn what VAT is its purpose and how it functions in modern taxation VAT explained in simple terms for consumers and businesses plus its global significance