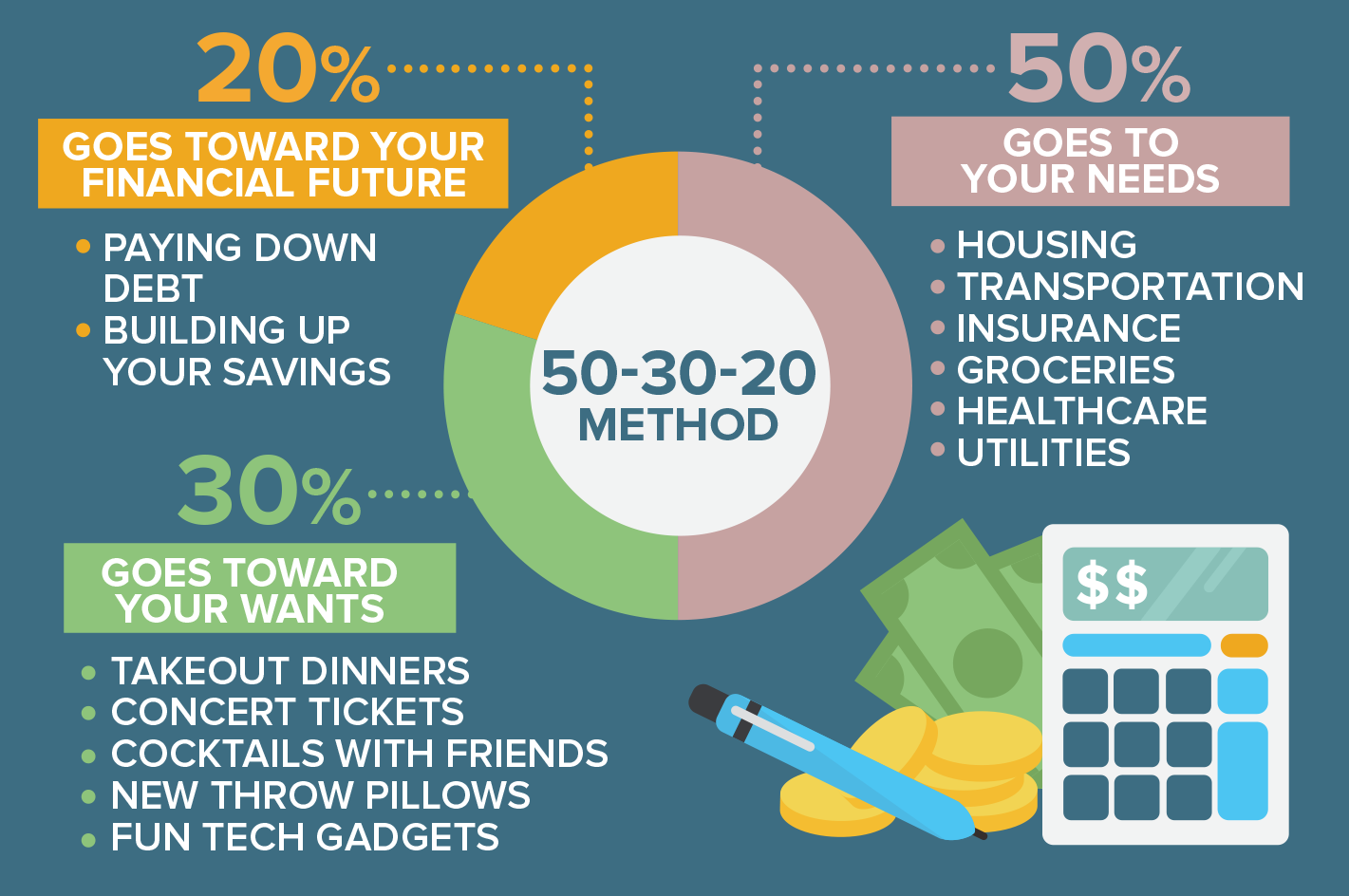

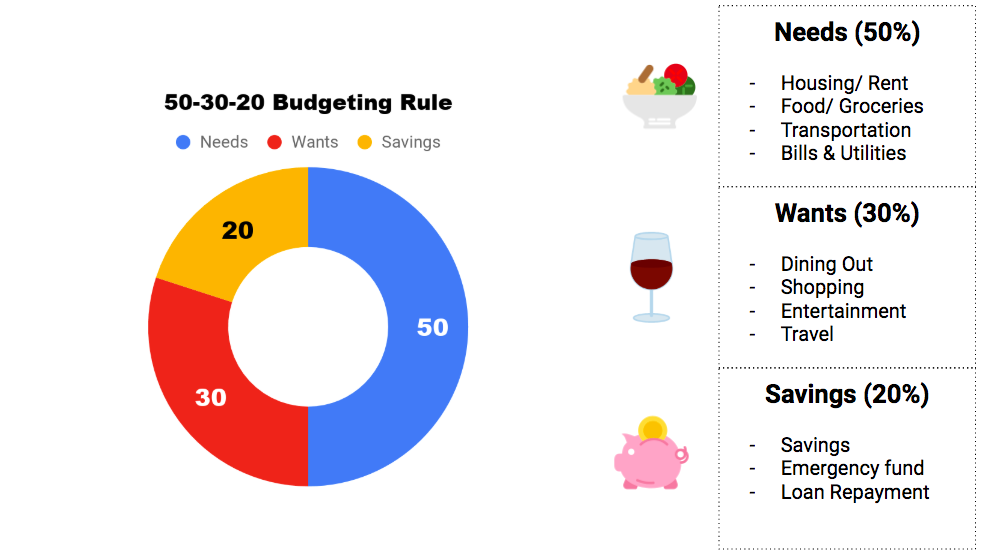

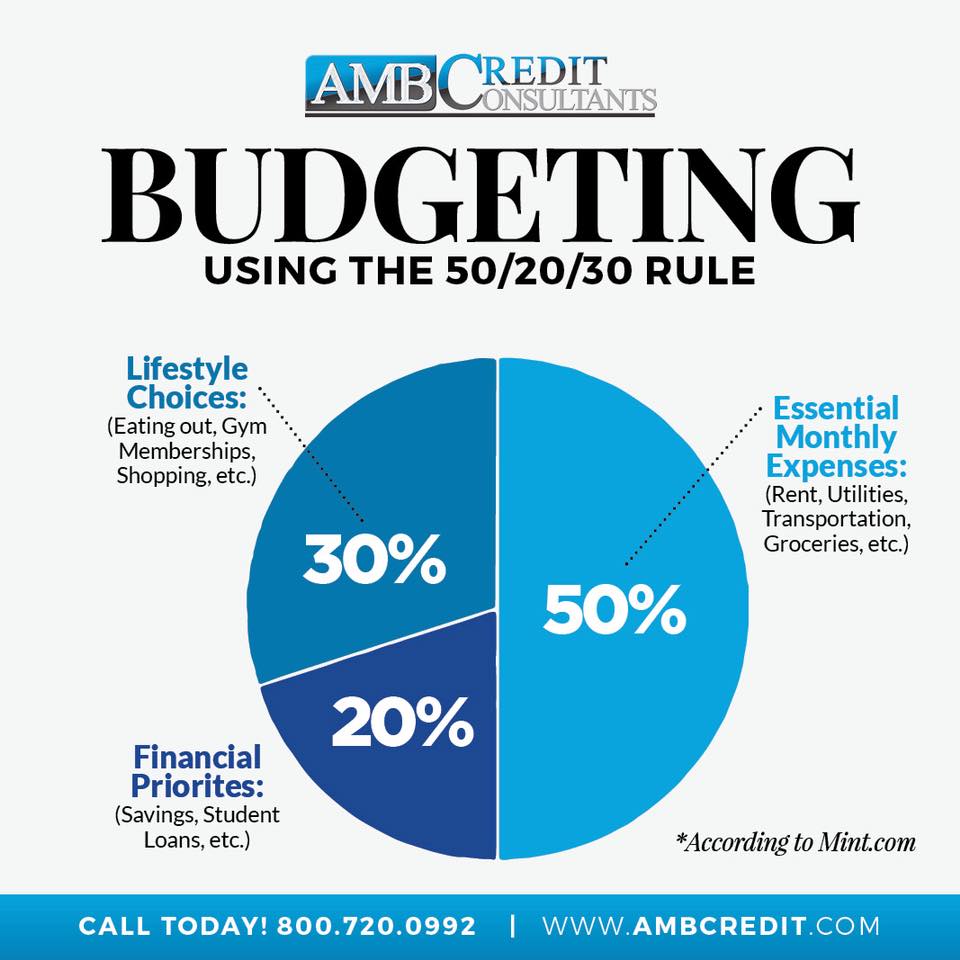

