Gst Rate On Rock Salt Remit pay the GST HST you collected When and how to remit pay the tax including by instalments Claim a GST HST rebate All rebates available charging GST HST in error and

GST HST NETFILE is an Internet based filing service that allows registrants to file their goods and services tax harmonized sales tax GST HST returns and eligible rebates directly to the The Canada Revenue Agency usually send the GST HST credit payments on the fifth day of July October January and April If you do not receive your GST HST credit payment on the

Gst Rate On Rock Salt

Gst Rate On Rock Salt

https://ebizfiling.com/wp-content/uploads/2023/05/A-guide-to-GST-LUT.png

Queen Admin

https://queensavtm.com/upload/1680079596WhatsApp Image 2023-03-29 at 2.07.29 PM.jpeg

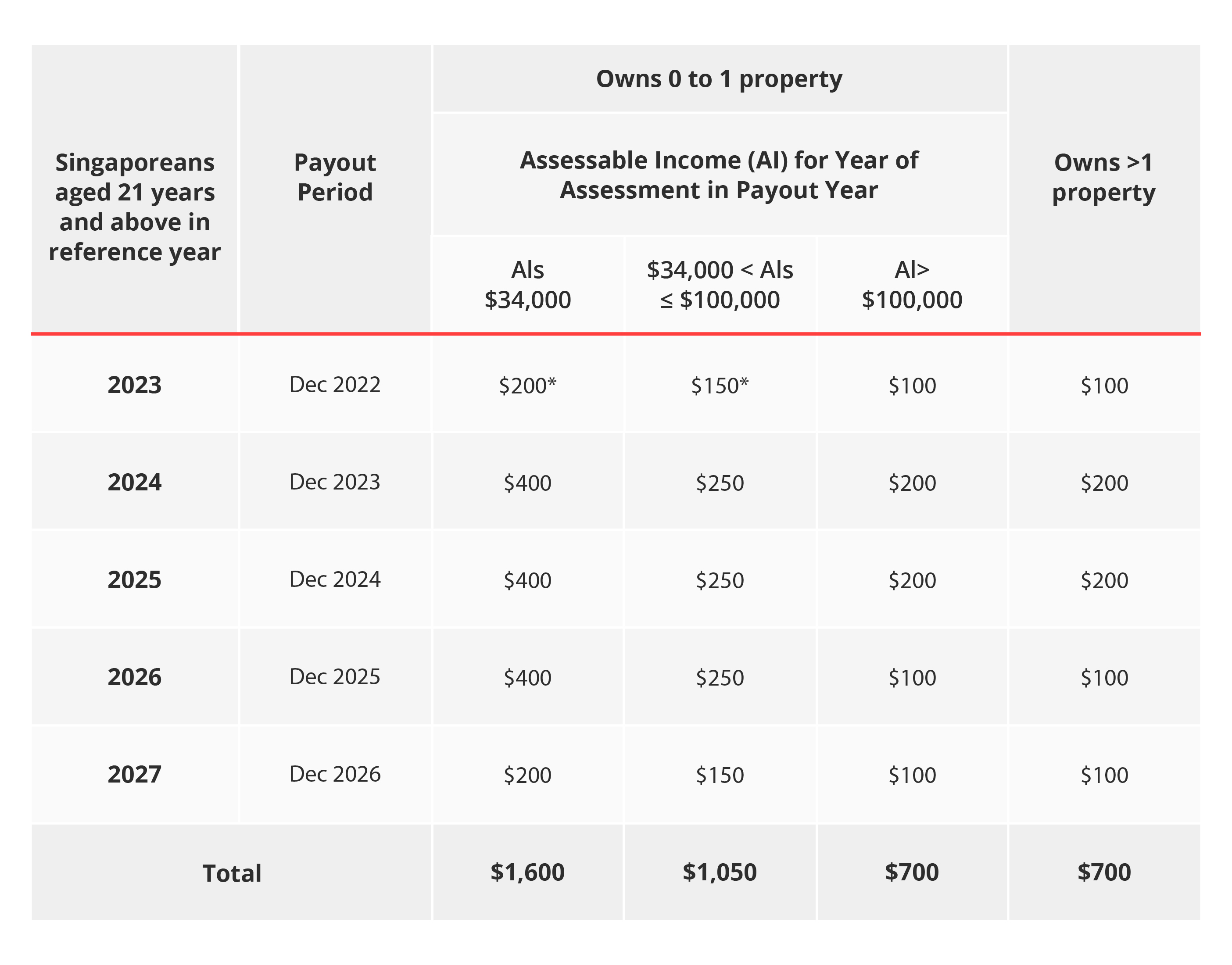

Pay Increment Singapore 2024 Printable Online

https://www.dbs.com.sg/iwov-resources/media/images/nav/preparing-for-GST-rate-changes/preparing-for-GST-rate-changes-img1.jpg

