Rate Of Gst On Salt 36 rowsGST Rates HSN Codes for Salts And Marbles Unroasted iron

Is GST applicable on salt Salt attracts no GST As per GST Law there is no GST payable on Salt all types So the rate of GST payable on Salt all types is nil rate 264 rowsDisclaimer Rates given above are updated up to the GST Rate

Rate Of Gst On Salt

Rate Of Gst On Salt

https://i.pinimg.com/736x/b2/61/84/b2618496add203c301a4bab8a1dbde3b.jpg

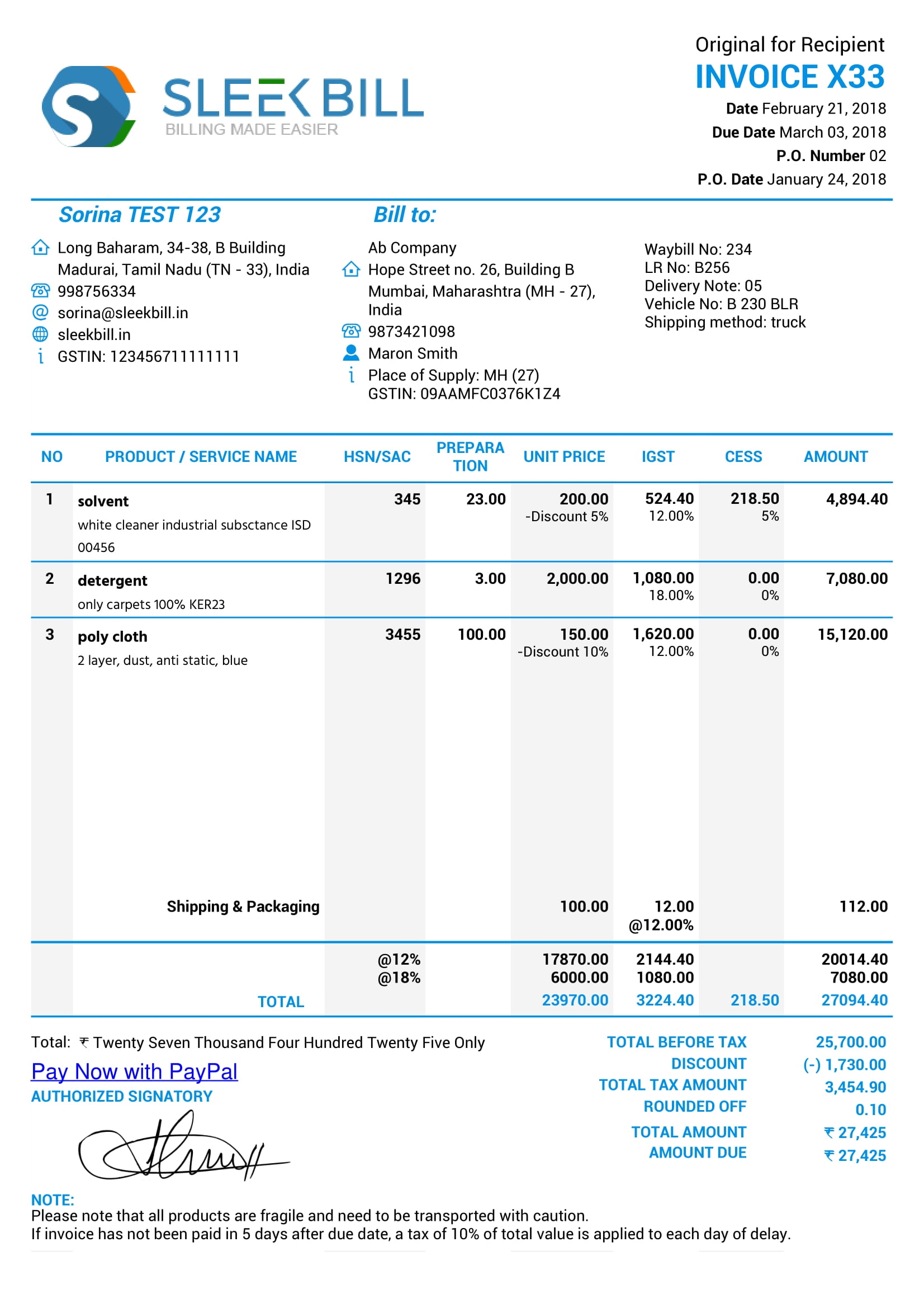

How To Apply GST On Freight Insurance And Packing Charges In Invoice

https://i.ytimg.com/vi/JegLwt0BvXc/maxresdefault.jpg

GST Wallpapers Wallpaper Cave

https://wallpapercave.com/wp/wp3730531.jpg

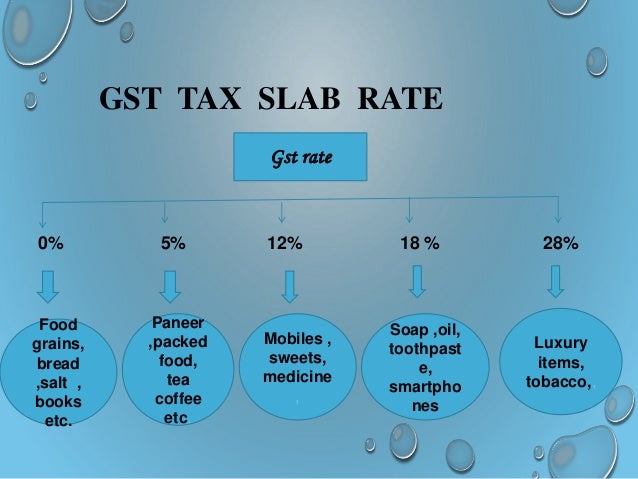

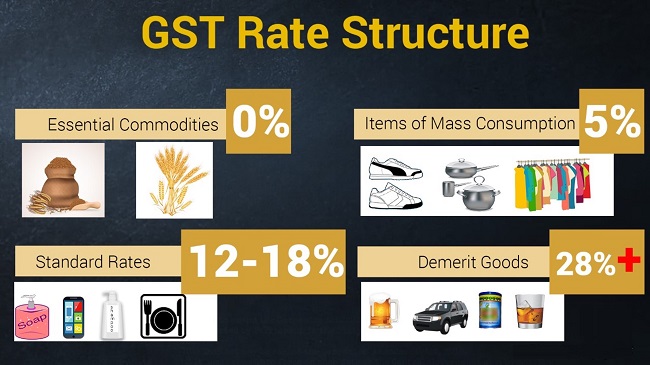

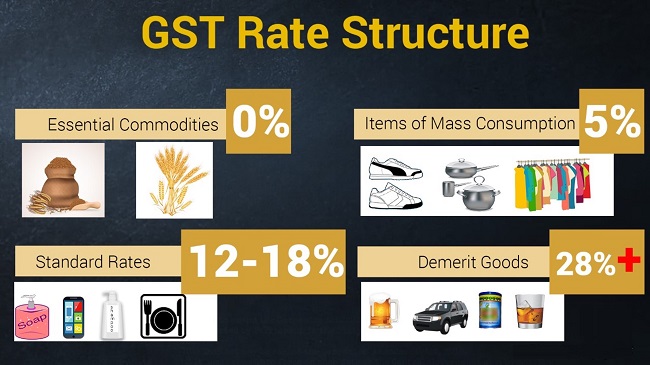

As per GST Law there is no GST payable on Salt all types So the rate of GST payable on Salt all types is nil rate The Goods and Services Tax GST will be levied at multiple rates ranging from 0 per cent to 28 per cent GST rate for both goods and services are applicable in 5 slabs namely 0 5 12 18 and 28 In this article let us look at the GST rate for sugar salt chocolate and spices in detail Sugar and sugar confectioneries

As per GST Law there is no GST payable on Common salt iodized and other fortified salts So the rate of GST payable on Common salt iodized and other fortified salts is nil rate Under GST all goods and services transacted in India Find GST rates HSN codes for salts sands including graphite quartz cement clay marble Learn HSN codes for classification of products tax purposes

More picture related to Rate Of Gst On Salt

The Marked Price Of An Article Is 10000 And Rate Of GST On It Is 18

https://hi-static.z-dn.net/files/d10/83f18fc66578f0e243b85d54205b7489.jpg

Templates

https://assets-global.website-files.com/637f7c151a1423bb35a84737/6426d03c0650036b96d86876_temp-7.webp

Gst Example Of Invoices Invoice Template Ideas

https://simpleinvoice17.net/wp-content/uploads/2019/11/gst-invoice-format-gst-example-of-invoices.jpg

31 rowsThis chapter contains the GST tax rates released by the government on Salt sulphur earths and stone plastering materials lime and cement which are covered under chapter 25 of HSN code 1 Salt sulphur Get all 6 digit and 8 digit codes and their GST Rates under HSN Code 2501 Salts incl table salt and denatured salt and pure sodium chloride whether or not in aqueous solution or