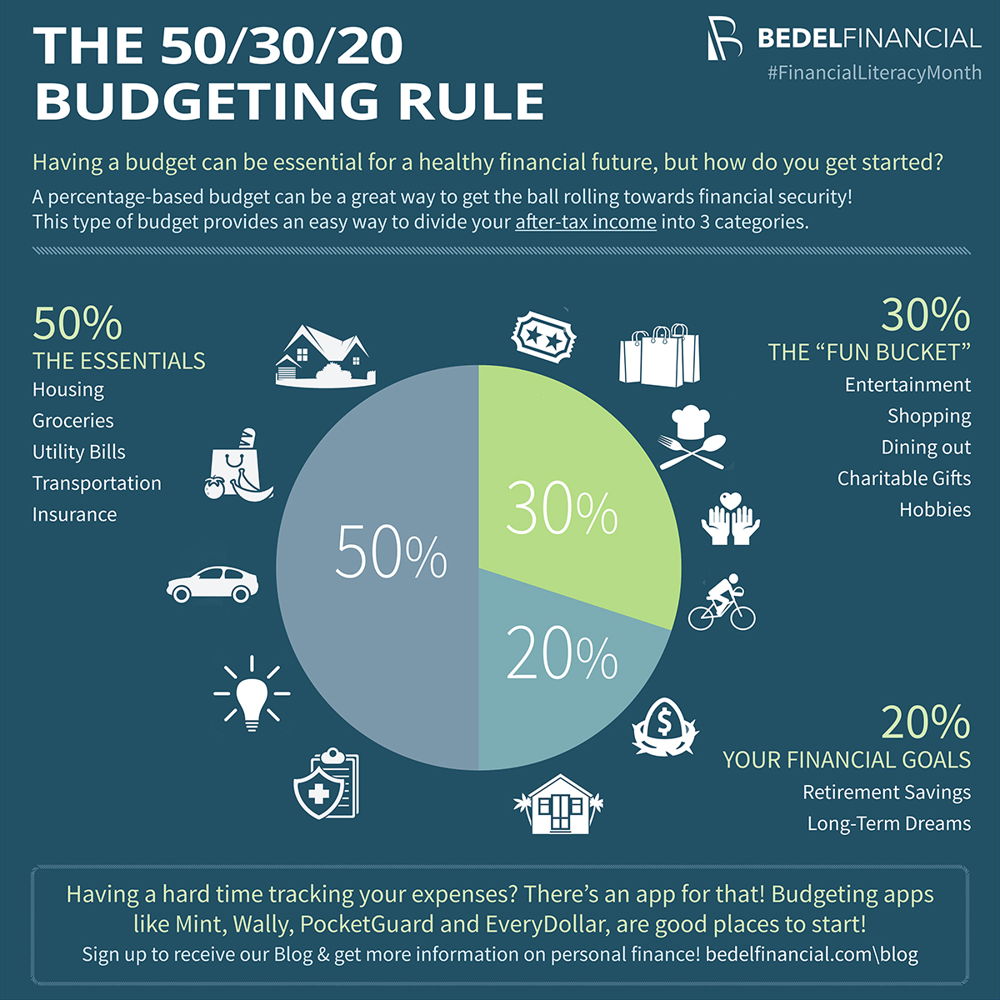

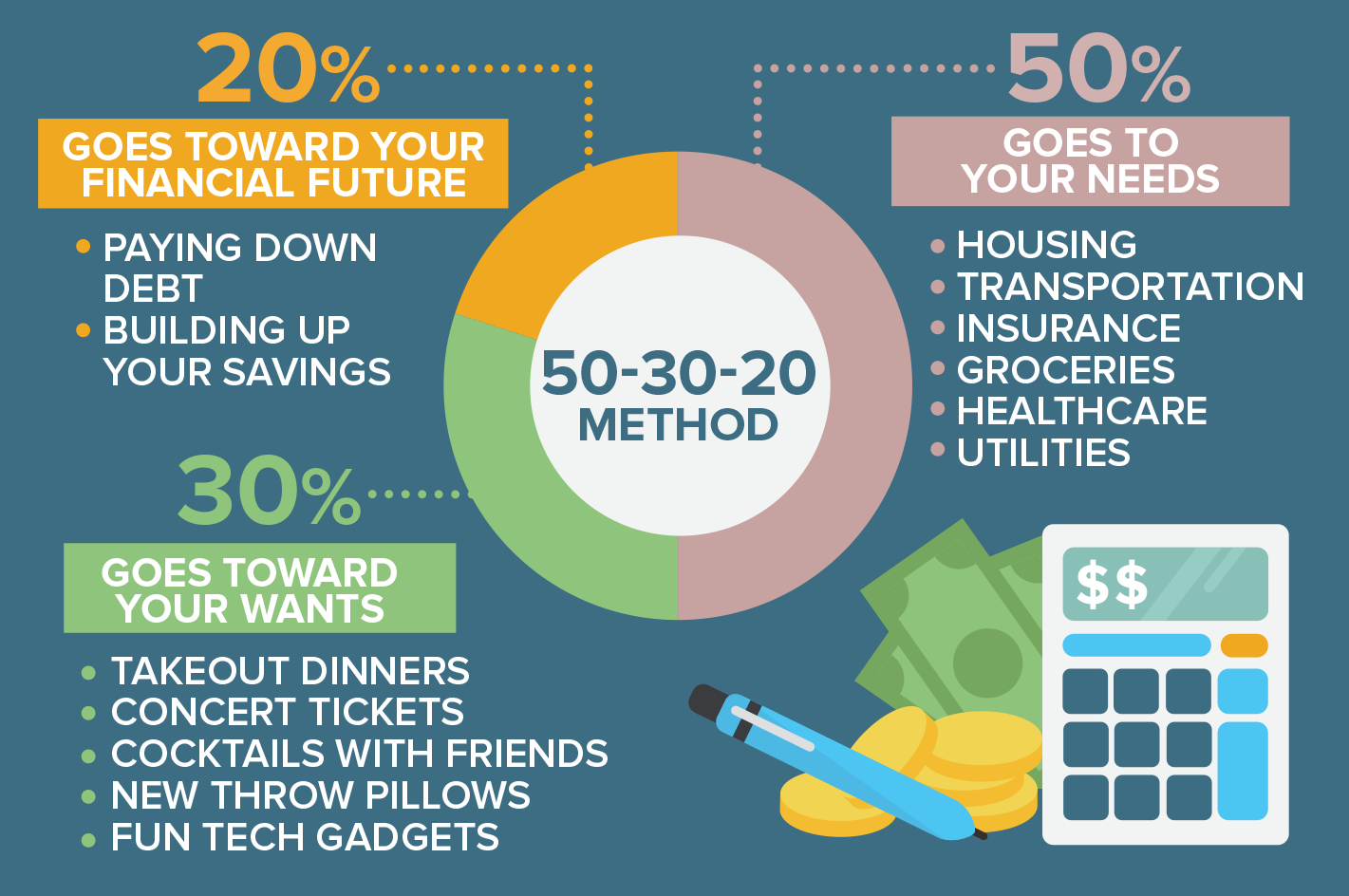

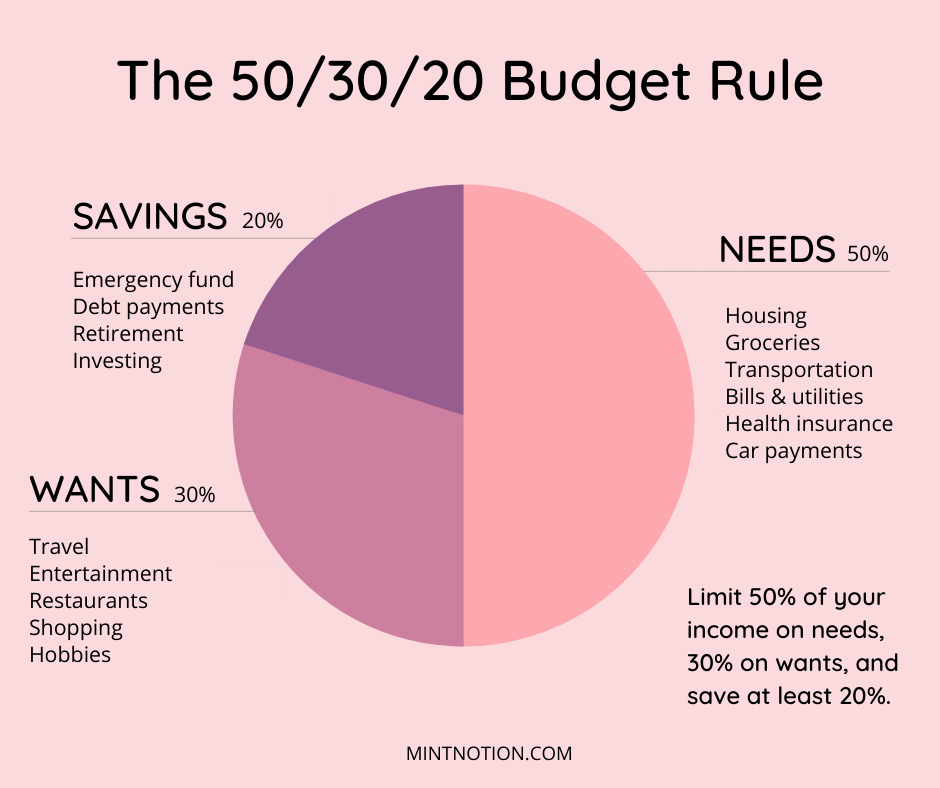