Most basic grocery items already have no GST HST charged on them These food items also temporarily had no GST HST charged during the GST HST break Prepared foods Business accounts include GST HST except for GST HST accounts administered by Revenu Qu bec payroll corporation income taxes excise taxes excise duties and more Represent

For the GST HST rates applicable before April 1 2013 go to GST HST Statistics Tables For the PST rates of previous years go to the respective province s website Other Your GST HST credit payments are based on the following your adjusted net income If you have a spouse or common law partner your adjusted net incomes are combined to get your

More picture related to Gst Rate On Rock Salt

Salt Lamp Information Himalayan Salt Lamp Benefits Himalayan Salt

https://i.pinimg.com/originals/73/dd/a9/73dda9d267a4ab5143459ec075a4534a.jpg

Gst Bill 2024 25 Bonita Marketa

https://qualsbiz.com/wp-content/uploads/2023/12/2024-GST-Rate-Change-11.jpg

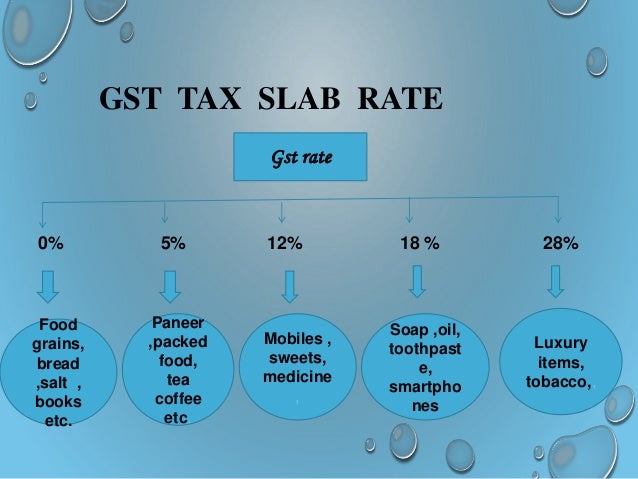

A Quick Guide To India GST Rates In 2017 Indian Legal System

https://d494qy7qcliw5.cloudfront.net/s/img/20170519194833/GST-Rate-infographic-02-e1495203622473.png

GST HST registrants who make taxable supplies other than zero rated supplies in the participating provinces collect tax at the applicable HST rate GST HST registrants collect tax Registrants that are not required to file their GST HST return electronically selected listed financial institutions and most charities can file a paper return such as Form GST34 2 Goods

[desc-10] [desc-11]