Common salt is not taxable under GST Under the GST regime most spices attract a GST rate of 5 However fresh ginger and fresh turmeric other than in processed form are exempt from GST Also Read How to Start Here s a complete list of HSN codes for 25010020 along with units GST rates which comes under under the chapter 25 of Mineral Products Salt Sulphu To find more click on our HSN code

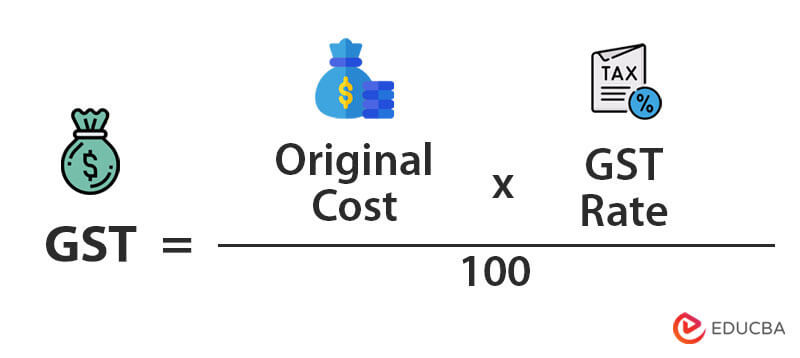

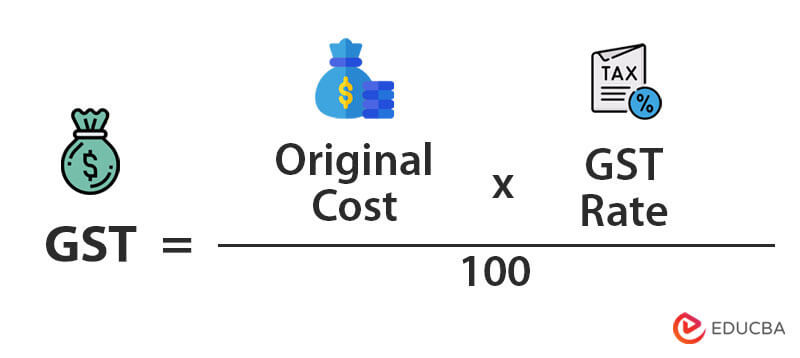

What Is GST Detailed Overview Its Calculation In Excel EDUCBA

https://cdn.educba.com/academy/wp-content/uploads/2023/01/GST.jpg

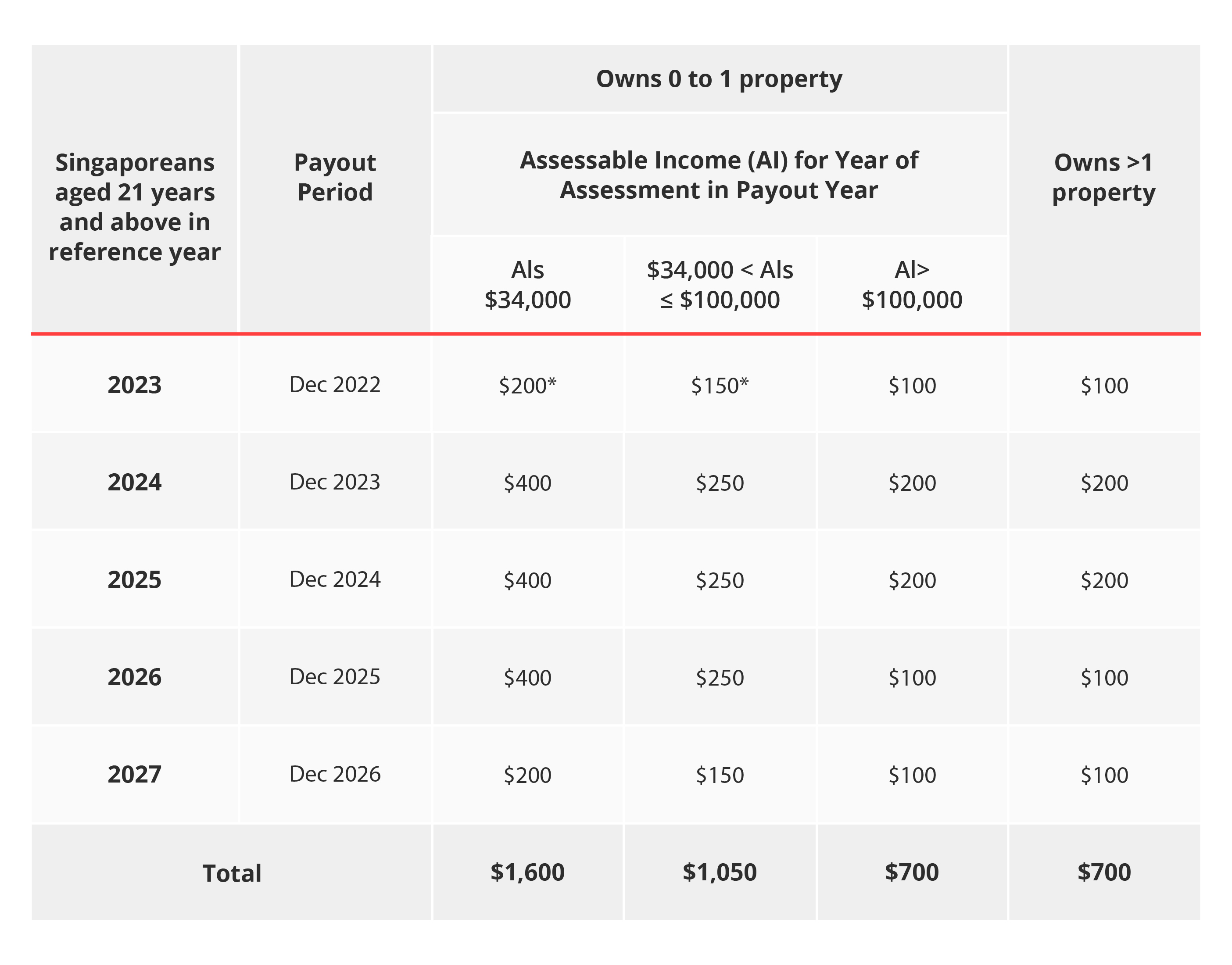

Pay Increment Singapore 2024 Printable Online

https://www.dbs.com.sg/iwov-resources/media/images/nav/preparing-for-GST-rate-changes/preparing-for-GST-rate-changes-img1.jpg

https://tax2win.in › guide › salts-sands-sulpher-earth...

36 rowsGST Rates HSN Codes for Salts And Marbles Unroasted iron

https://learn.quicko.com