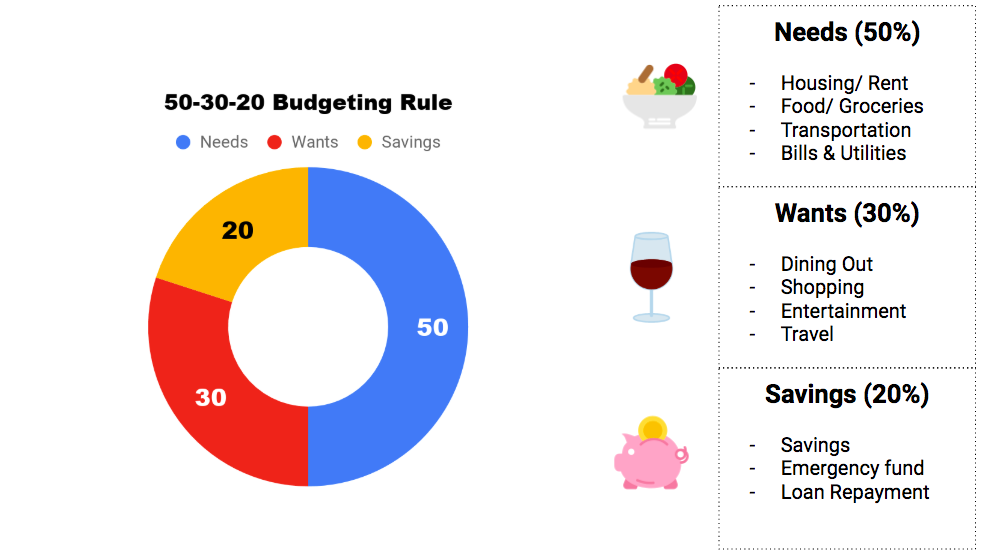

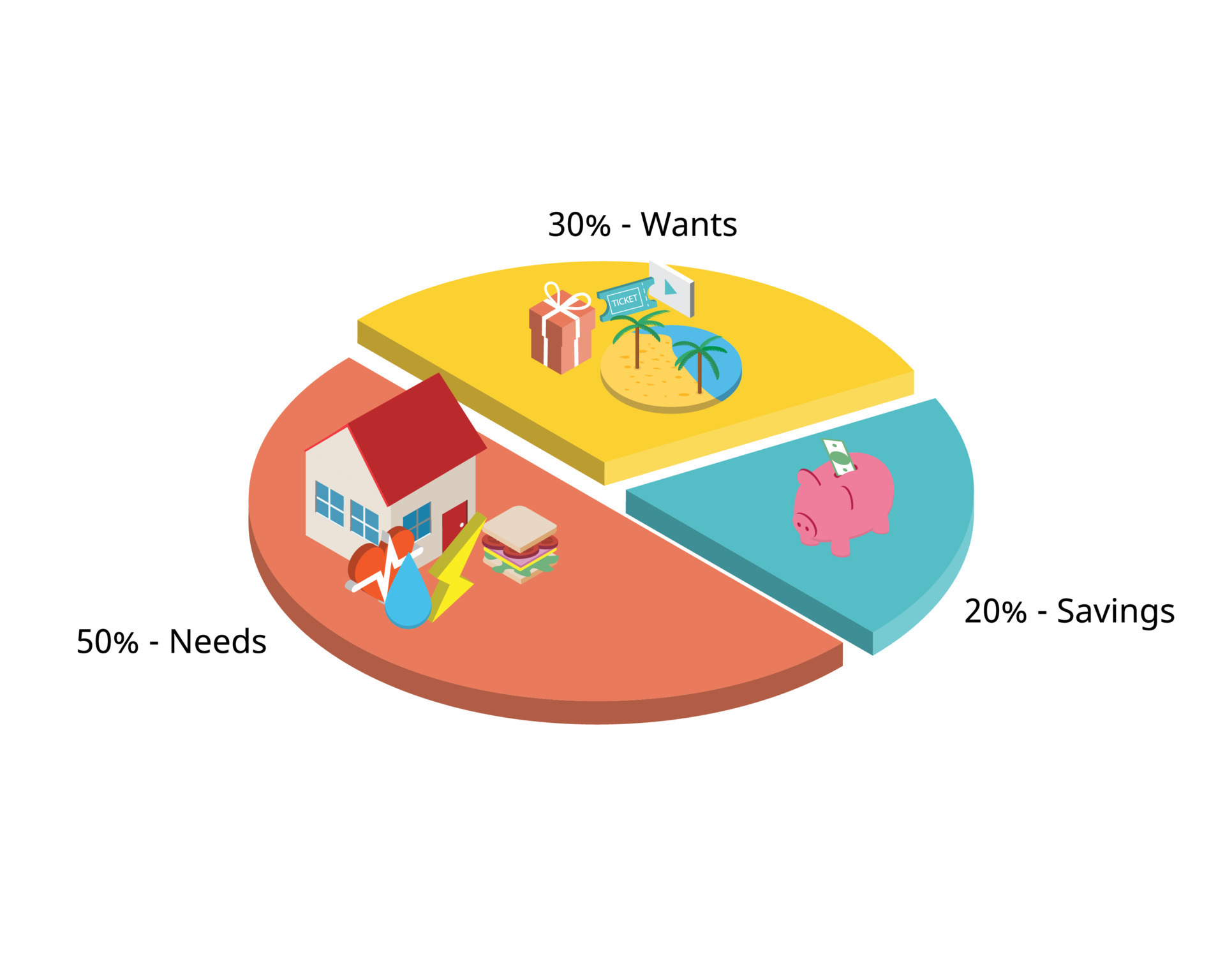