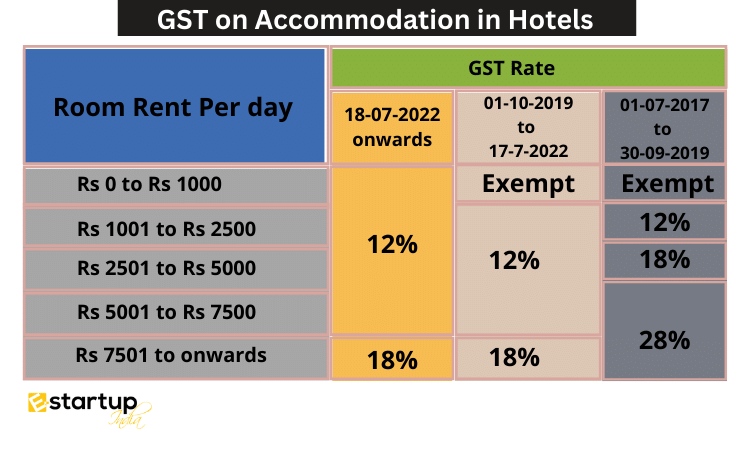

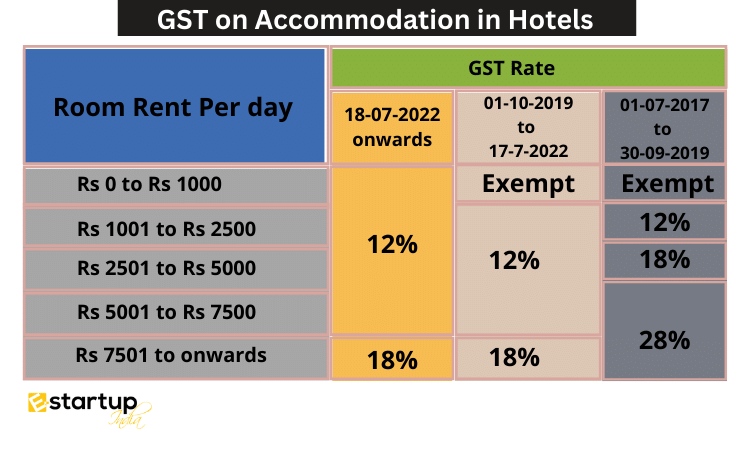

GST On Hotel Tourism Industry E startup India

https://www.e-startupindia.com/learn/wp-content/uploads/2022/09/GST-on-Accommodation-in-Hotels-1.png

GST Rates Applicable To Cars And Its Accessories SAG Infotech

https://blog.saginfotech.com/wp-content/uploads/2019/07/gst-rate-on-cars.jpg

https://www.canada.ca › en › services › taxes › resources-for-small-and-…

Remit pay the GST HST you collected When and how to remit pay the tax including by instalments Claim a GST HST rebate All rebates available charging GST HST in error and

https://www.canada.ca › ... › e-services › digital-services-businesses › g…

GST HST NETFILE is an Internet based filing service that allows registrants to file their goods and services tax harmonized sales tax GST HST returns and eligible rebates directly to the