Is GST applicable on salt Salt attracts no GST As per GST Law there is no GST payable on Salt all types So the rate of GST payable on Salt all types is nil rate

The Marked Price Of An Article Is 3500 Of GST 12 A Shopkeeper Allows A

What Is GST Detailed Overview Its Calculation In Excel EDUCBA

A Quick Guide To India GST Rates In 2017 Indian Legal System

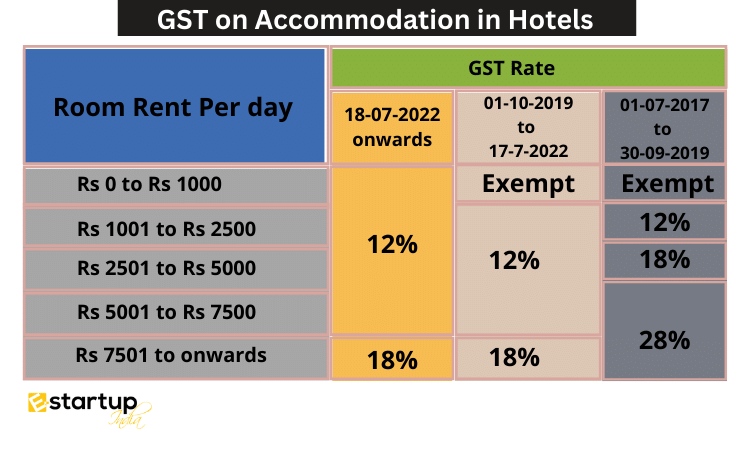

GST On Hotel Tourism Industry E startup India

Gst Ppt Anju

GST For E Commerce Businesses Info About Education Online Learning

GST For E Commerce Businesses Info About Education Online Learning

Implementation Of GST And Act Of GST Example TutorsTips

Influence Of GST On Manufacturing Sector And Exports In Indian Economy

Sample Letter Revoking Consent

Rate Of Gst On Salt - As per GST Law there is no GST payable on Common salt iodized and other fortified salts So the rate of GST payable on Common salt iodized and other fortified salts is nil rate Under GST all goods and services transacted in India