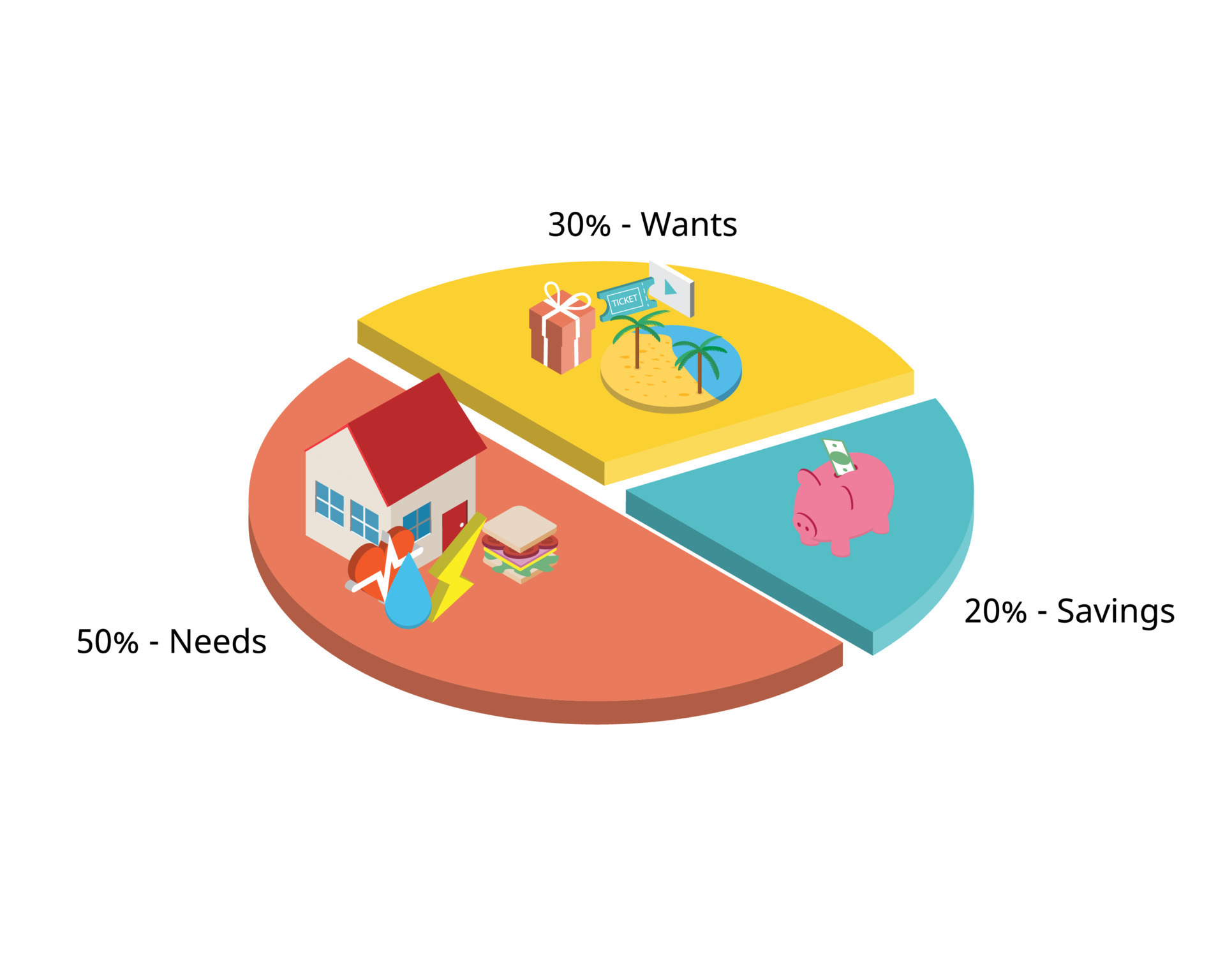

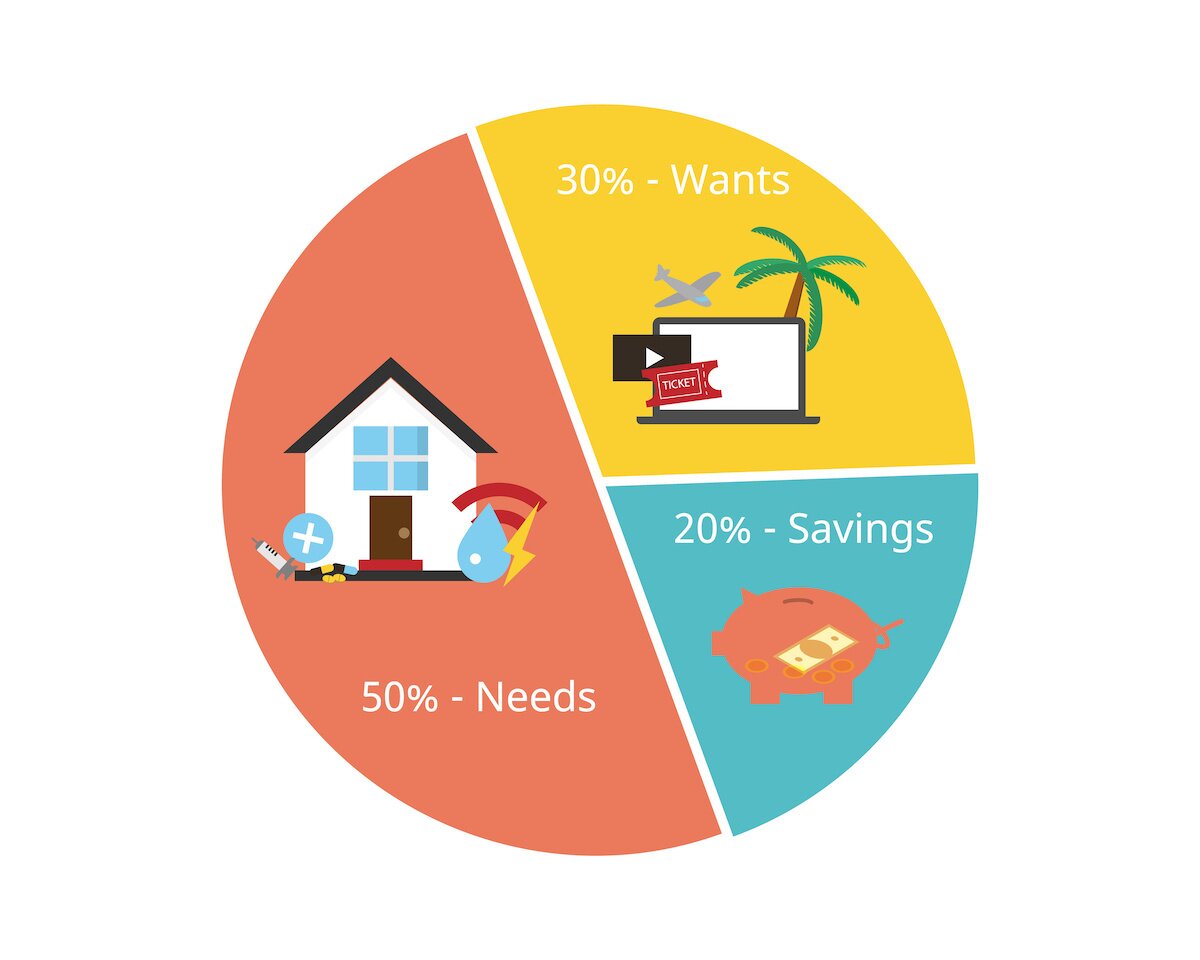

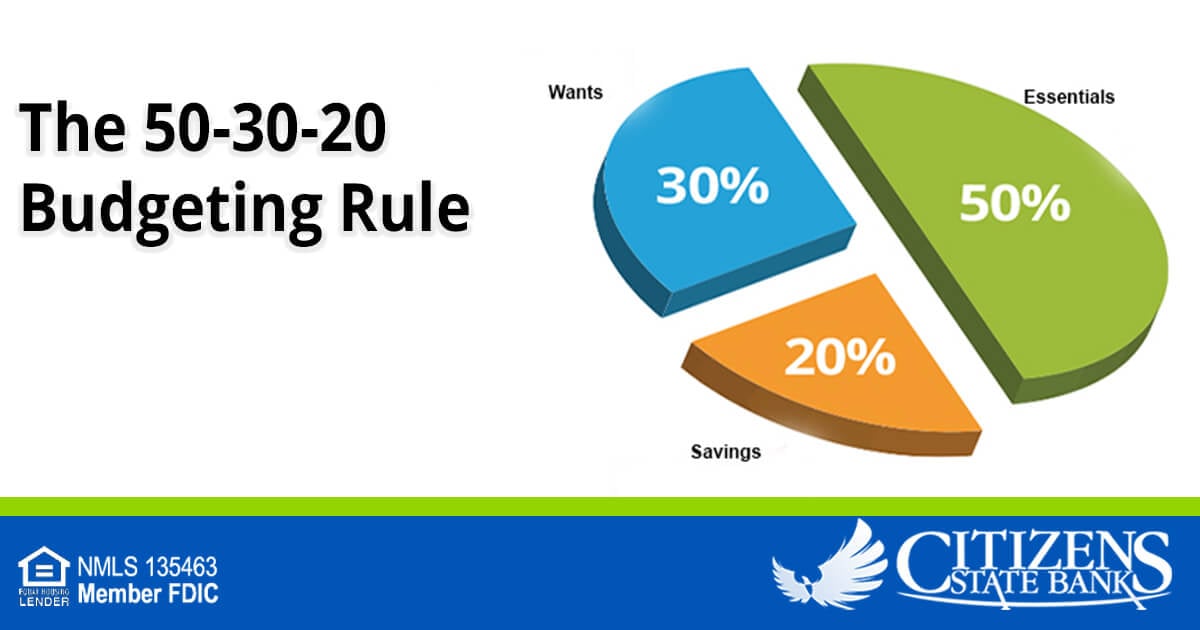

Saving Rule 50 30 20 What Is the 50 30 20 Budget Rule The 50 30 20 budget rule is a simple and effective method for managing personal finances This rule allocates after tax income into three main categories 50 for needs 30 for wants and 20 for savings and debt repayment Budgeting is crucial for achieving financial stability and success It helps