Gst Ppt Anju

GST On Hotel Tourism Industry E startup India

Implementation Of GST And Act Of GST Example TutorsTips

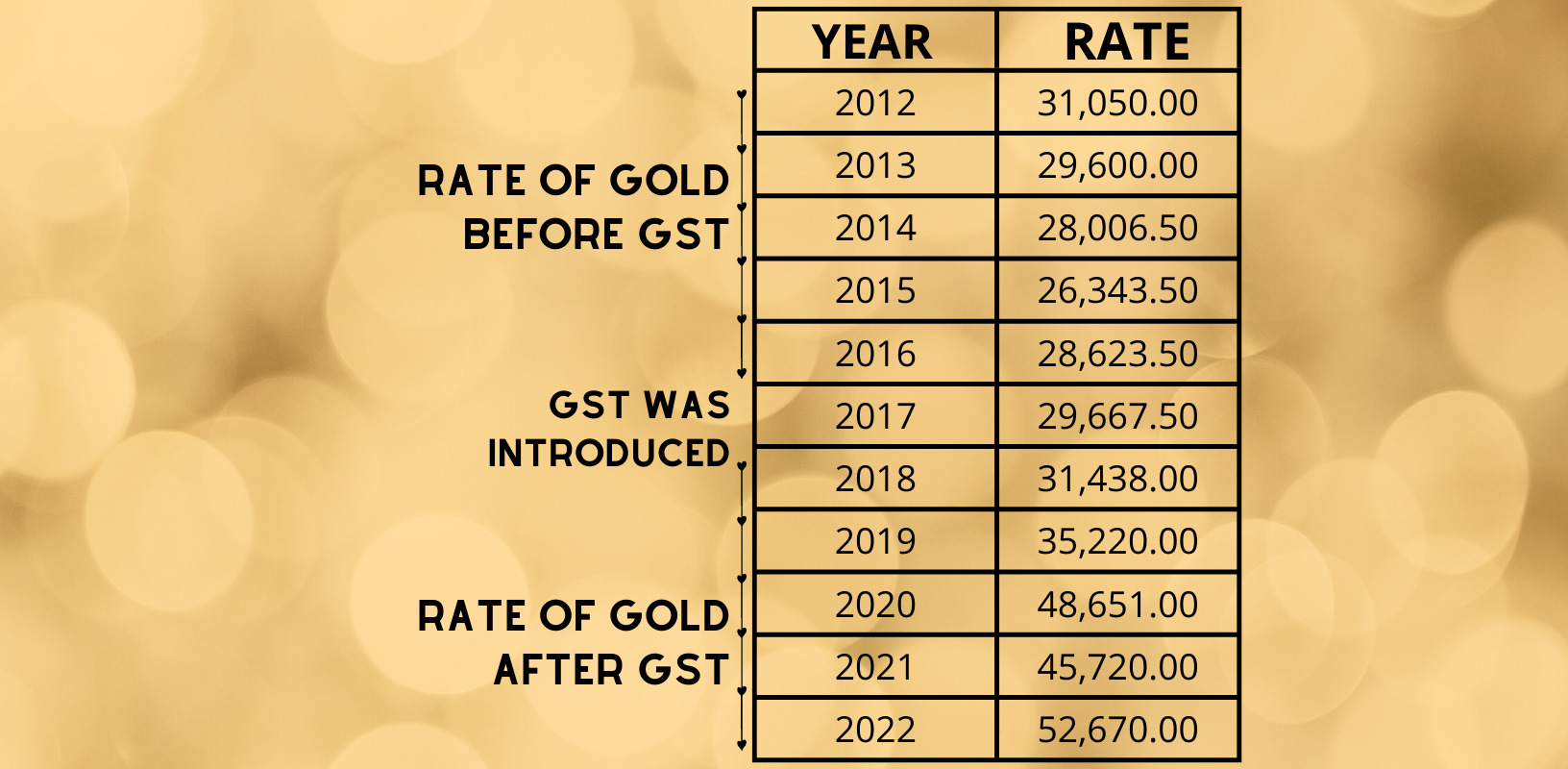

Gst Tax Rate On Gold Official Online Imrd cucuta gov co

GST Composition Scheme Rules Rate Limits And Benefits

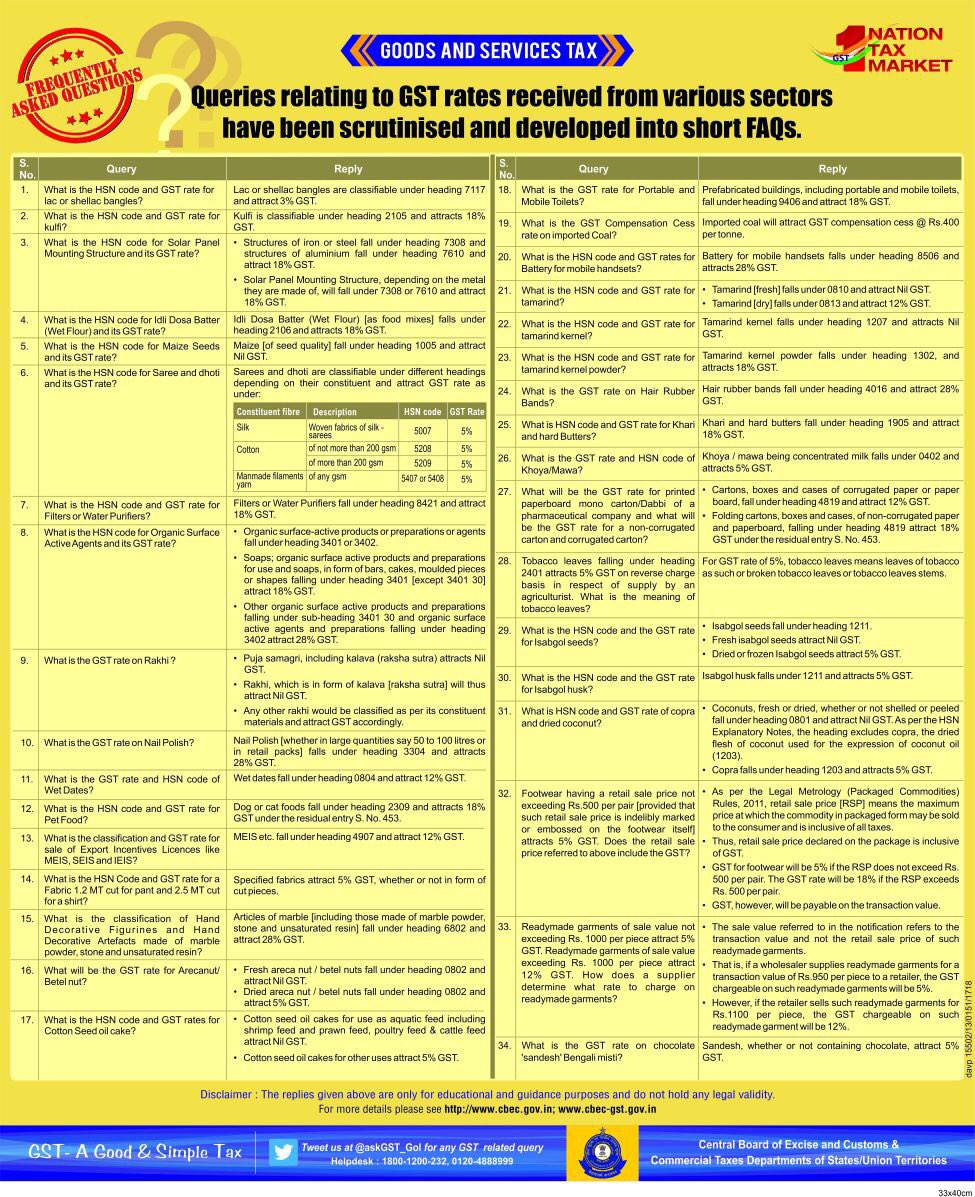

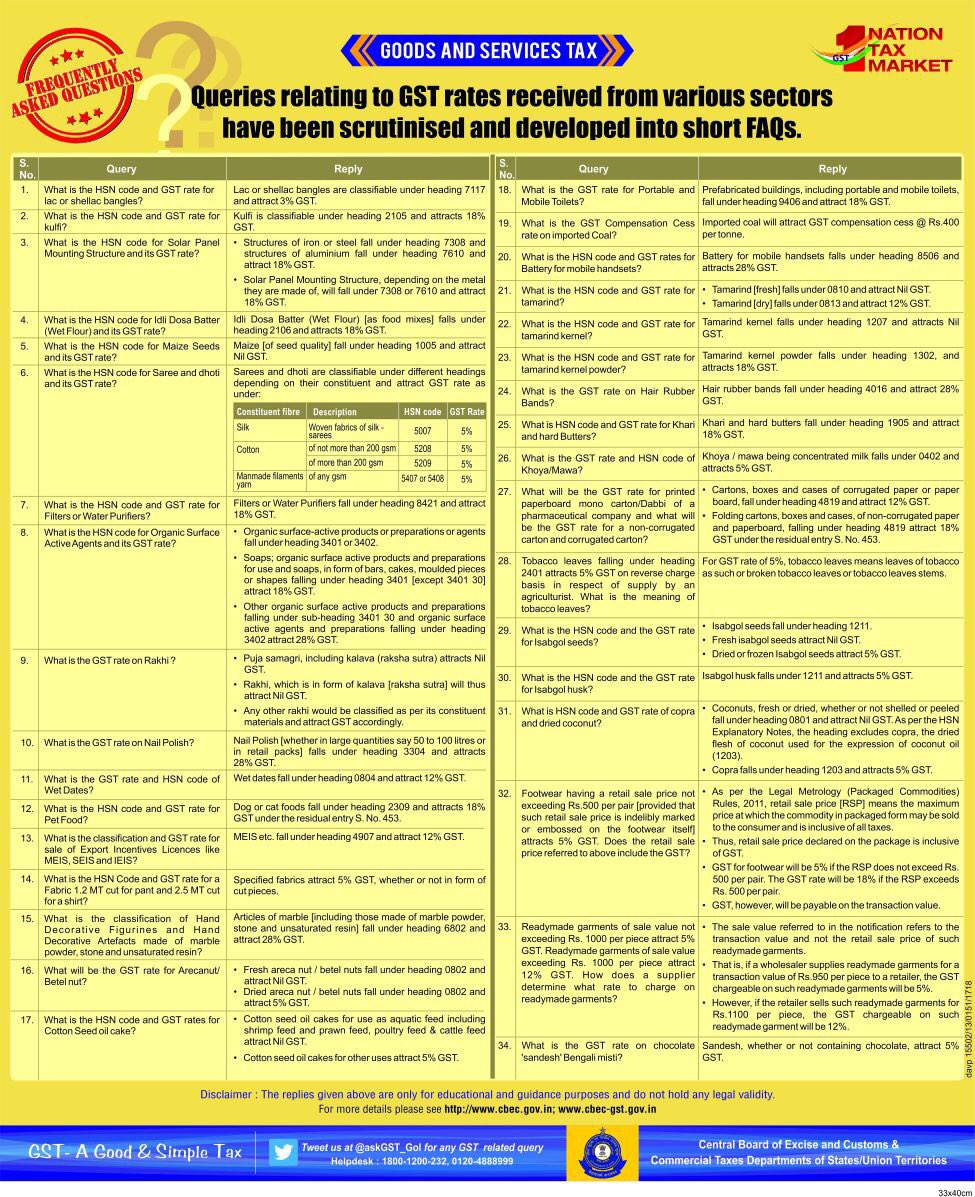

GST GoI On Twitter What Is GST Rate On Rakhi Dosa Batter Nail

GST GoI On Twitter What Is GST Rate On Rakhi Dosa Batter Nail

GST Rate On Sale Of Scrap Materials With HSN Code

18 GST Rate On Govt Contracts May Impact Infra Projects

Brick Manufacturers Request Govt To Back 1 GST Rate From 6

Gst Rate On Rock Salt - [desc-14]