To make a budget for a month according to the 50 30 20 rule you need to allocate your after tax salary to the following three categories Spend 50 on necessities things that you need Spend 30 on wants entertainment shopping Allocate 20 of your income for saving or making a loan payment The 50 30 20 rule of thumb is a guideline for allocating your budget accordingly 50 to needs 30 to wants and 20 to your financial goals The rule was popularized in a book by U S Senator Elizabeth Warren and her daughter Amelia Warren Tyagi

Saving Rule 50 30 20

Saving Rule 50 30 20

https://cdn.zephyrcms.com/f2355e37-2e91-45ba-a8f3-0e91187cf8e5/-/progressive/yes/-/format/jpeg/-/stretch/off/-/resize/1000x/50-30-20-budgeting-infographic.jpg

How 50 20 30 Rule Will Change Your Life Finance Expert

https://bankonus.com/finance-expert/wp-content/uploads/2018/11/d4b56bad34702ffb869c6e9628f996f6-1.png

50 30 20 Budget Rule A Better Way To Budget Your Money Boss Personal

https://cdn.shopify.com/s/files/1/0258/4566/1782/articles/50_30_20_rule.jpg?v=1663168783

Users of the system divide their transactions into just three buckets needs wants and debt payments savings Spending is broken up into 50 for needs 30 for wants and 20 for savings and debt Groceries would be in the needs group makeup would be a want and student loan bills would be a debt payment Well this budgeting plan first showed up in 2005 in a book called All Your Worth It was originally named the 50 20 30 rule but you ll see it called the 50 30 20 rule more often This budgeting method divides your spending and saving into three categories needs 50 wants 30 and savings 20

The 50 30 20 rule is a budgeting technique that involves dividing your money into three primary categories based on your after tax income i e your take home pay 50 to needs 30 to What is the 50 30 20 rule The 50 30 20 rule is a budgeting strategy that allocates 50 percent of your income to must haves 30 percent to wants and 20 percent to savings

More picture related to Saving Rule 50 30 20

Do You Have Trouble Budgeting Try The 50 30 20 Budget Rule

https://www.infinitysolutions.com/wp-content/uploads/Infinity-Infographic-for-Jordan-Do-you-have-trouble-budgeting_@27Aug-02.jpg

The 50 30 20 Budget Rule Explained Ultimate Guide Arrest Your Debt

https://i.pinimg.com/originals/07/63/e5/0763e54227e94cdb07c42253e29857f2.jpg

Understanding The 50 30 20 Rule To Help You Save MagnifyMoney

https://www.magnifymoney.com/wp-content/uploads/2019/06/Graphic-1.png

As the 50 30 20 rule dictates 20 percent of your post tax income must be saved and then utilized through investments Please note unlike needs and wants savings should be non negotiable and need to be a top priority Is the 50 30 20 Budget Right For You It can help you divide your income among needs wants and savings Learn when experts say it may be a good fit The 50 30 20 budgeting rule can

[desc-10] [desc-11]

Money Lover Blog What Are The Difference Between Premium And Basic

https://note.moneylover.me/content/images/2018/08/Screen-Shot-2018-08-25-at-11.46.26-PM.png

AMB Credit Consultants A New Way To Budget Budgeting Using The 50 30

https://ambcreditconsultants.com/wp-content/uploads/2018/08/30714501_10156080578686488_8446984791760306176_n.jpg

https://www.financestrategists.com/financial...

What Is the 50 30 20 Budget Rule The 50 30 20 budget rule is a simple and effective method for managing personal finances This rule allocates after tax income into three main categories 50 for needs 30 for wants and 20 for savings and debt repayment Budgeting is crucial for achieving financial stability and success It helps

https://www.omnicalculator.com/finance/50-30-20-rule

To make a budget for a month according to the 50 30 20 rule you need to allocate your after tax salary to the following three categories Spend 50 on necessities things that you need Spend 30 on wants entertainment shopping Allocate 20 of your income for saving or making a loan payment

50 30 20 Budget Template Free

Money Lover Blog What Are The Difference Between Premium And Basic

Budget Planner Free Money Planner Budget Planner Template Planning

The 50 30 20 Budget Rule Explained with Examples

Video Of 50 30 20 Rule A Budget Strategy Britannica

Monthly 50 30 20 Budget Rule Of Guideline For Saving And Spending The

Monthly 50 30 20 Budget Rule Of Guideline For Saving And Spending The

Guide To The 50 30 20 Budget Rule In 2024

The 50 30 20 Budgeting Rule

How To Use The 50 30 20 Rule For Budgeting Your Money

Saving Rule 50 30 20 - [desc-13]